Best Buy 2011 Annual Report Download - page 20

Download and view the complete annual report

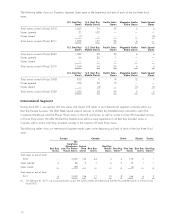

Please find page 20 of the 2011 Best Buy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.certain costs associated with our credit card programs. Financing fees are paid by us to the banks and are variable based

on certain factors such as the London Interbank Offered Rate (‘‘LIBOR’’), charge volume and/or the types of promotional

financing offers.

Given the continuing changes in the economic and regulatory environment for banks, as well as a continuing period of

consumer credit delinquencies, banks continue to re-evaluate their lending practices and terms, including, but not limited

to, the levels at which consumer credit is granted. If any of our credit card programs ended prematurely or the terms and

provisions, or interpretations thereof, were substantially modified, our results of operations and financial condition may be

materially adversely impacted.

Our International activities subject us to risks associated with the legislative, judicial, accounting,

regulatory, political and economic conditions specific to the countries or regions in which we operate,

which could materially adversely affect our financial performance.

We have a presence in various foreign countries including Belgium, Bermuda, Canada, China, France, Germany, Hong

Kong, India, Ireland, Japan, Luxembourg, Mexico, the Republic of Mauritius, the Netherlands, Portugal, Spain, Sweden,

Switzerland, Taiwan, Turkey, Turks and Caicos, and the U.K. During fiscal 2011, our International segment’s operations

generated 26% of our revenue. Our growth strategy includes expansion of existing international markets and possible

expansion into new international markets. Accordingly, our International segment’s operations may account for a larger

portion of our revenue in the future. Our future operating results in these countries and in other countries or regions

throughout the world where we may operate in the future could be materially adversely affected by a variety of factors,

many of which are beyond our control, including political conditions, economic conditions, legal and regulatory

constraints and foreign currency regulations.

In addition, foreign currency exchange rates and fluctuations may have an impact on our future earnings and cash flows

from our International segment’s operations, and could materially adversely affect our financial performance. Moreover,

the economies of some of the countries in which we have operations have in the past suffered from high rates of inflation

and currency devaluations, which, if they were to occur again, could materially adversely affect our financial performance.

Other factors which may materially adversely impact our International segment’s operations include foreign trade,

monetary, tax and fiscal policies both of the U.S. and of other countries; laws, regulations and other activities of foreign

governments, agencies and similar organizations; and maintaining facilities in countries which have historically been less

stable than the U.S.

Additional risks inherent in our International segment’s operations generally include, among others, the costs and

difficulties of managing international operations, adverse tax consequences and greater difficulty in enforcing intellectual

property rights in countries other than the U.S. The various risks inherent in doing business in the U.S. generally also exist

when doing business outside of the U.S., and may be exaggerated by the difficulty of doing business in numerous

sovereign jurisdictions due to differences in culture, laws and regulations.

We rely heavily on our management information systems for inventory management, distribution and other

functions. If our systems fail to perform these functions adequately or if we experience an interruption in

their operation, our business and results of operations could be materially adversely affected.

The efficient operation of our business is dependent on our management information systems. We rely heavily on our

management information systems to manage our order entry, order fulfillment, pricing, point-of-sale and inventory

replenishment processes. The failure of our management information systems to perform as we anticipate, or to meet the

continuously evolving needs of our business, could disrupt our business and could result in decreased revenue, increased

overhead costs and excess or out-of-stock inventory levels, causing our business and results of operations to suffer

materially.

20