Cash America 2000 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2000 Cash America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

w e re to reposition and lower levels of

m e r chandise available for disposition and

ease unit expansion. While management

anticipated that these activities would result in lower

y e a r- o v e r-year earnings, they were also designed to

position Cash America for renewed loan and market

s h a r e growth in fiscal 2001. The success of these

strategic initiatives is evidenced by the year- e n d

domestic loan and merchandise mix which is balanced

to pursue loan growth in the coming year from either

the weakness and disappearance of

competitors or a softening of the stro n g

economic environment in the United States.

In addition, Cash America tested a new

s h o rt - t e r m loan product during fiscal 1999

for introduction in fiscal 2000. This new

loan product, re f e rred to as small consumer

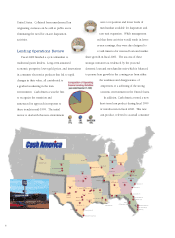

Denver (1)

Tulsa (6)

Oklahoma City (14)

Dallas/ Fort Worth (43)

Lubbock (3)

Austin (22)

San Antonio (19)

El Paso (11)

Corpus Christi (5)

Houston (44)

Baton Rouge (3)

Mobile (4)

Memphis (23)

Nashville (5)

Atlanta (14)

Kansas City (11)

Fort Wayne (3)

Indianapolis (9)

Louisville (9)

Charlotte (7)

Savannah (5)

Charleston (4)

Orlando (14)

Jacksonville (10)

Midland/

Odessa (7)

New Orleans (9)

St. Louis (5)

Greensbor o

Winston Salem (2)

Tampa/

St. Petersburg (15)

Cincinnati (6)

Birmingham (4)

Pensacola (3)

Salt Lake City (7)

Colorado Springs (3)

Pueblo

Chicago (7)

McAllen/ Brownsville (2)

Loredo (4)

Shreveport (2)

Tyler (2)

Killeen (3)

Waco (2)

Greenville (3)

West Palm Beach (5)

Ft. Lauderdale (2)

Miami (2)

8

United States. Collateral from unredeemed loans

originating overseas can be sold at public auction,

eliminating the need for on-site disposition

a c t i v i t i e s .

Lending Operations Review

Fiscal 2000 finished a cycle unfamiliar to

traditional pawn lenders. Long-term sustained

economic pro s p e r i t y, lower gold prices, and innovations

in consumer electronics products that led to rapid

changes in their value, all contributed to

a gradual weakening in the loan

e n v i ronment. Cash America was the first

to recognize the transition and

announced its approach in response to

these trends in mid-1999. The initial

tactics to deal with this new enviro n m e n t

Wichita

Daytona Beach (2)

Monroe

Omaha