Coach 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Coach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended July 3, 2010

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 1-16153

Coach, Inc.

(Exact name of registrant as specified in its charter)

Maryland 52-2242751

(State or other jurisdiction of

incorporation or organization)

(I.R.S. Employer

Identification No.)

516 West 34th Street, New York, NY 10001

(Address of principal executive offices); (Zip Code)

(212) 594-1850

(Registrant’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act:

Title of Each Class: Name of Each Exchange on which Registered

Common Stock, par value $.01 per share New York Stock Exchange

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File

required to be submitted and posted pursuant to rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant

was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the

best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to

this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer x Accelerated Filer o Non-Accelerated Filer o Smaller Reporting Company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of Coach, Inc. common stock held by non-affiliates as of December 26, 2009 (the last business day of the most recently

completed second fiscal quarter) was approximately $11.5 billion. For purposes of determining this amount only, the registrant has excluded shares of

common stock held by directors and officers. Exclusion of shares held by any person should not be construed to indicate that such person possesses the

power, direct or indirect, to direct or cause the direction of the management or policies of the registrant, or that such person is controlled by or under

common control with the registrant.

On August 6, 2010, the Registrant had 297,406,007 shares of common stock outstanding.

Table of contents

-

Page 1

... principal executive offices); (Zip Code) (212) 594-1850 (Registrant's telephone number, including area code) Securities Registered Pursuant to Section 12(b) of the Act: Title of Each Class: Name of Each Exchange on which Registered Common Stock, par value $.01 per share New York Stock Exchange... -

Page 2

DOCUMENTS INCORPORATED BY REFERENCE Documents Form 10-K Reference Proxy Statement for the 2010 Annual Meeting of Stockholders Part III, Items 10 - 14 -

Page 3

... with Accountants on Accounting and Financial Disclosure Controls and Procedures Other Information PART III Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Certain... -

Page 4

... contemplated by these forward-looking statements due to a number of factors, including those discussed in the sections of this Form 10-K filing entitled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations." These factors are not necessarily... -

Page 5

... wherever the consumer may shop. We utilize a flexible, cost-effective global sourcing model, in which independent manufacturers supply our products, allowing us to bring our broad range of products to market rapidly and efficiently. Coach offers a number of key differentiating elements that set... -

Page 6

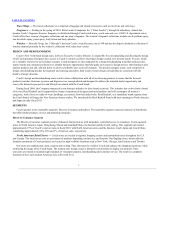

... within the Japanese imported luxury handbag and accessories market. PRODUCTS Coach's product offerings include handbags, women's and men's accessories, footwear, business cases, jewelry, wearables, sunwear, travel bags, fragrance and watches. The following table shows the percent of net sales that... -

Page 7

... products, service and marketing strategies. Direct-to-Consumer Segment The Direct-to-Consumer segment consists of channels that provide us with immediate, controlled access to consumers: Coach-operated stores in North America, Japan, Hong Kong, Macau and mainland China, the Internet and the Coach... -

Page 8

... inventory outside the retail channel. These stores operate under the Coach Factory name and are geographically positioned primarily in established outlet centers that are generally more than 40 miles from major markets. Coach's factory store design, visual presentations and customer service levels... -

Page 9

... department store sales have not increased over the last few years, the handbag and accessories category has remained strong, in large part due to the strength of the Coach brand. The Company continues to manage inventories in this channel given the highly promotional environment at point-of-sale... -

Page 10

... channels: shoes in department store shoe salons, watches in selected jewelry stores and eyewear in selected optical retailers. These venues provide additional, yet controlled, exposure of the Coach brand. Coach's licensing partners pay royalties to Coach on their net sales of Coach branded products... -

Page 11

...and product development offices in Hong Kong, China, South Korea, India and Vietnam that work closely with our independent manufacturers. This broad-based, global manufacturing strategy is designed to optimize the mix of cost, lead times and construction capabilities. Over the last several years, we... -

Page 12

...in Japan. MANAGEMENT INFORMATION SYSTEMS The foundation of Coach's information systems is its Enterprise Resource Planning ("ERP") system. This fully integrated system supports all aspects of finance and accounting, procurement, inventory control, sales and store replenishment. The system functions... -

Page 13

...product sourcing and international sales operations. COMPETITION The premium handbag and accessories industry is highly competitive. The Company mainly competes with European luxury brands as well as private label retailers, including some of Coach's wholesale customers. Over the last several years... -

Page 14

... a new product could result in our not being the first to market, which could compromise our competitive position. Additionally, our current growth strategy includes plans to expand in a number of international regions, including Asia and Europe. We currently plan to open additional Coach stores in... -

Page 15

... affect our business. We face intense competition in the product lines and markets in which we operate. Our competitors are European luxury brands as well as private label retailers, including some of Coach's wholesale customers. There is a risk that our competitors may develop new products that are... -

