Barnes and Noble 2001 Annual Report Download

Download and view the complete annual report

Please find the complete 2001 Barnes and Noble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

T A B L E O F C O N T E N T S

2 0 0 1 A n n u a l R e p o r t ■B a r n e s & N o b l e , I n c .

2L E T TER TO OUR SHAREHOLDERS

4C O N S O L I D ATE D FINANCIAL HIGHLIGHTS

5S E L E CTED CONSOLIDATED FINANCIAL DATA

9M A N AGEMENT’S DISCUSSION AND ANALYSIS OF FI NANCIAL CONDI TION AND RE SULTS OF OPERAT I O N S

23 C O N S O L I DATED STAT E M E N T S OF OPERAT I O N S

24 C O N S O L I DATE D BALANCE SHEETS

2 5 C O N S O L I D ATE D STAT E M E N T S OF CHANG ES IN SHAREHOLDERS’ EQ U I T Y

2 6 C O N S O L I D ATED STAT E M E N T S OF CASH FLOW S

2 7 N OTES TO CONSOLIDATED FINANCIAL STAT E M E N T S

4 6 R E P O RT OF INDEPENDENT CERTIFIED PUBLIC AC C O U N TA N TS

47 SHAREHOLDER INFO R M AT I O N

Table of contents

-

Page 1

...N S O L I DATE D BA LANCE SHEETS C O N S O L I DATE D STAT E M E N TS OF CHANG ES IN SHAREHOLD ER S' EQ U I T Y C O N S O L I DATED STAT E M E N TS OF CASH FLOW S N OT ES TO CONSOLIDATED FINANCIAL STAT E M E N TS R E P O RT OF INDEPEND ENT CE RTIFIED PUBLIC AC C O U N TA N TS SHAREHOLDER INFO R M AT... -

Page 2

...customers, the largest group of loyal book patrons in the world. Elsewhere at Barnes & Noble, or should I say, central to Barnes & Noble's future plans, has been the remarkable growth of GameStop, our video-game business. Against the backdrop of declining retail sales all over America, this company... -

Page 3

... working capital management and corporate finance activities, have resulted in our being in the strongest financial position in the company's history. We are well within the appropriate safety margins in terms of all of our key ratios, and in a position to negotiate credit facilities to provide... -

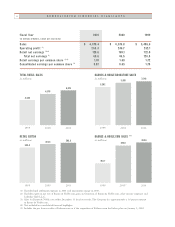

Page 4

...Excludes legal settlement expenses in 2001 and impairment charge in 2000. (2) Excludes equity in net loss of Barnes & Noble.com, gain on formation of Barnes & Noble.com, other income (expense) and Calendar Club L.L.C. (3) Sales for Barnes & Noble.com reflect December 31 fiscal year-ends. The Company... -

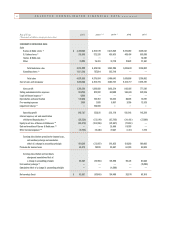

Page 5

...forth on the following pages should be read in conjunction with the consolidated financial statements and notes included elsewhere in this report. The Company's fiscal year is comprised of 52 or 53 weeks, ending on the Saturday closest to the last day of January. The Statement of Operations Data for... -

Page 6

... Sales Barnes & Noble stores (4) B. Dalton stores (5) Barnes & Noble.com Other Total bookstore sales GameStop stores (6) Total sales Cost of sales and occupancy Gross profit Selling and administrative expenses Legal settlement expense (7) Depreciation and amortization Pre-opening expenses Impairment... -

Page 7

... OPERATING DATA: Number of stores Barnes & Noble stores (4) B. Dalton stores (5) GameStop stores (6) Total Comparable store sales increase (decrease) (14) Barnes & Noble stores (4) B. Dalton stores (5) GameStop stores (6) Capital expenditures BALANCE SHEET DATA: Working capital Total assets Long... -

Page 8

... Barnes & Noble trade name representing the Company's original retail strategy. Also includes FuncoLand stores, Software Etc. stores and Babbage's stores. Represents legal and settlement costs associated with the lawsuit brought by the American Booksellers Association. Represents a non-cash charge... -

