Banana Republic 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 Banana Republic annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 Annual Report

Table of contents

-

Page 1

2006 Annual Report -

Page 2

-

Page 3

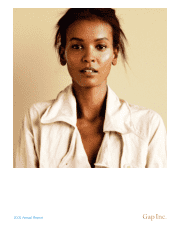

... iconic apparel brand recognized throughout the world for its casual American classics-great knits, khakis, t-shirts and of course, denim. Through GapKids, babyGap, Gap maternity, and GapBody we build on the power of the brand by dressing our customers throughout the different stages of their lives. -

Page 4

-

Page 5

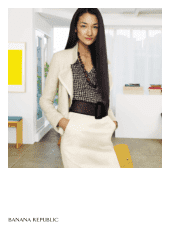

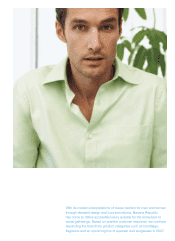

... of classic fashion for men and women through elevated design and luxurious fabrics, Banana Republic has come to define accessible luxury suitable for the workplace to social gatherings. Based on positive customer response, we continue expanding the brand into product categories such as handbags... -

Page 6

-

Page 7

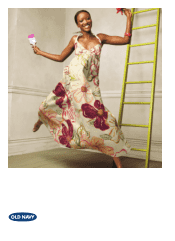

... value, all in a fun energizing shopping environment. Customers count on Old Navy to deliver what they want-and need. From Old Navy's Item of the Week-a special item at a special price each week-to its eye popping deals and promotions, Old Navy strives to be the place to go for the newest fashion at... -

Page 8

www.gap.com www.oldnavy.com www.bananarepublic.com Gap Inc.Direct -

Page 9

... our brands online. With Gap Online, Old Navy Online and Banana Republic Online, Gap Inc. Direct is one of the largest specialty e-commerce apparel retailers in the U.S. In 2006, our online sales increased 23 percent. We also launched Piperlime, a fresh online shoe shop featuring a growing number of... -

Page 10

... the opening of new Gap franchise locations around the world. But these were overshadowed by performance at Gap and Old Navy. Importantly, we came out of 2006 with a clear consensus for significant change in our business, and the urgency to take immediate action. With nearly 30 years of professional... -

Page 11

...consistently based on Gap's iconic casual heritage. We believe the primary challenge at Old Navy is somewhat different. While we're still assessing, we know we must develop great product with enticing marketing, pricing and inventory strategies and act on them decisively. Old Navy operates in one of... -

Page 12

..., Gap and Old Navy helped drive a four-point improvement in gross margins and our earnings more than doubled year-over-year. Rebuilding Management Strength Our second priority is to retain, develop and recruit the best talent in the industry, particularly in key creative positions like design and... -

Page 13

...appropriate return rates. We are pleased to be bringing Gap and Banana Republic to new customers in global markets through international franchising, and we're excited by the launch of Piperlime, our online shoe store. Looking Ahead This is an exciting time to be leading Gap Inc., and I'm personally... -

Page 14

... of exchange rate fluctuations on cash Net decrease in cash and equivalents Per Share Data Net earnings-diluted Dividends paid Statistics Net earnings as a percentage of net sales Return on average assets Return on average stockholders' equity Current ratio Number of store locations open at year-end... -

Page 15

...' Equity percent 25 24 22 Net Sales Per Average Square Foot in dollars 415 378 428 412 390* 15 15 02 03 04 05 06 02 03 04 05 06 * The calculation for 2006 net sales per average square foot is based on 52 weeks for a consistent comparison to the prior years. Financial Highlights 13 -

Page 16

... Corporate Overview Executive Officers of the Registrant Five-Year Selected Financial Data Management's Discussion and Analysis Quantitative and Qualitative Disclosures About Market Risk Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets Consolidated Statements... -

Page 17

...(d) of the Securities Exchange Act of 1934 For the transition period from to Commission File Number 1-7562 (Exact name of registrant as specified in its charter) THE GAP, INC. Two Folsom Street San Francisco, California 94105 (Address of principal executive offices) (Zip code) Delaware (State of... -

