Coach 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 Coach annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended June 28, 2003

or

oo TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 1-16153

Coach, Inc.

(Exact name of registrant as specified in its charter)

Maryland 52-2242751

(State or other jurisdiction of

incorporation or organization) (I.R.S. Employer

Identification No.)

516 West 34th Street, New York, NY 10001

(Address of principal executive offices) (Zip Code)

(212) 594-1850

(Registrant’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act:

Title of Each Class: Name of Each Exchange on which Registered

Common Stock, par value $.01 per share New York Stock Exchange

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been

subject to such filing requirements for the past 90 days. Yes No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be

contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this

Form 10-K or any amendment to this Form 10-K.

The approximate aggregate market value of the voting and non-voting stock held by non-affiliates of the registrant was approximately

$5,287,719,864 as of August 29, 2003. For purposes of determining this amount only, the registrant has excluded shares of common stock

held by directors and officers. Exclusion of shares held by any person should not be construed to indicate that such person possesses the

power, direct or indirect, to direct or cause the direction of the management or policies of the registrant, or that such person is controlled by or

under common control with the registrant.

On August 29, 2003, the Registrant had 91,954,939 outstanding shares of common stock, which is the Registrant’s only class of capital

stock.

Table of contents

-

Page 1

... 34th Street, New York, NY (Address of principal executive offices) 52-2242751 (I.R.S. Employer Identification No.) 10001 (Zip Code) (212) 594-1850 (Registrant's telephone number, including area code) Securities Registered Pursuant to Section 12(b) of the Act: Title of Each Class: Name of Each... -

Page 2

... Notes to Consolidated Financial Statements Market and Dividend Information COACH, INC. 2000 STOCK INCENTIVE PLAN COACH, INC. EXECUTIVE DEFERRED COMPENSATION PLAN COACH, INC. 2000 NON-EMPLOYEE DIRECTOR STOCK PLAN NON-QUALIFIED DEF. COMPENSATION PLAN OUTSIDE DIR. EMPLOYMENT AGREEMENT - COACH AND... -

Page 3

... with Accountants on Accounting and Financial Disclosure Item 9A. Controls and Procedures PART III Item 10. Directors and Executive Officers of the Registrant Item 11. Executive Compensation Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters... -

Page 4

... stores, its direct mail catalog and its internet site. Coach has built upon its national brand awareness, expanded into international sales, particularly in Japan and East Asia, further developed its multi-channel distribution strategy and licensed products with the Coach brand name. SPECIAL NOTE... -

Page 5

... and department locations operated by Coach Japan, Inc.; and • corporate sales programs. Over the last several years, Coach has successfully transformed itself from a manufacturer of classic leather products, to a marketer of more modern, fashionable handbags and accessories, using a broader... -

Page 6

... fiscal 2002. In each of the next two years, Coach plans to expand its network of 156 retail stores by opening at least 20 new stores per year located primarily in high volume markets. Coach believes that it has a successful retail store format that reinforces its brand image, generates strong sales... -

Page 7

... airport locations operated by a distributor. Coach Japan plans to open additional locations within existing major retailers, enter new department store relationships and open freestanding retail locations. Further Penetrate International Markets. Coach is increasing its international distribution... -

Page 8

...views its website, like its catalogs, as a key communications vehicle for the brand that also promotes store traffic. Coach's Products Handbags. Coach's original business was the design, manufacture and distribution of fine handbags, which accounted for approximately 56% of its net sales in fiscal... -

Page 9

... for all new licensed products prior to their sale. Marketing Coach's marketing strategy is to deliver a consistent message every time the consumer comes in contact with the Coach brand through all of its communications and visual merchandising. The Coach image is created and executed internally by... -

Page 10

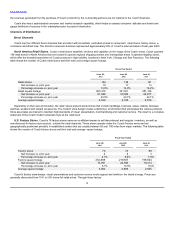

...operates flagship stores, which offer the broadest assortment of Coach products in high-visibility locations in New York, Chicago and San Francisco. The following table shows the number of Coach retail stores and their total and average square footage: Fiscal Year Ended June 28, 2003 June 29, 2002... -

Page 11

...At the end of fiscal 2003, 86 international locations and 67 U.S. department stores had been renovated to reflect the new modern design. The indirect channel represented approximately 41% of total net sales in fiscal 2003. Coach Japan, Inc. In order to expand its presence in the Japanese market and... -

Page 12

... and luggage, plans to open up to 25 Coach locations in the United Kingdom. Case will develop a multi channel distribution strategy consistent with the successful Coach model in the United States and Japan. In addition, Case assumed the responsibility of operating the existing Coach store on Sloane... -

Page 13

... works closely with the New York design team. This broad-based multi-country manufacturing strategy is designed to optimize the mix of cost, lead times and construction capabilities. Coach carefully balances its commitments to a limited number of "better brand" partners with demonstrated integrity... -

Page 14

... all management reporting. The supply chain management system supports corporate sales and inventory functions, creating a monthly demand plan and reconciling production/ procurement with financial plans. Product fulfillment is facilitated by Coach's highly automated warehouse management system and... -

Page 15

...product lines and markets in which it operates. Coach's products compete with other brands of products within their product category and with private label products sold by retailers, including some of Coach's wholesale customers. In its wholesale business, Coach competes with numerous manufacturers... -

Page 16

...the market price of its common stock. Because Coach products are frequently given as gifts, Coach has experienced, and expects to continue to experience, substantial seasonal fluctuations in its sales and operating results. Over the past two fiscal years approximately 33% of Coach's annual sales and... -

Page 17

...stock at an exercise price far below the then-current market price. Subject to certain exceptions, Coach's Board of Directors will be entitled to redeem the rights at $0.001 per right at any time before the close of business on the tenth day following either the public announcement that, or the date... -

