Circuit City 2000 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2000 Circuit City annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. Competition with respect to industrial products in the United Kingdom is similar to competition in the U.S., with

the exception that most direct mail companies in the United Kingdom drop ship the majority of their products from the

manufacturer, resulting in long delivery lead times. As Systemax stocks the majority of its products featured in its

dedicated industrial catalogs, management believes it has a significant advantage over most of its direct mail

competitors in the United Kingdom.

Elsewhere in Europe, no dedicated industrial catalogs are mailed by the Company, although industrial products

are featured in computer supplies and/or office supplies catalogs. Overall, sales of industrial products in Central

European markets are not material to the Company's overall sales in those markets.

There can be no assurance that the Company will be able to maintain or improve its current competitive position

with respect to any of these or other competitive factors.

Employees

As of December 31, 2000, the Company employed a total of 4,019 employees, including 3,865 full-time and 154

part-time employees, of whom 2,661 were in North America and 1,358 were in Europe.

None of the Company's employees is represented by a labor union, except for approximately 39 warehouse

employees in New York who are covered by an "open-shop" agreement with the Company which expires at the end of

2001, and certain employees at several locations in Europe. Employees are not required to join the union.

The Company considers its relationships with employees to be good and has not experienced a work stoppage in

26 years.

Environmental Matters

Under various national, state and local environmental laws and regulations in North America and Europe, a

current or previous owner or operator (including the lessee) of real property may become liable for the costs of removal

or remediation of hazardous substances at such real property. Such laws and regulations often impose liability without

regard to fault. The Company leases most of its facilities. In connection with such leases, the Company could be held

liable for the costs of removal or remedial actions with respect to hazardous substances. Although the Company has not

been notified of, and is not otherwise aware of, any material environmental liability, claim or non-compliance, there

can be no assurance that the Company will not be required to incur remediation or other costs in connection with

environmental matters in the future.

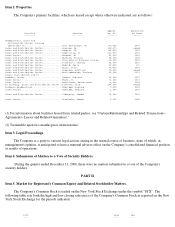

Financial Information About Foreign and Domestic Operations

The Company conducts its business in North America (the United States and Canada) and Europe. The following sets

forth the Company's operations in its two geographic markets (in thousands):

2000 Europe North America TOTAL

---- -------------------- --------------------- --------------

Net sales.............................. $548,097 $1,138,006 $ 1,686,103

Income (loss) from operations.......... $17,294 $(78,302) $(61,008)

Identifiable assets.................... $107,800 $430,219 $538,018

1999 Europe North America TOTAL

---- -------------------- --------------------- --------------

Net sales.............................. $491,071 $1,263,401 $ 1,754,472

Income from operations................. $10,541 $49,294 $59,835

Identifiable assets.................... $93,900 $457,912 $551,812

1998 Europe North America TOTAL

---- -------------------- --------------------- -----------

Net sales.............................. $314,404 $1,121,250 $1,435,654

Income from operations................. $10,851 $53,497 $64,348

Identifiable assets.................... $111,412 $343,027 $454,439