Barnes and Noble 2001 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2001 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

L E T T E R T O O U R S H A R E H O L D E R S c o n t i n u e d

S i n c e re l y,

Leonard Riggio

Chairman

2 0 0 1 A n n u a l R e p o r t ■B a r n e s & N o b l e , I n c .

3

over into 2002. The expense reductions helped mitigate the

l o w e r-than-budgeted sales, as bookstore operating pro f i t

came in at $216 million; disappointing, yet a good re s u l t

considering the numbers posted by other re t a i l e r s .

During the year we rolled out our Readers’ AdvantageT M

p rogram (which continues to grow), and by the end of

2001, enrolled nearly two million members who paid

$25.00 to join. We realized at the outset that a marg i n

s h o r tfall would result in the early stages of the pro g r a m

due to the ten percent discount members received, but

believed then, as we do now, that this “loyalty” card

would provide a long-range sales lift and higher pro f i t s

in the future. The program was also intended to mitigate

the negative impact of publishers’ higher pricing and the

d i ff e rential between bookstore pricing and that of

a g g r essive online discounters. As a result, we believe the

nearly two million members we enrolled last year will

outspend non-members sufficiently to produce a positive

delta in gross profit (not gross margin percent) for the

c u r rent year, and will only increase in years to come.

As planned, the pace of store closings at B. Dalton continued

in 2001, as we closed 35 stores, leaving us with a total of

3 0 5 c o m p a red to nearly 600 six years ago. As a re s u l t ,

our mall-store business, whose operating margins have

been declining for the past six years, now constitutes

only eight p e rcent of our total bookstore sales. The

t r a n s f o rmation of our business from a mall-based operator

to a growing enterprise of world-class bookstores is now

v i r tually completed. We are extremely pleased with our

strategic positioning and with the balancing of our re a l

estate port f o l i o .

Within the context of the national retail climate, what

we experienced with our GameStop business was

nothing short of phenomenal. Overall, sales grew by 48

percent to $1.1 billion, with 74 new stores opened for a

total of 1,038 stores. More significantly, we were major

participants in the sale of new platforms (PlayStation 2,

Xbox, Game Boy Advance and GameCube), which

together with the previously “installed base,” brings

this industry to an unprecedented level. The next several

years promise to produce “trailing” software sales, whose

higher margins will nourish our bottom line.

Finally, the rationalization (lower expenses and targeted

marketing) of our Barnes & Noble.com affiliate has

produced a dramatic reduction in net losses, while at

the same time allowed for the continued growth of the

business: sales increased by 8 percent and net operating

losses declined by 38 percent.

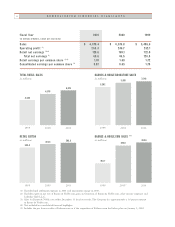

The year 2001 also ended with significant impro v e m e n t s

to our balance sheet. Retail earnings before interest,

taxes, depreciation and amoritization (EBITDA) grew

from $381 million in 2000 to $392 million for the

year, with free cash flow of $218 million, compared to

a negative cash flow of $77 million for the previous

y e a r. Our balance sheet was further bolstered by

the GameStop IPO in the first quarter of 2002. These

t a rgeted initiatives, including working capital management

and corporate finance activities, have resulted in our

being in the strongest financial position in the

company’s history. We are well within the appropriate

safety margins in terms of all of our key ratios, and in a

position to negotiate credit facilities to provide upside

support as well as downside protection. Given the

current nature of the debt and equity markets, we

believe we are in an enviable position.

Looking forw a rd to this year, and to the years that

f o l l o w, we are optimistic and encouraged. As always in

the world of retail, and especially as a bookseller in the

midst of an information revolution, we have much work

ahead of us. We are resolved, we are committed, and we

will remain opportunistic. As always, we will strive to

achieve the best business practices, and of course, chart

the best and clearest path to profitable gro w t h .

Our success ultimately depends upon the work of our

dedicated booksellers and the faith of our share h o l d e r s .

Thank you for your support and the import a n t

contributions you continue to make.