Page 18

... Square Footage Location Use Jacksonville, Florida New York, New York Carlstadt, New Jersey Florence, Italy Tokyo, Japan Shenzhen, People's Republic of China Distribution and customer service Corporate Corporate and product development Product development Coach Japan, corporate Quality control... -

Page 19

..., New York City Agency for Child Development. Mr. Frankfort holds a Bachelor of Arts degree from Hunter College and an MBA in Marketing from Columbia University. Keith Monda was appointed President of Coach in May 2002 after serving as Executive Vice President and Chief Operating Officer of Coach... -

Page 20

... store operator. Previously, Mr. Devine was Chief Financial Officer at Industrial System Associates, Inc. from 1995 to 1997, and for the prior six years he was the Director of Finance and Distribution for McMaster-Carr Supply Co. Mr. Devine holds a Bachelor of Science degree in Finance and Marketing... -

Page 21

... Harvard Business School. PART II Item 5. Market for Registrant's Common Equity and Related Stockholder Matters Refer to the information regarding the market for Coach's Common Stock and the quarterly market price information appearing under the caption "Market and Dividend Information" included... -

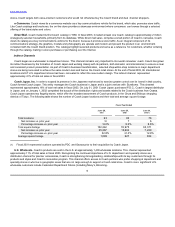

Page 22

... Percentage of Net Sales Data: Gross margin Selling, general and administrative expenses Operating income Net income Consolidated Balance Sheet Data: Working capital Total assets Inventory Receivable from Sara Lee Revolving credit facility Long-term debt Stockholders' equity (1) 71.1% 45.5% 25... -

Page 23

-

Page 24

... all Coach Japan operating expenses. Advertising, marketing and design expenses include employee compensation, media space and production, advertising agency fees, new product design costs as well as public relations, market research expenses and mail order costs. Distribution and customer services... -

Page 25

... the termination of 394 manufacturing, warehousing and management employees at the Lares facility. These actions reduced costs by the resulting transfer of production to lower cost third-party manufacturers. Coach's fiscal year ends on the Saturday closest to June 30. Results Of Operations The... -

Page 26

... included a full year. In the third quarter of fiscal 2002, Coach Japan acquired the distribution rights and assets of Osawa. The effect of the incremental month of operations and acquisition of Osawa locations represented approximately $19 million of the increase in net sales. These increases were... -

Page 27

... of store inventory and fixed asset recoveries relating to our World Trade Center location. Reorganization Costs In March 2002, Coach ceased production at its Lares, Puerto Rico, manufacturing facility. This reorganization involved the termination of 394 manufacturing, warehousing and management... -

Page 28

...from new retail and factory stores accounted for approximately 78% or $42.9 million of the increase in net sales. Since the end of fiscal 2001, Coach opened 20 retail stores and six factory stores. In addition, comparable store sales growth for retail stores and factory stores open for one full year... -

Page 29

... fiscal 2002 relating to our World Trade Center location. Reorganization Costs In the third fiscal quarter of 2002, management of Coach committed to and announced a plan to cease production at the Lares, Puerto Rico, manufacturing facility in March 2002. This reorganization involved the termination... -

Page 30

... fiscal 2002, and in both periods related primarily to new and renovated retail stores. Coach's future capital expenditures will depend on the timing and rate of expansion of our businesses, new store openings, store renovations and international expansion opportunities. Net cash used in financing... -

Page 31

...and at prevailing market prices, through open market purchases. Repurchased shares will be retired and may be reissued in the future for general corporate or other purposes. The Company may terminate or limit the stock repurchase program at any time. During fiscal 2003, Coach repurchased 1.9 million... -

Page 32

... Coach builds inventory for the holiday selling season, opens new retail stores and generates higher levels of trade receivables. In the second fiscal quarter its working capital requirements are reduced substantially as Coach generates consumer sales and collects wholesale accounts receivable... -

Page 33

...-counter consumer transaction or, for the wholesale channels, upon shipment of merchandise, when title passes to the customer. Allowances for estimated uncollectible accounts, discounts, returns and allowances are provided when sales are recorded based upon historical experience and current trends... -

Page 34

... through license agreements with manufacturers of other consumer products that incorporate the Coach brand. Revenue earned under these contracts is recognized based upon reported sales from the licensee. New Accounting Standards On December 31, 2002, the Financial Accounting Standards Board ("FASB... -

Page 35

... 92% of Coach's fiscal 2003 non-licensed product needs were purchased from independent manufacturers in countries other than the United States. These countries include China, Costa Rica, Italy, India, Indonesia, Malaysia, Spain, Turkey, Thailand, Taiwan, Korea, Hungary, Singapore, Great Britain... -

Page 36

...this report. Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure None Item 9A. Controls and Procedures Based on the evaluation of the Company's disclosure controls and procedures as of June 28, 2003, each of Lew Frankfort, the Chief Executive Officer of... -

Page 37

Table of Contents PART IV Item 15. Exhibits, Financial Statement Schedules and Reports on Form 8-K (a) Financial Statements and Financial Statement Schedule. See the "Index to Financial Statements" which is located on page 36 of this report. (b) Exhibits. See the exhibit index which is included ... -

Page 38

... by the undersigned thereunto duly authorized. COACH, INC. By: /s/ LEW FRANKFORT Name: Lew Frankfort Title: Chairman and Chief Executive Officer Pursuant to the requirements of the Securities Act of 1934, this report has been signed below by the following persons on behalf of the Registrant and in... -