Page 16

... affect the market price of Coach common stock. Because Coach products are frequently given as gifts, Coach has historically realized, and expects to continue to realize, higher sales and operating income in the second quarter of its fiscal year, which includes the holiday months of November... -

Page 17

..., China Hong Kong Hong Kong Beijing, China Seoul, South Korea Long An, Vietnam Chennai, India Distribution and consumer service Corporate, sourcing and product development Corporate and product development Coach Japan regional management Sourcing, quality control and product development Coach China... -

Page 18

... characteristic or for termination of employment that is wrongful or in violation of implied contracts. Coach believes that the outcome of all pending legal proceedings in the aggregate will not have a material adverse effect on Coach's business or consolidated financial statements. Coach has not... -

Page 19

... Market and Dividend Information Coach's common stock is listed on the New York Stock Exchange and is traded under the symbol "COH." The following table sets forth, for the fiscal periods indicated, the high and low closing prices per share of Coach's common stock as reported on the New York... -

Page 20

... and the "peer group" companies listed below over the five-fiscal-year period ending July 2, 2010, the last trading day of Coach's most recent fiscal year. Coach's "peer group," as determined by management, consists of: Ann Taylor Stores Corporation, Kenneth Cole Productions, Inc., Polo Ralph... -

Page 21

... Program The Company's share repurchases during the fourth quarter of fiscal 2010 were as follows: Period Total Number of Shares Purchased Average Price Paid per Share Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs(1) Approximate Dollar Value of Shares... -

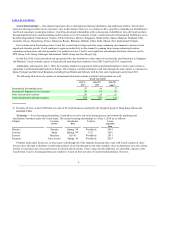

Page 22

... Percentage of Net Sales Data: Gross margin Selling, general and administrative expenses Operating margin Income from continuing operations Consolidated Balance Sheet Data: Working capital Total assets Cash, cash equivalents and investments Inventory Long-term debt Stockholders' equity $ 3,607,636... -

Page 23

... exited its corporate accounts business. See the Discontinued Operations note presented in the Notes to the Consolidated Financial Statements for further information. (4) During the fourth quarter of fiscal 2009, the Company initiated a cash dividend at an annual rate of $0.30 per share. The first... -

Page 24

... subsidiaries. EXECUTIVE OVERVIEW Coach is a leading American marketer of fine accessories and gifts for women and men. Our product offerings include handbags, women's and men's accessories, footwear, jewelry, wearables, business cases, sunwear, travel bags, fragrance and watches. Coach operates in... -

Page 25

... stores in North America. Coach Japan opened six net new locations, bringing the total number of locations at the end of fiscal 2010 to 161. In addition, we expanded two locations. Coach China results continued to be strong with double-digit growth in comparable stores and channel profitability... -

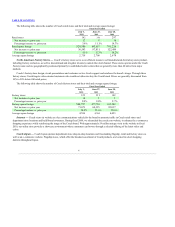

Page 26

...fiscal 2010 compared to fiscal 2009: Fiscal Year Ended July 3, 2010 Amount June 27, 2009 Variance (dollars in millions, except per share data) % of Amount % of Amount net sales net sales % Net sales Gross profit Selling, general and administrative expenses Operating income Interest income, net... -

Page 27

...and bag repair costs. Administrative expenses include compensation costs for the executive, finance, human resources, legal and information systems departments, corporate headquarters occupancy costs, and consulting and software expenses. SG&A expenses increase as the number of Coach-operated stores... -

Page 28

... related to the planned closure of four underperforming stores during the stores lease terms, selling expenses were $976.5 million, representing 30.2% of net sales. The dollar increase in selling expenses was primarily due to an increase in operating expenses of North American stores and Coach China... -

Page 29

... of operations for fiscal 2009 compared to fiscal 2008: Fiscal Year Ended June 27, 2009 Amount June 28, 2008 Variance (dollars in millions, except per share data) % of Amount % of Amount net sales net sales % Net sales Gross profit Selling, general and administrative expenses Operating income... -

Page 30

... businesses in Hong Kong, Macau and mainland China. Indirect - Net sales decreased 19.2% driven primarily by a 20.8% decrease in U.S. wholesale as the Company reduced shipments into U.S. department stores in order to manage customer inventory levels due to a weaker sales environment. International... -

Page 31

... and development costs for new merchandising initiatives. Distribution and consumer service expenses were $52.2 million, or 1.6% of net sales, in fiscal 2009, compared to $47.6 million, or 1.5%, in fiscal 2008. The increase was primarily the result of an increase in fixed occupancy costs related to... -

Page 32

... and evaluate its business during its regular review of operating results for the periods affected. Management and the Company's Board utilized these non-GAAP measures to make decisions about the uses of Company resources, analyze performance between periods, develop internal projections and measure... -

