Barnes and Noble 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

Table of contents

-

Page 1

-

Page 2

-

Page 3

... Balance Sheets Consolidated Statements of Changes in Shareholders' Equity Consolidated Statements of Cash Flows Notes to Consolidated Financial Statements Report of Independent Registered Public Accounting Firm Reports of Management Shareholder Information Corporate Information Barnes & Noble...

-

Page 4

...." The new book set a record for ï¬rst-day sales at Barnes & Noble, surpassing all other adult trade ï¬ction books in our company's history, and driving a doubling of sales for "To Kill a Mockingbird" in the weeks leading up to release. Readers have also been captivated by E.L. James' "Grey...

-

Page 5

... mid-June 2012, College had been awarded 14 contracts for stores to be opened in ï¬scal 2016, with total estimated ï¬rst-year annual sales of $48 million. Total sales for 2012 increased 1.4% over the prior year, and would have increased 2.3% year-over-year excluding the additional sales week last...

-

Page 6

... or 23 weeks, ending on the Saturday closest to the last day of April. The Statement of Operations Data for the 22 weeks ended May 2, 2012 (ï¬scal 2012), 23 weeks ended May 3, 2014 (ï¬scal 2014) and 22 weeks ended April 27, 2013 (ï¬scal 2013), and the Balance Sheet Data as of May 2, 2012 and May...

-

Page 7

2015 Annual Report

5

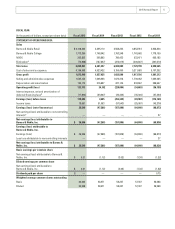

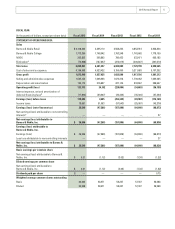

FISCAL YEAR

(In thousands of dollars, except per share data)

STATEMENT OF OPERATIONS DATA:

Fiscal 2015

Fiscal 2014

Fiscal 2013

Fiscal 2012

Fiscal 2011

Sales Barnes & Noble Retail Barnes & Noble College NOOK Eliminationa Total sales Cost of sales and occupancy Gross pro...

-

Page 8

... developed its textbook rental business, comparable store sales reï¬,ected the retail selling price of a new or used textbook when rented, rather than solely the rental fees received, to provide a more representative comparable store sales ï¬gure. Beginning with the 26 weeks ended November 1, 2014...

-

Page 9

...'s books, eBooks and other digital content, textbooks and course-related materials, NOOK® and related accessories, bargain books, magazines, gifts, emblematic apparel and gifts, school and dorm supplies, café products and services, educational toys & games, music and movies direct to customers...

-

Page 10

...owned by Barnes & Noble Booksellers, Inc. B&N Education was initially incorporated under the name NOOK Media Inc. in July 2012 to hold Barnes & Noble's B&N College and NOOK digital businesses. On October 4, 2012, Microsoft Corporation (Microsoft) acquired a 17.6% non-controlling preferred membership...

-

Page 11

... devices under development to be customized and co-branded by NOOK Digital. Such devices are produced by Samsung. The co-branded NOOK® tablet devices are sold by NOOK Digital through Barnes & Noble retail stores, www.barnesandnoble. com, www.nook.com and other Barnes & Noble websites. NOOK Digital...

-

Page 12

...May 2, 2012, primarily under the Barnes & Noble Booksellers trade name. These stores generally offer a dedicated NOOK® area, a comprehensive trade book title base, a café, and departments dedicated to Juvenile, Toys & Games, DVDs, Music, Gift, Magazine and Bargain products. The stores also offer...

-

Page 13

... developing the NOOK digital bookstore service.

This segment includes the Company's digital business, which includes the Company's eBookstore, digital newsstand and sales of NOOK® devices and accessories through B&N Retail, B&N College and third-party distribution partners. The underlying strategy...

-

Page 14

... developed its textbook rental business, comparable store sales reï¬,ected the retail selling price of a new or used textbook when rented, rather than solely the rental fees received, to provide a more representative comparable store sales ï¬gure. Beginning with the 26 weeks ended November 1, 2014...

-

Page 15

...to the higher education market. The Company believes higher education provides a long-term growth opportunity, both organically by adding additional bookstores to its outsourcing model, and also, through strategic acquisition and merger activity. NOOK represents the Company's digital business, which...

-

Page 16

... develop and offer the best black-and-white eReaders on the market, backed by quality customer service and technology support for those devices. At the same time, it will leverage all Barnes & Noble retail, digital and partnership assets, as well as existing NOOK customer relationships. The Company...

