Casio 2014 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2014 Casio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

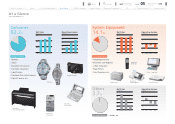

Management’s Discussion and Analysis

Net Sales

Consolidated net sales for the year ended March 31, 2014 were ¥321,761 million, an increase

of 8.1% from the previous year

Millions of Yen

2014 2013

Consumer ¥264,404 ¥227,861

System Equipment 45,299 41,778

Others 12,058 28,124

Total ¥321,761 ¥297,763

Results by Segment

By operating segment, in the Consumer segment, sales were ¥264,404 million, an increase of

16.0% from the previous year. This segment accounted for 82.2% of net sales.

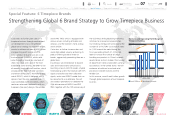

By business, in the timepiece business, sales increased significantly overall with brands such

as G-SHOCK and EDIFICE continuing to perform well, primarily in overseas markets such as

North America and China under a stronger global brand strategy. The line-up of watches for

women in brands such as Baby-G and SHEEN continued steady growth. In the electronic dic-

tionary business, sales of the EX-word series remained strong, mainly for the student model,

and Casio continued to hold the overwhelming No.1 share of the Japanese market. In the elec-

tronic musical instrument business, sales of electronic pianos increased steadily.

In the System Equipment segment, sales were ¥45,299 million, an increase of 8.4% from the

previous year. In the Others segment, sales were ¥12,058 million, a decrease of 57.1% from the

previous year.

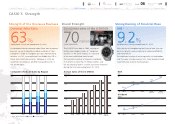

Results of Operations

In income for fiscal 2014, the Consumer segment posted ¥35,504 million in operating income.

The timepiece and electronic dictionary businesses maintained high profitability. The System

Equipment segment posted an operating loss of ¥1,765 million mainly as a result of cooling of

corporate-sector demand. The Others segment posted an operating loss of ¥512 million. As a

result, Casio posted ¥26,576 million in consolidated operating income, allowing for adjustments.

Financial expenses amounted to ¥178 million, compared to financial expenses of ¥235 mil-

lion in the previous fiscal year. Other expenses amounted to ¥3,441 million, compared to other

expenses of ¥876 million in the previous fiscal year. The main reason for these changes was an

increase of directors’ retirement benefits.

Net income amounted to ¥15,989 million.

Financial Condition

Total assets at the end of March 2014 were ¥366,964 million, largely on a par with the previous

fiscal year. Current assets declined by ¥5,584 million to ¥244,135 million, partly as a result of a

decrease in inventories. Non-current assets increased by ¥3,226 million to ¥122,829 million, largely

as a result of a net defined benefit asset newly recorded and a decrease in deferred tax assets.

Total liabilities decreased 11.5% year-on-year to ¥181,708 million. Current liabilities

increased by ¥6,808 million to ¥122,110 million and non-current liabilities declined by ¥30,454

million to ¥59,598 million, due primarily to an increase in notes and accounts payable-trade and

transfer of the non-current portion of long-term loans and bonds payable to the current portion

of long-term loans and bonds payable. Net assets at year-end rose ¥21,288 million to ¥185,256

million due mainly to an increase in retained earnings.

As a result, the equity ratio was improved to 50.5%, a 6.1 point increase over the previous year.

Cash Flow Analysis

Cash and cash equivalents at the reporting year-end came to ¥114,129 million, an increase of

¥16,779 million.

Net cash provided by operating activities amounted to ¥40,107 million, an increase of

¥30,629 million from the previous year. This was mainly due to a decrease in working capital.

Net cash provided by investing activities amounted to ¥8,044 million, an increase of ¥21,421

million from a net cash outflow of ¥13,377 million in the previous year. This was mainly due to

an increase in net cash inflow of purchase, sales and redemption of investment securities.

Net cash used in financing activities amounted to ¥38,523 million, a ¥33,828 million wors-

ening from the previous year. This was chiefly attributable to increases in net cash outflow of

short-term and long-term loans payable and cash outflow of redemption of bonds.

Capital Investment

Capital investment decreased 27.0% year-on-year to ¥5,574 million. By segment, capital invest-

ment came to ¥4,064 million in the Consumer segment, ¥939 million in the System Equipment

segment, and ¥221 million in the Others segment.

Research & Development

R&D expenses came to ¥8,352 million. By segment, R&D expenses were ¥3,592 million in the

Consumer segment, ¥1,013 million in the System Equipment segment, and ¥7 million in the

Others segment.

Profile / Contents CASIO’s StrengthHistory To Our Stakeholders At a Glance Special Feature CSRCorporate Governance

PAGE 15

Move back to

previous page

Move forward to

next page

Search

Print

Corporate DataFinancial Section