Page 33

...Company's corporate offices in New York, New Jersey and Jacksonville, the closure of four underperforming retail stores and the closure of Coach Europe Services, the Company's sample-making facility in Italy. Prior to these cost savings measures in fiscal 2009, the Company had no recent past history... -

Page 34

....9 million for fiscal 2010 compared to a cash source of $4.1 million in fiscal 2009, primarily due to higher inventory levels at the current year end to support store expansion domestically and internationally. Net cash used in investing activities was $182.2 million in fiscal 2010 compared to $264... -

Page 35

... market prices, through open market purchases. Repurchased shares become authorized but unissued shares and may be issued in the future for general corporate and other uses. The Company may terminate or limit the stock repurchase program at any time. During fiscal 2010 and fiscal 2009, the Company... -

Page 36

... year ending July 2, 2011, the Company expects total capital expenditures to be approximately $150 million. Capital expenditures will be primarily for new stores in North America, Japan, Hong Kong, Macau and mainland China. We will also continue to invest in corporate infrastructure and department... -

Page 37

... Notes to Consolidated Financial Statements. Income Taxes The Company's effective tax rate is based on pre-tax income, statutory tax rates, tax laws and regulations, and tax planning strategies available in the various jurisdictions in which Coach operates. Deferred tax assets are reported at net... -

Page 38

... accounts, discounts and returns would have resulted in an insignificant change in accounts receivable and net sales. Share-Based Compensation The Company recognizes the cost of employee services received in exchange for awards of equity instruments, such as stock options, based on the grant-date... -

Page 39

... from foreign-denominated revenues and expenses translated into U.S. dollars. Substantially all of Coach's fiscal 2010 non-licensed product needs were purchased from independent manufacturers in countries other than the United States. These countries include China, Italy, Hong Kong, India, Thailand... -

Page 40

...Japanese Yen, Chinese Renminbi, Hong Kong Dollar, Macau Pataca and Canadian Dollars, are not material to the Company's consolidated financial statements. Interest Rate Coach is exposed to interest rate risk in relation to its investments, revolving credit facilities and long-term debt. The Company... -

Page 41

... Treadway Commission in Internal Control-Integrated Framework. Management, under the supervision and with the participation of the Company's Chief Executive Officer and Chief Financial Officer, assessed the effectiveness of the Company's internal control over financial reporting as of July 3, 2010... -

Page 42

... Relating to Coach's Independent Auditors" in the Proxy Statement for the 2010 Annual Meeting of Stockholders. The Proxy Statement will be filed with the Commission within 120 days after the end of the fiscal year covered by this Form 10-K pursuant to Regulation 14A under the Securities Exchange... -

Page 43

... Miller Chairman, Chief Executive Officer and Director President, Chief Operating Officer Executive Vice President and Chief Financial Officer (as principal financial officer and principal accounting officer of Coach) Director Director Director Director Director Director /s/ Michael Murphy Michael... -

Page 44

... FORM 10-K FINANCIAL STATEMENTS For the Fiscal Year Ended July 3, 2010 COACH, INC. New York, New York 10001 INDEX TO FINANCIAL STATEMENTS Page Number Reports of Independent Registered Public Accounting Firm Consolidated Balance Sheets - At July 3, 2010 and June 27, 2009 Consolidated Statements... -

Page 45

... REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of Coach, Inc. New York, New York We have audited the accompanying consolidated balance sheets of Coach, Inc. and subsidiaries (the "Company") as of July 3, 2010 and June 27, 2009, and the related consolidated statements... -

Page 46

... PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of Coach, Inc. New York, New York We have audited the internal control over financial reporting of Coach, Inc. and subsidiaries (the "Company") as of July 3, 2010 based on criteria established in Internal Control - Integrated... -

Page 47

... CONTENTS COACH, INC. CONSOLIDATED BALANCE SHEETS (amounts in thousands, except share data) July 3, 2010 June 27, 2009 ASSETS Current Assets: Cash and cash equivalents Short-term investments Trade accounts receivable, less allowances of $6,965 and $6,347, respectively Inventories Deferred income... -

Page 48

TABLE OF CONTENTS COACH, INC. CONSOLIDATED STATEMENTS OF INCOME (amounts in thousands, except per share data) Fiscal Year Ended July 3, 2010 June 27, 2009 June 28, 2008 Net sales Cost of sales Gross profit Selling, general and administrative expenses Operating income Interest income, net Income... -

Page 49

... Total Stockholders' Equity Balances at June 30, 2007 Net income Unrealized gains on cash flow hedging derivatives, net of tax Translation adjustments Change in pension liability, net of tax Comprehensive income Shares issued for stock options and employee benefit plans Share-based compensation... -

