Big Lots 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Big Lots annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

READY FOR BUSINESS

Big Lots, Inc. 2008 Annual Report

Table of contents

-

Page 1

Big Lots, Inc. 2008 Annual Report READY FOR BUSINESS -

Page 2

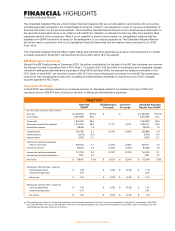

... 2008 Earnings from continuing operations per share diluted (a) (b) 8.0% Balance Sheet Data and Financial Ratios Cash and cash equivalents Inventories Property and equipment - net Total assets Borrowings under bank credit facility Shareholders' equity Working capital (c) Current ratio Inventory... -

Page 3

... future results, our management believes that the adjusted non-GAAP information is useful for the assessment of our ongoing operations. The Unaudited Adjusted Results should be read in conjunction with our Consolidated Financial Statements and the related notes contained in our 2008 Form 10-K. The... -

Page 4

... 500 company with over 1,300 stores in 47 states. For more than three decades, we've delighted our customers with a vibrant mix of exciting brands, unique products and closeout prices. Big Lots offers new merchandise every week at substantial savings over traditional discount retailers. Shoppers... -

Page 5

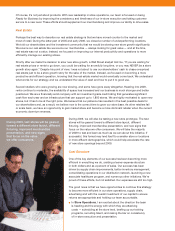

...other retailers or manufacturers, we anticipate more deals will be available to us at savings we can pass on to our customers. Ongoing improvements in inventory management and product turnover will ensure an exciting and ever-changing assortment for our customers. N N N Big Lots, Inc. 2008 Annual... -

Page 6

... our in-store execution and taking customer service to a new level. These efforts should supplement our merchandising and improve our ability to drive sales. Real Estate Perhaps the best way to describe our real estate strategy is that we have moved counter to the market and most of retail. During... -

Page 7

... continued focus on inventory management and ï¬,ow of goods. Advertising spend has remained relatively stable as we have invested in our Web site and built our Buzz Clubâ„¢ membership to over four million customers. The overall dynamics of how customers wish to receive their information continues to... -

Page 8

... & Risk Management Roger D. Erwin Store Operations Jo L. Roney Human Resources Services Richard L. Fannin Senior Vice Presidents Lisa M. Bachmann Merchandise Planning/Allocation & Chief Information Ofï¬cer Technology & Data Services Shelley L. Rubin Advertising Patrick S. Finley Special... -

Page 9

Big Lots, Inc. 300 Phillipi Road Columbus, Ohio 43228 April 14, 2009 Dear Shareholder: We cordially invite you to attend the 2009 Annual Meeting of Shareholders of Big Lots, Inc. The Annual Meeting will be held at our corporate offices located at 300 Phillipi Road, Columbus, Ohio, on May 28, 2009, ... -

Page 10

... at the close of business on the record date, March 30, 2009, are entitled to notice of and to vote at the Annual Meeting and any postponement or adjournment thereof. By Order of the Board of Directors, CHARLES W. HAUBIEL II Senior Vice President, Legal and Real Estate, General Counsel and Corporate... -

Page 11

...Current Members of the Board ...Board Meetings in Fiscal 2008 ...Role of the Board's Committees ...Audit Committee ...Compensation Committee ...Nominating/Corporate Governance Committee ...Selection of Nominees by the Board ...Majority Vote Policy...Determination of Director Independence...Related... -

Page 12

...Internal Pay Equity ...Minimum Share Ownership Requirements ...Equity Grant Timing ...Tax and Accounting Considerations ...Our Executive Compensation Program for Fiscal 2009 ...Summary Compensation Table ...Bonus and Equity Plans ...Big Lots 2006 Bonus Plan...Big Lots 2005 Long-Term Incentive Plan... -

Page 13

... ...Change in Control Described ...Estimated Payments if Triggering Event Occurred at 2008 Fiscal Year-End ...Steven S. Fishman ...Joe R. Cooper ...Brad A. Waite ...John C. Martin ...Lisa M. Bachmann ...AUDIT COMMITTEE DISCLOSURE ...General Information ...Independent Registered Public Accounting... -

Page 14

... "Big Lots"), for use at the 2009 Annual Meeting of Shareholders to be held on May 28, 2009 ("Annual Meeting"), at our corporate offices located at 300 Phillipi Road, Columbus, Ohio at 9:00 a.m. EDT. On or about April 14, 2009, we began mailing to our shareholders of record at the close of business... -

Page 15

... the opportunity to vote your common shares online at www.proxyvote.com until May 27, 2009 at 11:59 p.m. EDT. When voting online, you must follow the instructions posted on the website and you will need the control number included on your Notice of Internet Availability (or proxy card, if applicable... -

Page 16

... Meeting will need to obtain a completed form of proxy from the broker, bank or other holder of record who is the registered holder of their common shares. Householding SEC rules allow multiple shareholders residing at the same address the convenience of receiving a single copy of the annual report... -

Page 17

... your common shares for the election of directors even if the broker, bank or other holder of record does not receive voting instructions from you. Under our Corporate Governance Guidelines, in an uncontested election (i.e., when all nominees are recommended by the Board and the number of nominees... -

