Clearwire 2010 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2010 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

response to changes in our strategy, funding availability, technology and industry trends additional projects could be

identified for abandonment, for which the associated write-downs could be material.

Additionally, during the year ended December 31, 2010, we recorded an impairment charge of $2.6 million

related to our indefinite-lived spectrum assets in Ireland in conjunction with our sale of those operations, as well as

impairment losses of $7.8 million related to network and other intangible assets in our international operations.

There were no impairment losses recorded in the years ended December 31, 2009 and 2008.

Transaction Related Expenses

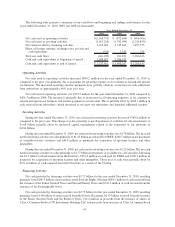

(In thousands, except percentages) 2010 2009 2008

Year Ended

December 31,

Transaction related expenses ................................... $— $— $82,960

Transaction related expenses in 2008 include a one-time $80.6 million settlement loss resulting from the

termination of spectrum lease agreements under which Sprint leased spectrum to Old Clearwire prior to the Closing.

As part of the Closing, Sprint contributed both the spectrum lease agreements and the spectrum assets underlying

those agreements to our business. As a result of the Closing, the spectrum lease agreements were effectively

terminated, and the settlement of those agreements was accounted for as a separate element apart from the business

combination. The settlement loss recognized from the termination was valued based on the amount by which the

agreements were favorable or unfavorable to our business as compared to current market rates. We had no

comparable expenses in 2010 or 2009.

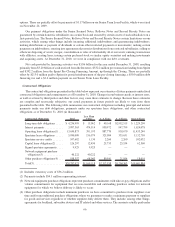

Interest Expense

(In thousands, except percentages) 2010 2009 2008

Year Ended

December 31,

Interest expense .................................... $(152,868) $(69,468) $(16,545)

We incurred $361.5 million and $209.6 million in gross interest costs during the years ended December 31,

2010 and 2009, respectively. Interest costs were partially offset by capitalized interest of $208.6 million and

$140.2 million for the years ended December 31, 2010 and 2009, respectively. Interest expense also includes

adjustments to accrete our debt to par value. The increase in interest expense for the year ended December 31, 2010

as compared to the same period in 2009 is due primarily to the issuance of the Senior Secured Notes in November

2009, which increased the outstanding principal balances by approximately $1.36 billion during 2010 as compared

to 2009.

For the year ended December 31, 2009, we incurred twelve months of interest costs totaling $209.6 million,

which were partially offset by capitalized interest of $140.2 million. Interest expense for 2008 included $7.9 million

of interest expense recorded on the note payable to Sprint for the repayment of an obligation to reimburse Sprint for

financing the Sprint WiMAX Business between April 1, 2008 and the Closing, which we refer to as the Sprint Pre-

Closing Financing Amount, and one month of interest expense totaling $8.6 million on the long-term debt acquired

from Old Clearwire.

We expect interest expense to increase next year compared to 2010 as we will incur a full year of interest costs

for the additional $1.40 billion of debt issued during December 2010 and a full year of accretion of the significant

discount on the Exchangeable Notes resulting from separation of the Exchange Options. In addition, capitalized

interest is expected to be reduced as network expansion activities subside.

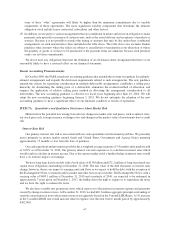

Gain (Loss) on Derivative Instruments

(In thousands, except percentages) 2010 2009 2008

Year Ended

December 31,

Gain (loss) on derivative instruments ........................ $63,255 $(6,976) $(6,072)

61