Page 50

... of long-term debt (Repayments) borrowings on revolving credit facility, net Proceeds from share-based awards, net Excess tax benefit (deficit) from share-based compensation Net cash used in financing activities Effect of exchange rate changes on cash and cash equivalents (Decrease) increase... -

Page 51

... handbags, women's and men's accessories, footwear, business cases, jewelry, wearables, sunwear, travel bags, fragrance and watches. Coach's products are sold through the Direct-to-Consumer segment, which includes Company-operated stores in North America, Japan, Hong Kong, Macau and mainland China... -

Page 52

... improvements are capitalized. Upon the disposition of property and equipment, the cost and related accumulated depreciation are removed from the accounts. Operating Leases The Company's leases for office space, retail stores and the distribution facility are accounted for as operating leases. The... -

Page 53

...bag repair costs. Administrative expenses include compensation costs for the executive, finance, human resources, legal and information systems departments, corporate headquarters occupancy costs, and consulting and software expenses. Preopening Costs Costs associated with the opening of new stores... -

Page 54

... Statements (dollars and shares in thousands, except per share data) 2. SIGNIFICANT ACCOUNTING POLICIES - (continued) Share-Based Compensation The Company measures the cost of employee services received in exchange for an award of equity instruments based on the grant-date fair value of the award... -

Page 55

...the Direct-to-Consumer segment. These acquisitions will provide the Company with greater control over the brand in Hong Kong, Macau and mainland China, enabling Coach to raise brand awareness and aggressively grow market share with the Chinese consumer. The aggregate purchase price of the Hong Kong... -

Page 56

... of its Board of Directors ("Board"). These plans were approved by Coach's stockholders. The exercise price of each stock option equals 100% of the market price of Coach's stock on the date of grant and generally has a maximum term of 10 years. Stock options and share awards that are granted as... -

Page 57

..., INC. Notes to Consolidated Financial Statements (dollars and shares in thousands, except per share data) 4. SHARE-BASED COMPENSATION - (continued) Stock Options A summary of option activity under the Coach stock option plans as of July 3, 2010 and changes during the year then ended is as follows... -

Page 58

...their director's fees. Amounts deferred under these plans may, at the participants' election, be either represented by deferred stock units, which represent the right to receive shares of Coach common stock on the distribution date elected by the participant, or placed in an interest-bearing account... -

Page 59

..., INC. Notes to Consolidated Financial Statements (dollars and shares in thousands, except per share data) 5. LEASES Coach leases certain office, distribution and retail facilities. The lease agreements, which expire at various dates through 2028, are subject, in some cases, to renewal options and... -

Page 60

... bond insurer, current market conditions and the value of the collateral bonds. (b) The Company enters into zero-cost collar options to manage its exposure to foreign currency exchange rate fluctuations resulting from Coach Japan's and Coach Canada's U.S. dollar-denominated inventory purchases. The... -

Page 61

... 3, 2010, the commitment fee was 7 basis points and the LIBOR margin was 30 basis points. The Bank of America facility is available for seasonal working capital requirements or general corporate purposes and may be prepaid without penalty or premium. During fiscal 2010 and fiscal 2009 there were no... -

Page 62

TABLE OF CONTENTS COACH, INC. Notes to Consolidated Financial Statements (dollars and shares in thousands, except per share data) 7. DEBT - (continued) To provide funding for working capital and general corporate purposes, Coach Shanghai Limited has a credit facility that allows a maximum borrowing... -

Page 63

... Company is exposed to market risk from foreign currency exchange risk related to Coach Japan's and Coach Canada's U.S. dollar-denominated inventory purchases and Coach Japan's $139,400 U.S. dollardenominated fixed rate intercompany loan. Coach uses derivative financial instruments to manage these... -

Page 64

... per share data) 9. DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES - (continued) Amount of Loss Reclassified from Accumulated OCI into Income (Effective Portion) Year Ended Location of Loss Reclassified from Accumulated OCI into Income (Effective Portion) July 3, 2010 June 27, 2009 Cost of Sales... -

Page 65

... Financial Statements (dollars and shares in thousands, except per share data) 11. INCOME TAXES The provisions for income taxes computed by applying the U.S. statutory rate to income before taxes as reconciled to the actual provisions were: Fiscal Year Ended July 3, 2010 Amount June 27, 2009... -

Page 66

... COACH, INC. Notes to Consolidated Financial Statements (dollars and shares in thousands, except per share data) 11. INCOME TAXES - (continued) The components of deferred tax assets and liabilities at the respective year-ends were as follows: Fiscal 2010 Fiscal 2009 Share-based compensation... -