Page 18

...Music Company filed for bankruptcy on July 11, 2006; former Chief Operating Officer, The Sports Authority (sporting goods retailer). 65 Chairman and Chief Executive Officer, Drew Shoe Corporation (footwear manufacturer, importer, exporter, retailer and wholesaler); President, Tishkoff and Associates... -

Page 19

..., accounting and financial reporting processes generally. The Audit Committee was established in accordance with the Securities Exchange Act of 1934, as amended ("Exchange Act"), and each of its members is independent as required by the Audit Committee's charter and by the applicable New York Stock... -

Page 20

... members of our executive management committee ("EMC"). The EMC is currently comprised of 11 employees - the five executives named in the Summary Compensation Table ("named executive officers") and all other senior vice presidents. The Compensation Committee is involved in establishing our general... -

Page 21

... of the Nominating/ Corporate Governance Committee, Big Lots, Inc., 300 Phillipi Road, Columbus, Ohio 43228. The written notice must include the prospective nominee's name, age, business address, principal occupation, ownership of our common shares, information that would be required under the rules... -

Page 22

...Corporate Governance Guidelines, Code of Business Conduct and Ethics, Code of Ethics for Financial Professionals, and human resources policies address governance matters and prohibit, without the consent of the Board or the Nominating/Corporate Governance Committee, directors, officers and employees... -

Page 23

...-7325 Big Lots Board of Directors, 300 Phillipi Road, Columbus, Ohio 43228-5311 www.biglots.ethicspoint.com Under a process approved by the Nominating/Corporate Governance Committee for handling correspondence received by us and addressed to outside directors, our General Counsel reviews all such... -

Page 24

... restricted stock awards were made in June 2008 under the Big Lots 2005 Long-Term Incentive Plan ("2005 Incentive Plan"). The restricted stock awarded to the outside directors in fiscal 2008 will vest on the earlier of (i) the trading day immediately preceding the Annual Meeting, or (ii) the outside... -

Page 25

...Critical Accounting Policies and Estimates - Share-Based Compensation section of Management's Discussion and Analysis of Financial Condition and Results of Operations ("MD&A") in our Annual Report on Form 10-K for fiscal 2008 ("Form 10-K") regarding the assumptions underlying the valuation of equity... -

Page 26

... named in the Summary Compensation Table, and all our executive officers and directors as a group. The assessment of holders of more than five percent of our common shares is based on a review of and reliance upon their respective filings with the SEC. Except as otherwise indicated, all information... -

Page 27

... power over 9,926 of the shares. (3) In its Schedule 13G filed on February 13, 2009, State Street Bank and Trust Company, Trustee, One Lincoln Street, Boston, MA 02111, stated that it beneficially owned the number of common shares reported in the table as of December 31, 2008, had sole voting power... -

Page 28

... the price of our common shares. As a named executive officer's level of responsibility and the potential impact that a named executive officer could have on our operations and financial condition increase, the percentage of the named executive officer's compensation at risk through bonus and equity... -

Page 29

... executives. Salary serves as a short-term retention tool. Bonus under the Big Lots 2006 Bonus Plan ("2006 Bonus Plan") is based on annual corporate financial performance and is designed primarily to retain executives on a year-to-year basis. Stock options issued under the 2005 Incentive Plan... -

Page 30

... compensation generally increases as the executive's level of responsibility and impact on our business increases. Following the end of each fiscal year, we calculate and review each named executive officer's annual "at-risk incentive compensation" as a percentage of his or her annual "total... -

Page 31

... and financial measures are set annually at the discretion of the Committee and the other outside directors in connection with the Board's approval of our annual corporate operating plan, subject to the terms of the 2006 Bonus Plan and the named executive officers' employment agreements. - 18... -

Page 32

... received by named executive officers during its annual review of the named executive officers' total compensation. We offer all full-time employees medical and dental benefits under the Big Lots Associate Benefit Plan ("Benefit Plan"). We also offer employees at or above the vice president... -

Page 33

... factors considered when evaluating each named executive officer's salary and payout percentages change, the Committee reviews the salaries and payout percentages annually and adjustments are made if warranted. See the "Salary for Fiscal 2008" and "Bonus for Fiscal 2008" sections of this CD&A for... -

Page 34

...the named executive officers with important protections that we believe are necessary to attract and retain executive talent. While the Committee considers the potential payments upon termination or change in control annually when it establishes compensation for the applicable year, this information... -

Page 35

... two fiscal years; analyzed the potential payments to each EMC member upon termination of employment and change in control events; considered the parameters on executive compensation awards established by the terms of the shareholder-approved plans under which bonus and equity compensation may be... -

Page 36

...Salary for Fiscal 2008 The salaries paid to the named executive officers for fiscal 2008 are shown in the "Salary" column of the Summary Compensation Table. At its annual review in March 2008, the Committee and the outside directors approved the following fiscal 2008 salaries for the named executive... -

Page 37

...the named executive officers under the 2006 Bonus Plan for fiscal 2008 are shown in the "Non-Equity Incentive Plan Compensation" column of the Summary Compensation Table. At its annual review in March 2008, the Committee and the outside directors approved the financial measure, corporate performance... -