Page 18

... conversion of Old Navy Outlet stores into Old Navy stores, the Forth & Towne closure, and the closure of a distribution facility in Kentucky; (vi) interest expense for fiscal 2007; (vii) effective tax rate for fiscal 2007; (viii) year-over-year change in inventory per square foot at the end of the... -

Page 19

... and Issuer Purchases of Equity Securities ...Item 6. Selected Financial Data ...Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations ...Item 7A. Quantitative and Qualitative Disclosures about Market Risk ...Item 8. Financial Statements and Supplementary... -

Page 20

...our brands: Gap. Founded in 1969, Gap stores offer extensive selections of classically styled, high quality, casual apparel at moderate price points. Products range from wardrobe basics such as denim, khakis and T-shirts to fashion apparel, accessories, personal care products for men and women, ages... -

Page 21

...the size and location of the store. Our stores generally are open seven days per week (where permitted by law) and most holidays. All sales are tendered for cash, personal checks, debit cards, or credit cards, including Gap, Banana Republic and Old Navy private label credit cards which are issued by... -

Page 22

... changing consumer preferences to succeed" below in Item 1A. Competitors The global specialty apparel industry is highly competitive. We compete with national and local department stores, specialty and discount store chains, independent retail stores and internet businesses that market similar lines... -

Page 23

... Chief Financial Officer since January 2003; Executive Vice President and Chief Financial Officer of Walt Disney Parks and Resorts from 1999 to 2003. Dawn Robertson, 51, President, Old Navy since November 2006; Managing Director of Myer Department Stores, Australia's leading department store, from... -

Page 24

... and local department stores, specialty and discount store chains, independent retail stores and internet businesses that market similar lines of merchandise. We face a variety of competitive challenges including: • • anticipating and quickly responding to changing consumer demands; maintaining... -

Page 25

... merchandise and promotional events, changes in our merchandise mix, the success of marketing programs and weather conditions. These factors may cause our comparable store sales results to differ materially from prior periods and from expectations. Over the past five years our reported gross margins... -

Page 26

..."Debt and Credit Facility" in our Management's Discussion and Analysis of Financial Condition and Results of Operations included as Part II, Item 7. Trade matters and IT systems changes may disrupt our supply chain. We cannot predict whether any of the countries in which our merchandise currently is... -

Page 27

... January 2006, we entered into a non-exclusive services agreement with International Business Machines Corporation ("IBM") under which IBM operates certain significant aspects of our information technology infrastructure that historically were operated by us, including technology services supporting... -

Page 28

.... Item 2. Properties We operate stores in the United States, Canada, the United Kingdom, France, Ireland, and Japan. The stores operated as of February 3, 2007 aggregated approximately 38.9 million square feet. Almost all our stores are leased either on a short-term basis with one or more options... -

Page 29

... development, settlement or resolution. However, we do not believe that the outcome of any current Action would have a material adverse effect on our results of operations, liquidity or financial position taken as a whole. Item 4. Submission of Matters to a Vote of Security Holders Not applicable... -

Page 30

... Securities The principal market on which our stock is traded is the New York Stock Exchange. The number of holders of record of our stock as of March 26, 2007 was 9,847. The table below sets forth the market prices and dividends paid for each of the fiscal quarters in fiscal 2006 and 2005. Market... -

Page 31

... presents information with respect to purchases of common stock of the Company made during the fourteen weeks ended February 3, 2007, by The Gap, Inc. or any affiliated purchaser, as defined in Rule 10b-18(a)(3) under the Exchange Act. Total Number of Shares Purchased as Part of Publicly Announced... -

Page 32

...inventory per square foot. Weighted average shares and square footage of store space are presented in thousands. 2006 (53) Fiscal Year (number of weeks) 2005 (52) 2004 (52) 2003 (52) 2002 (52) Operating Results Net sales ...Gross margin ...Operating margin (a) ...Net earnings ...Cash dividends paid... -