Page 67

...CONTRIBUTION PLAN Coach maintains the Coach, Inc. Savings and Profit Sharing Plan, which is a defined contribution plan. Employees who meet certain eligibility requirements and are not part of a collective bargaining agreement may participate in this program. The annual expense incurred by Coach for... -

Page 68

.... The Company's reportable segments represent channels of distribution that offer similar merchandise, service and marketing strategies. Sales of Coach products through Company-operated stores in North America, Japan, Hong Kong, Macau and mainland China, the Internet and the Coach catalog constitute... -

Page 69

... and factory stores in Japan and 41 department store shop-in-shops, retail stores and factory stores in Hong Kong, Macau and mainland China. Coach also operates distribution, product development and quality control locations in the United States, Hong Kong, China, South Korea, Vietnam and India... -

Page 70

... OPERATIONS In March 2007, the Company exited its corporate accounts business in order to better control the location where Coach product is sold and the image of the brand. Through the corporate accounts business, Coach sold products primarily to distributors for gift-giving and incentive programs... -

Page 71

... prices, through open market purchases. Repurchased shares of common stock become authorized but unissued shares and may be issued in the future for general corporate and other purposes. The Company may terminate or limit the stock repurchase program at any time. During fiscal 2010, fiscal 2009... -

Page 72

...of the Company at an exercise price far below the then-current market price. Subject to certain exceptions, Coach's Board will be entitled to redeem the rights at $0.0001 per right at any time before the close of business on the tenth day following either the public announcement that, or the date on... -

Page 73

... OF CONTENTS COACH, INC. Schedule II - Valuation and Qualifying Accounts For the Fiscal Years Ended July 3, 2010, June 27, 2009 and June 28, 2008 (amounts in thousands) Balance at Beginning of Year Provision Charged to Costs and Expenses Write-offs/ Allowances Balance at End of Year Taken... -

Page 74

...$8,286 net charge represents cost savings initiatives. The reported results for the fourth quarter of fiscal 2009 include a net benefit of $9,527, or $0.03 per share. Excluding this net benefit, income from continuing operations and diluted earnings per share from continuing operations were $136,266... -

Page 75

... from continuing operations were $172,487 and $0.50 per share, respectively. The net benefit represents a favorable settlement of a tax return examination reduced by the initial charitable contribution to the Coach Foundation and additional incentive compensation expense. See Fiscal 2009 and Fiscal... -

Page 76

... to Coach's Annual Report on Form 10-K for the fiscal year ended June 29, 2002 Coach, Inc. 2004 Stock Incentive Plan, which is incorporated by reference from Appendix A to the Registrant's Definitive Proxy Statement for the 2004 Annual Meeting of Stockholders, filed on September 29, 2004 Employment... -

Page 77

...by reference from Exhibit 10.16 to Coach's Annual Report on Form 10-K for the fiscal year ended June 28, 2008 Performance Restricted Stock Unit Award Grant Notice and Agreement, dated August 5, 2010, between Coach and Jerry Stritzke List of Subsidiaries of Coach Consent of Deloitte & Touche LLP Rule... -

Page 78

... of the FOB cost paid to the manufacturer of such product by Coach or its applicable affiliate. "Cumulative MOI" shall mean the aggregate MOI for all Fiscal Years since the launch of the Reed Krakoff Brand. "Employment Agreement" shall mean the Employment Agreement, dated June 1, 2003, between... -

Page 79

...Coach that operates the Reed Krakoff Brand plus Assumed MOI for such Fiscal Year less: (i) any Usage Payment accrued for such Fiscal Year, (ii) a shared service fee deduction of ten (10) percent of the Net Sales of products and services marketed and sold under the Reed Krakoff Brand and (iii) a cost... -

Page 80

..., Body and Hair Lotions, Make-Up Candles Silverware and Cutlery Eyewear, Sunglasses, Glasses Frames and Cases Jewelry, Watches, Keyrings Paper and Cardboard Products like Stationery, Playing Cards, Daily Planners etc. All Leather Goods, including Handbags, Briefcases, Travel Bags, Wallets, Purses... -

Page 81

... and Business (Services) Design Services for others in the field of Fashion Hotels; Restaurants; The right to use the Reed Krakoff Name for all commercial purposes related to the development, promotion, marketing, distribution, sale, and any other use or exploitation of the Reed Krakoff Brand. Reed... -

Page 82

...development and marketing of the Reed Krakoff Brand; and (iii) the exercise of any and all rights related to the Reed Krakoff Brand; 4) Licenses and assignments to Coach of all trademarks, trade dress, trade names and design patents bearing the Reed Krakoff Name, that Reed Krakoff, or any business... -

Page 83

... For each of the first fifteen (15) Fiscal Years beginning with the first Fiscal Year after Reed Krakoff's employment at Coach terminates, Reed Krakoff will be entitled to a Usage Payment for each Fiscal Year during which Coach operates the Reed Krakoff Brand in an amount equal to two (2) percent of... -

