Chesapeake Energy 2008 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2008 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

our natural gas shale expertise from the U.S.

to other parts of the world through this joint

venture with StatoilHydro.

2008 Joint Ventures

In total, during 2008 we sold assets with a

cost basis of $1.2 billion for $8.6 billion in cash

and drilling carries in our three joint ventures.

This would be a remarkable achievement in

any economy, but we believe it was par ticularly

impressive in an economy that steadily wors-

ened throughout the second half of 2008. We

have announced that we would like to enter

into a Barnett joint venture in 2009, and we

also have a few other large attractive plays

in which we may consider bringing in joint

venture partners.

The three 2008 joint ventures, along with

our extremely valuable natural gas hedges

and low-cost, high-quality asset base, will

enable Chesapeake to continue drilling ag-

gressively in an environment very conducive

to value creation through the drillbit in 2009

and 2010. This will occur because drilling costs

should decline by at least 25% during 2009,

allowing Chesapeake to extend the value of

its drilling carries and find new reserves of

natural gas during some of the most chal-

lenging times our industry has seen in the

past 30 years – just the right time for Chesa-

peake to take full advantage of our significant

competitive strengths.

Natural Gas

Chesapeake’s final Powerful Asset to high-

light is natural gas. The Big 4 shale plays have

quite simply changed the game of how to solve

our nation’s energy and environmental chal-

lenges in the years ahead. There has never

really been any debate about whether natural

gas is a good fuel – its carbon-light molecu-

lar structure guarantees that. The issue has

been whether there is enough of it to begin

moving our electrical generation system more

aggressively away from carbon-heavy fuels

such as coal and oil to carbon-light natural

gas and whether it is the right time to begin

moving our transportation system away from

carbon-heavy oil, much of which we import

from unstable or unfriendly areas.

With the enormity of the Big 4 shale plays

now more fully understood, it should become

increasingly clear that the U.S. has a huge com-

petitive advantage when it comes to addressing

economic, environmental and energy issues.

On the economic side, U.S. natural gas prices

are the lowest in the industrialized world. They

16

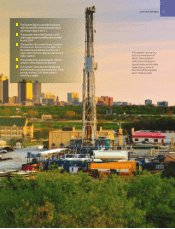

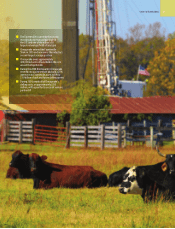

From silent desert landscapes to bustling

cities, Chesapeake rigs work in a multitude

of environments.

Chesapeake Energy Corporation Annual Report 2008

IN TOTAL, DURING 2008

WE SOLD ASSETS WITH

A COST BASIS OF $1.2

BILLION FOR $8.6 BILLION

IN CASH AND DRILLING

CARRIES IN OUR THREE

JOINT VENTURES

The company’s unique world-class Reservoir Technology Center helps crack the code in

finding and developing natural gas from shale formations.