Page 33

...former Vice President, Director of Brand Marketing for J.C. Penney Company, Inc., as the new executive vice president of marketing for the Old Navy brand. Conversion of Old Navy's Outlet stores into Old Navy stores. In order to drive improved returns and leverage its existing retail channel, we made... -

Page 34

... week of fiscal 2006 were $200 million. Net sales by brand, region and channel are as follows: 53 Weeks Ended February 3, 2007 Gap Old Navy Banana Republic Other (3) Total Net Sales ($ in millions) North America (1) Europe Asia Other Regions (2) Total Stores Direct (Online) Stores Stores $4,873... -

Page 35

...and Business Direct which ended in July 2006. Our fiscal 2006 sales decreased $80 million compared with fiscal 2005. Our fiscal 2006 comparable store sales declined 7 percent compared with the prior year primarily due to our product assortments at the Gap and Old Navy brands which did not perform to... -

Page 36

...millions) January 28, 2006 Number of Square Footage Store Locations (in millions) Gap North America ...Gap Europe ...Gap Asia ...Old Navy North America ...Banana Republic North America ...Banana Republic Japan ...Forth & Towne ...Total ...Increase over Prior Year ...Cost of Goods Sold and Occupancy... -

Page 37

... and related benefits (for our store operations, field management, distribution centers, and corporate functions), advertising, and general and administrative expenses. Also included are costs to design and develop our products, merchandise handling and receiving in distribution centers and stores... -

Page 38

... of long-lived assets offset by $31 million in income relating to the change in our estimate of the elapsed time for recording income associated with unredeemed gift cards in the second quarter of fiscal 2006. Operating expenses as a percentage of net sales decreased 0.7 percentage points, or... -

Page 39

... 28, 2006 due primarily to lower short-term investments and the reclassification of the current portion of our long-term debt to current liabilities, offset by higher inventory as a result of an increase in stores and square footage. Our shortterm investments decreased as a result of our share... -

Page 40

...-store merchandise levels and product assortment to support sales growth. Inventory per square foot at February 3, 2007 was $44, a 2 percent increase over fiscal 2005 primarily due to the change in shortage trends resulting in a lower shortage estimate. Inventory per square foot at January 28, 2006... -

Page 41

... stores and purchase new equipment to keep the business growing. We use this metric internally, as we believe our sustained ability to increase free cash flow is an important driver of value creation. The following table reconciles free cash flow, a non-GAAP financial measure, to a GAAP financial... -

Page 42

... of credit agreements expired and the total letter of credit capacity was reduced to $500 million. This reduction in the letter of credit capacity reflects our transition to open account payment terms as well as the available capacity under our $750 million revolving credit facility to issue trade... -

Page 43

..., working capital, trade letters of credit and standby letters of credit. The facility usage fees and fees related to the New Facility fluctuate based on our long-term senior unsecured credit ratings and our leverage ratio. The New Facility and letter of credit agreements contain financial and... -

Page 44

... Balance Sheets; however, the minimum lease payments related to these leases are disclosed in Note 4 of Notes to the Consolidated Financial Statements. Purchase obligations include our non-exclusive services agreement with International Business Machines Corporation ("IBM") entered in fiscal... -

Page 45

... the development and selection of these critical accounting policies and estimates with the Audit and Finance Committee of our Board of Directors. Merchandise Inventory In fiscal 2005, we implemented a new inventory system and effective January 29, 2006 (the beginning of fiscal 2006), we changed our... -

Page 46

... asset may not be recoverable. Events that result in an impairment review include decisions to close a store, headquarter facility or distribution center, or a significant decrease in the operating performance of the long-lived asset. For assets that are identified as potentially being impaired, if... -

Page 47

... the estimate of fair value of share-based compensation and, consequently, the related amount recognized in the Consolidated Statements of Income. In the second quarter of fiscal 2006, we proactively reviewed our stock option granting practices over the 10-year period ended June 2006, given the... -

Page 48

Item 7A. Quantitative and Qualitative Disclosures about Market Risk We operate in foreign countries, which exposes us to market risk associated with foreign currency exchange rate fluctuations. Our risk management policy is to hedge substantially all forecasted merchandise purchases for foreign ... -