Page 38

... 2006 Bonus Plan participants while encouraging strong corporate earnings growth. As a consequence of the fiscal 2008 bonus payments, total cash compensation paid to the named executive officers for fiscal 2008 was at or above the median for our peer groups. We believe higher than market average... -

Page 39

...the market price of our common shares. See the introduction to the "Our Executive Compensation Program for Fiscal 2008" section and the "Performance Evaluation" section of this CD&A for a discussion of how our CEO and the Committee evaluate performance. • The Committee reviewed the total number of... -

Page 40

...fiscal 2008. Having met the first trigger, if the named executive officer remains employed by us, the restricted stock will vest upon the earliest of: (i) the first trading day after we file with the SEC our Annual Report on Form 10-K for the year in which the second trigger is met; (ii) the opening... -

Page 41

...determining executive compensation. Additionally, our CEO and the Committee consult with management from our human resources, finance and legal departments regarding the design and administration of our compensation programs, plans and awards for executives and directors. These members of management... -

Page 42

..., earnings per share, price-to-earnings ratio and shareholder return. After we developed this new retailer-only peer group with Watson Wyatt, Watson Wyatt provided the Committee with comparative executive compensation data it obtained from the proxy statements and other reports made public by these... -

Page 43

... EMC member through prior equity awards (assuming employment continues, awards vest and the market price of our common shares fluctuates through the life of the awards). While the Committee considered the accumulated total value as a factor in setting fiscal 2008 compensation, this information was... -

Page 44

... multiple of his or her Board retainer or salary (as is in effect at the time compliance with the requirements is evaluated), as applicable: Title Multiple of Retainer or Salary Director Chief Executive Officer Executive Vice President Senior Vice President 4x 4x 2x 1x Shares counted toward these... -

Page 45

... compensation disclosures required by the SEC. At the subsequent Board meeting, the Committee recommended, and the outside directors approved, the following fiscal 2009 equity awards for the named executive officers (with the salaries and bonus payout percentages remaining the same as fiscal 2008... -

Page 46

... Officer Brad A. Waite, Executive Vice President, Human Resources, Loss Prevention and Risk Management John C. Martin, Executive Vice President, Merchandising Lisa M. Bachmann, Senior Vice President, Merchandise Planning/Allocation and Chief Information Officer Year (b) Salary ($) (c) Stock Bonus... -

Page 47

... plan year reflecting this change (fiscal 2008) consisted of 13 months. See Note 8 (Employee Benefit Plans) to the consolidated financial statements and the Critical Accounting Policies and Estimates - Pension section of MD&A in our Form 10-K regarding the measurement dates, interest rate, mortality... -

Page 48

... 2008 - Bonus for Fiscal 2008" sections of the CD&A for more information regarding the 2006 Bonus Plan and the awards made under that plan for fiscal 2008. Big Lots 2005 Long-Term Incentive Plan Since January 1, 2006, all employee equity awards, including those made to the named executive officers... -

Page 49

... 2005 Incentive Plan in fiscal 2008. Upon a change in control (as defined in the 2005 Incentive Plan), all awards outstanding under the 2005 Incentive Plan automatically become fully vested. For a discussion of the change in control provisions in the named executive officers' employment agreements... -

Page 50

... Executive Compensation Program for Fiscal 2008 - Equity Grant Timing" section of the CD&A, in fiscal 2008, the Board set as the grant date of these equity awards the second day following our release of results from our last completed fiscal year. This future date was established to allow the market... -

Page 51

...Equity for Fiscal 2008" section of the CD&A. Pursuant to the terms of the 2005 Incentive Plan, the exercise price of the fiscal 2008 stock option awards is equal to an average trading price of our common shares on the grant date. We believe this method is preferable to using the closing market price... -

Page 52

... vested on March 31, 2009, the first trading day after we filed with the SEC our Annual Report on Form 10-K for fiscal 2008. We have not yet achieved the second trigger applicable to the fiscal 2008 restricted stock awards. For a description of the vesting terms of these restricted stock awards... -

Page 53

...for services rendered during a plan year prior to salary reductions pursuant to Sections 401(k) or 125 of the IRC, including bonuses, incentive compensation, severance pay, disability payments and other forms of irregular payments. The table below illustrates the amount of annual benefits payable at... -

Page 54

... (Employee Benefit Plans) to the consolidated financial statements and the "Critical Accounting Policies and Estimates - Pension" section of the MD&A in our Form 10-K regarding the interest rate, mortality rate and other assumptions underlying the calculations in this table. Number of Years Credited... -

Page 55

... if Triggering Event Occurred at 2008 Fiscal Year End" section below reflects the payments that may be received by each named executive officer (or his or her beneficiaries, as applicable) upon a change in control or in the event the executive's employment with us is terminated: (i) involuntarily... -

Page 56

...healthcare coverage ("Tax Gross-Up Amount"). Upon a change in control, each participating named executive officer will receive a lump sum payment of all amounts (vested and unvested) under the Supplemental Savings Plan. (See the "Nonqualified Deferred Compensation" section above for more information... -

Page 57

... fair market value of all of our assets, as measured immediately prior to such acquisition(s). Notwithstanding the foregoing definitions, pursuant to the named executive officers' employment agreements, the 1996 Incentive Plan, the 2005 Incentive Plan and the 2006 Bonus Plan, a change in control... -

