Blackberry 1998 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 1998 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.16

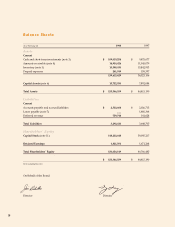

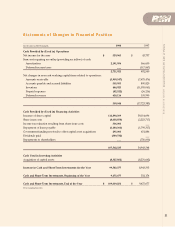

As a result of substantial cash inflows from

financing activities, RIM ended 1998 with a strong

balance sheet. Cash and short-term investments of

$109 million represented more than two-thirds of

total assets, and RIM was virtually debt-free.

Management believes the Company’s current cash

position and existing working capital are sufficient to

meet its foreseeable requirements.

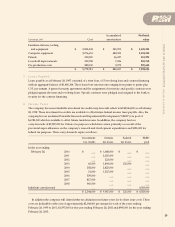

Year 2000 compliance

The Company believes Year 2000 issues will have

a negligible impact on its ongoing operations.

Nonetheless, enterprise-wide programs have been

implemented to identify, test, and minimize RIM’s

exposure to Year 2000 issues. These programs are

examining internal systems and equipment as well

as the risks in the event trading partners, such as

suppliers and customers, are not compliant. An

external consulting firm that specializes in this field is

assisting the Company with these tasks. RIM will take

such steps as deemed necessary to correct any risks or

weaknesses identified by this examination, and

foresees no barriers to taking remedial action. The

costs of Year 2000 programs are not anticipated to

be material and will be expensed as incurred or

capitalized as appropriate as part of the Company’s

normal operating and capital budgets.

Outlook

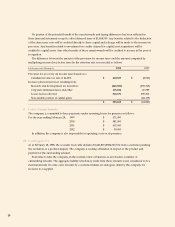

RIM’s order backlog was roughly $100 million at fiscal

year end, most of which is scheduled for delivery in

fiscal 1999. Approximately $90 million of these orders

are for RIM’s next-generation paging products. Sales

of RIM’s OEM radio modem are expected to continue

to contribute to revenue growth, as evidenced by

approximately $6 million in orders received in early

fiscal 1999 from Panasonic Corporation and Mobile

Integrated Technologies. Sales of Wireless PC Cards

should also remain steady during fiscal 1999.

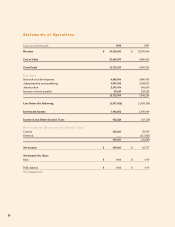

Management’s long-term target is to achieve gross

margin of 35-40%. In fiscal 1999, economies of scale

associated with rising production should increase

RIM’s gross margin above 35%. The 36% gross margin

achieved in the fourth quarter of fiscal 1998 suggests

margins are normalizing as expected.

To maintain market leadership, the Company

expects to apply roughly half of its cash resources to

investments in new equipment, sales and marketing

initiatives, general working capital purposes, and

R&D in 1999. RIM also intends to add roughly 200

new employees in the upcoming year, with up to 25

dedicated to sales and marketing.

R&D is an integral component of the Company’s

long-term product development strategy. Future R&D

expenditures will be maintained at 10% to 15% of

sales, and will continue to be augmented by outside

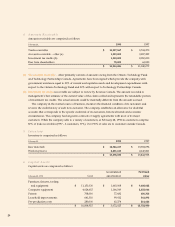

sources. In May of 1998, Technology Partnerships

Canada entered into an agreement with RIM to invest

$5.7 million in RIM’s $19.1 million R&D initiative for

next-generation two-way messaging products. RIM

should also benefit from the R&D efforts of its

numerous technology partners.

Current trends and industry forecasts indicate

growth for wireless messaging products will escalate.

RIM expects to gain an increasing share of this

expanding market.