Page 9

... Software Etc. and FuncoLand trade names, a Web site, gamestop.com, and Game Informer , one of the largest multi-platform video-game magazines, with circulation of over 415,000 subscribers. The Company employed approximately 45,000 full- and part-time employees as of February 2, 2002. Barnes & Noble... -

Page 10

... the top 50 largest Web properties on the Internet. Co-marketing agreements with major Web portals such as AOL, Yahoo! and MSN as well as content sites have extended Barnes & Noble.com's brand and increased consumer exposure to its site. Barnes & Noble.com has also established a network of remote... -

Page 11

...$32.4 million of property, plant and equipment related to the book business, primarily goodwill associated with the purchase of B. Dalton and other mall-bookstore assets. M a r ketable Equity Securities All marketable equity securities are classified as available-for-sale. The Company carries these... -

Page 12

...) 2001 2000 1999 SALES Bookstores (1) Video Game & Entertainment Software stores Total OPERATING PROFIT Bookstores (1)(2) Video Game & Entertainment Software stores Total COMPARABLE STORE SALES INCREASE (DECREASE) (3) Barnes & Noble stores B. Dalton stores GameStop stores STORES OPENED Barnes... -

Page 13

... of Calendar Club for fiscal 1999 was $1,228. (2) Fiscal 2001 operating profit is net of legal and settlement expenses of $4,500. Fiscal 2000 operating profit is net of a non-cash impairment charge of $106,833. (3) Comparable store sales for Barnes & Noble stores are determined using stores open at... -

Page 14

...the Video Game & Entertainment Software segment and the increase in bookstore expenses from the opening of 40 Barnes & Noble stores in fiscal 2001. Selling and administrative expenses remained unchanged at 18.6% of sales during fiscal 2001 and 2000. Legal Settlement Ex p e n s e In fiscal 2001, the... -

Page 15

... Calendar Club) Total Investing Activities Other Adjustments Legal settlement expense Impairment charge Total Other Adjustments 2001 2000 $ Equity in Net Loss of Barnes & Noble.com In November 2000, Barnes & Noble.com acquired Fatbrain.com, Inc. (Fatbrain), the third largest online bookseller... -

Page 16

...-required advertising. Cost of sales and occupancy increased to $3.170 billion in fiscal 2000 from $2.484 billion in fiscal 1999 primarily due to the increase in Video Game & E n t e rtainment Software's cost of sales and occupancy as a result of the Acquisitions. The Company's gross margin rate... -

Page 17

... as follows: Fiscal Year Retail Earnings Per Share Bookstores Video Game & Entertainment Software Stores Retail EPS EPS Impact of Investing Activities Cash: Gain on Barnes & Noble.com Gain on partial sale of Indigo Books & Music Inc. Non-cash: Share in net losses of Barnes & Noble.com Share of net... -

Page 18

... number and timing of new store openings, as well as the amount and timing of sales contributed by new stores. Cash flows from operating activities, funds available under its revolving credit facility and vendor financing continue to provide the Company with liquidity and capital resources for store... -

Page 19

... expansion planned for the next fiscal year, management believes cash flows generated from operating activities, short-term vendor financing and borrowing capacity under its revolving credit facility will be sufficient to meet the Company's working capital and debt service requirements, and support... -

Page 20

...which Barnes & Noble College Bookstores, Inc. (B&N College), a company owned by Leonard Riggio, subleases space for its executive offices from the Company. Occupancy costs allocated by the Company to B&N College for this space totaled $0.7 million, $0.7 million and $0.7 million for fiscal years 2001... -

Page 21

... an agreement whereby the Company pays a commission on all items ordered by customers at the Company's stores and shipped directly to customers' homes by Barnes & Noble.com. Commissions paid for these sales were $0.4 million during fiscal 2001. The Company paid B&N College certain operating costs... -

Page 22

... service, effects of competition, possible disruptions or delays in the opening of new stores or the inability to obtain suitable sites for new stores, higher-than-anticipated store closing or relocation costs, higher interest rates, the performance of the Company's online initiatives such as Barnes... -