Page 58

... Voluntary upon upon with a Change (without with Cause Termination Disability Death in Control termination) Cause Salary/Salary Continuation ($) Non-Equity Incentive Plan Compensation ($) Healthcare Coverage ($) Long-Term Disability Benefit ($) Use of Automobile/Automobile Allowance ($) Accelerated... -

Page 59

... in Connection Control with without Voluntary upon upon with a Change (without Cause Cause Termination Disability Death in Control termination) Salary/Salary Continuation ($) Non-Equity Incentive Plan Compensation ($) Healthcare Coverage ($) Long-Term Disability Benefit ($) Use of Automobile... -

Page 60

... in Connection upon with a Change (without with without Voluntary upon Death in Control termination) Cause Cause Termination Disability Salary/Salary Continuation ($) Non-Equity Incentive Plan Compensation ($) Healthcare Coverage ($) Long-Term Disability Benefit ($) Use of Automobile/Automobile... -

Page 61

... at each regularly scheduled Audit Committee meeting. The Audit Committee also reviewed the report of management contained in our Form 10-K, as well as the independent registered public accounting firm's Report of Independent Registered Public Accounting Firm included in our Form 10-K related to its... -

Page 62

... registered public accounting firm for fiscal 2009. The submission of this matter for approval by shareholders is not legally required; however, we believe that such submission is consistent with best practices in corporate governance and is another opportunity for shareholders to provide direct... -

Page 63

... Board is cognizant of recent developments with respect to majority voting in director elections. In fact, to address concerns presented in the shareholder proposal, we adopted a majority vote policy as part of our Corporate Governance Guidelines, which can be found in the Investor Relations section... -

Page 64

... the applicable NYSE listing standards and/or federal securities laws. Similarly, the majority voting standard could leave the Board with an insufficient number of directors to conduct business or perform its duties. By contrast, the plurality voting standard promotes stability in our governance... -

Page 65

... is not received by our Corporate Secretary at our corporate offices on or before March 1, 2010, or if we meet other requirements of the SEC rules, proxies solicited by the Board for our 2010 annual meeting of shareholders will confer discretionary authority on the proxy holders named therein to... -

Page 66

...shares represented by proxies returned to us will be voted on such matter in accordance with the recommendations of the Board. By order of the Board of Directors, CHARLES W. HAUBIEL II Senior Vice President, Legal and Real Estate, General Counsel and Corporate Secretary April 14, 2009 Columbus, Ohio... -

Page 67

...file number 1-8897 (Exact name of registrant as speciï¬ed in its charter) BIG LOTS, INC. Ohio (State or other jurisdiction of incorporation or organization) 06-1119097 (I.R.S. Employer Identification No.) 300 Phillipi Road, P.O. Box 28512, Columbus, Ohio (Address of principal executive offices... -

Page 68

... Market Risk...Financial Statements and Supplementary Data ...Changes in and Disagreements With Accountants on Accounting and Financial Disclosure ...Controls and Procedures...Other Information ...PART III Directors, Executive Officers and Corporate Governance ...Executive Compensation ...Security... -

Page 69

...weeks that began on January 30, 2005 and ended on January 28, 2006. We manage our business on the basis of one segment: broadline closeout retailing. Please refer to the consolidated financial statements and related notes in this Annual Report on Form 10-K ("Form 10-K") for our financial information... -

Page 70

...18 Wisconsin ...11 Wyoming...2 Total stores...1,339 Number of states . . 47 Of our 1,339 stores, 37% operate in four states: California, Texas, Ohio, and Florida, and net sales from stores in these states represent 38% of our 2008 net sales. Associates At January 31, 2009, we had approximately 37... -

Page 71

... compete with a number of companies for retail site locations, to attract and retain quality employees, and to acquire our broad assortment of closeout merchandise from vendors. Purchasing An integral part of our business is the sourcing and purchasing of quality brand-name merchandise directly from... -

Page 72

...and re-launched our website. Our on-line customer list, which we refer to as the Buzz Club, has grown from just over one million members at the end of 2006 to over four million members at the end of 2008. The Buzz Club is an important marketing tool which allows us to communicate in a cost effective... -

Page 73

...; charters of our Board of Directors' Audit, Compensation, and Nominating/ Corporate Governance Committees; Code of Business Conduct and Ethics; Code of Ethics for Financial Professionals; Chief Executive Officer and Chief Financial Officer certifications related to our SEC filings; the means by... -

Page 74

... us, to offer significant discounts or promotions on their merchandise, which could negatively affect our sales and profit margins. A downgrade in our credit rating could negatively affect our ability to access capital or increase the borrowing rates we pay. A further decline in the market value of... -

Page 75

... states (Ohio, Texas, California, and Florida) are particularly important as approximately 37% of our current stores operate in these states and 38% of our 2008 net sales occurred in these states. Changes by vendors related to the management of their inventories may reduce the quantity and quality... -

Page 76

...and enter into purchase order contracts for the purchase and manufacture of such merchandise well in advance of the time these products are offered for sale. As a result, we may experience difficulty in responding to a changing retail environment, which makes us vulnerable to changes in price and in... -