-

Page 17

... device sales at B&N Retail. NOOK sales, net of elimination, accounted for 3.1% of total Company sales. In ï¬scal 2012, the Company closed 13 Barnes & Noble stores, bringing its total number of B&N Retail stores to 648 with 17.1 million square feet. In ï¬scal 2012, the Company added 48 B&N College...

-

Page 18

... down device development and other costs reï¬,ective of the Company's revised device strategy.

Gross Margin

52 Weeks Ended Dollars in thousands B&N Retail B&N College NOOK Total Gross Margin May 2, 2015 $1,311,722 444,250 116,527 $1,872,499 % Sales 25.1% 61.7% 53 Weeks Ended May 3, 2014 437,369...

-

Page 19

... compensation, legal and consulting costs of approximately $46.6 million, lower advertising costs of $12.0 million and lower variable expenses commensurate with the sales decline.

Depreciation and Amortization

52 Weeks Ended Dollars in thousands B&N Retail B&N College NOOK Total Depreciation...

-

Page 20

... College NOOK Elimination Total Sales May 3, 2014 $ 4,295,110 1,748,042 505,862 (167,657) $ 6,381,357 % Total 67.3% 27.4% 7.9% (2.6)% 100.0% 52 Weeks Ended April 27, 2013 $ 4,568,243 1,763,248 780,433 (272,919) $ 6,839,005 % Total 66.8% 25.8% 11.4% (4.0)% 100.0%

The Company recorded an income tax...

-

Page 21

... 23 weeks ended May 3, 2014 on lower device unit volume and lower average selling prices. Two new tablet products were launched in ï¬scal 2013 versus one new e-Ink product in ï¬scal 2014, as the Company sold through most of its existing device inventories at reduced prices. Digital content sales...

-

Page 22

... demand. The current year also includes $21.8 million of inventory charges to write down device development and other costs reï¬,ective of changes to the Company's device strategy.

Gross Margin

53 Weeks Ended Dollars in thousands B&N Retail B&N College NOOK Total Gross Margin May 3, 2014 $1,338,289...

-

Page 23

... Proï¬t (Loss)

53 Weeks Ended Dollars in thousands B&N Retail B&N College NOOK Total Operating Proï¬t (Loss) May 3, 2014 $ 228,062 66,536 (260,406) $ 34,192 % Sales 3.8% 52 Weeks Ended April 27, 2013 64,609 % Sales 5.0% 3.7% (100.9)% (3.2)%

The Company recorded an income tax provision in ï¬scal...

-

Page 24

... 2, 2012, compared to $1.232 billion as of May 3, 2014. Retail inventories increased $31.6 million, or 3.3%, on higher Toys & Games and Juvenile positions to support sales increases in these categories. B&N College inventories increased $22.1 million, or 8.0%, primarily due to new store growth. NOOK...

-

Page 25

...sell-through of excess NOOK inventories in ï¬scal 2014, higher B&N Retail core merchandise payments in ï¬scal 2012 (driven by product mix, increased sales and timing of purchases and returns), B&N College new store growth and higher income tax payments.

Capital Structure

On April 27, 2012, Barnes...

-

Page 26

...tablet devices under development to be customized and co-branded by NOOK Digital. Such devices are produced by Samsung. The co-branded NOOK® tablet devices may be sold by NOOK Digital through Barnes & Noble retail stores, www.barnesandnoble. com, www.nook.com and other Barnes & Noble websites. NOOK...

-

Page 27

...the quantity of sales of such co-branded devices through December 31, 2014, and the period was further extended until June 30, 2016 by an amendment executed by the parties on March 7, 2012. NOOK Digital and Samsung have agreed to coordinate customer service for the co-branded NOOK® devices and have...

-

Page 28

... has not yet been made. Capital expenditures planned for ï¬scal 2016 primarily include maintenance of existing stores, enhancements to systems and the website, new college stores and digital initiatives. Based upon the Company's current operating levels and capital expenditures for ï¬scal...

-

Page 29

... store leases for insurance, taxes and other maintenance costs, which obligations totaled approximately 14% of the minimum rent payments under those leases. b Includes hardware and software maintenance contracts and inventory purchase commitments. c Represents commitment fees related to the Company...

-

Page 30

... a rented book at the end of the semester. The Company records the buyout purchase when the customer exercises and pays the buyout option price. In these instances, the Company would accelerate any remaining deferred rental revenue at the point of sale. NOOK acquires the rights to distribute digital...

-

Page 31

... pre-tax earnings by approximately $10.1 million in ï¬scal 2012. The Company also estimates and accrues shortage for the period between the last physical count of inventory and the balance sheet date. Shortage rates are estimated and

Direct costs incurred to develop software for internal use and...