Page 39

... the Fiscal Year Ended June 28, 2003 COACH, INC. New York, New York 10001 INDEX TO FINANCIAL STATEMENTS Page Number Financial Statements Independent Auditors' Report Report of Independent Public Accountants Consolidated Balance Sheets - At June 28, 2003 and June 29, 2002 Consolidated Statements... -

Page 40

... AUDITORS' REPORT To the Board of Directors and Shareholders of Coach, Inc.: We have audited the accompanying consolidated balance sheets of Coach, Inc. and subsidiaries (the "Company") as of June 28, 2003 and June 29, 2002 and the related consolidated statements of income, stockholders' equity, and... -

Page 41

...INDEPENDENT PUBLIC ACCOUNTANTS To the Board of Directors and Shareholders of Coach, Inc.: We have audited the accompanying consolidated balance sheets of Coach, Inc. (a Maryland corporation) as of June 30, 2001 and July 1, 2000, and the related consolidated statements of income, stockholders' equity... -

Page 42

...13,006 9,389 14,968 $ 440,571 Goodwill Indefinite life intangibles Other noncurrent assets Total assets Accounts payable Accrued liabilities Revolving credit facility Current portion of long-term debt LIABILITIES AND STOCKHOLDERS' EQUITY $ 26,637 108,273 26,471 80 161,461 3,535 3,572 22,155 $ 25... -

Page 43

Table of Contents COACH, INC. CONSOLIDATED STATEMENTS OF INCOME Fiscal Year Ended June 28, 2003 June 29, 2002 June 30, 2001 (amounts in thousands, except per share data) Net sales Cost of sales $ 953,226 275,797 677,429 433,667 - 243,762 (1,754) 695 244,821 90,585 7,608 $ 146,628 $ 719,403 ... -

Page 44

... Shares issued for stock options and employee benefit plans Tax benefit from exercise of stock options Repurchase of common stock Grant of restricted stock awards Amortization of restricted stock awards Translation adjustments Minimum pension liability Comprehensive income Balances at June 29, 2002... -

Page 45

Balances at June 28, 2003 $ 426,929 $ - $ 915 $ 215,399 $ 217,622 $ (1,359) $ (5,648) 91,505 See accompanying Notes to the Consolidated Financial Statements. 41 -

Page 46

...and amortization Reorganization costs Tax benefit from exercise of stock options Decrease (increase) in deferred taxes Other non cash credits, net Changes in current assets and liabilities: Increase in trade accounts receivable Decrease in receivable from Sara Lee Increase in inventories Increase in... -

Page 47

... classic accessories. Coach products are manufactured primarily by third-party suppliers. Coach markets products via Company operated retail stores and factory stores, direct mail catalogs, an e-commerce website, and via selected upscale department and specialty retailer locations and international... -

Page 48

... Company places its cash investments with high-credit quality financial institutions and currently invests primarily in bank money market funds placed with major banks and financial institutions. Accounts receivable is generally diversified due to the number of entities comprising Coach's customer... -

Page 49

...passes to the customer. Allowances for estimated uncollectible accounts, discounts, returns and allowances are provided when sales are recorded. Royalty revenues are earned through license agreements with manufacturers of other consumer products that incorporate the Coach brand. Revenue earned under... -

Page 50

... per share data) method, compensation expense is the excess, if any, of the quoted market price of the stock at the grant date or other measurement date over the amount an employee must pay to acquire the stock. The Company has elected to account for its stock-based employee compensation plans under... -

Page 51

... May 2002, Coach's Board of Directors authorized a two-for-one split of the Company's common stock, to be effected in the form of a special dividend of one share of the Company's common stock for each share outstanding. The additional shares issued as a result of the stock split were distributed on... -

Page 52

... have an impact on its financial position or results of operations. 2. Balance Sheet Components The components of certain balance sheet accounts are as follows: June 28, 2003 June 29, 2002 Property and Equipment Machinery and equipment Furniture and fixtures Leasehold improvements Construction... -

Page 53

...INC. Notes to Consolidated Financial Statements - (Continued) (dollars and shares in thousands, except per share data) 3. Income Taxes The provisions for income taxes computed by applying the U.S. statutory rate to income before taxes as reconciled to the actual provisions were: Fiscal Year Ended... -

Page 54

... This long-term debt had an original maturity date of September 30, 2002, accruing interest at U.S. dollar LIBOR plus 30 basis points. The note contained certain covenants, consistent with the above mentioned revolving credit facility. In fiscal 2001, this loan was fully paid off by the Company from... -

Page 55

... share data) To provide funding for working capital for operations and general corporate purposes, on February 27, 2001, Coach, certain lenders and Fleet National Bank ("Fleet"), as primary lender and administrative agent, entered into a $100,000 senior unsecured three-year revolving credit facility... -

Page 56

...Fiscal Year Amount 2004 2005 2006 2007 2008 Subsequent to 2008 Total $ 80 115 150 170 235 2,865 $ 3,615 5. Leases Coach leases certain office, distribution, retail and manufacturing facilities. The lease agreements, which expire at various dates through 2019, are subject, in some cases, to... -

Page 57

... the resulting transfer of production to lower cost third-party manufacturers. Coach recorded reorganization costs of $3,373 in fiscal 2002. The reorganization costs included $2,229 for worker separation costs, $659 for lease termination costs and $485 for the write-down of long-lived assets to net... -

Page 58

... other forms of equity compensation to certain members of Coach management and the outside members of its Board of Directors. These plans were approved by Coach's stockholders during fiscal 2002. The exercise price of each stock option equals 100% of the market price of Coach's stock on the date of... -

Page 59

...of each Coach option grant is estimated on the date of grant using the Black-Scholes option-pricing model and the following weighted-average assumptions: Fiscal Year Ended June 28, 2003 June 29, 2002 June 30, 2001 Expected lives (years) Risk-free interest rate Expected volatility Dividend yield... -

