Chrysler 1999 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 1999 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

FINANCIAL POSITION AND OPERATING RESULTS

OF THE FIAT GROUP

Introduction

During 1999, in continued pursuit of a strategy of international

expansion, the Group carried out important transactions

designed to strengthen its competitive position and focus

the operations of its Sectors. The process of redefining and

strategically positioning the Group required the deployment

of massive financial resources, as capital investment reached

the unprecedented total of more than 6,000 million euros.

The impact of these developments on the scope of

consolidation should be kept in mind when reviewing the

performance of the individual Sectors and of the Group as

a whole. The most important changes are listed below:

❚In view of the growing importance of its Indian operations,

Fiat Auto consolidated Fiat India Automobiles Ltd. and its

subsidiary Ind. Auto Ltd. on a line-by-line basis.

❚Iveco consolidated on a 50% proportional basis the results

of Naveco Ltd., a Chinese company that manufactures and

sells commercial vehicles, and those of Irisbus, a 50-50 joint

venture to which Iveco and Renault V.I. transferred their bus

operations.

In December, Iveco acquired a controlling interest in Fraikin,

a leading French provider of long-term leasing services for

commercial vehicles. Fraikin was consolidated in the Group’s

financial statements for the fourth quarter.

❚In November, New Holland completed the acquisition of

Case Corporation at a total cost of about 4,600 million

euros. Following the acquisition, New Holland changed its

name to CNH Global N.V. (CNH). Because of problems

arising from the difference between its accounting principles

(U.S. GAAP) and those of the Group, Case could not be

consolidated in 1999. However, its results will be reflected

in the Group’s financial statements starting with 2000.

CNH consolidated for the full year on a line-by-line basis

O&K Orenstein & Koppel AG, a German construction

equipment company which it acquired at the end of 1998,

and New Holland Bizon Sp. Zo.o., a Polish producer of

combine harvesters which it bought in July 1998.

❚Teksid consolidated on a line-by-line basis Meridian

Technologies Inc., a producer of magnesium components

which is now controlled by the Sector, and the operations

transferred by Renault into a unit that operates the cast-iron

and aluminum production activities of both Groups.

The Steel Division, which was sold to Neumayer GmbH,

was removed from the scope of consolidation.

❚Magneti Marelli consolidated on a line-by-line basis the

European operations it had purchased from Midas (quick

repair centers). At the same time, it sold to Denso of Japan an

80% interest in its Rotary Devices Business Unit, continued

to divest the nonstrategic product lines of the Cofap Group

in Brazil and deconsolidated the Fuel Supply Division, which

is in the process of being sold. In addition, it consolidated on

a proportional basis Viasat, a 50-50 joint venture established

with Telecom Italia to provide infomobility services.

In December, it announced the sale of its Lubricants Division,

which will be deconsolidated as of 2000, and the purchase

of Seima, a manufacturer of automotive lighting fixtures.

❚Fiat S.p.A. acquired the Pico (Progressive Tools & Industries

Co.) Group, a leading U.S. producer of bodywork systems.

Comau is also active in this field. Pico’s results were

consolidated by the Fiat Group as of May 1999.

The new Sector Comau/Pico used the line-by-line method

to consolidate Renault Automation, a manufacturer of

systems and equipment used in the production of automotive

components in which it had acquired a 51% interest, and

the Bodywork Systems activities of Sciaky S.A. in France.

❚In December, Toro Assicurazioni purchased the French

operations of the Guardian Group Royal Exchange, which

specializes in the areas of life insurance and asset management.

❚Lastly, the tender offers for Toro Assicurazioni S.p.A. (71%

and 80% of the outstanding preference and saving shares

respectively) and Comau S.p.A. (substantially 100% of the

outstanding shares) were completed successfully at a total

cost of 622 million euros.

In 1999, the Group divested several nonstrategic equity

investments, including those in Banco Central Hispano

Americano, Rhône Poulenc, Impregilo and Intesa.

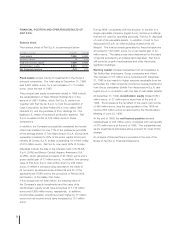

Operating performance

Steadily rising unit sales and the significant improvement in

operating margins recorded in the last quarter of the year,

combined with the effect of sizable reductions in product costs

and overhead, enabled the Fiat Group to report a moderate

improvement in operating income compared with 1998.

The higher financial expenses incurred as a result of the

acquisitions completed during the year and a higher tax

burden had a dampening effect on the bottom line.

Nevertheless, net income exceeded 500 million euros in 1999.

In order to provide a better understanding of the Group’s

performance, the statement of operations has been reclassified

by destination in the table below, providing a breakdown

between industrial and insurance activities.

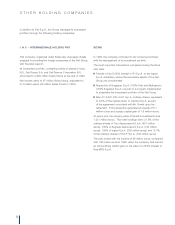

ANALYSIS OF THE FINANCIAL POSITION AND

OPERATING RESULTS OF THE FIAT GROUP AND FIAT S.P.A.