CenterPoint Energy 2007 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2007 CenterPoint Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

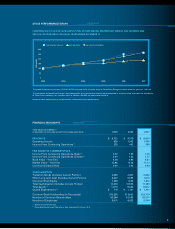

The dividends we paid in 2007, when combined with a 3.3 percent change in

our stock price, produced a total shareholder return of 7.4 percent.

BUILDING ON OUR STRENGTHS

Our company remains focused on creating long-term growth and sustainable

earnings in each of our businesses. For our regulated operations, we work

continuously to improve our business models and are implementing our rate

strategy to give us a better opportunity to earn our authorized rates of return.

In our pipelines and field services businesses, we are capturing growth

opportunities from our unique position in the mid-continent region where

gas drilling and production are at record levels. The focus of our competitive

natural gas sales and services business is on expanding our commercial

and industrial customer base and optimizing the assets used to serve these

customers. Finally, we continue to evaluate the acquisition of other assets

that would complement our existing businesses and create long-term

shareholder value.

This year, each of our businesses strengthened its position in the industry

in which it operates.

Electric transmission and distribution performed in line with our expectations.

While operating income declined $15 million, as we felt the full impact of our

2006 rate case settlement, we added 53,000 new customers. We are confident

that customer growth driven by the strong Houston economy will require

continued investment in needed infrastructure and will position us for

long-term success.

Our strongest growth last year was in natural gas distribution where operating income increased

$94 million, 76 percent over 2006. An improved business model, productivity improvements, more

normal weather and the addition of over 38,000 customers helped this business achieve record

performance. We also worked to implement a rate strategy that separates the recovery of our fixed

operating costs and return on our investment from the volume of natural gas consumed, thus reducing

the impact of unpredictable weather. These progressive rate designs better align the interests of our

company and our customers and support the promotion of energy conservation.

Benefiting from pipeline investments needed to get new natural gas supplies to market, interstate

pipelines saw operating income increase by $56 million, 31 percent over 2006. Income from the first two

phases of our Carthage to Perryville (CP) pipeline accounted for much of the increase. Our growth will

continue in 2008 with the scheduled completion of CP Phase III and the Southeast Supply Header,

a joint venture with Spectra Energy.

“Our company remains focused on creating long-term growth and

sustainable earnings in each of our businesses.”