Page 60

...a limited number of Coach common shares at 85% of market value. Under this plan, Coach sold 67 shares to employees in fiscal 2003 and 26 shares to employees in fiscal year 2002. Pro forma compensation expense is calculated for the fair value of employees purchase rights using the Black-Scholes model... -

Page 61

...of Sara Lee. The annual expense incurred by Coach for the defined contribution and benefit plans is as follows: Fiscal Year Ended June 28, 2003 June 29, 2002 June 30, 2001 Coach, Inc. Savings and Profit Sharing Plan Coach Leatherware Company, Inc. Supplemental Pension Plan Patricipation in Sara... -

Page 62

-

Page 63

...Company operates its business in two reportable segments: Direct-to-Consumer and Indirect. The Company's reportable segments represent channels of distribution that offer similar merchandise, service and marketing strategies. Sales of Coach products through Company-operated retail and factory stores... -

Page 64

..., except per share data) Unallocated corporate expenses include production variances, general marketing, administration and information systems, distribution and customer service expenses. Direct-to- Fiscal 2003 Consumer Indirect Corporate Unallocated Total Net sales Operating income Interest... -

Page 65

... 2002 and fiscal 2001, sales from Coach-operated retail stores in the United Kingdom. 11. Coach Japan, Inc. and the Acquisition of Distributors In order to expand its presence in the Japanese market and to exercise greater control over its brand in that country, Coach formed Coach Japan, Inc... -

Page 66

...the Company. On January 1, 2002, Coach Japan completed the buyout of the distribution rights and assets, related to the Coach business, from J. Osawa and Company, Ltd. ("Osawa") for $5,792 in cash. At the time of the acquisition, Osawa operated 13 retail and department store locations in Japan. The... -

Page 67

... in fiscal 2002 and fiscal 2003. Under this standard, goodwill and indefinite life intangible assets, such as the Company's trademarks, are no longer amortized but are subject to annual impairment tests. In accordance with SFAS No. 142, prior period amounts were not restated. Coach recorded goodwill... -

Page 68

... outstanding and calculation of basic and diluted earnings per share: Fiscal Year Ended June 28, 2003 June 29, 2002 June 30, 2001 Net earnings Total basic shares Dilutive securities: Employee benefit and stock award plans Stock option programs $146,628 89,779 460 2,682 $85,827 88,048 342... -

Page 69

... prices, through open market purchases. Repurchased shares will become authorized but unissued shares and may be issued in the future for general corporate and other uses. The Company may terminate or limit the stock repurchase program at any time. On January 30, 2003, the Coach Board of Directors... -

Page 70

...be made from time to time, subject to market conditions and at prevailing market prices, through open market purchases. Repurchased shares will be retired and may be reissued in the future for general corporate or other purposes. The Company may terminate or limit the stock repurchase program at any... -

Page 71

... 7,993 132,254 82,729 9,242 $ $ 0.11 0.10 $ $ 0.11 0.11 $ $ 0.45 0.44 $ $ 0.09 0.09 The sum of the quarterly earnings per common share may not equal the full-year amount since the computations of the weightedaverage number of common-equivalent shares outstanding for each quarter and the full... -

Page 72

... public trading market for any of our securities. The following table sets forth, for the fiscal periods indicated, the high and low closing prices per share of Coach's common stock as reported on the New York Stock Exchange Composite Tape. Fiscal Year Ended 2003 High Low Quarter ended September... -

Page 73

Table of Contents COACH, INC. Schedule II - Valuation and Qualifying Accounts For the Fiscal Years Ended June 28, 2003, June 30, 2002 and June 30, 2001 Provision Charged Balance at Beginning of Year to Costs and Expenses Write-offs/ Allowances Taken Balance at End of Year (amounts in thousands)... -

Page 74

... from Exhibit 3.4 to Coach's Annual Report on Form 10-K for the fiscal year ended June 29, 2002 Rights Agreement, dated as of May 3, 2001, between Coach, Inc. and Mellon Investor Services LLC, which is incorporated herein by reference from Exhibit 4 to Coach's Current Report on Form 8-K filed on May... -

Page 75

... Stock Plan Coach, Inc. Non-Qualified Deferred Compensation Plan for Outside Directors Coach, Inc. 2001 Employee Stock Purchase Plan, which is incorporated by reference from Exhibit 10.15 to Coach's Annual Report on Form 10-K for the fiscal year ended June 29, 2002 Jacksonville, FL Lease Agreement... -

Page 76

... corporation, or any entity that is directly or indirectly controlled by Coach, Inc. and its subsidiaries. (f) amended. "EXCHANGE ACT" means the Securities Exchange Act of 1934, as (g) "FAIR MARKET VALUE" means the average of the highest and lowest sale prices of a Share on the New York Stock... -

Page 77

... or Awards under the Plan: (i) an officer or key employee of the Company at or above the "director" level, (ii) all other employees of the Company, including, but not limited to, Regional Managers, District Managers, Area Managers and Store Managers in the Company's Retail Division, (iii) a person... -

Page 78

...be five-hundred thousand (500,000) Shares with respect to the calendar year in which such person begins service as the Chief Executive Officer of the Company; and provided, further, that neither limit shall include any Restoration Options and the number of Shares for which Restoration Options may be... -

Page 79

... previous sentence (determined, if applicable, as the price at which such shares are sold into the market), and would have a term equal to the remaining term of the original Option. No person may be granted Restoration Options more than twice in any calendar year. (ii) SARs - An SAR shall represent... -

Page 80

... on invested capital, return on equity, return on sales and return on investment, cash flows, market share or cost reduction goals. The Committee may select one criterion or multiple criteria for measuring -5- performance, and the measurement may be based on Company or business unit performance, or... -

