Chesapeake Energy 1994 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 1994 Chesapeake Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

production per share increased 63% and our proved reserves increased to 23 MCFE

per share, among the highest in our peer group.

TEAMWORK + TECHNOLOGY = SUPERIOR PERFORMANCE

As reflected by the increases in production and reserves and the decreases in unit

operating costs, Chesapeake's operations team performed exceptionally well in fiscal

1994. We expect this performance to continue as we enhance Chesapeake's position

as an industry leader by implementing state-of-the-art horizontal drilling techniques

in the Giddings Field.

We have now drilled 63 horizontal wells in Giddings and have developed a specific

expertise in the high pressure and high temperature environment of the downdip, or

deeper, portion of the Giddings Field. Chesapeake is drilling or has drilled eight of

the 12 deepest horizontal wells in the Giddings Field. The company is presently

capable of drilling its Giddings wells to a combined vertical and horizontal depth in

excess of 20,000 feet.

Since our IPO in February 1993, Chesapeake has drilled 52 horizontal wells in

the Giddings Field. These wells have produced an average of 369 BOD and 5.1

MMCFD, have returned an average of 127% of their cost, and paid out in an

average of six months. The strength of these wells has enabled Chesapeake to lead

its peer group in per-well productivity, an important contributor to meeting our

profitability goals.

Even more impressive are the 13 Giddings wells we have drilled in the Navasota River

area, which was introduced in last year's annual report as one of Chesapeake's "New

Areas". Our first well in Navasota River began producing in February 1994, and since

that time these 13 Navasota River wells have averaged 600 BOD and 10.7 MMCFD

and paid out in less than three months. We believe these Navasota River wells are

among the best wells drilled in the onshore U. S. by any company in 1994.

PRIMARY OPERATING AREAS

For the third consecutive year and for the foreseeable future, Chesapeake will focus

its drilling activities on the Giddings Field of southern Texas arid the Golden Trend

Field of southern Oklahoma. in these fields, the company has developed a

competitive advantage through its proprietary land tnd geophysical assets and its

expertise in advanced drilling techniques. By utilizing sophisticated drilling and

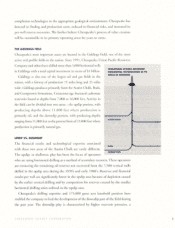

CHESAPEAKE CAPITAL

EXPENDITURES AND AN

INCREASED FOCUS IN

GIDDINGS

in rnillic

GiddiN

U Totol

I

93

:11

94 95 (E(

GREATER OPERATING

EFFICIENCY

(Production expenses and

G&A/MCFE produced)

iiI

4APEAKE ENERGY CORPORATON

I

95 (E(