Blackberry 2015 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2015 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BlackBerry Limited

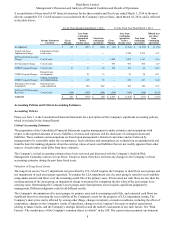

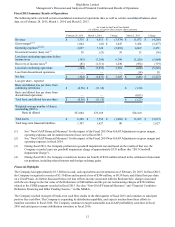

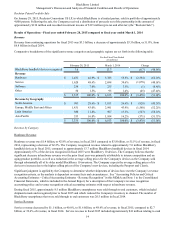

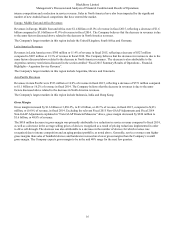

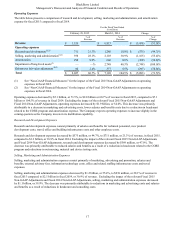

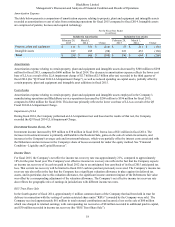

Management’s Discussion and Analysis of Financial Condition and Results of Operations

13

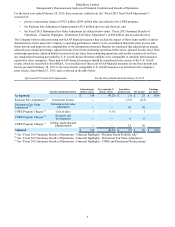

CORE and Operational Restructuring

In fiscal 2013, the Company commenced the CORE program, which drove significant improvements and efficiencies across all

functions in the Company’s organization.

The Company continued to implement the planned restructuring activities in the fourth quarter of fiscal 2015, incurring

approximately $58 million in pre-tax charges related to the CORE program. In fiscal 2015, the Company recorded $322 million

in pre-tax charges related to the CORE program.

The Company's headcount reductions and the other elements of the CORE program, including the Real Estate Sale, have been

completed as of the fourth quarter of fiscal 2015.

Debentures Fair Value Adjustment

As previously disclosed, the Company elected the fair value option to account for the Debentures; therefore, periodic

revaluation is required under U.S. GAAP. The valuation is influenced by a number of embedded features within the

Debentures, including the Company’s put option on the debt and the investors' conversion option, among others. The primary

factors that influence the fair value adjustment are the Company’s share price, as well as associated volatility in the share price,

and the Company's implied credit rating. The fair value adjustment charge does not impact the key terms of the Debentures

such as the face value, the redemption features or the conversion price. In the fourth quarter of fiscal 2015, the Company

recorded a non-cash charge associated with the change in the fair value of the Debentures of approximately $50 million (pre-

tax and after tax) (the “Q4 Fiscal 2015 Debentures Fair Value Adjustment”). In fiscal 2015, the Company recorded net non-cash

charges associated with the change in the fair value of the Debentures of approximately $80 million (pre-tax and after tax) (the

“Fiscal 2015 Debentures Fair Value Adjustment”).

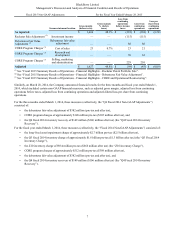

Argentina Service Revenue

Beginning in the fourth quarter of fiscal 2014, the Company ceased recognizing revenues related to service access fees charged

to customers in Argentina due to that country's political and economic condition, as well as its foreign currency restrictions.

During the third quarter of fiscal 2015, the Company reached agreements with certain carrier partners in Argentina to address

long outstanding receivables and related terms for future service access fees (the “Argentina Settlement Agreements”). As part

of the Argentina Settlement Agreements, the Company received $7 million in cash and recognized $8 million in service

revenue in the fourth quarter of fiscal 2015, while $40 million total cash collected was recognized as service revenue in fiscal

2015. In addition, the Company continued to defer additional service revenue of $9 million (the “Q4 Fiscal 2015 Argentina

Service Revenue Deferral”).

Venezuela Collection Agreement

Beginning in the first quarter of fiscal 2014, the Company ceased recognizing revenues related to service access fees charged to

customers in Venezuela due to that country's political and economic condition, as well as its foreign currency restrictions.

During the first quarter of fiscal 2015, the Company reached an agreement with its carrier partners in Venezuela to address the

Company's inability to timely collect past service revenue charged in U.S. dollars and to address revenue for future services

(the “Venezuela Collection Agreement”). As a result of the Venezuela Collection Agreement, the Company received $124

million in fiscal 2015. $41 million of the cash collected was recognized as service revenue in fiscal 2015, with the remainder

representing payment of previously recognized service revenues and the pre-payment of service access fees for services to be

provided up to the end of the 2015 calendar year.

Business Acquisitions

On December 1, 2014, the Company acquired all of the issued and outstanding shares of Secusmart, a developer of high-security

voice and data encryption and anti-eavesdropping solutions, for $82 million in cash and future contingent consideration with a

fair value of $8 million. The acquisition aligns with the Company's strategy of addressing growing security costs and threats

ranging from individual privacy to national security by obtaining leading voice and data encryption and anti-eavesdropping

technologies, and furthers the Company's security capabilities in end-to-end mobile solutions.

On September 8, 2014, the Company acquired all of the issued and outstanding shares of Movirtu, a virtual SIM solutions company

based in the United Kingdom, for $32.5 million of cash consideration (including transaction expenses of $2 million). The acquisition

of Movirtu led to the announcement of the WorkLife by BlackBerrry solution, which allows an enterprise to provision a work

phone number and data plan onto a “Bring Your Own Device” (or “BYOD”) device.

On July 31, 2014, the Company paid $9 million for all of the assets constituting the business of a provider of cloud-based

software technology allowing users to connect devices and build an ecosystem with their data. With this acquisition, the

Company obtained technology closely aligned to its announced BlackBerry IoT Platform.