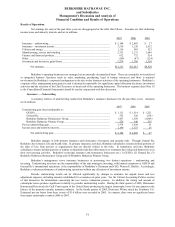

Berkshire Hathaway 2007 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2007 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

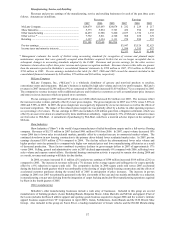

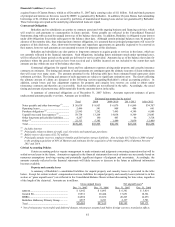

Finance and Financial Products

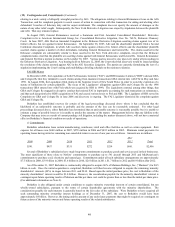

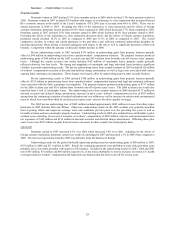

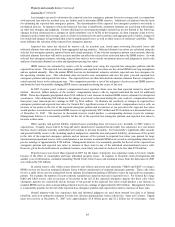

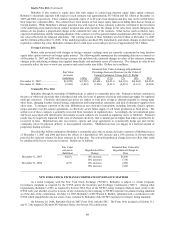

A summary of revenues and pre-tax earnings from Berkshire’ s finance and financial products businesses follows.

Amounts are in millions.

Revenues Earnings

2007 2006 2005 2007 2006 2005

Manufactured housing and finance............................. $3,665 $3,570 $3,175 $ 526 $ 513 $ 416

Furniture/transportation equipment leasing................ 810 880 856 111 182 173

Other........................................................................... 644 674 528 369 462 233

$5,119 $5,124 $4,559

Pre-tax earnings ............................................................. 1,006 1,157 822

Income taxes and minority interests.............................. 374 425 308

$ 632 $ 732 $ 514

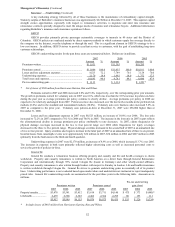

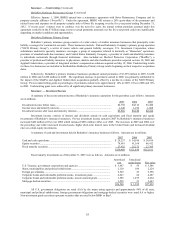

Revenues from manufactured housing and finance activities (Clayton Homes) increased $95 million (3%) as compared

to 2006. In 2007, interest income from financing activities increased $70 million (7%) over 2006 reflecting higher average

installment loan balances. Installment loan balances outstanding as of December 31, 2007 were approximately $11.1 billion

compared to $9.9 billion and $9.5 billion at the end of 2006 and 2005. Pre-tax earnings of Clayton Homes increased $13 million

(3%) over 2006 reflecting a $30 million increase in net interest earned and lower credit losses partially offset by an overall 5%

decline in sales of manufactured homes. Installment loans originated or acquired by subsidiaries of Clayton Homes are financed

primarily with proceeds from debt issued by Berkshire Hathaway Finance Corporation (“BHFC”). In September 2007 and

January 2008, BHFC issued an aggregate of $2.75 billion par amount of new notes at interest rates that are on average

approximately 72 basis points higher than notes that matured in the second half of 2007 and January 2008. Accordingly, net

interest earned from financing activities may decline in 2008.

The increase in revenues in 2006 as compared to 2005 from Clayton Homes was primarily attributable to increased

sales of manufactured homes of $302 million due to increased sales of higher priced homes as well as an increase in total units

sold. Pre-tax earnings from Clayton Homes in 2006 increased $97 million (23%) as compared to 2005 which was due to

increased interest income from higher average installment loan balances as a result of loan portfolio acquisitions in 2005.

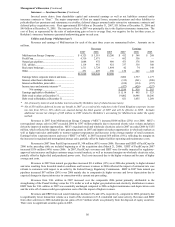

Revenues and pre-tax earnings from furniture/transportation equipment leasing activities for 2007 decreased $70

million (8%) and $71 million (39%), respectively, as compared to 2006. The declines primarily reflect lower rental income

driven by lower utilization rates for the over-the-road trailer and storage units. Due to significant cost components of this

business being fixed (depreciation and facility expenses), pre-tax earnings declined disproportionately to revenues.

Revenues of other finance business activities consist primarily of interest income earned on short-term and other fixed

maturity investments. Pre-tax earnings in 2007 reflected a charge of approximately $67 million from the adverse effects of

changes in mortality assumptions on certain life annuity contract liabilities. In 2006, pre-tax earnings included income of $67

million from an equity commitment fee and in 2005 pre-tax earnings included losses of $137 million from the General Re

derivatives business, which has now completed a major portion of its run-off, and Berkshire’ s investment in Value Capital, a

partnership interest that was liquidated as of June 30, 2006.

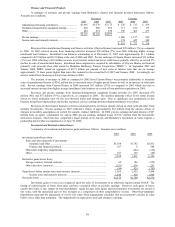

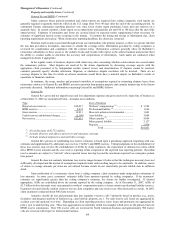

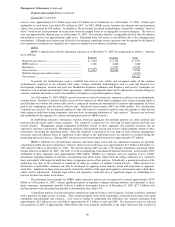

Investment and Derivative Gains/Losses

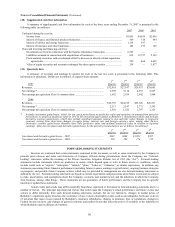

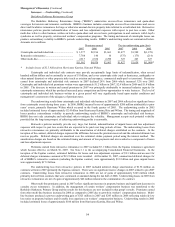

A summary of investment and derivative gains and losses follows. Amounts are in millions.

2007 2006 2005

Investment gains/losses from -

Sales and other disposals of investments -

Insurance and other ...................................................................................... $5,308 $1,782 $5,831

Finance and financial products .................................................................... 187 6 544

Other-than-temporary impairments.................................................................... — (142) (114)

Other .................................................................................................................. 103 165 (65)

5,598 1,811 6,196

Derivative gains/losses from -

Foreign currency forward contracts ................................................................... 62 186 (955)

Other derivative contracts .................................................................................. (151) 638 253

(89) 824 (702)

Gains/losses before income taxes and minority interests ........................................ 5,509 2,635 5,494

Income taxes and minority interests............................................................. 1,930 926 1,964

Net gains/losses....................................................................................................... $3,579 $1,709 $3,530

Investment gains or losses are recognized upon the sales of investments or as otherwise required under GAAP. The

timing of realized gains or losses from sales can have a material effect on periodic earnings. However, such gains or losses

usually have little, if any, impact on total shareholders’ equity because most equity and fixed maturity investments are carried at

fair value, with the unrealized gain or loss included as a component of other comprehensive income. Other-than-temporary

impairments represent the adjustment of cost to fair value when management concludes that an investment’ s decline in value

below cost is other than temporary. The impairment loss represents a non-cash charge to earnings.