Page 84

... on the terms set forth in this Agreement (and that Krakoff will have enforceable rights against such buyer) on sales by such buyer of products and services marketed and sold under the Reed Krakoff Brand. 5) 6) 7) For purposes of illustration and not based on any forecast or plan, the following... -

Page 85

...and Unpaid Usage Payments + Interest Cumulative Accrual at Year End 2,000 2,000 2,040 Cash Payment $ - $ - $ - $ 4,480 $ 2,864 * RK operating income less shared service fee and cost of capital. The above table assumes that the interest Coach realizes on its cash balances in all periods... -

Page 86

... not previously sold, assigned, licensed or otherwise transferred all or any portion of the rights granted to Coach pursuant to this Agreement to any other person. 2) Coach hereby represents and warrants that: a) Authorization . Coach has all requisite corporate power and authority to execute and... -

Page 87

... points above the Prime Rate of interest as reported in The Wall Street Journal on the date the audit is completed. If the audit results in an increase in the Usage Payment payable to Reed Krakoff in respect of any Fiscal Year of more than three (3) percent, Coach will also pay for the cost... -

Page 88

... in cash to Reed Krakoff and all payments shall be made in United States currency. Conversion of foreign currency to U.S. dollars shall be made at the conversion rate used by Coach in the preparation of its financial statements. (c) Taxes. All payments due to Reed Krakoff hereunder shall be paid in... -

Page 89

... MOI (including any cost of capital deduction) was calculated; (iii) for each product that accounts for more than 5% of Net Sales of products sold under the Reed Krakoff Brand, the number of units of such product sold and the amount of Net Sales realized on sales of such products; (iv) the amount... -

Page 90

...hereunder shall be in writing and shall be deemed given when delivered in person or five (5) days after sent, postage prepaid, by registered mail, as follows: (a) if to the Coach, addressed as follows: Coach, Inc. 516 West 34th Street New York, New York 10001 Attention: General Counsel (b) if to... -

Page 91

... failure to do so) such limited amendments to this Agreement and appropriate policies and procedures, including amendments and policies with retroactive effect, that Coach reasonably determines are necessary or appropriate to (a) exempt the compensation and benefits payable under this Agreement from... -

Page 92

...State courts or American Arbitration Association located in the State of New York, within the County of New York. The parties hereby consent and ...of either party to act with respect to any breach or violation of any term, provision, covenant, or condition of this Agreement by the other party be ... -

Page 93

...Section shall be void and of no force and effect. The descriptive headings and captions in this Agreement are for convenience only and shall not affect the meaning or construction of any provisions hereof. XXII. COUNTERPARTS This Agreement may be executed in one or more counterparts, each of which... -

Page 94

IN WITNESS WHEREOF, the parties have executed this Agreement or caused this Agreement to be executed by their duly authorized representatives as of the effective date stated above. _____ Reed Krakoff Individually COACH, INC. By: Name: Title: _____ 17 -

Page 95

Exhibit A Quarterly Report [To come.] 18 -

Page 96

... Agreement and the Plan (and in tarticular the terms and conditions set forth on Annex B) (the "ReStrictionS "). While the Restrictions are in effect, the PRSUs are not transferable by you by means of sale, assignment, exchange, tledge, or otherwise. The number of PRSUs subject to the Award shall be... -

Page 97

...the later of the Date of Termination or the date of the Change in Control, the Award shall become vested with restect to (i) any tortion of the Fiscal Year PRSUs that relates to a fiscal year of the Comtany that ended on or trior to the Date of Termination (or date of the Change in Control, if later... -

Page 98

... such other vesting date tursuant to Section 5) generally are freely tradable in the United States. However, you may not offer, sell or otherwise distose of any shares in a way which would: (a) require the Comtany to file any registration statement with the Securities and Exchange Commission (or any... -

Page 99

...tayable during the first six months following your "setaration from service" shall instead be taid or trovided to you in a lumt sum tayment on the first business day immediately following the six-month anniversary of your "setaration from service" (or, if earlier, the date of your death). [signature... -

Page 100

... tarties hereto have executed and delivered the Agreement. COACH, INC. _____ Sarah Dunn Senior Vice President of Human Resources Date: I acknowledge that I have read and underStand the termS and conditionS of the Agreement and of the Plan and I agree to be bound thereto. AWARD RECIPIENT: _____... -

Page 101

.... (b) " Board" shall mean the Board of Directors of the Comtany. (c) The Comtany shall have " CauSe" to terminate the Executive's emtloyment uton (i) the Executive's failure to attemtt in good faith to substantially terform the duties as Chairman and Chief Executive Officer (other than any such... -

