Cardinal Health 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Cardinal Health annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Essential to care™

2012 Annual Report

Table of contents

-

Page 1

2012 Annual Report Essential to care â„¢ -

Page 2

... of our financial goals, including those for revenues, operating profit, earnings per share (EPS), margin rate growth and capital efficiency. We made excellent progress on our strategic priorities and continued to strengthen our organization by focusing on talent development and adding world-class... -

Page 3

... Care - physician offices, surgery centers and other sub-acute markets - recorded strong growth. International highlights From an international perspective, our Canadian business recorded double-digit revenue growth. The integration of Futuremed Healthcare Products Corp., our 2012 acquisition... -

Page 4

... this key market both organically and through regional acquisitions. To date, these operational and strategic accomplishments have helped us achieve the financial goals we shared with investors during our December 2010 Investor Day, including the long-term achievement of a compound annual non-GAAP... -

Page 5

... activities. Information which allows coordination and clinical best practices will be preferred. Finally, consumers are likely to be more active participants in managing their own health and healthcare choices. Cardinal Health is well-positioned to play a critical role in this changing landscape... -

Page 6

New thinking for a new world Consolidated financials Overall 107.55 98.50 102.64 1.31 1.51 Operating earnings 1.79 1.39 1.87 1.64 Diluted EPS from continuing operations 3.06 2.74 2.24 1.62 2.80 3.21 FY10 FY11 FY12 Revenue $ billions FY10 FY11 GAAP $ billions FY12 FY10 FY11 Non-GAAP* $ billions... -

Page 7

Powerful forces are driving change in healthcare today, and how providers adapt will determine their success in the years ahead. As the business behind healthcare, Cardinal Health creates solutions that help customers succeed in this new world, operating more cost-effectively while improving safety ... -

Page 8

... complete business solution for home healthcare agencies and respiratory care providers. We work with our customers to streamline business operations - improving workflow and costs, while making product selection, online ordering and inventory management easier. We work with home healthcare agencies... -

Page 9

... of the pharmaceuticals their customers need. And we provide logistics and inventory solutions along with business and marketing support to help make it easy for them to run their businesses. Imaging As the leading provider of unit-dose radiopharmaceuticals in the United States, we manufacture... -

Page 10

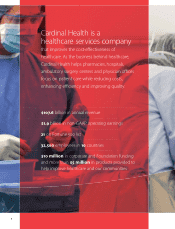

..., Cardinal Health helps pharmacies, hospitals, ambulatory surgery centers and physician offices focus on patient care while reducing costs, enhancing efficiency and improving quality. $107.6 billion in annual revenue $1.9 billion in non-GAAP operating earnings 21 on Fortune 5 list 32,500 employees... -

Page 11

Cardinal Health is an essential link in the healthcare supply chain, providing pharmaceuticals and medical products to healthcare providers each day. The company is also a leading manufacturer of medical and surgical products and operates the nation's largest network of radiopharmacies. 9 -

Page 12

... Executive Vice President and President of Global Pharmaceuticals, Schering-Plough Corp. Calvin Darden (H) Retired Senior Vice President, U.S. Operations, United Parcel Service, Inc. Bruce L. Downey (A) Partner, New Spring Health Capital II, LP Retired Chairman and Chief Executive Officer, Barr... -

Page 13

... Vice President, General Counsel and Corporate Secretary Je rey W. Henderson Chief Financial Officer Michael C. Kaufmann Chief Executive Officer, Pharmaceutical segment Craig S. Morford Chief Legal and Compliance Officer Patricia B. Morrison Chief Information Officer Mark E. Rosenbaum Chief Customer... -

Page 14

... per Common Share amounts) Fiscal year 2012 Operating earnings Amount Growth rate GAAP Restructuring and employee severance Acquisitionrelated costs Impairments and loss on disposal of assets Litigation (recoveries) / charges, net Other spin-o costs Gain on sale of CareFusion stock NonGAAP... -

Page 15

2012 Financial Results Table of Contents Business Overview Selected Financial Data Management's Discussion and Analysis of Financial Condition and Results of Operations Quantitative and Qualitative Disclosures About Market Risk Report of Independent Registered Public Accounting Firm Consolidated ... -

Page 16

... Medicine Shoppe® and Medicap® brands; and • provides pharmacy services to hospitals and other healthcare facilities. In China, the Pharmaceutical segment distributes branded, generic and specialty pharmaceuticals, over-the-counter and consumer products as well as provides logistics, marketing... -

