Cablevision 2012 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2012 Cablevision annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Dollars in thousands, except per share amounts)

I-35

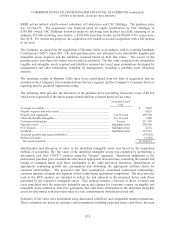

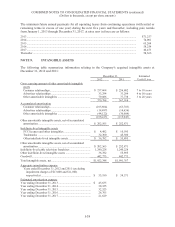

fair values of the Newsday business indefinite-lived intangibles, which relate primarily to the trademarks

associated with its mastheads, were based on discounted future cash flows calculated utilizing the relief-

from-royalty method. Changes in such estimates or the application of alternative assumptions could

produce significantly different results.

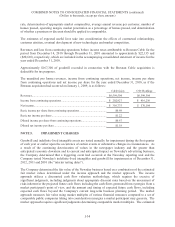

The Company's impairment analysis as of December 31, 2012, 2011 and 2010 resulted in pre-tax

impairment charges of $13,000, $11,000 and $7,800, respectively, related to the excess of the carrying

value over the estimated fair value of certain indefinite-lived intangibles. These pre-tax impairment

charges are included in depreciation and amortization (including impairments) in the Other segment. No

goodwill impairment was recorded for the years ended December 31, 2012, 2011 and 2010.

In addition, the Company recorded impairment charges of $1,131, $2,506 and $1,803 in 2012, 2011 and

2010, respectively, included in depreciation and amortization related primarily to certain other long-lived

assets of the Company's theatre operations and Newsday business included in the Other segment.

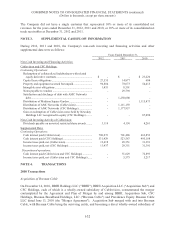

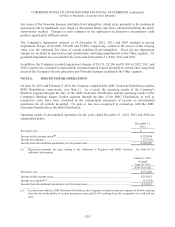

NOTE 6. DISCONTINUED OPERATIONS

On June 30, 2011 and February 9, 2010, the Company completed the AMC Networks Distribution and the

MSG Distribution, respectively, (see Note 1). As a result, the operating results of the Company's

Rainbow segment through the date of the AMC Networks Distribution and the operating results of the

Company's Madison Square Garden segment through the date of the MSG Distribution, as well as

transaction costs, have been classified in the consolidated statements of income as discontinued

operations for all periods presented. No gain or loss was recognized in connection with the AMC

Networks Distribution or the MSG Distribution.

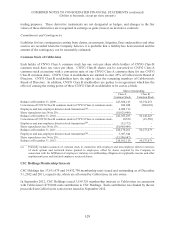

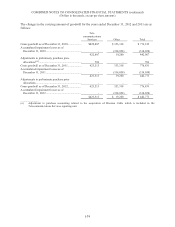

Operating results of discontinued operations for the years ended December 31, 2012, 2011 and 2010 are

summarized below:

December 31,

2012

Revenues, net .................................................................................................................................. $ -

Income before income taxes(a) ........................................................................................................ $ 339,004

Income tax expense ......................................................................................................................... (138,754)

Income from discontinued operations, net of income taxes ............................................................ $ 200,250

________________

(a) Represents primarily the gain relating to the settlement of litigation with DISH Network. See Note 20 for

additional information.

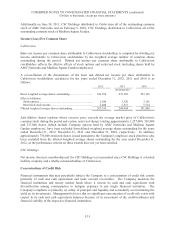

January 1, 2011

through

June 30, 2011

AMC Networks

Revenues, net .................................................................................................................................. $551,480

Income before income taxes ............................................................................................................ $115,015

Income tax expense(a) ..................................................................................................................... (61,392)

Income from discontinued operations, net of income taxes ............................................................ $ 53,623

________________

(a) In connection with the AMC Networks Distribution, the Company recorded income tax expense of $6,406 resulting

from the non-deductibility of certain transaction costs and $3,969 resulting from the recognition of a deferred tax

gain.