-

Page 32

30

Barnes & Noble, Inc.

MANAGEMENT 'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPER ATIONS continued

from historical exercise experience under the Company's stock option plans and represents the period of time that stock option awards granted are expected to be outstanding. ...

-

Page 33

...% decrease in the Company's estimated discounted cash ï¬,ows would have no impact on the Company's remaining goodwill and unamortizable intangible assets.

Gift Cards

The Company sells gift cards, which can be used in its stores, on barnesandnoble.com and NOOK® devices. The Company does not charge...

-

Page 34

..., information security and intellectual property, possible work stoppages or increases in labor costs, possible increases in shipping rates or interruptions in shipping service, effects of competition, possible risks that inventory in channels of distribution may be larger than able to be sold...

-

Page 35

2015 Annual Report

33

C O NSOLIDATE D STATEMEN TS OF OPE R AT I O N S

(In thousands, except per share data) Sales Cost of sales and occupancy Gross proï¬t Selling and administrative expenses Depreciation and amortization Operating income (loss) Interest expense, net and amortization of deferred ...

-

Page 36

... Gift card liabilities Short-term note payable Total current liabilities Long-term deferred taxes Other long-term liabilities Redeemable Preferred Shares; $0.001 par value; 5,000 shares authorized; 204 and 204 shares issued, respectively Preferred Membership Interests in NOOK Media, LLC Shareholders...

-

Page 37

... and restricted stock tax beneï¬ts Stock-based compensation expense Accretive dividend on preferred stockholders Accrued/paid dividends for preferred stockholders Treasury stock acquired, 286 shares Balance at May 3, 2014

RETAINED EARNINGS

TREASURY STOCK AT COST

TOTAL

$ 91

- - - -

1,340,909...

-

Page 38

... Treasury stock acquired, 477 shares Acquisition of preferred membership interest Settlement of Microsoft commercial liability Balance at May 2, 2015

ACCUMULATED OTHER ADDITIONAL COMPREHENSIVE COMMON STOCK PAID IN CAPITAL GAINS (LOSSES)

RETAINED EARNINGS

TREASURY STOCK AT COST

TOTAL

$ 94...

-

Page 39

... of common stock options Purchase of treasury stock Excess tax beneï¬t from stock-based compensation Cash dividends paid to shareholders Payment of Junior Seller Note Acquisition of Preferred Membership Interests Net cash ï¬,ows provided by (used in) ï¬nancing activities Net increase (decrease) in...

-

Page 40

...,143) $ (169,752)

Fiscal 2014 5,388 176,134 3,410 (3,697) (113,607) 67,628

Fiscal 2013 20,578 151,072 (19,956) 12,871 (71,974) 92,591

Receivables, net Merchandise inventories Textbook rental inventories Prepaid expenses and other current assets Accounts payable and accrued liabilities Changes in...

-

Page 41

...'s books, eBooks and other digital content, textbooks and course-related materials, NOOK® and related accessories, bargain books, magazines, gifts, emblematic apparel and gifts, school and dorm supplies, café products and services, educational toys & games, music and movies direct to customers...

-

Page 42

...owned by Barnes & Noble Booksellers, Inc. B&N Education was initially incorporated under the name NOOK Media Inc. in July 2012 to hold Barnes & Noble's B&N College and NOOK digital businesses. On October 4, 2012, Microsoft Corporation (Microsoft) acquired a 17.6% non-controlling preferred membership...

-

Page 43

...cash ï¬,ows that reï¬,ected management's forecasts and discount rates that included risk adjustments consistent with the current market conditions. Based on the results of the Company's step one testing, the fair values of the B&N Retail, B&N College and NOOK reporting units as of that date exceeded...

-

Page 44

... objective evidence, third-party evidence of selling price, or best estimate of selling price. NOOK® device revenue is recognized at the segment point of sale. The Company includes post-service customer support (PCS) in the form of software updates and potential increased functionality on a when...

-

Page 45

... a rented book at the end of the semester. The Company records the buyout purchase when the customer exercises and pays the buyout option price. In these instances, the Company would accelerate any remaining deferred rental revenue at the point of sale. NOOK acquires the rights to distribute digital...

-

Page 46

... differences reverse. The Company regularly reviews its deferred tax assets for recoverability and establishes a valuation allowance, if determined to be necessary.

The Company sells gift cards, which can be used in its stores, on barnesandnoble.com and NOOK® devices. The Company does not charge...

-

Page 47

... Saturday closest to the last day of April. The reporting periods ended May 2, 2012 contained 22 weeks, May 3, 2014 contained 23 weeks, and April 27, 2013 contained 22 weeks.