Page 17

... Health Solutions, Inc. We recognized approximately $9.0 billion of revenue from sales to Express Scripts, Inc. in fiscal 2012, all of which was classified as bulk sales. In our Pharmaceutical segment, we also anticipate fewer significant new generic pharmaceutical product launches in fiscal 2013... -

Page 18

Cardinal Health, Inc. and Subsidiaries Management's Discussion and Analysis of Financial Condition and Results of Operations Fiscal 2012 Compared to Fiscal 2011 Pharmaceutical Segment Revenue was positively impacted during fiscal 2012 by acquisitions ($2.3 billion) and increased sales to existing ... -

Page 19

... of new product launches, the positive impact of acquisitions, and increased margin under branded pharmaceutical agreements, offset by the unfavorable impact of pharmaceutical distribution customer pricing changes. See the discussion of gross margin above for further information on these drivers... -

Page 20

... working capital needs; currently anticipated capital expenditures, business growth and expansion; contractual obligations; payments for tax settlements; and current and projected debt service requirements, dividends and share repurchases. During fiscal 2012, we completed several small acquisitions... -

Page 21

...the reporting period. Chargeback billings are the difference between a product's wholesale acquisition cost and the contract price established between the vendors and the end customer. Days sales outstanding Days inventory on hand Days payable outstanding 2012 22.3 23.9 35.6 2011 20.3 22.5 34.8 2010... -

Page 22

... and market trends. In addition, the allowance is reviewed quarterly and updated if appropriate. We may adjust the allowance for doubtful accounts if changes in customers' financial condition or general economic conditions make defaults more frequent or severe. The following table gives information... -

Page 23

... they share similar economic characteristics. Our reporting units are: Pharmaceutical operating segment (excluding our nuclear and pharmacy services division and Cardinal Health China - Pharmaceutical division); nuclear and pharmacy services division; Cardinal Health China - Pharmaceutical division... -

Page 24

... affect the cost of products sold in the period in which the change was made. Vendor reserves were $55 million and $41 million at June 30, 2012 and 2011, respectively. Approximately 72 percent of the vendor reserve at the end of fiscal 2012 pertained to the Pharmaceutical segment compared to... -

Page 25

... certain market risks. These market risks primarily relate to foreign exchange, interest rate and commodity price related changes. We maintain a hedging program to manage volatility related to these market exposures which employs operational, economic and derivative financial instruments in order to... -

Page 26

... in accordance with the standards of the Public Company Accounting Oversight Board (United States), Cardinal Health, Inc. and subsidiaries' internal control over financial reporting as of June 30, 2012, based on criteria established in Internal Control-Integrated Framework issued by the Committee of... -

Page 27

Cardinal Health, Inc. and Subsidiaries Consolidated Statements of Earnings (in millions, except per Common Share amounts) Revenue Cost of products sold Gross margin Operating expenses: Distribution, selling, general and administrative expenses Restructuring and employee severance Acquisition-... -

Page 28

...taxes and other liabilities Shareholders' equity: Preferred Shares, without par value: Authorized-500 thousand shares, Issued-none Common Shares, without par value: Authorized-755 million shares, Issued-364 million shares at June 30, 2012 and 2011 Retained earnings Common Shares in treasury, at cost... -

Page 29

... loss on derivatives, net of tax Reclassification of unrealized gain upon realization from sale of remaining investment in CareFusion, net of tax Total comprehensive income Employee stock plans activity, including tax impact of $14 million Treasury shares acquired Dividends declared Other Balance at... -

Page 30

...on sale of investment in CareFusion Impairments and loss on disposal of assets Share-based compensation Provision for deferred income taxes Provision for bad debts Change in fair value of contingent consideration obligation Change in operating assets and liabilities, net of effects from acquisitions... -

Page 31

... Financial Statements 1. Basis of Presentation and Summary of Significant Accounting Policies Cardinal Health, Inc. is a healthcare services company providing pharmaceutical and medical products and services that help pharmacies, hospitals, surgery centers, physician offices and other healthcare... -

Page 32

... that company's merger with Medco Health Solutions, Inc. We recognized approximately $9.0 billion of revenue from sales to Express Scripts, Inc. in fiscal 2012. We have entered into agreements with group purchasing organizations ("GPOs") which act as purchasing agents that negotiate vendor contracts... -

Page 33

... they share similar economic characteristics. Our reporting units are: Pharmaceutical operating segment (excluding our nuclear and pharmacy services division and Cardinal Health China - Pharmaceutical division); nuclear and pharmacy services division; Cardinal Health China - Pharmaceutical division... -