Page 23

...Thousands of dollars, except per share data) 2001 2000 1999 Sales Cost of sales and occupancy Gross profit Selling and administrative expenses Legal settlement expense Depreciation and amortization Pre-opening expenses Impairment charge Operating profit Interest (net of interest income of $1,319... -

Page 24

... Net property and equipment Intangible assets, net Investment in Barnes & Noble.com Other noncurrent assets Total assets Liabilities and Shareholders' Equity Current liabilities: Accounts payable Accrued liabilities Total current liabilities Long-term debt Deferred income taxes Other long... -

Page 25

... Capital 5 23 , 51 7 Accumulated Other Comprehensive Loss -- Retained Earnings 155,203 Treasury Stock at Cost -- Total 678,789 Balance at January 30, 1999 Comprehensive earnings: Net earnings Other comprehensive loss: Unrealized loss on available-for-sale securities (net of deferred tax benefit... -

Page 26

...accounting principle, net of taxes Other (income) expense, net Gain on formation of Barnes & Noble.com Equity in net loss of Barnes & Noble.com Changes in operating assets and liabilities, ne t Net cash flows from operating activities Cash flows from investing activities: Acquisition of consolidated... -

Page 27

... management information systems are capitalized and included in property and equipment. These costs are amortized over their estimated useful lives from the date the systems become operational. C o n s o l i d at i o n The consolidated financial statements include the accounts of Barnes & Noble... -

Page 28

...twelve-month membership period based upon historical spending patterns for Barnes & Noble customers. Refunds of membership fees due to cancellations within the first 30 days are minimal. Sales returns (which are not significant) are recognized at the time returns are made. D efe rred Charge s Costs... -

Page 29

... Standards Executive Committee issued Statement of Position 98-5, "Reporting on the Costs of Start-Up Activities" (SOP 985). SOP 98-5 requires an entity to expense all start-up activities, as defined, when incurred. Prior to 1999, the Company amortized costs associated with the opening of new stores... -

Page 30

... rowings at an interest rate based on LIBOR. In addition, the agreement required the Company to pay a commitment fee of 0.375 percent of the unused portion. The seasonal credit facility was guaranteed by all restricted subsidiaries of Barnes & Noble. In fiscal 2001, the Company issued $300,000, 5.25... -

Page 31

... agreement to terminate the Company's planned acquisition of Ingram. The Company's application before the Federal Trade Commission for the purchase was formally withdrawn. As a result, other income reflects a one-time charge of $5,000 for acquisition costs relating primarily to legal, accounting... -

Page 32

...MARKETABLE EQ U I TY SEC U R I T I E S Marketable equity securities are carried on the balance sheet at their fair market value as a component of other noncurrent assets. The following marketable equity securities as of February 2, 2002 and February 3, 2001 have been classified as available-for-sale... -

Page 33

...,000 and $742,000 at February 2, 2002, February 3, 2001 and January 29, 2000, respectively. Summarized financial information for Barnes & Noble.com follows: 12 months ended December 31, 2001 Net sales Gross profit Net loss(b) Cash and cash equivalents Other current assets Noncurrent assets Current... -

Page 34

..., the Company provides certain health care and life insurance benefits (the P o s t re t i rement Plan) to retired employees, limited to those receiving benefits or retired as of April 1, 1993. A summary of the components of net periodic cost for the Pension Plan and the Postretirement Plan follows... -

Page 35

... 3,664 ) $ $ $ Settlements in the form of lump sum cash payments were made in fiscal 2001 to plan participants in exchange for their rights to receive specified pension benefits. The health-care cost trend rate used to measure the expected cost of the Postretirement Plan benefits is assumed to be... -

Page 36

... ST AT E M E N T S c o n t i n u e d 10. INCOME TAXES The Company files a consolidated federal return. Federal and state income tax provisions (benefits) for fiscal 2001, 2000 and 1999 are as follows: Fiscal Year Current: Federal State 2001 2000 1999 The tax effects of temporary differences that... -

Page 37

...video-game and entertainment-software stores. B o o ksto re s This segment includes 591 bookstores under the Barnes & Noble Booksellers, Bookstop and Bookstar names which generally offer a comprehensive title base, a café, a children's section, a music department, a magazine section and a calendar... -