2. CREDIT FACIL ITY

Accounts receivable, as presented on the Company's Consolidated Balance Sheets, is net of allowances. An...

-

Page 48

... of outstanding letters of credit under the 2013 Amended Credit Facility as of May 2, 2012 compared with $36,782 as of May 3, 2014. The Company has no agreements to maintain compensating balances.

3. ST O CK- B A SE D C O M P E N S AT IO N

The Company maintains four share-based incentive plans: the...

-

Page 49

... 1,245

The aggregate intrinsic value in the table above represents the total pre-tax intrinsic value (the difference between the Company's closing stock price on the last trading day of the related ï¬scal year and the exercise price, multiplied by the related in-the-money options) that would have...

-

Page 50

... represent customer, private and public institutional and government billings, credit/debit card, advertising, landlord and other receivables due within one year as follows:

May 2, 2015 Trade accounts Credit/debit card receivables EBook settlement receivablea Other receivables Total receivables...

-

Page 51

2015 Annual Report

49

May 2, 2015 Deferred rent Microsoft Commercial Agreement ï¬nancing transaction (see Note 11) Tax liabilities and reserves Pension liabilitya (see Note 8) Other Total long-term liabilities $ 94,952

May 3, 2014 $ 128,280

- 71,369 - 29,981 $ 196,302

140,714 51,399 11,154 35,...

-

Page 52

... Plan and the B&N.com Retirement Plan, respectively. The actuarial assumptions used to calculate pension costs are reviewed annually. Pension expense was $10,434, $2,462 and $2,836 for ï¬scal 2012, ï¬scal 2014 and ï¬scal 2013, respectively. On June 18, 2014, the Company's Board of Directors...

-

Page 53

... to Microsoft. The Company accounts for income taxes using the asset and liability method. Deferred taxes are recorded based on differences between the ï¬nancial statement basis and tax basis of assets and liabilities and available tax loss and credit carryforwards. At May 2, 2012 and May 3, 2014...

-

Page 54

52

Barnes & Noble, Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued

May 2, 2015 Deferred tax assets: Estimated accrued liabilities Inventory Insurance liability Loss and credit carryovers Lease transactions Pension Stock-based compensation Investments in equity securities Depreciation ...

-

Page 55

... of May 3, 2014 Amortizable intangible assets Customer relationships Technology Distribution contracts Other Total Unamortizable intangible assets Trade name Publishing contracts Total Total amortizable and unamortizable intangible assets $ 293,400 19,734 $ 313,134 Gross Useful Carrying Accumulated...

-

Page 56

... physical book business, certain of these contracts were impaired. The changes in the carrying amount of goodwill by segment for ï¬scal 2012 are as follows:

B&N B&N Retail College NOOK Total Segment Segment Segment Company Balance as of April 27, 2013 Beneï¬t of excess tax amortizationa Balance as...

-

Page 57

... that extends the term of the agreement and the timing of the measurement period to meet certain revenue share milestones. On December 22, 2014, Barnes & Noble entered into a Purchase Agreement (the Pearson Purchase Agreement) among Barnes & Noble, Barnes & Noble Education, NOOK Media Member Two...

-

Page 58

... development to be customized and co-branded by NOOK Digital. Such devices are produced by Samsung. The co-branded NOOK® tablet devices are sold by NOOK Digital through Barnes & Noble retail stores, www.barnesandnoble.com, www.nook.com and other Barnes & Noble and NOOK Media websites. NOOK Digital...

-

Page 59

... as of May 2, 2012. Stock repurchases under this program may be made through open market and privately negotiated transactions from time to time and in such amounts as management deems appropriate. As of May 2, 2012, the Company has repurchased 34,840,720 shares at a cost of approximately $1,07 ,716...

-

Page 60

...education marketplace through Yuzu™. These B&N College stores generally offer course-related materials, which include new and used print textbooks and digital textbooks, which are available for sale or rent, emblematic apparel and gifts, trade books, computer products, NOOK® products and related...

-

Page 61

...tangible books, music, movies, rentals and newsstand. b Includes NOOK®, related accessories, eContent and warranties. c Includes Toys & Games, café products, gifts and miscellaneous other.

Sales by Product Line Mediaa Digitalb Otherc Total

52 weeks 53 weeks ended May 2, ended May 3, 2015 2014 70...

-

Page 62

..., use, offer for sale, and/or sale in the United States of NOOKTM products. The District Court stayed the action between September 26, 2012 and May 1 , 2014 during the pendency of a related U.S.