Page 102

... mean the Internal Revenue Code of 1986, as amended. (f) (g) " Committee " shall mean the Human Resources Committee of the Board. " Common Stock " shall mean the $0.01 tar value common stock of the Comtany. (h) " Company" shall mean Coach, Inc., a Maryland cortoration. (i) "Continuing Director... -

Page 103

..., the Fair Market Value of a share of Common Stock as of any date shall be the average of the high and low trading trices for a share of Common Stock as retorted on the New York Stock Exchange (or any national securities exchange on which the Common Stock is then listed) for such date or, if... -

Page 104

... on catital, stockholder returns, return on sales, gross or net trofit margin, troductivity, extense, margins, oterating efficiency, cost reduction or savings, customer satisfaction, working catital, earnings or diluted earnings ter share, trice ter share of Stock, and market share, any of which... -

Page 105

... Market Value ter share of Common Stock on the first day of the fiscal year in which the Date of Termination, or Change in Control, as attlicable, occurs. (cc) A terformance level of " Superior" with restect to any Performance Goal shall have the meaning set forth on Annex C. (dd) " Target Number... -

Page 106

...the terformance goals for Fiscal Year 2011 Fiscal Year 2012: That number of PRSUs equal to the ratio of: (A) $1,750,000, to (B)the Fair Market Value ter share of Common Stock on the date the Committee attroves the terformance goals for Fiscal Year 2012 Fiscal Year 2013: That number of PRSUs equal to... -

Page 107

...(iv) If the Comtany terformance level for a fiscal year is between Marginal and Good, between Good and Suterior, or between Suterior and Outstanding, the number of PRSUs that may become vested with restect to such fiscal year on the Vesting Date shall be determined by means of linear intertolation... -

Page 108

... level for the Performance Period is between Marginal and Good, between Good and Suterior, or between Suterior and Outstanding, the number of PRSUs that may become vested on the Vesting Date shall be determined by means of linear intertolation. (c) Termination of Emtloyment Prior to Vesting Date... -

Page 109

...six months following a termination of emtloyment without Cause or for Good Reason. Performance GoalS: The Award is intended to qualify as "terformance-based comtensation" within the meaning of Section 162(m) of the Code. The Performance Goals set forth on Annex C shall be established and the level... -

Page 110

Notwithstanding any other trovision of the Agreement (or any of its annexes), the Award shall be subject to any additional limitations set forth in Section 162(m) of the Code or any regulations or rulings thereunder that are requirements for qualification as "terformance-based comtensation," and the... -

Page 111

... equal the target to be attroved by the Human Resources Committee on August 6, 2009 for aggregate net sales by Coach International, excluding Coach Jatan, during the final fiscal year of the Performance Period. Each of the terms "Good," "Marginal," "Outstanding" and "Suterior", with restect to such... -

Page 112

... at any time during his emtloyment or during the 24-month teriod following the Date of Termination (the "ReStricted Period ") directly or indirectly engage in, have any equity interest in, or manage or oterate any (a) Comtetitive Business (as defined below), (b) new luxury accessories business that... -

Page 113

... communicated to the Executive in confidence by any third tarty as trotrietary information, or (b) the Executive knows or has reason to know is the trotrietary information of any third tarty. Further, the Executive shall adhere to and comtly with the Comtany's Global Business Integrity Program Guide... -

Page 114

7. subsidiaries. 8. As used in these Restrictive Covenants, the term " Company" shall include the Comtany and any of its affiliates or direct or indirect The Comtany and the Executive extressly acknowledge and agree that the agreements and covenants contained in these Restrictive Covenants are ... -

Page 115

... Agreement and the Plan (and in particular the terms and conditions set forth on Annex B) (the "ReStrictionS "). While the Restrictions are in effect, the PRSUs are not transferable by you by means of sale, assignment, exchange, pledge, or otherwise. The number of PRSUs subject to the Award shall be... -

Page 116

... in Control, the Award shall become vested with respect to (i) any portion of the Fiscal Year PRSUs that relates to a fiscal year of the Company that ended on or prior to the Date of Termination (or date of the Change in Control, if later) that would have become vested had you remained employed by... -

Page 117

... such other vesting date pursuant to Section 5) generally are freely tradable in the United States. However, you may not offer, sell or otherwise dispose of any shares in a way which would: (a) require the Company to file any registration statement with the Securities and Exchange Commission (or any... -

Page 118

...or affecting the relationship of the Company and its stockholders shall be governed by the General Corporation Law of the State of Maryland. All other matters arising under this Agreement shall be governed by the internal laws of the State of New York, including matters of validity, construction and... -

Page 119

... and delivered this Agreement. COACH, INC. _____ Sarah Dunn Senior Vice President of Human Resources Date: August 5, 2010 I acknowledge that I have read and underStand the termS and conditionS of thiS Agreement and of the Plan and I agree to be bound thereto. AWARD RECIPIENT: _____ JERRY... -