Page 77

...and to make other investments in the business for which we expect a future economic benefit. The termination of the 2004 Credit Agreement in October 2009 and the reduced availability and increased costs in the current credit market may impact our current operating and investing strategies. We intend... -

Page 78

... impact on our information systems and across a significant portion of our general office operations, including merchandising, technology, and finance. If we are unable to successfully implement SAP® for Retail, it may have an adverse effect on our capital resources, financial condition, results of... -

Page 79

... states: State Stores Owned Arizona ...California ...Colorado ...Florida ...Louisiana...New Mexico ...Ohio...Texas ...Total ... 3 39 3 2 1 2 1 3 54 Store leases generally obligate us for fixed monthly rental payments plus the payment, in most cases, of our applicable portion of real estate... -

Page 80

... Vice President, Store Operations Senior Vice President, Marketing Senior Vice President and Chief Financial Officer Senior Vice President, Legal and Real Estate, General Counsel and Corporate Secretary Senior Vice President, Big Lots Capital and Wholesale Senior Vice President, General Merchandise... -

Page 81

... joining us in 2005, Mr. Claxton served as General Manager and Executive Vice President of Initiative Media, an advertising and communications company, and Chief Marketing Officer and Senior Vice President of Montgomery Ward, a retailer. Joe R. Cooper was promoted to Senior Vice President and Chief... -

Page 82

... with an average price paid per share of $17.28. The repurchased common shares were placed into treasury and are used for general corporate purposes including the issuance of shares related to employee benefit plans. At the close of trading on the NYSE on March 25, 2009, there were approximately... -

Page 83

... Five Year Total Return $200 $150 $100 $50 $0 Jan04 Jan05 Jan06 Jan07 Jan08 Jan09 Big Lots, Inc. S&P 500 Index S&P 500 Retailing Index Indexed Returns Years Ending Base Period January 2004 Company / Index January 2005 January 2006 January 2007 January 2008 January 2009 Big Lots, Inc... -

Page 84

... financial statements and related notes included herein. 2008 (b) (In thousands, except per share amounts and store counts) 2007 (c) Fiscal Year (a) 2006 (b)(d) 2005 2004 Net sales...Cost of sales...Gross margin ...Selling and administrative expenses...Depreciation expense ...Operating profit... -

Page 85

.... Our total inventory per average store was flat at the end of 2008 compared to 2007. Our accounts payable leverage declined at the end of 2008 as a result of a shift in our merchandise mix to higher purchases from vendors which have shorter payment terms, many of whom offer cash discounts. The 2008... -

Page 86

... such as timing of new or closed stores, timing and extent of advertisements and promotions, and timing of holidays. We expect that the Christmas holiday selling season will continue to result in a significant portion of our sales and operating profits. If our sales performance is significantly... -

Page 87

... on the availability, timing, and/or size of closeout deals. One of the key elements to the success of our merchandising strategy over the past few years has been to offer our customers better quality merchandise, better values, and more prominent brand name products. This strategy involved offering... -

Page 88

... time in the last five years. We plan to open 45 new stores and close approximately 40 stores in 2009. The openings are expected to be throughout the country with the largest concentration of new stores in the Northeast, North Carolina, South Carolina, Florida, California, Oregon, and Washington... -

Page 89

... efficiency: • In 2007 and 2008, we invested approximately $38 million to implement our new point-of-sale register system in all of our existing stores with the expected benefits to include more timely and accurate sales and inventory information, improved customer service through faster speed at... -

Page 90

...KB Toys business in discontinued operations. See note 11 to the accompanying consolidated financial statements for a more detailed discussion of all of our discontinued operations. 2008 Compared to 2007 Net Sales As previously discussed, we report net sales information for six merchandise categories... -

Page 91

... a drugstore liquidation deal, a furniture closeout from a large national brand, and our Home Event merchandise. Our inventory turnover improved to 3.6 turns in 2008 compared to 3.5 turns in 2007. Based on historical results and current economic conditions, we expect our 2009 gross margin rate to be... -

Page 92

... such as rent, employee salaries, insurance, and benefits over flat to lower sales dollars. As stated in the discussion of our operating expense strategy above, we expect lower distribution and outbound transportation costs in the first half of 2009, when compared to the first half of 2008, due to... -

Page 93

...may pay higher interest rates in the future under a new bank credit agreement; however, the current LIBOR rate, which is a base rate available to us under the 2004 Credit Agreement and expected to be available to us under a new bank credit agreement (prior to the application of the applicable credit... -

Page 94

... old and new styles of merchandise in upholstery and case goods and a successful launch of Serta mattresses occurred in the fourth quarter of 2006. Seasonal was driven by strength in lawn & garden, summer, and Christmas, which was partially offset by disappointing Halloween and harvest sales. This... -

Page 95

... in 2006. The furniture deal was an opportunity for us to offer branded furniture in about 1,100 of our stores, just in time for the tax refund selling season, which historically is the highest volume period for sales of furniture. The merchandise from the furniture deal was largely sold by the end... -

Page 96

...a new point-of-sale register system, which was installed in approximately 700 of our stores as of February 2, 2008, and other items generally considered "maintenance capital" items for our distribution centers and stores. In 2006, upon the successful completion of a pilot program in 32 of our stores... -