Page 38

... follows: Fiscal Year Reportable segments operating profit Interest, net Equity in net loss of Barnes & Noble.com Gain on formation of Barnes & Noble.com Other income (expense) Consolidated earnings (loss) before income taxes and cumulative effect of a change in accounting principle $ 2001 24 5 ,78... -

Page 39

... under which stock options have been or may be granted to officers, directors and key employees of the Company, the 1991 Employee Incentive Plan (the 1991 Plan) and the 1996 Incentive Plan (the 1996 Plan). The options to purchase common shares generally are issued at fair market value on the date of... -

Page 40

... 35 percent, risk-free interest rate of 4.86 percent in fiscal 2001, 6.50 percent in fiscal 2000, and 5.90 percent in fiscal 1999, and an expected life of six years. A summary of the status of the Company's stock options is presented below: Weighted-Average Exercise Price $ 1 6 .22 22 . 3 1 1 1.39... -

Page 41

... provide for both minimum and percentage rentals and require the Company to pay all insurance, taxes and other maintenance costs. Percentage rentals are based on sales performance in excess of specified minimums at various stores. Rental expense under operating leases are as follows: 18. LEGAL... -

Page 42

... to such lease, the Company paid $490, $648 and $573 in fiscal years 2001, 2000 and 1999, respectively. The Company leases retail space in a building in which Barnes & Noble College Bookstores, Inc. (B&N College), a company owned by Leonard Riggio, subleases space for its executive offices from the -

Page 43

... totaled $748, $709 and $686 for fiscal years 2001, 2000 and 1999, respectively. The amount paid by B&N College to the Company approximates the cost per square foot paid by the Company to its unaffiliated third-party landlord. The Company subleases warehouse space from Barnes & Noble.com in Reno... -

Page 44

...an agreement whereby the Company pays a commission on all items ordered by customers at the Company's stores and shipped directly to customers' homes by Barnes & Noble.com. Commissions paid for these sales were $359 during fiscal 2001. The Company paid B&N College certain operating costs B&N College... -

Page 45

...21. SELECTED QUA RT E R LY FINANCIAL INFO R M ATION (UNAUDITED) A summary of quarterly financial information for each of the last two fiscal years is as follows: Fiscal 2001 Quarter End On or About Sales Gross profit Equity in net loss of Barnes & Noble.com (a) Net earnings (loss) (b) Earnings (loss... -

Page 46

..., in conformity with accounting principles generally accepted in the United States of America. As discussed in Note 1 to the Consolidated Financial Statements, effective January 31, 1999, the Company changed its method of accounting for pre-opening expenses. New York, New York March 21, 2002 BDO... -

Page 47

... Barnes & Noble, Inc. Stephen Riggio Vice Chairman and Chief Executive Officer Barnes & Noble, Inc. Matthew A. Berdon Chairman of the New York Division Urbach, Kahn & Werlin Michael J. Del Giudice Senior Managing Director Millennium Credit Markets LLC William Dillard, II Chief Executive Officer... -

Page 48

... our shareholders and potential investors are always welcome. General financial information can be obtained via the Internet by visiting the Company's Corporate Web site: www.barnesandnobleinc.com/financials Up-to-the-minute news about Barnes & Noble, requests for Annual Reports, Form 10-K and 10... -

Page 49

Barnes & Noble, Inc â- 1 22 Fifth Avenue â- New York , NY 10011 -

Page 50

-

Page 51

... Eisenberg, Heidi E. Murkoff, Sandee E. Hathaway, Workman (127,365) Me Talk Pretty One Day David Sedaris, Little, Brown (104,035) D r. Atkins' New Diet Revo l u t i o n Robert C. Atkins, Avon (97,358) A Heart b reaking Work of St aggering Genius Dave Eggers, Vintage (89,363) The World Almanac and... -

Page 52

... 0 0 Mark Amis Talk Miramax Poetry: Saving Live s Albert Goldbarth Ohio State University Press Biography: B o swell's Pre s u m ptuous Tas k : The Making of the Life of D r. Johnson Adam Sisman Farrar, Straus & Giroux BARNES & NOBLE DISCOV E R G R EAT NEW WRITERS AWA R D Fiction: The Death of Vishnu...