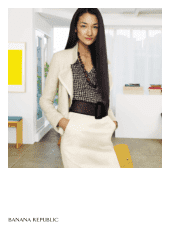

Banana Republic 2006 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2006 Banana Republic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Letter to Shareholders 9

Implicit in all three is the need to improve our financial performance and

deliver an acceptable return to you, our shareholders.

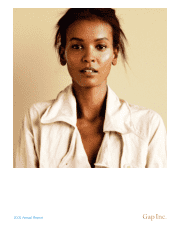

Gap and Old Navy

Our first priority is to fix our core business. We must rebuild Gap and

Old Navy and return them to premiere positions in the marketplace. We

need to do a better job of identifying the target customer and delivering

the right product.

At Gap, we have a clear sense of our BabyGap, GapKids and GapBody

customers and we’ve seen positive momentum in these businesses

because we are delivering the right product in store environments that

speak distinctly to them. But at Gap adult we’ve defined our target

customer too broadly and that, in part, is what hurt our performance

in 2006. Today’s specialty retailers have a much narrower focus, and

consumers are exposed to more selective, niche marketing. Moving

forward, we are committed to establishing a clear point of view for the

brand. We will communicate more consistently based on Gap’s iconic

casual heritage.

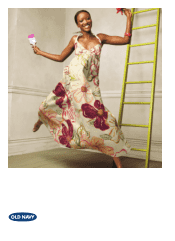

We believe the primary challenge at Old Navy is somewhat different.

While we’re still assessing, we know we must develop great product

with enticing marketing, pricing and inventory strategies and act on them

decisively. Old Navy operates in one of our most competitive markets,

and we cannot be as tentative as we became in the past two years.

Moving forward, we will stand strong behind key product trends each

season, and back our big ideas with the right inventory investments,

visual merchandising and all elements of marketing. It is these kinds

of well-executed ideas that helped Old Navy become the first retailer to

hit $1 billion in less than 4 years. There is still great potential in Old Navy,

and I believe we can re-capture the unique retail experience that we

broke ground with more than 13 years ago.

In short, the simple fact is that we need to know our customer and then

give them the right product in appealing store environments. We know

that when we align these factors, we drive results. We’ve done it before;