Page 97

... each year. In 2006, our capital expenditures were limited principally to maintenance type capital related to various store, distribution center, and lease related requirements, as well as capital related to opening 11 new stores, and software development costs for our new point-of-sale register... -

Page 98

... under the 2004 Credit Agreement may fluctuate materially depending on various factors, including our operating financial performance, the time of year, and our need to increase merchandise inventory levels prior to the peak selling season. We anticipate total indebtedness under the facility... -

Page 99

... 31, 2009: Payments Due by Period (1) Less than 1 year 1 to 3 years 3 to 5 years More than 5 years Total (In thousands) Obligations under bank credit facility (2) ...Operating lease obligations (3) (4) ...Capital lease obligations (4) ...Purchase obligations (4) (5) ...Other long-term liabilities... -

Page 100

... data center, office, and warehouse space operating leases are $663.5 million. For a discussion of leases, see note 5 to the accompanying consolidated financial statements. Many of the store lease obligations require us to pay for our applicable portion of common area maintenance costs ("CAM"), real... -

Page 101

... our reported financial results. Management has reviewed these critical accounting estimates and related disclosures with the Audit Committee of our Board of Directors. Merchandise Inventories Merchandise inventories are valued at the lower of cost or market using the average cost retail inventory... -

Page 102

... we closed a number of underperforming stores at the end of 2005, and continued to close (primarily through non-renewal of leases) underperforming stores in 2006, 2007 and 2008. We only identified seven stores with impairment indicators as a result of our annual store impairment tests in 2008 and... -

Page 103

...This evaluation requires us to make assumptions that require significant judgment about the forecasts of future pretax accounting income. The assumptions that we use in this evaluation are consistent with the assumptions and estimates used to develop our consolidated operating financial plans. If we... -

Page 104

... trends, estimated lag time to report and pay claims, average cost per claim, network utilization rates, network discount rates, and other factors. A 10% change in our self-insured liabilities at January 31, 2009 would have affected selling and administrative expenses, operating profit, and income... -

Page 105

... Effective in 2008, SFAS No. 158 requires us to measure defined benefit plan assets and obligations as of the date of our year-end consolidated balance sheet. Previously, our pension plans had a measurement date of December 31. Switching to the new measurement date required one-time adjustments of... -

Page 106

... AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK We are subject to market risk from exposure to changes in interest rates on investments that we make from time to time and on borrowings under the 2004 Credit Agreement. We had no fixed rate long-term debt at January 31, 2009. An increase of 1.0% in... -

Page 107

... SUPPLEMENTARY DATA Report of Independent Registered Public Accounting Firm To the Board of Directors and Shareholders of Big Lots, Inc. Columbus, Ohio We have audited the internal control over financial reporting of Big Lots, Inc. and subsidiaries (the "Company") as of January 31, 2009, based on... -

Page 108

Report of Independent Registered Public Accounting Firm To the Board of Directors and Shareholders of Big Lots, Inc. Columbus, Ohio We have audited the accompanying consolidated balance sheets of Big Lots, Inc. and subsidiaries (the "Company") as of January 31, 2009 and February 2, 2008, and the ... -

Page 109

BIG LOTS, INC. AND SUBSIDIARIES Consolidated Statements of Operations (In thousands, except per share amounts) 2008 2007 2006 Net sales ...Cost of sales ...Gross margin ...Selling and administrative expenses ...Depreciation expense...Operating profit ...Interest expense ...Interest and investment ... -

Page 110

... under bank credit facility ...Accounts payable ...Property, payroll, and other taxes...Accrued operating expenses...Insurance reserves ...KB bankruptcy lease obligation ...Accrued salaries and wages ...Income taxes payable ...Total current liabilities ...Long-term obligations under bank credit... -

Page 111

......Purchases of common shares ...Structured share repurchase ...Exercise of stock options...Tax benefit from share-based awards...Treasury shares used for matching contributions to savings plan. . Sale of treasury shares used for deferred compensation plan...Share-based employee compensation expense... -

Page 112

... taxes ...Employee benefits paid with common shares ...KB Toys matters ...Non-cash share-based compensation expense...Non-cash impairment charges ...Loss on disposition of property and equipment...Pension...Change in assets and liabilities: Inventories ...Accounts payable ...Current income taxes... -

Page 113

... year 2006 ("2006") was comprised of the 53 weeks that began on January 29, 2006 and ended on February 3, 2007. Segment Reporting We manage our business based on one segment, broadline closeout retailing. At the end of 2008, 2007, and 2006, all of our operations were located within the United States... -

Page 114

... or available-for-sale securities as of January 31, 2009 or February 2, 2008. Merchandise Inventories Merchandise inventories are valued at the lower of cost or market using the average cost retail inventory method. Cost includes any applicable inbound shipping and handling costs associated with... -

Page 115

... LOTS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements (Continued) Note 1 - Summary of Significant Accounting Policies (Continued) Store Supplies When opening a new store, a portion of the initial shipment of supplies (including primarily display materials, signage, security-related... -

Page 116

BIG LOTS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements (Continued) Note 1 - Summary of Significant Accounting Policies (Continued) Closed Store Accounting We recognize an obligation for the fair value of lease termination costs when we cease using the leased property in our ... -

