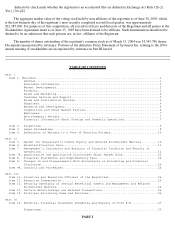

Circuit City 2003 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2003 Circuit City annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Balance Sheet Data:

------------------

Working capital $149.1 $133.3 $103.3 $106.7 $186.9

Total assets $445.7 $437.9 $454.4 $538.0 $551.8

Short-term debt $20.8 $21.2 $2.8 $48.6 $9.0

Long-term debt, excluding current portion $18.4 $17.5 $1.7

Shareholders' equity $212.6 $201.9 $254.9 $255.7 $310.2

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

Overview

We are a direct marketer of brand name and private label products, including personal desktop computers,

notebook computers, computer related products and industrial products in North America and Europe. We assemble our

own PCs and sell them under our own trademarks, which we believe gives us a competitive advantage. We also sell

computers manufactured by other leading companies, such as IBM and Hewlett Packard. We offer more than 100,000

products and continuously update our product offerings to address the needs of our customers, which include large, mid-

sized and small businesses, educational and government entities as well as individual consumers. Computers and

computer related products account for more than 90% of our net sales, and, as a result, we are dependent on the general

demand for information technology products.

The market for computer products is subject to intense price competition and is characterized by narrow gross

profit margins. Distribution of information technology products is working capital intensive, requiring us to incur

significant costs associated with the warehousing of many products, including the costs of leasing warehouse space,

maintaining inventory and tracking systems, and employing personnel to perform the associated tasks. We supplement

our product availability by maintaining relationships with major distributors, utilizing a combination of stocking and

drop-ship fulfillment.

During fiscal 2002 and 2003, our performance and that of the industry as a whole was impacted negatively by the

global economic downturn and cautious information technology spending. As it became evident that the industry was

experiencing a prolonged economic downturn, we took measures to align our cost structure with lower revenues and

decreasing gross margins. The primary component of our operating expenses historically has been employee related

costs, which includes items such as wages, commissions, bonuses, and benefits. We have recently made substantial

reductions in our workforce and closed or consolidated several facilities. We have reduced selling, general and

administrative expenses from 17.6% of net sales in 2001 to 14.3% (on a comparable basis) of net sales in 2003. In the

first quarter of 2004 we announced and began the implementation of a plan to streamline our United States computer

business. This plan will consolidate duplicative back office and warehouse operations, which we expect to result in

annual savings of approximately $8 million excluding severance and other restructuring costs of approximately $3

million to be recognized in fiscal 2004.

The discussion of our results of operations and financial condition that follows will provide information that will

assist in understanding our financial statements, the factors that we believe may affect our future results and financial

condition as well as information about how certain accounting principles and estimates affect the financial statements.

Results of Operations

We had net income for the year ended December 31, 2003 of $5.6 million. For the year ended December 31,

2002, we had a net loss of $58.9 million, after recording a cumulative effect of a change in accounting principle of $51

million, net of tax, to reflect the impairment of the entire carrying amount of goodwill. We had net income for the year

ended December 31, 2001 of $653,000.

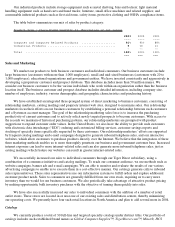

The following table represents our consolidated statement of operations data expressed as a percentage of net

sales for the three most recent fiscal years:

2003 2002 2001

---- ---- ----

Net sales 100.0% 100.0% 100.0%

Gross profit 16.2% 17.1% 17.9%