Clearwire 2008 Annual Report Download - page 94

Download and view the complete annual report

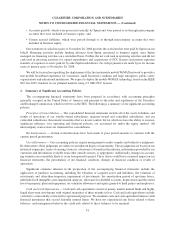

Please find page 94 of the 2008 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Restricte

d

Cas

h

—

Restr

i

cte

d

cas

hi

sc

l

ass

ifi

e

d

as a current or noncurrent asset

b

ase

d

on

i

ts

d

es

i

gnate

d

p

urpose. T

h

ema

j

or

i

ty o

f

t

hi

s restr

i

cte

d

cas

h

re

l

ates to outstan

di

ng

l

etters o

f

cre

di

t.

I

nvestments — Statement of Financial Accountin

g

Standards, which we refer to as SFAS, No. 115

,

A

ccounting

f

or Certain Investments in Debt and E

q

uity Securitie

s

,

and Staff Accountin

g

Bulletin, which we refer to as

S

AB Topic 5.M, Ot

h

er T

h

an Temporary Impairment of Certain Investments in De

b

tan

d

Equity Securitie

s

,

prov

ide

gu

id

ance on account

i

ng

f

or

i

nvestments an

dd

eterm

i

n

i

ng w

h

en an

i

nvestment

i

sot

h

er-t

h

an-temporar

il

y

i

mpa

i

re

d

.

W

e classif

y

marketable debt and equit

y

securities that are available for current operations as short-term available-

f

or-sa

l

e

i

nvestments, an

d

t

h

ese secur

i

t

i

es are state

d

at

f

a

i

rva

l

ue. Unrea

li

ze

d

ga

i

ns an

dl

osses are recor

d

e

d

w

i

t

hi

n

accumu

l

ate

d

ot

h

er compre

h

ens

i

ve

i

ncome (

l

oss). Losses are recogn

i

ze

di

n net

l

oss w

h

en a

d

ec

li

ne

i

n

f

a

i

rva

l

ue

is

determined to be other-than-temporar

y

. Realized

g

ains and losses are determined on the basis of the specifi

c

i

dentification method. We review our short-term and long-term investments on an ongoing basis for indicators o

f

ot

h

er-t

h

an-temporary

i

mpa

i

rment, an

d

t

hi

s

d

eterm

i

nat

i

on requ

i

res s

i

gn

ifi

cant

j

u

d

gment

.

We

h

ave an

i

nvestment port

f

o

li

o compr

i

se

d

o

f

U.S. Treasur

i

es an

d

auct

i

on rate secur

i

t

i

es. T

h

eva

l

ue o

f

t

h

ese

s

ecur

i

t

i

es

i

ssu

bj

ect to mar

k

et vo

l

at

ili

t

yd

ur

i

n

g

t

h

e per

i

o

d

t

h

e

i

nvestments are

h

e

ld

an

d

unt

il

t

h

e

i

rsa

l

e or matur

i

t

y.

W

e recognize realized losses when declines in the fair value of our investments below their cost basis are judged to

be other-than-temporary. In determining whether a decline in fair value is other-than-temporary, we consider

var

i

ous

f

actors

i

nc

l

u

di

n

g

mar

k

et pr

i

ce (w

h

en ava

il

a

bl

e),

i

nvestment rat

i

n

g

s, t

h

e

fi

nanc

i

a

l

con

di

t

i

on an

d

near-ter

m

p

rospects of the issuer, the len

g

th of time and the extent to which the fair value has been less than the cost basis, an

d

our intent and ability to hold the investment until maturity or for a period of time sufficient to allow for any

ant

i

c

i

pate

d

recover

yi

n mar

k

et va

l

ue. We ma

k

es

ig

n

ifi

cant

j

u

dg

ments

i

n cons

id

er

i

n

g

t

h

ese

f

actors. I

fi

t

i

s

j

u

dg

e

d

t

h

at

a decline in fair value is other-than-temporar

y

, the investment is valued at the current estimated fair value and

a

r

ealized loss e

q

ual to the decline is reflected in the consolidated statement of o

p

erations.