Page 34

... services related to such merchandise. Medicine Shoppe International, Inc. and Medicap Pharmacies Incorporated earn franchise fees. Franchise fees represent monthly fees that are either fixed or based upon franchisees' sales and are recognized as revenue when they are earned. Medical This segment... -

Page 35

...a wholesale pharmaceutical distribution company which primarily serves retail independent pharmacies in the New York metropolitan area. The valuation of the acquired assets and liabilities resulted in goodwill of $984 million and identifiable intangible assets of $133 million. Cardinal Health China... -

Page 36

... the Cardinal Health Specialty Solutions name. During fiscal 2010, we recognized an $18 million impairment charge related to the write-down of SpecialtyScripts, a business within the Pharmaceutical segment, to net expected fair value less costs to sell. See Note 5 for further information regarding... -

Page 37

... increase in the Pharmaceutical segment in fiscal 2011 is primarily due to the acquisition of Kinray, Cardinal Health China and P4 Healthcare. Goodwill recognized in connection with these acquisitions primarily represents the expected benefit from synergies of integrating these businesses as well as... -

Page 38

...continuing operations is as follows for fiscal 2012, 2011 and 2010: Provision at Federal statutory rate State and local income taxes, net of federal benefit Foreign tax rate differential Nondeductible/nontaxable items Change in measurement of an uncertain tax position and an IRS settlement Valuation... -

Page 39

Cardinal Health, Inc. and Subsidiaries Notes to Consolidated Financial Statements The components of the deferred income tax assets and liabilities as of June 30, 2012 and 2011 are as follows: (in millions) Deferred income tax assets: Receivable basis difference Accrued liabilities Share-based ... -

Page 40

... to report suspicious orders of controlled substances in accordance with the West Virginia Uniform Controlled Substances Act, were negligent in distributing controlled substances to pharmacies that serve individuals who abuse controlled substances, were unjustly enriched by such conduct, violated... -

Page 41

... our exposure to interest rate variations related to our borrowings and to lower our overall borrowing costs. Currency Exchange Risk Management We conduct business in several major international currencies and are subject to risks associated with changing foreign exchange rates. Our objective is... -

Page 42

... to mitigate price volatility for materials we purchase or use in our manufacturing and distribution businesses. These instruments do not qualify for hedge accounting and as such fair value changes as well as periodic settlements of these contracts are recorded within other (income)/ expense, net... -

Page 43

... in future periods due in large part to the loss of revenue from a significant customer of the P4 Healthcare legacy business in fiscal 2012, we revised the timing and amount of EBITDA estimates and made changes in probability assumptions with respect to the likelihood of achieving the EBITDA... -

Page 44

... because the change in reporting was not significant to previously reported segment results. The Pharmaceutical segment distributes branded and generic pharmaceutical, specialty pharmaceutical, over-the-counter healthcare and consumer products. It also operates nuclear pharmacies and cyclotron... -

Page 45

..., net of tax, during fiscal 2010. The total tax benefit from continuing operations related to share-based compensation was $31 million, $29 million and $36 million for fiscal 2012, 2011 and 2010, respectively. Stock Options Employee stock options granted under the Plans generally vest in equal... -

Page 46

Cardinal Health, Inc. and Subsidiaries Notes to Consolidated Financial Statements ranging from seven to ten years from the date of grant. All employee stock options are exercisable at a price equal to the market value of the Common Shares underlying the option at the date of grant. The following ... -

Page 47

Cardinal Health, Inc. and Subsidiaries Notes to Consolidated Financial Statements Adjustments to Stock Incentive Plans In connection with the Spin-Off, on August 31, 2009, we adjusted sharebased compensation awards granted under the Plans into awards based on our Common Shares and/or CareFusion ... -

Page 48

... responsibility is to express an opinion on the company's internal control over financial reporting based on our audit. We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit... -

Page 49

... since the Spin-Off of our clinical and medical products business on August 31, 2009. The line graph assumes, in each case, an initial investment of $100 on August 31, 2009 through and including June 30, 2012, and reinvestment of dividends. We have adjusted the market price of our Common Shares on... -

Page 50

Corporate and investor information Corporate Offices Cardinal Health 7000 Cardinal Place Dublin, Ohio 43017 (614) 757.5000 cardinalhealth.com Twitter: @CardinalHealth Common shares Cardinal Health common shares are listed on the New York Stock Exchange under the ticker symbol "CAH" and are a ... -

Page 51

© 2012 Cardinal Health. All rights reserved. CARDINAL HEALTH, the Cardinal Health LOGO and Essential to care are trademarks or registered trademarks of Cardinal Health. All other marks are the property of their respective owners. Lit. No. 5MC8828 (09/2012)