Page 81

... trustee or other fiduciary holding securities under an employee benefit plan of the Company, or any corporation owned, directly or indirectly, by the stockholders of the Company in substantially the same proportions as their ownership of Voting Stock (as defined below) of the Company) is or becomes... -

Page 82

..., city and local taxes as shall be legally required using statutory rates. (e) EFFECT ON OTHER PLANS OR AGREEMENTS - Payments or benefits provided to a Participant under any stock, deferred compensation, savings, retirement or other employee benefit plan are governed solely by the terms of such plan... -

Page 83

... 23, 2000 and was originally approved by the stockholders of Coach, Inc. on June 29, 2000. I hereby certify that the Plan, as amended and restated in its entirety, was approved by the by the Board of Directors of Coach, Inc., effective as of August 6, 2003. Executed on this sixth day of August, 2003... -

Page 84

... of October 21, 2002) ARTICLE I INTRODUCTION 1.1 The Plan and Its Effective Date. The Coach, Inc. Executive Deferred Compensation Plan was originally established as of June 1, 2000 (the "Effective Date"). In furtherance of the purposes of said plan and in order to amend said plan in certain respects... -

Page 85

..., full-time employee of an Employer on the date such election is made. (b) For each Plan Year, an Eligible Employee may make no more than one Deferral Election for the Eligible Employee's Annual (onus and such number of Deferral Elections with respect to the Eligible Employee's Annual (ase Salary as... -

Page 86

... by the average of the high and low quotes of a share of Common Stock on the applicable day on the New York Stock Exchange Composite Transaction Tape ("Market Value"). Fractional Deferred Stock Units will be computed to two decimal places. On any Common Stock dividend record date, an amount equal to... -

Page 87

... with the Administrator prior to the Valuation Date the change is to become effective. The amount elected to be transferred to the Stock Equivalent Account shall be treated as invested in Deferred Stock Units as of the Valuation Date and the number of Deferred Stock Units to be credited to the... -

Page 88

...unless the election to change the method of payment is received by the Administrator prior to the December 1 of the Plan Year preceding the Plan Year in which the Distribution Date specified in the original Deferral Election occurs. If a Participant's Deferral Account is payable in a single lump sum... -

Page 89

... of a Deferral deemed to be invested in the Stock Equivalent Account shall be distributed in whole shares of Common Stock with fractional shares credited to federal income taxes withheld. 4.7 Unforeseeable Financial Emergency. If the Administrator or its designee determines that a Participant has... -

Page 90

... Administrator prior to the date the Change of Control is to become effective. The amount to be credited to the Participant's Interest Account as of the effective time of the Change of Control shall be determined by multiplying the -7- number of Deferred Stock Units to be transferred by the Market... -

Page 91

...by the Company). The Company and the Employers shall not be required to fund, or otherwise segregate assets to be used for payment of benefits under the Plan. 5.2 Account Statements. As soon as practical after the end of each Plan Year (or after such additional date or dates as the Administrator, in... -

Page 92

... the end of such two-year period. These forfeitures will reduce the obligations of the Company under the Plan and the Participant or (eneficiary, as applicable, shall have no further right to his Deferral Account unless the Administrator determines otherwise in a particular case. 5.6 Controlling Law... -

Page 93

... Administrator determines to be necessary or desirable that does not materially change benefits to Participants or their (eneficiaries or materially increase the Company's or adopting Employers' obligations under the Plan. * * * * * I hereby certify that the Plan was originally established effective... -

Page 94

... "CODE" means the United States Internal Revenue Code of 1986, as amended, or any successor law. 2.6 "CO.PANY" means Coach, Inc., a .aryland corporation. 2.7 "FAIR .ARKET VALUE" means, with respect to any date, the average between the highest and lowest sale prices per Share on the New York Stock... -

Page 95

...14 "STOCK AWARD DATE" means the date on which Shares are awarded to a Non-Employee Director. 2.15 "STOCK OPTION AGREE.ENT" means a written agreement between a Non-Employee Director and the Company evidencing an Option. ARTICLE III - AD.INISTRATION OF THE PLAN 3.1 the Board. AD.INISTRATOR OF THE PLAN... -

Page 96

... Non-Employee Director on the day that the Company first offers Shares to the public in an initial public offering. (b) On the day of the last regularly scheduled meeting of the Board held in the second fiscal quarter of each fiscal year: (i) each Non-Employee Director shall be granted the Annual... -

Page 97

... IX, any stock certificates representing Shares awarded in respect of, and prior to, the one-year period beginning on the date of grant of a Stock Award shall not be transferred to the Non-Employee Director until immediately after the first annual meeting of stockholders held after the date of grant... -

Page 98

...exercisable and any and all stock certificates representing Shares awarded to a Non-Employee Director pursuant to the first sentence of Section 8.1 and not transferred to such Non-Employee Director pursuant to Section 8.3, and any and all dividend equivalents with respect thereto held by the Company... -

Page 99

... adversely change the terms and conditions of an outstanding Award without the Non-Employee Director's consent. ARTICLE XI - ADJUST.ENT PROVISIONS 11.1 If the Company shall at any time change the number of issued Shares without new consideration to the Company (such as by stock dividend, stock split... -

Page 100

... 23, 2000 and was originally approved by the stockholders of Coach, Inc. on June 29, 2000. I hereby certify that the Plan, as amended and restated in its entirety, was approved by the by the Board of Directors of Coach, Inc., effective as of August 6, 2003. Executed on this sixth day of August, 2003... -

