CDW 2014 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2014 CDW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

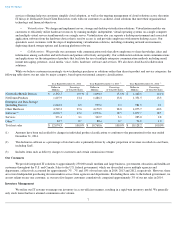

Our distribution process is highly automated. Once a customer order is received and credit approved, orders are automatically routed to

one of our distribution centers for picking and shipping as well as configuration and imaging services. We operate two distribution centers: a

450,000 square foot facility in Vernon Hills, Illinois, and a 513,000 square foot facility in North Las Vegas, Nevada. We ship almost 37 million

units annually on an aggregate basis from our two distribution centers. We believe that the location of our distribution centers allows us to

efficiently ship products throughout the U.S. and provide timely access to our principal distributors. In addition, in the event of weather-related

or other disruptions at one of our distribution centers, we are able to shift order processing and fulfillment from one center to the other quickly

and efficiently, enabling us to continue to ship products in a timely manner. We believe that competitive sources of supply are available in

substantially all of the product categories we offer. We continue to improve the productivity of our distribution centers as measured by key

performance indicators such as units shipped per hour worked and bin accuracy.

We also have drop-

shipment arrangements with many of our OEMs and wholesale distributors, which permit us to offer products to our

customers without having to take physical delivery at either of our distribution centers. These arrangements generally represent approximately

40% to 50% of total net sales, including approximately 15% to 20% related to electronic delivery for software licenses.

Information Technology Systems

We maintain customized IT and unified communication systems that enhance our ability to provide prompt, efficient and expert service

to our customers. In addition, these systems enable centralized management of key functions, including purchasing, inventory management,

billing and collection of accounts receivable, sales and distribution. Our systems provide us with thorough, detailed and real-time information

regarding key aspects of our business. This capability helps us to continuously enhance productivity, ship customer orders quickly and

efficiently, respond appropriately to industry changes and provide high levels of customer service. We believe that our websites, which provide

electronic order processing and advanced tools, such as order tracking, reporting and asset management, make it easy for customers to transact

business with us and ultimately strengthen our customer relationships.

Product Procurement

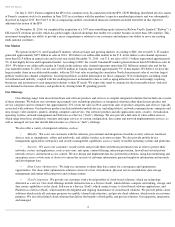

We may purchase all or only some of the products that our vendor partners offer for resale to our customers or for inclusion in the

solutions we offer. Each vendor partner agreement provides for specific terms and conditions, which may include one or more of the following:

product return privileges, price protection policies, purchase discounts and vendor incentive programs, such as purchase or sales rebates and

cooperative advertising reimbursements. We also purchase software from major software publishers for resale to our customers or for inclusion

in the solutions we offer. Our agreements with software publishers allow the end-user customer to acquire software or licensed products and

services.

In addition to purchasing products directly from our vendor partners, we purchase products from wholesale distributors for resale to our

customers or for inclusion in the solutions we offer. These wholesale distributors provide logistics management and supply-

chain services for us,

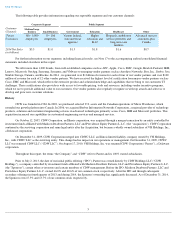

as well as for our vendor partners. For the year ended December 31, 2014 , we purchased 54% of the products we sold as discrete products or as

components of a solution directly from our vendor partners and the remaining 46% from wholesale distributors. Purchases from our three largest

wholesale distributors, Tech Data, SYNNEX and Ingram Micro each represented 9% of our total purchases. Sales of products manufactured by

Apple, Cisco, EMC, Hewlett-Packard, Lenovo and Microsoft, whether purchased directly from these vendor partners or from a wholesale

distributor, represented in the aggregate 54% of our net sales in 2014 . Sales of products manufactured by Hewlett-Packard and Cisco

represented 18% and 14% , of our 2014 net sales, respectively.

Competition

The market for technology products and services is highly competitive. Competition is based on the ability to tailor specific solutions to

customer needs, quality and breadth of product and service offerings, knowledge and expertise of sales force, customer service, price, product

availability, speed of delivery and credit availability. Our competition includes:

8

• resellers such as Dimension Data, ePlus, Insight Enterprises, PC Connection, PCM, Presidio, Softchoice, World Wide Technology

and many smaller resellers;

• manufacturers who sell directly to customers, such as Dell, Hewlett-

Packard and Apple;

• large service providers and system integrators, such as IBM, Accenture, Hewlett-

Packard and Dell;

• e-

tailers such as Amazon, Newegg, and TigerDirect.com;

•

cloud providers such as AT&T, Amazon Web Services and Box; and