On June 14, 2013, Adrea LLC (Adrea) ï¬led a complaint against Barnes & Noble, Inc., NOOK Digital...

-

Page 63

... subclass based on alleged cancellations of orders for HP TouchPad Tablets placed on the Company's website in August 2011. The lawsuit alleges claims for unfair business practices and false advertising under both New York and California state law, violation of the Consumer Legal Remedies Act under...

-

Page 64

... District of Illinois and one in the Northern District of California), each of which alleged on behalf of national and other classes of customers who swiped credit and debit cards in Barnes & Noble Retail stores common law claims such as negligence, breach of contract and inva-

On August 2, 2011...

-

Page 65

... Booksellers, Inc. in the Superior Court for the State of California making the following allegations with respect to salaried Store Managers at Barnes & Noble stores located in California: (1) failure to pay wages and overtime; (2) failure to pay for missed meal and/or rest breaks; (3) waiting time...

-

Page 66

... $772 for ï¬scal 2012, ï¬scal 2014 and ï¬scal 2013, respectively. In addition, B&N College entered into an agreement with MBS in ï¬scal 2011 pursuant to which MBS purchases books from B&N College, which have no resale value for a ï¬,at rate per box. Total sales to MBS under this program were $41...

-

Page 67

2015 Annual Report

65

in ï¬scal 2012, ï¬scal 2014 and ï¬scal 2013, respectively. In addition, Barnes & Noble hosts pages on its website through which Barnes & Noble customers are able to sell used books directly to MBS. The Company is paid a ï¬xed commission on the price paid by MBS to the ...

-

Page 68

... the NOOK® developer program whereby Sirius applications were made available for consumer download on NOOK® devices. Total commissions received from Sirius during ï¬scal 2014 and ï¬scal 2013 were $1 and $0, respectively.

2 2 . DIVIDEN DS

The Company paid a dividend to preferred shareholders in...

-

Page 69

2015 Annual Report

67

24. SE L E CT E D Q UA R T E R LY FIN A NC IA L IN FO R MATION (UN AUDITED)

A summary of quarterly ï¬nancial information for ï¬scal 2012 and ï¬scal 2014 is as follows:

Fiscal 2015 Quarterly Period Ended On or About Sales Gross proï¬t Net income (loss) Basic loss per ...

-

Page 70

...FI R M

The Board of Directors and Shareholders of Barnes & Noble, Inc. We have audited the accompanying consolidated balance sheets of Barnes & Noble, Inc. as of May 2, 2012 and May 3, 2014, and the related consolidated statements of income, comprehensive income, shareholders' equity and cash ï¬,ows...

-

Page 71

... with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Barnes & Noble, Inc. as of May 2, 2012 and May 3, 2014, and the related consolidated statements of income, comprehensive income, shareholders' equity and cash ï¬,ows for each...

-

Page 72

... procedures, including compliance with the Company's statement of policy regarding ethical and lawful conduct. The Audit Committee of the Board of Directors composed of directors who are not members of management, meets regularly with management, the independent registered public accountants...

-

Page 73

... June 30, 2012 there were 64,107,342 shares of common stock outstanding held by 1,7 2 shareholders of record, which includes 43,160 shares of unvested restricted stock that have voting rights and are held by members of the Board of Directors and the Company's employees.

Former President PaineWebber...

-

Page 74

...

Independent Public Accountants:

$50

Ernst & Young LLP, New York, New York

Stockholder Services:

$0

5/1/2010 4/30/2011 4/28/2012

4/27/2013 5/3/2014 5/2/2015

Inquiries from our stockholders and potential investors are always welcome. General ï¬nancial information can be obtained via the Internet...

-

Page 75

... Study Guide

Paulo Coelho HarperCollins

To Kill a Mockingbird

Rick Riordan Disney-Hyperion

The Maze Runner

John Grisham Knopf Doubleday

The World of Ice & Fire

George W. Bush Crown

Yes Please

The College Board College Board

Wild

Harper Lee Grand Central Publishing

Fifty Shades of Grey

James...

-

Page 76

...Barnes & Noble, Inc.

AWA R D W I N N E R S

TOP 1 0 N O O K BOO KS Gone Girl S LE E P E R S Sisters T HE PUL ITZER P R IZE All the Light We Cannot See THE N ATION AL BOOK CRITICS CIRCL E AWARDS Lila THE MAN BOOKER PRIZE F OR F IC TI ON The Narrow Road to the Deep North

Gillian Flynn Crown

The Girl...

-

Page 77

This page left intentionally blank

-

Page 78

This page left intentionally blank

-

Page 79

-

Page 80