Bank of the West 2007 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2007 Bank of the West annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The unfavorable economic environment of the past year

overshadowed Bank of the West’s otherwise good

performance in 2007. We saw robust asset generation,

reflecting strong loan and equipment finance growth.

We continued efforts to deepen our deposit customer

relationships, and our cross-sale efforts met with growing

success. Restrained by low net interest margins, the bank

worked to diversify its revenue streams.

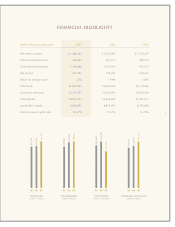

Surpassing $60 billion in assets for the first time, the

bank’s assets grew 11.1% over year-end 2006 to $61.8

billion. Loans and leases at year’s end 2007 totaled

$43.7 billion, a 10.4% increase over the 2006 total of

$39.6 billion. Net income for the year was $417.3

million, a decline of 27.1% from net income of $572.0

million in 2006.

Two factors negatively impacted our earnings. First, we

recorded impairment charges of $189.5 million in the

final quarter of the year to address exposure to mortgage-

backed securities and related vehicles. Second, we set aside

larger reserves than anticipated in the second half of 2007

to cover expected losses in the homebuilder industry as

well as deterioration of consumer credit. As it has for our

peers and competitors, net income suffered accordingly.

Bank of the West has experienced dramatic growth in

recent years, especially with acquisitions in 2004 and 2005

that served to introduce our brand in 13 states new to us.

Recognizing this growth and determined to continue

to make decisions swiftly and close to the customer, we

reorganized the bank in 2006 to decentralize and flatten

the organization.

This was our first full year implementing a decentralized

business model that made the bank’s array of products

available to both commercial and individual customers in

most of our 700-location footprint stretching from

California to Wisconsin. Our business model, aptly named

Business Empowerment to Achieve Results, reinforces

effective teamwork in providing more solutions for

more customers.

In 2007, we fine-tuned our new structure, developed and

offered new products, opened seven new retail branches

and launched 14 commercial sales offices in key growth

markets, including representative offices in New York

City and Taiwan. We successfully increased product

distribution in our credit card, mortgage, home equity

lending and insurance businesses. Net operating earnings

in our BW Insurance Agency subsidiary increased by 26%.

New prime mortgage lending rose by 10%, and our

Consumer Finance loan and lease production increased,

with indirect lending rising 12% for the year.

Our new commercial offices contributed to a 14%

increase in loans and leases over 2006 and a 7% increase

in commercial deposits. New cash management relation-

ships developed steadily throughout the year, and we

expect continued growth in commercial and industrial

relationships in 2008. On the small business end of the

commercial spectrum, we increased loan commitments

by 64% in 2007.

The Year In Review

2