Chesapeake Energy 2006 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2006 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chesapeake Energy Corporation 2006 Annual Report

7

every day from approximately 35,000 producing wells. These attributes enable us to create substantial shareholder value from a

business managed to mitigate risk and capture value from increasing volatility in oil and natural gas markets, which are significantly

influenced by unpredictable weather patterns and turbulent geopolitical events.

A closer look at Chesapeake’s achievements in 2006 reflects the following financial and operational highlights:

As a result of our achievements in 2006, Chesapeake became the third-largest independent producer of U.S. natural gas and the

seventh-largest U.S. natural gas producer overall. Given our production growth trends and those of our competitors, we expect to

end 2007 as a top-five producer of natural gas in the U.S. and possibly the largest independent natural gas producer. Moreover,

we led the nation in drilling activity last year and we expect to do so again this year. In 2006, we utilized an average of 98 operated

rigs and 79 non-operated rigs, or 11% of the nation’s drilling rig fleet, to drill over 3,000 wells (1,450 net to Chesapeake). In 2007,

we expect to use between 130-140 operated rigs and 80-90 non-operated rigs, thereby participating in approximately 13% of the

nation’s drilling activity. This drilling program should result in a production increase for 2007 of between 14-18%, an increase

we expect will lead our large-cap peer group.

Chesapeake’s proved and unproved oil and natural gas reserves continue to increase significantly as a result of our successful

drilling and acquisition programs. Following an increase to 9 trillion cubic feet of natural gas equivalent (tcfe) proved reserves

(the energy equivalent of 1.5 billion barrels of oil) in 2006, Chesapeake’s proved reserves should exceed 10 tcfe by year-end 2007.

Furthermore, we fully expect to reach at least 12 tcfe (or 2 billion barrels of oil equivalent) by year-end 2009.

It is important to note the distinction between proved and unproved reserves has become increasingly blurred as the SEC definition

of proved reserves (which was last updated in 1979) has not kept pace with the industry’s ability to find, evaluate and produce

natural gas reserves from unconventional reservoirs. While the industry has long known that fractured carbonates, tight sands and

shales contain natural gas, it has only been the recent arrival of higher natural gas prices and greatly improved drilling and

completion technologies that has made developing many of these reservoirs economical. However, because these reserves often lie

in reservoirs that are continuous for tens of miles and the SEC definition of proved reserves only allows for the recognition of proved

undeveloped reserves as direct offsets to producing wells in a particular formation, significant reserves of natural gas are not captured

in the SEC’s current definition of proved reserves. The substantial value of unproved reserves in unconventional reservoirs is

evidenced by companies routinely valuing and paying for unproved reserves in today’s acquisition market.

Our point is not to disagree with the SEC’s reserve definitions, but rather to simply state our belief that today’s E&P industry, and

especially Chesapeake, is substantially undervalued in the equity markets because value is not always appropriately given by investors

for what can be very significant amounts of low-risk unproved reserves.

At Chesapeake, we believe we have captured the nation’s largest inventories of leasehold, 3-D seismic and unconventional natural

gas resources. As a result, our 9 tcfe of proved reserves are dwarfed by our 18 tcfe of risked, unproved reserves and our 71 tcfe of

unrisked, unproved reserves. We believe Chesapeake’s current stock price reflects very little of this large storehouse of future natural

gas production. However, continued success from our industry-leading drilling campaign in 2007 should help highlight the enormity

of Chesapeake’s unproved reserves and should lead to more appropriate value recognition.

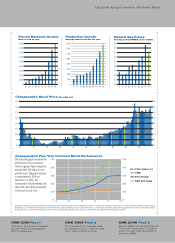

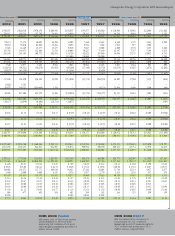

•Average daily oil and natural gas production increased

23% from 1.28 bcfe to 1.59 bcfe;

•Proved oil and natural gas reserves increased 19% from

7.5 tcfe to 9.0 tcfe;

•Reserve replacement for the year reached 348% at a

drilling and acquisition cost of only $1.93 per mcfe1;

•Revenues rose 57% from $4.7 billion to $7.3 billion;

•Ebitda2 increased 89% from $2.7 billion to $5.0 billion;

•Operating cash flow3 grew 67% from $2.4 billion to

$4.0 billion; and

•Net income per fully diluted common share increased

73% from $2.51 to $4.35.