Page 101

...such future date (the "Distribution Date") or dates and in such manner as a director who elects to participate in the Plan ("Participating Director") shall elect in a written Deferred Compensation Agreement in such form, consistent with the terms of the Plan, as shall be provided by the Board or its... -

Page 102

... Participating Director's Deferral Account and appropriate subaccounts on each Credit Date shall be determined by dividing the Deferred Compensation to be "invested" on that date by the average of the high and low quotes of a share of Common Stock on the applicable day on the New York Stock Exchange... -

Page 103

... Board prior to the Valuation Date the change is to become effective. The amount elect to be transferred to the Stock Equivalent Account shall be treated as invested in Deferred Stock Units as of the Valuation Date and the number of Deferred Stock Units to be credited to the Participating Director... -

Page 104

... to the date the Change of Control is to become effective. The amount to be credited to the Participating Director's Interest Account as of the effective time of the Change of Control shall be determined by multiplying the number of Deferred Stock Units to be transferred by the Market Value upon... -

Page 105

...to the Board is recommended by a majority of the Continuing Directors and (B) the term "Voting Stock" means all capital stock of the Company which by its terms may be voted on all matters submitted to stockholders of the Company generally. (c) Immediately upon the consummation of a Change in Control... -

Page 106

... Deferred Compensation accumulated in the Deferral Accounts. SECTION 11. EFFECTIVE DATE; TERMINATION. The Plan originally became effective on June 29, 2000. The Board may terminate the Plan at any time; provided that, such termination shall not affect the rights of Participating Directors that have... -

Page 107

... (b) "Annual Base Salary" shall have the meaning set forth in Section 5(a). (c) the Company. "Board" shall mean the Board of Directors of (d) Section 5(b). "Bonus" shall have the meaning set forth in (e) The Company shall have "Cause" to terminate the Executive's employment upon (i) the Executive... -

Page 108

... "Change in Control" shall occur when: (i) A Person (which term, when used in this Section 1(f), shall not include the Company, any underwriter temporarily holding securities pursuant to an offering of such securities, any trustee or other fiduciary holding securities under an employee benefit plan... -

Page 109

... agree may be changed by the Committee in accordance with the terms of the immediately preceding sentence) shall be communicated by the Company to the Executive as soon as reasonably practicable following the Effective Date. (l) "Continuing Director" means (i) any member of the Board (other than an... -

Page 110

... based compensation plan or agreement that may be adopted or entered into by the Company from time to time). (y) "Person" shall mean an individual, partnership, corporation, business trust, limited liability company, joint stock company, trust, unincorporated association, joint venture, governmental... -

Page 111

... of time shall mean the product of (i) the number of shares of Common Stock purchased upon the exercise of any Retention Options during such period and (ii) the excess of (A) the fair market value per share of Common Stock as of the date of such exercise over (B) the exercise price per share of... -

Page 112

... with his employment during the Term, the Executive shall be based at the Company's offices in New York, New York, except for necessary travel on the Company's business. 5. Compensation and Related Matters (a) Annual Base Salary. At the commencement of the Term, the Executive shall receive... -

Page 113

... Stock Units (i) During the Term, the Executive shall be eligible to be awarded Restricted Stock Units ("RSUs") and other equity compensation awards pursuant to the Stock Incentive Plan (or any other equity based compensation plan that may be adopted by the Company from time to time), at such time... -

Page 114

... effect from time to time (but in no event shall the Executive be entitled to fewer than two personal days per Contract Year). (h) Automobile. During the Term, the Company shall provide the Executive with a Company-leased automobile in accordance with the Company's applicable policies and procedures... -

Page 115

... and Benefits (a) Termination for any Reason. In the event the Executive's employment with the Company is terminated for any reason, the Company shall pay the Executive (or his beneficiary in the event of his death) any unpaid Annual Base Salary that has accrued as of the Date of Termination, any... -

Page 116

...Release")): (i) Pay to the Executive an amount equal to the product of (A) the sum of his then current (i) Annual Base Salary and (ii) Target Bonus for the year of termination, and (B) two; payable in equal monthly installments during the period beginning on the Date of Termination and ending on the... -

Page 117

... such Change in Control, the Company shall (subject to the receipt of the Release): (i) Pay to the Executive an amount equal to the product of (A) the sum of his then current (i) Annual Base Salary and (ii) Target Bonus for the year of termination, and (B) two; payable in equal monthly installments... -

Page 118

... in accordance with the terms of the applicable Option or RSU agreement. (e) Termination for Cause or without Good Reason. If the Executive's employment shall terminate by reason of his voluntary resignation without Good Reason (pursuant to Section 6(a)(vi)) or by the Company for Cause (pursuant to... -

Page 119

... The Executive shall not, at any time during the Term or during the 24-month period following the Date of Termination (the "Restricted Period") directly or indirectly engage in, have any equity interest in, or manage or operate any (i) Competitive Business, (ii) new luxury accessories business that... -

Page 120

..., letters, notes, notebooks, reports, programs, plans, proposals, financial documents, or any other documents concerning the Company's customers, business plans, designs, marketing or other business strategies, products or processes, provided that the Executive may retain his rolodex, address book... -

Page 121

... Global Business Integrity Program Guide. All Intellectual Property created or assembled in connection with the Executive's employment hereunder shall be the permanent and exclusive property of the Company. The Company and the Executive mutually agree that all Intellectual Property and work product... -

Page 122

... or his serving or having served any other enterprise or benefit plan as a director, officer, employee or fiduciary at the request of the Company (other than any dispute, claim or controversy arising under or relating to this Agreement). Notwithstanding anything to the contrary herein, the... -

Page 123

... 1000 New York, NY 10022 Attn: Jed W. Brickner to him at the most recent address in the Company's records. with a copy to: If to the Executive: Either party may change the address to which notices, requests, demands and other communications to such party shall be delivered personally or mailed by... -

