Berkshire Hathaway 2004 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2004 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.whether you can save big money (which you might want to use, of course, to buy other Berkshire

products).

* * * * * * * * * * * *

Reinsurance – insurance sold to other insurers who wish to lay off part of the risks they have

assumed – should not be a commodity product. At bottom, any insurance policy is simply a promise, and

as everyone knows, promises vary enormously in their quality.

At the primary insurance level, nevertheless, just who makes the promise is often of minor

importance. In personal-lines insurance, for example, states levy assessments on solvent companies to pay

the policyholders of companies that go broke. In the business-insurance field, the same arrangement

applies to workers’ compensation policies. “Protected” policies of these types account for about 60% of

the property-casualty industry’ s volume. Prudently-run insurers are irritated by the need to subsidize poor

or reckless management elsewhere, but that’ s the way it is.

Other forms of business insurance at the primary level involve promises that carry greater risks for

the insured. When Reliance Insurance and Home Insurance were run into the ground, for example, their

promises proved to be worthless. Consequently, many holders of their business policies (other than those

covering workers’ compensation) suffered painful losses.

The solvency risk in primary policies, however, pales in comparison to that lurking in reinsurance

policies. When a reinsurer goes broke, staggering losses almost always strike the primary companies it has

dealt with. This risk is far from minor: GEICO has suffered tens of millions in losses from its careless

selection of reinsurers in the early 1980s.

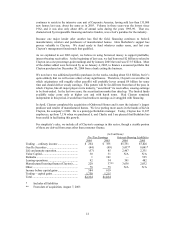

Were a true mega-catastrophe to occur in the next decade or two – and that’ s a real possibility –

some reinsurers would not survive. The largest insured loss to date is the World Trade Center disaster,

which cost the insurance industry an estimated $35 billion. Hurricane Andrew cost insurers about $15.5

billion in 1992 (though that loss would be far higher in today’ s dollars). Both events rocked the insurance

and reinsurance world. But a $100 billion event, or even a larger catastrophe, remains a possibility if either

a particularly severe earthquake or hurricane hits just the wrong place. Four significant hurricanes struck

Florida during 2004, causing an aggregate of $25 billion or so in insured losses. Two of these – Charley

and Ivan – could have done at least three times the damage they did had they entered the U.S. not far from

their actual landing points.

Many insurers regard a $100 billion industry loss as “unthinkable” and won’ t even plan for it. But

at Berkshire, we are fully prepared. Our share of the loss would probably be 3% to 5%, and earnings from

our investments and other businesses would comfortably exceed that cost. When “the day after” arrives,

Berkshire’ s checks will clear.

Though the hurricanes hit us with a $1.25 billion loss, our reinsurance operations did well last

year. At General Re, Joe Brandon has restored a long-admired culture of underwriting discipline that, for a

time, had lost its way. The excellent results he realized in 2004 on current business, however, were offset

by adverse developments from the years before he took the helm. At NICO’ s reinsurance operation, Ajit

Jain continues to successfully underwrite huge risks that no other reinsurer is willing or able to accept.

Ajit’ s value to Berkshire is enormous.

* * * * * * * * * * * *

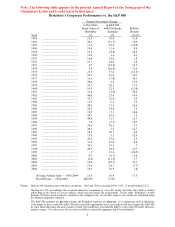

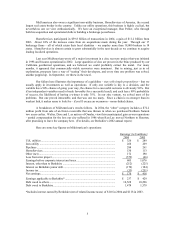

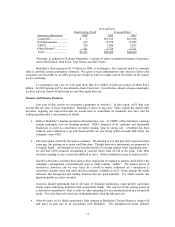

Our insurance managers, maximizing the competitive strengths I’ ve mentioned in this section,

again delivered first-class underwriting results last year. As a consequence, our float was better than

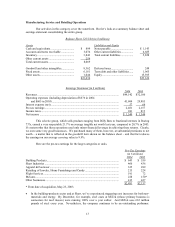

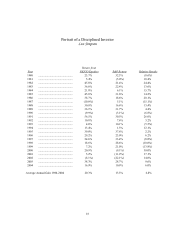

costless. Here’ s the scorecard:

10