I

n determinin

g

fair value, we use quoted prices in active markets where such prices are available, or models to

e

st

i

mate t

h

e

f

a

i

rva

l

ue us

i

ng var

i

ous met

h

o

d

s

i

nc

l

u

di

ng t

h

e mar

k

et an

di

ncome approac

h

es. For

i

nvestments w

h

er

e

m

odels are used to estimate fair value in the absence of

q

uoted market

p

rices, we utilize certain assum

p

tions tha

t

m

arket participants would use in pricin

g

the investment, includin

g

assumptions about risk and the risks inherent in

t

h

e

i

nputs to t

h

eva

l

uat

i

on tec

h

n

i

que. T

h

ese

i

nputs

i

nc

l

u

d

et

h

ose t

h

at are rea

dil

yo

b

serva

bl

e, mar

k

et corro

b

orate

d,

and unobservable Compan

y

inputs. We believe that our pricin

g

models, inputs and assumptions are what marke

t

p

articipants would use in pricin

g

the securities. We maximize the use of observable inputs in the pricin

g

model

s

w

h

ere quote

d

mar

k

et pr

i

ces

f

rom secur

i

t

i

es an

dd

er

i

vat

i

ves exc

h

anges are ava

il

a

bl

ean

d

re

li

a

bl

e. We typ

i

ca

ll

y

r

ece

i

ve externa

l

va

l

uat

i

on

i

n

f

ormat

i

on

f

or U.S. Treasur

i

es, ot

h

er U.S. Government an

d

A

g

enc

y

secur

i

t

i

es, as we

ll

a

s

c

ertain corporate debt securities, mone

y

market funds and certificates of deposit. We also use certain unobservable

i

nputs that cannot be validated by reference to a readily observable market or exchange data and rely, to a certain

e

xtent, on mana

g

ement’s own assumpt

i

ons a

b

out t

h

e assumpt

i

ons t

h

at mar

k

et part

i

c

i

pants wou

ld

use

i

npr

i

c

i

n

g

t

he

s

ecur

i

t

y

. Our

i

nterna

lly g

enerate

d

pr

i

c

i

n

g

mo

d

e

l

sma

yi

nc

l

u

d

e our own

d

ata an

d

requ

i

re us to use our

j

u

dg

ment

in

i

nterpreting relevant market data, matters of uncertainty and matters that are inherently subjective in nature. We use

m

any

f

actors t

h

at are necessary to est

i

mate mar

k

et va

l

ues,

i

nc

l

u

di

ng,

i

nterest rates, mar

k

et r

i

s

k

s, mar

k

et sprea

d

s,

t

i

m

i

n

g

o

f

cas

hfl

ows, mar

k

et

li

qu

idi

t

y

,rev

i

ew o

f

un

d

er

lyi

n

g

co

ll

atera

l

an

d

pr

i

nc

i

pa

l

,

i

nterest an

ddi

v

id

en

d

p

a

y

ments. The use of different

j

ud

g

ments and assumptions could result in different presentations of pricin

g

an

d

secur

i

ty pr

i

ces cou

ld

c

h

ange s

i

gn

ifi

cant

l

y

b

ase

d

on mar

k

et con

di

t

i

ons

.

F

air Va

l

ue Measurement

s

—

On January 1, 2008, we adopted SFAS No. 157, Fair Va

l

ue Measurement

s

,

w

hi

c

h

we refer to as SFAS No. 157, for our financial assets and liabilities that are reco

g

nized or disclosed at fair value on

an annual or more frequentl

y

recurrin

g

basis. These include our derivative financial instruments and our short-term

and long-term investments. The adoption of SFAS No. 157 did not have a significant effect on our consolidated

fi

nanc

i

a

l

statements. In accor

d

ance w

i

t

h

F

i

nanc

i

a

l

Account

i

ng Stan

d

ar

d

s Boar

d

,w

hi

c

h

we re

f

er to as FASB, Sta

ff

P

osition No. FAS 1

5

7-2

,

Eff

ective Date o

f

FASB Statement No. 15

7

, which we refer to as FSP No. 1

5

7-2, we hav

e

82

CLEARWIRE CORPORATION AND

S

UB

S

IDIARIE

S

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)