Page 117

BIG LOTS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements (Continued) Note 1 - Summary of Significant Accounting Policies (Continued) Income Taxes We account for income taxes under the asset and liability method, which requires the recognition of deferred tax assets and liabilities ... -

Page 118

... long-term rate of return. Our objective in selecting a discount rate is to identify the best estimate of the rate at which the benefit obligations would be settled on the measurement date. In making this estimate, we review rates of return on high-quality, fixed-income investments available at... -

Page 119

... end of their original issuance month. The liability for the unredeemed cash value of gift cards and merchandise credits is recorded in accrued operating expenses. We offer price hold contracts on selected furniture merchandise. Revenue for price hold contracts is recognized when the customer makes... -

Page 120

... amounts payable under the lease as deferred incentive rent. We also receive tenant allowances, which are recorded in deferred incentive rent and are amortized as a reduction to rent expense over the term of the lease. Our leases generally obligate us for our applicable portion of real estate taxes... -

Page 121

... Effective in 2008, SFAS No. 158 requires us to measure defined benefit plan assets and obligations as of the date of our year-end consolidated balance sheet. Previously, our pension plans had a measurement date of December 31. Switching to the new measurement date required one-time adjustments of... -

Page 122

... information available in the marketplace for similar assets. Upon the successful completion of a pilot program in 32 of our stores in 2006 and the decision to move forward with the implementation of a new point-of-sale register system in all of our stores, we reduced the remaining estimated service... -

Page 123

..., Massachusetts distribution center (formerly owned by the KB Toys business) in 2006. Note 5 - Leases Leased property consisted primarily of 1,285 of our retail stores, 1.2 million square feet of warehouse space, certain transportation equipment, and information technology and other office equipment... -

Page 124

... $239,349 Future minimum rental commitments for leases, excluding closed store leases, real estate taxes, CAM, and property insurance, at January 31, 2009, were as follows: Fiscal Year (In thousands) 2009 ...2010 ...2011 ...2012 ...2013 ...Thereafter ...Total leases ... $192,424 156,412 122,568 88... -

Page 125

... and are available to meet obligations under equity compensation plans and for general corporate purposes. Note 7 - Share-Based Plans In May 2005, our shareholders approved the Big Lots 2005 Long-Term Incentive Plan ("2005 Incentive Plan"). The 2005 Incentive Plan replaced the Big Lots, Inc. 1996... -

Page 126

... related to cancelled stock options. The Committee imposed a holding period that requires all directors, executive vice presidents, and senior vice presidents (including our named executive officers other than Mr. Fishman whose stock options were not accelerated) to refrain from selling shares... -

Page 127

... granted and assumptions used in the option pricing model for each of the respective periods were as follows: 2008 2007 2006 Weighted-average fair value of options granted...Risk-free interest rates ...Expected life (years) ...Expected volatility ...Expected annual forfeiture ... $8.74 2.2% 4.3 48... -

Page 128

... on the opening of our first trading window five years after the grant date of the award. If we meet a higher financial performance objective and the grantee remains employed by us, the restricted stock will vest on the first trading day after we file our Annual Report on Form 10-K with the SEC for... -

Page 129

... employees whose hire date was on or before April 1, 1994. Benefits under each plan are based on credited years of service and the employee's compensation during the last five years of employment. The Supplemental Pension Plan is maintained for certain highly compensated executives whose benefits... -

Page 130

... were caused by lump sum benefit payments made to plan participants in excess of combined annual service cost and interest cost for each year. A portion of the 2006 settlement charge was due to benefit payments to former employees of the 130 closed stores previously reclassified as discontinued... -

Page 131

BIG LOTS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements (Continued) Note 8 - Employee Benefit Plans (Continued) Weighted-average assumptions used to determine benefit obligations were: 2008 2007 Discount rate ...Rate of increase in compensation levels...Measurement date for plan ... -

Page 132

BIG LOTS, INC. AND SUBSIDIARIES Notes to Consolidated Financial Statements (Continued) Note 8 - Employee Benefit Plans (Continued) The following table sets forth certain information for the Pension Plan and the Supplemental Pension Plan at January 31, 2009 and December 31, 2007: Pension Plan January... -

Page 133

... federal income tax rate and the effective income tax rate was as follows: 2008 2007 2006 Statutory federal income tax rate ...Effect of: State and local income taxes, net of federal tax benefit ...Work opportunity tax and other employment tax credits ...Net benefit recognized for prior year FIN No... -

Page 134

... tax credits ...State and local: State net operating loss carryforwards ...California enterprise zone credits...Texas business loss credits ...New Jersey alternative minimum tax credits ...Total income tax loss and credit carryforwards ... $ 233 3,951 662 292 135 $5,273 Expires fiscal year 2010... -

Page 135

... on our financial condition, results of operations, or liquidity. In September 2006, a class action complaint was filed against us in the Superior Court of California, Los Angeles County, alleging that we violated certain California wage and hour laws by misclassifying California store managers as... -

Page 136

...liquidity. For a discussion of discontinued operations, including KB Toys matters, see note 11 to our accompanying consolidated financial statements. We are self-insured for certain losses relating to property, general liability, workers' compensation, and employee medical and dental beneï¬t claims... -