Page 124

... respect to which the Executive may be subject under any other agreement with the Company. Notwithstanding the foregoing, no amount of (a) Annual Base Salary or Bonus deferred by the Executive on or following the Effective Date pursuant to any deferred compensation plan or arrangement maintained by... -

Page 125

[signature page follows] 20 IN WITNESS WHEREOF, the parties have executed this Agreement on the date and year first above written. COMPANY By: _____ Its: _____ EXECUTIVE _____ Lew Frankfort 21 -

Page 126

Exhibit 10.21 EMPLOYMENT AGREEMENT THIS AGREEMENT, effective as of June 1, 2003 (the "Effective Date"), is made by and between Coach, Inc., a Maryland corporation (the "Company"), and Reed Krakoff (the "Executive"). RECITALS: A. It is the desire of the Company to assure itself of the services of the... -

Page 127

..."Change in Control" shall occur when: (i) A Person (which term, when used in this Section 1(f), shall not include the Company, any underwriter temporarily holding securities pursuant to an offering of such securities, any trustee or other fiduciary holding securities under an employee benefit plan... -

Page 128

... agree may be changed by the Committee in accordance with the terms of the immediately preceding sentence) shall be communicated by the Company to the Executive as soon as reasonably practicable following the Effective Date. (l) "Continuing Director" means (i) any member of the Board (other than an... -

Page 129

... based compensation plan or agreement that may be adopted or entered into by the Company from time to time). (y) "Person" shall mean an individual, partnership, corporation, business trust, limited liability company, joint stock company, trust, unincorporated association, joint venture, governmental... -

Page 130

... President and Executive Creative Director of the Company, reporting to the Company's Chief Executive Officer, with such responsibilities, duties and authority as are customary for such role. The Executive shall devote all necessary business time and attention, and employ his reasonable best efforts... -

Page 131

... to the product of (i) $2,750,000 and (ii) the ratio of (A) 36 minus the number of full months the Executive was employed by the Company following the Effective Date and prior to the date of such termination, to (B) 36. (d) Retention Bonuses. During the Term, in addition to any Annual Bonuses paid... -

Page 132

... thereunder, such additional bonus to be paid at the time bonuses under the Bonus Plan are paid generally but, in any event, no later than 90 days after the end of the applicable Contract Year. 7 (e) Stock Options (i) During the Term, the Executive shall be eligible to be granted Options at such... -

Page 133

... Stock Units (i) During the Term, the Executive shall be eligible to be awarded Restricted Stock Units ("RSUs") and other equity compensation awards pursuant to the Stock Incentive Plan (or any other equity based compensation plan that may be adopted by the Company from time to time), at such time... -

Page 134

... than two personal days per Contract Year). (j) Automobile Allowance. During the Term, the Company shall provide the Executive with a Company-leased automobile or a car allowance in accordance with the Company's applicable policies and procedures. 6. Termination. The Executive's employment hereunder... -

Page 135

... Release Agreement with the Company in substantially the form attached hereto as Exhibit C (the "Release")): (i) Pay to the Executive (A) an amount equal to his then current Annual Base Salary, payable in equal monthly installments during the period beginning on the Date of Termination and ending on... -

Page 136

...immediately following such Change in Control, the Company shall (subject to the receipt of the Release): (i) Pay to the Executive (A) an amount equal to his then current Annual Base Salary, payable in equal monthly installments during the period beginning on the Date of Termination and ending on the... -

Page 137

... equity based compensation awards then held by the Executive to become fully vested and exercisable with respect to all shares subject thereto, effective immediately prior to the Date of Termination and all Options shall remain exercisable for the remainder of the 10 year term; (iv) Pay Executive... -

Page 138

... recognized United States public accounting firm selected by the Company and approved in writing by the Executive (which approval shall not be unreasonably withheld) (the "Auditors") that any payment or benefit made or provided to the Executive in connection with this Agreement or otherwise... -

Page 139

...The Executive shall not, at any time during the Term or during the 12-month period following the Date of Termination (the "Restricted Period") directly or indirectly engage in, have any equity interest in, or manage or operate any (i) Competitive Business or (ii) new luxury accessories business that... -

Page 140

..., letters, notes, notebooks, reports, programs, plans, proposals, financial documents, or any other documents concerning the Company's customers, business plans, designs, marketing or other business strategies, products or processes, provided that the Executive may retain his rolodex, address book... -

Page 141

...to use the Executive's name and likeness in connection with the sale, display and advertising of any product designed by the Executive during his employment with the Company; provided that, at any time after the Date of Termination, such use is limited to use in conjunction with the trademark "Coach... -

Page 142

... or his serving or having served any other enterprise or benefit plan as a director, officer, employee or fiduciary at the request of the Company (other than any dispute, claim or controversy arising under or relating to this Agreement). Notwithstanding anything to the contrary herein, the... -

Page 143

..., Suite 1000 New York, NY 10022 Attn: Jed W. Brickner to him at the most recent address in the Company's records. If to the Executive: Either party may change the address to which notices, requests, demands and other communications to such party shall be delivered personally or mailed by giving... -

Page 144

... any other agreement with the Company. Notwithstanding the foregoing, no amount of (a) Annual Base Salary or Annual Bonus deferred by the Executive on or following the Effective Date pursuant to any deferred compensation plan or arrangement maintained by the Company, or (b) compensation deferred by... -

Page 145

...22 EMPLOYMENT AGREEMENT THIS AGREEMENT, effective as of June 1, 2003 (the "Effective Date"), is made by and between Coach, Inc., a Maryland corporation (the "Company") and Keith Monda (the "Executive"). RECITALS: A. It is the desire of the Company to assure itself of the services of the Executive by... -

