Cisco 2011 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2011 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

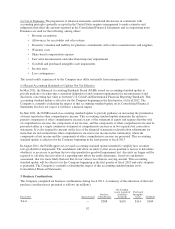

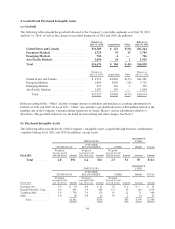

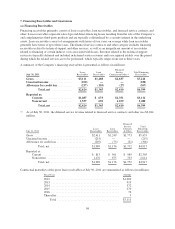

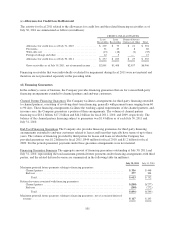

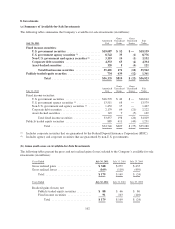

For purchased intangible assets with finite lives, the estimated future amortization expense as of July 30, 2011 is

as follows (in millions):

Fiscal Year Amount

2012 .............................................. $ 736

2013 .............................................. 621

2014 .............................................. 434

2015 .............................................. 366

2016 .............................................. 160

Thereafter .......................................... 46

Total .......................................... $2,363

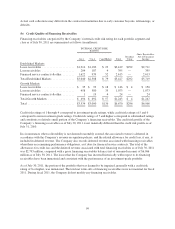

5. Restructuring and Other Charges

In the second half of fiscal 2011, the Company initiated a number of key, targeted actions to address several

areas in its business model intended to accomplish the following: simplify and focus the Company’s organization

and operating model; align the Company’s cost structure given transitions in the marketplace; divest or exit

underperforming operations; and deliver value to the Company’s shareholders. The Company is taking these

actions to align its business based on its five foundational priorities: leadership in its core business (routing,

switching, and associated services) which includes comprehensive security and mobility solutions; collaboration;

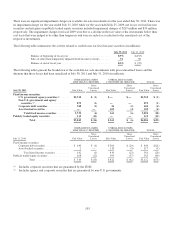

data center virtualization and cloud; video; and architectures for business transformation. The following table

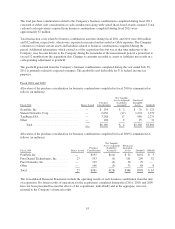

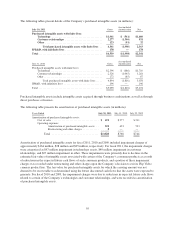

summarizes the activity related to the restructuring and other charges (in millions):

Voluntary Early

Retirement Program

Employee

Severance

Goodwill and Intangible

Assets Other Total

Fiscal 2011 Charges ..................... $453 $247 $ 71 $ 28 $ 799

Cash payments ......................... (436) (13) — — (449)

Non-cash items ........................ — — (71) (17) (88)

Restructuring liability as of July 30, 2011 .... $ 17 $234 $ — $ 11 $ 262

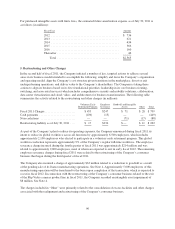

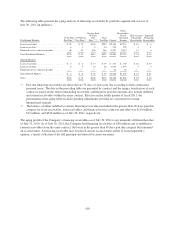

As part of the Company’s plan to reduce its operating expenses, the Company announced during fiscal 2011 its

intent to reduce its global workforce across all functions by approximately 6,500 employees, which includes

approximately 2,100 employees who elected to participate in a voluntary early retirement program. This global

workforce reduction represents approximately 9% of the Company’s regular full-time workforce. The employee

severance charge incurred during the fourth quarter of fiscal 2011 was approximately $214 million and was

related to approximately 2,600 employees, most of whom are expected to exit in early fiscal 2012. The remaining

employee severance charges during fiscal 2011 were related to the restructuring of the Company’s consumer

business that began during the third quarter of fiscal 2011.

The Company also incurred a charge of approximately $63 million related to a reduction to goodwill as a result

of the pending sale of its Juarez manufacturing operations. See Note 4. Approximately 5,000 employees of this

manufacturing operation will be transferred to the buyer upon completion of the transaction, which is expected to

occur in fiscal 2012. In connection with the restructuring of the Company’s consumer business related to the exit

of the Flip Video cameras product line in fiscal 2011, the Company recorded an intangible asset impairment of

$8 million. See Note 4.

The charges included in “Other” were primarily related to the consolidation of excess facilities and other charges

associated with the realignment and restructuring of the Company’s consumer business.

96