Page 137

...future inventory purchases totaling $167.4 million at January 31, 2009. We paid $31.5 million, $28.3 million, and $36.1 million related to this commitment during 2008, 2007, and 2006, respectively. We are not required to meet any periodic minimum purchase requirements under this commitment. The term... -

Page 138

... closed stores with leases that had not yet been terminated or subleased. Future cash outlays under these store closure obligations are anticipated to be $0.5 million in 2009, $0.3 million in 2010, and $0.1 million in 2011. KB Toys Matters We acquired the KB Toys business from Melville Corporation... -

Page 139

... we have not recognized any charge or liability in 2008 related to these earlier lease rejections. HCC Note As partial consideration for our sale of the KB Toys business in 2000, we received a 10-year note from Havens Corners Corporation, a subsidiary of KBAC and a party to the KB-I bankruptcy... -

Page 140

... or warranties, shared litigation expenses, other payment obligations, and taxes. Under a tax indemnification provision in the KB Stock Purchase Agreement, we were to indemnify KB Toys for tax losses generally related to the periods prior to our sale of KB Toys. During the fourth quarter of 2006, we... -

Page 141

..., mattresses, ready-to-assemble, and case goods departments. Case goods consist of bedroom, dining room, and occasional furniture. The Hardlines category includes the electronics, appliances, tools, and home maintenance departments. The Seasonal category includes the lawn & garden, Christmas, summer... -

Page 142

... full year earnings per share amount. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE ITEM 9. Not applicable. ITEM 9A. CONTROLS AND PROCEDURES Evaluation of Disclosure Controls and Procedures Our management, with the participation of our Chief Executive Officer... -

Page 143

..., director compensation, the Compensation Committee Report, and executive compensation, is incorporated herein by reference in response to this item. ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS Equity Compensation Plan Information The... -

Page 144

... the 2005 Incentive Plan is adjusted annually by adding 0.75% of the total number of issued common shares (including treasury shares) as of the start of each of our fiscal years that the 2005 Incentive Plan is in effect. The information contained under the caption "Stock Ownership" in the 2009 Proxy... -

Page 145

... not required or are not applicable or because the information required to be set forth therein either was not material or is included in the consolidated financial statements or notes thereto. BIG LOTS, INC. AND SUBSIDIARIES SCHEDULE II - VALUATION AND QUALIFYING ACCOUNTS Beginning of Year Charged... -

Page 146

... 10(m) to our Form 10-K for the year ended January 31, 2004). First Amendment to Big Lots Executive Benefit Plan (incorporated herein by reference to Exhibit 10.11 to our Form 10-Q for the quarter ended November 1, 2008). Big Lots, Inc. Non-Employee Director Compensation Package (incorporated herein... -

Page 147

... our Form 8-K dated October 25, 2005). Second Amendment to Credit Agreement among Big Lots Stores, Inc., as borrower, the Guarantors named therein, and the Banks named therein (incorporated herein by reference to Exhibit 10.36 to our Form 10-K for the year ended February 3, 2007). Security Agreement... -

Page 148

... thereunto duly authorized, on this 30th day of March 2009. BIG LOTS, INC. By: /s/ Steven S. Fishman Steven S. Fishman Chairman of the Board, Chief Executive Officer and President Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following... -

Page 149

... Name Jurisdiction Big Lots Capital, Inc. Big Lots Online LLC Big Lots Stores, Inc. BLSI Property, LLC Capital Retail Systems, Inc. Closeout Distribution, Inc. Consolidated Property Holdings, Inc. CSC Distribution, Inc. C.S. Ross Company Durant DC, LLC Great Basin LLC Industrial Products of New... -

Page 150

... OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM We consent to the incorporation by reference in the following documents of our reports dated March 30, 2009, relating to the financial statements and financial statement schedule of Big Lots, Inc. and subsidiaries (the "Company") (which express... -

Page 151

... fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. By: /s/ Steven S. Fishman Steven S. Fishman Chairman of the Board, Chief Executive Officer and President b) Dated: March 30, 2009 -

Page 152

...information; and any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. By: /s/ Joe R. Cooper Joe R. Cooper Senior Vice President and Chief Financial Officer b) Dated: March 30, 2009 -

Page 153

... the year ended January 31, 2009, of Big Lots, Inc. (the "Company"). I, Steven S. Fishman, Chairman of the Board, Chief Executive Officer and President of the Company, certify that: (i) (ii) the Report fully complies with the requirements of Section 13(a) or Section 15(d) of the Securities Exchange... -

Page 154

...") for the year ended January 31, 2009, of Big Lots, Inc. (the "Company"). I, Joe R. Cooper, Senior Vice President and Chief Financial Officer of the Company, certify that: (i) (ii) the Report fully complies with the requirements of Section 13(a) or Section 15(d) of the Securities Exchange Act of... -

Page 155

... (614) 278-6622 [email protected] â- Telephone (614) 278-6800 â- Web Site www.biglots.com â- Independent Registered Public Accounting Firm Deloitte & Touche LLP 1700 Courthouse Plaza NE Dayton, Ohio 45402-1788 â- E-mail [email protected] N Big Lots, Inc. 2008 Annual Report N -

Page 156

Visit us at www.biglots.com