Page 146

..."Change in Control" shall occur when: (i) A Person (which term, when used in this Section 1(f), shall not include the Company, any underwriter temporarily holding securities pursuant to an offering of such securities, any trustee or other fiduciary holding securities under an employee benefit plan... -

Page 147

... agree may be changed by the Committee in accordance with the terms of the immediately preceding sentence) shall be communicated by the Company to the Executive as soon as reasonably practicable following the Effective Date. (l) "Continuing Director" means (i) any member of the Board (other than an... -

Page 148

... based compensation plan or agreement that may be adopted or entered into by the Company from time to time). (y) "Person" shall mean an individual, partnership, corporation, business trust, limited liability company, joint stock company, trust, unincorporated association, joint venture, governmental... -

Page 149

...of directors and advisory committees so long as such service does not materially interfere with Executive's obligations hereunder or violate Section 9 hereof. 4. Place of Performance. In connection with his employment during the Term, the Executive shall be based at the Company's offices in New York... -

Page 150

... Stock Incentive Plan and a written Retention Stock Option Agreement to be entered into by and between the Company and Executive as of the date hereof in substantially the form attached hereto as Exhibit A. The Retention Options shall have an exercise price equal to the fair market value per share... -

Page 151

... Stock Units (i) During the Term, the Executive shall be eligible to be awarded Restricted Stock Units ("RSUs") and other equity compensation awards pursuant to the Stock Incentive Plan (or any other equity based compensation plan that may be adopted by the Company from time to time), at such time... -

Page 152

... effect from time to time (but in no event shall the Executive be entitled to fewer than two personal days per Contract Year). (h) Automobile. During the Term, the Company shall provide the Executive with a Company-leased automobile in accordance with the Company's applicable policies and procedures... -

Page 153

... plan, policy, program or arrangement maintained by the Company. (b) Terminations without Cause or for Good Reason. Except as otherwise provided by Section 7(c) with respect to certain terminations of employment in connection with a Change in Control, if the Executive's employment shall terminate... -

Page 154

... such Change in Control, the Company shall (subject to the receipt of the Release): (i) Pay to the Executive an amount equal to the product of (A) the sum of his then current (i) Annual Base Salary and (ii) Target Bonus for the year of termination, and (B) 1.5; payable in equal monthly installments... -

Page 155

... equity based compensation awards then held by the Executive to become fully vested and exercisable with respect to all shares subject thereto, effective immediately prior to the Date of Termination and all Options shall remain exercisable for the remainder of the 10 year term; (iv) Pay Executive... -

Page 156

... recognized United States public accounting firm selected by the Company and approved in writing by the Executive (which approval shall not be unreasonably withheld) (the "Auditors") that any payment or benefit made or provided to the Executive in connection with this Agreement or otherwise... -

Page 157

... The Executive shall not, at any time during the Term or during the 18 month period following the Date of Termination (the "Restricted Period") directly or indirectly engage in, have any equity interest in, or manage or operate any (i) Competitive Business, (ii) new luxury accessories business that... -

Page 158

..., letters, notes, notebooks, reports, programs, plans, proposals, financial documents, or any other documents concerning the Company's customers, business plans, designs, marketing or other business strategies, products or processes, provided that the Executive may retain his rolodex, address book... -

Page 159

... Global Business Integrity Program Guide. All Intellectual Property created or assembled in connection with the Executive's employment hereunder shall be the permanent and exclusive property of the Company. The Company and the Executive mutually agree that all Intellectual Property and work product... -

Page 160

... or his serving or having served any other enterprise or benefit plan as a director, officer, employee or fiduciary at the request of the 17 Company (other than any dispute, claim or controversy arising under or relating to this Agreement). Notwithstanding anything to the contrary herein, the... -

Page 161

..., Suite 1000 New York, NY 10022 Attn: Jed W. Brickner to him at the most recent address in the Company's records. If to the Executive: Either party may change the address to which notices, requests, demands and other communications to such party shall be delivered personally or mailed by giving... -

Page 162

... respect to which the Executive may be subject under any other agreement with the Company. Notwithstanding the foregoing, no amount of (a) Annual Base Salary or Bonus deferred by the Executive on or following the Effective Date pursuant to any deferred compensation plan or arrangement maintained by... -

Page 163

... Stores Puerto Rico, Inc. (Delaware) Coach Japan Holdings, Inc. (Delaware) Coach Japan Investments, Inc. (Delaware) Coach (UK) Limited (United Kingdom) Coach Europe Services S.r.l. (Italy) Coach Stores Canada Inc. (Canada) Coach International Holdings, Inc. (Cayman Islands) Coach Japan, Inc. (Japan... -

Page 164

...consolidated financial statements and financial statement schedules of Coach, Inc. as of and for the years ended June 28, 2003 and June 29, 2002, appearing in this Annual Report on Form 10-K of Coach, Inc. for the year ended June 28, 2003. DELOITTE & TOUCHE LLP New York, New York September 15, 2003 -

Page 165

...; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: September 17, 2003 By: /s/ LEW FRANKFORT Name: Lew Frankfort Title: Chairman and Chief Executive Officer -

Page 166

... or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: September 17, 2003 By: /s/ MICHAEL F. DEVINE, III Name: Michael F. Devine, III Title: Senior Vice President and Chief Financial Officer -

Page 167

... Title: Chairman and Chief Executive Officer Pursuant to 18 U.S.C. § 1350, as created by Section 906 of the Sarbanes-Oxley Act of 2002, the undersigned officer of Coach, Inc. (the "Company") hereby certifies, to such officer's knowledge, that: (i) the accompanying Annual Report on Form 10-K of the...