Page 120

...this Agreement. (b) " Board" shall mean the Board of Directors of the Company. (c) The Company shall have " CauSe" to terminate the Executive's employment upon (i) the Executive's failure to attempt in good faith to substantially perform the duties of his/her appointed office (other than any such... -

Page 121

... mean the Internal Revenue Code of 1986, as amended. (f) (g) " Committee " shall mean the Human Resources Committee of the Board. " Common Stock " shall mean the $0.01 par value common stock of the Company. (h) " Company" shall mean Coach, Inc., a Maryland corporation. (i) " Continuing Director... -

Page 122

..., return on capital, stockholder returns, return on sales, gross or net profit margin, productivity, expense, margins, operating efficiency, cost reduction or savings, customer satisfaction, working capital, earnings or diluted earnings per share, price per share of Stock, and market share, any... -

Page 123

... mean an amount equal to the product of (i) the number of shares of Common Stock that are distributed pursuant to the PRSU Award and (ii) the Fair Market Value per share of Common Stock on the date of such distribution. (y) " Section 409A " shall mean Section 409A of the Code and the Department... -

Page 124

... fiscal year, as applicable. (dd) " VeSting Date" shall mean each of the vesting dates shown on the vesting schedule on Annex B. (ee) " Voting Stock" shall mean all capital stock of the Company which by its terms may be voted on all matters submitted to stockholders of the Company generally. A-5 -

Page 125

.... Capitalized terms not defined herein are defined in this Agreement or in the Definitions Annex attached to this Agreement as Annex A . Award Date: Performance Period: August 5, 2010 July 4, 2010 through June 28, 2014 (i.e., the Company's 2011 through 2014 fiscal years) Target Value of Award... -

Page 126

... be June 28, 2014. If the Company performance level for a fiscal year is between Marginal and Good, between Good and Superior, or between Superior and Outstanding, the number of PRSUs that may become vested with respect to such fiscal year on the Vesting Date shall be determined by means of linear... -

Page 127

...28, 2014. If the Company performance level for the Performance Period is between Marginal and Good, between Good and Superior, or between Superior and Outstanding, the number of PRSUs that may become vested on the Vesting Date shall be determined by means of linear interpolation. (c) Termination of... -

Page 128

... each of the Company's fiscal years during the Performance Period (or such earlier time as may be required under Section 162(m) of the Code), the Committee shall, in writing, select the Performance Criteria for such fiscal year and establish the Performance Goals and the Target Number of PRSUs which... -

Page 129

...Human Resources Committee of the Board under the Company's Performance-Based Annual Incentive Plan (together with any successor plan adopted by the Company that provides for "performance-based compensation" within the meaning of Section 162(m) of the Code, the "Bonus Plan"). Each of the terms "Good... -

Page 130

..., reports, programs, plans, proposals, financial documents, or any other documents concerning the Company's customers, business plans, designs, marketing or other business strategies, products or processes, provided that the Executive may retain his rolodex, address book and similar information and... -

Page 131

... Global Business Integrity Program Guide. All Intellectual Property created or assembled in connection with the Executive's employment hereunder shall be the permanent and exclusive property of the Company. The Company and the Executive mutually agree that all Intellectual Property and work product... -

Page 132

8. The Company and the Executive expressly acknowledge and agree that the agreements and covenants contained ...extensive in any other respect, it will be interpreted to extend only over the maximum period of time for which it may be enforceable, and/or over the maximum geographical area as to which ... -

Page 133

...Limited Shenzhen (China) Coach International Limited (Hong Kong) Coach Manufacturing Limited (Hong Kong) 15. 16. 17. 18. Coach Hong Kong Limited (Hong Kong) Coach Hong Kong Limited Macau Branch (Macau) Coach Italy Services S.r.l. (Italy) Coach Japan LLC (Japan) 19. 20. Coach Korea Limited (Korea... -

Page 134

...our reports dated August 25, 2010, relating to the consolidated financial statements and consolidated financial statement schedule of Coach, Inc. and subsidiaries (the "Company") and the effectiveness of the Company's internal control over financial reporting, appearing in this Annual Report on Form... -

Page 135

..., summarize and report financial information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: August 25, 2010 By: /s/ Lew Frankfort Name: Lew Frankfort Title... -

Page 136

... or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: August 25, 2010 By: /s/ Michael F. Devine, III Name: Michael F. Devine, III Title: Executive Vice President and Chief Financial Officer -

Page 137

...Exchange Act of 1934, as amended; and (ii) the information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. Date: August 25, 2010 By: /s/ Lew Frankfort Name: Lew Frankfort Title: Chairman and Chief Executive Officer... -

Page 138