Page 49

.... As a result of prior and current fiscal year changes to our long-term credit ratings, the interest payable by us on the 2008 Notes was 9.80 percent per annum as of February 3, 2007. Subsequent to year-end, our credit rating was further downgraded which will increase the interest payable by us to... -

Page 50

... THE GAP, INC. INDEX TO CONSOLIDATED FINANCIAL STATEMENTS Page Report of Independent Registered Public Accounting Firm ...Consolidated Balance Sheets as of February 3, 2007 and January 28, 2006 ...Consolidated Statements of Income for the fiscal years ended February 3, 2007, January 28, 2006 and... -

Page 51

... opinions. A company's internal control over financial reporting is a process designed by, or under the supervision of, the company's principal executive and principal financial officers, or persons performing similar functions, and effected by the company's board of directors, management, and other... -

Page 52

THE GAP, INC. CONSOLIDATED BALANCE SHEETS ($ in millions except par value, shares in thousands) February 3, 2007 January 28, 2006 ASSETS Current Assets: Cash and cash equivalents ...Short-term investments ...Restricted cash ...Merchandise inventory ...Other current assets ...Total current assets ... -

Page 53

THE GAP, INC. CONSOLIDATED STATEMENTS OF INCOME ($ in millions except per share amounts, shares in thousands) 53 Weeks Ended February 3, 2007 52 Weeks Ended January 28, 2006 52 Weeks Ended January 29, 2005 Net sales ...Cost of goods sold and occupancy expenses ...Gross profit ...Operating expenses ... -

Page 54

...Share-based compensation ...Tax benefit from exercise of stock options and vesting of service awards ...Excess tax benefit from exercise of stock options ...Other non-cash items ...Deferred income taxes ...Change in operating assets and liabilities: Merchandise inventory ...Other assets ...Accounts... -

Page 55

... Conversion of convertible debt ...434,367 Tax benefit from exercise of stock options by employees and from vesting of service awards ...Adjustments for foreign currency translation ...Adjustments for fluctuations in fair market value of financial instruments, net of tax ($21) ...Reclassification of... -

Page 56

... "our"), a Delaware Corporation, is a specialty retailer selling casual apparel, accessories and personal care products for men, women and children under a variety of brand names including Gap, Banana Republic, Old Navy, and Forth & Towne. We operate stores in the United States, Canada, Ireland, the... -

Page 57

... of sizes) and use markdowns to clear merchandise. We value inventory at the lower of cost or market and record a reserve when future estimated selling price is less than cost. In addition, we estimate and accrue shortage for the period between the last physical count and the balance sheet date. Our... -

Page 58

... on the Consolidated Balance Sheets. The $7 million increase in the gross carrying value of key money was due to the impact of changes in foreign currency rates from fiscal 2005 to fiscal 2006. The amortization expense associated with key money was $4 million in fiscal 2006. Rent Expense Minimum... -

Page 59

... asset may not be recoverable. Events that result in an impairment review include decisions to close a store, headquarter facility or distribution center, or a significant decrease in the operating performance of the long-lived asset. For assets that are identified as potentially being impaired, if... -

Page 60

... quarter of 2006, we changed our estimate of the elapsed time for recording income associated with unredeemed gift cards to three years from our prior estimate of five years. The liability for gift cards and gift certificates is recorded in accounts payable on the Consolidated Balance Sheets and was... -

Page 61

... Operating expenses include payroll and related benefits (for our store operations, field management, distribution centers, and corporate functions), advertising, general and administrative expenses, and other income (expense). Also included are costs to design and develop our products, merchandise... -

Page 62

... fair value recognition provisions of SFAS 123 on the grant date of stock options, and employee stock purchase rights during fiscal 2005 and fiscal 2004. ($ in millions, except per share data) 52 Weeks Ended January 28, 2006 52 Weeks Ended January 29, 2005 Net earnings, as reported ...Add: Share... -

Page 63

..., working capital, trade letters of credit and standby letters of credit. The facility usage fees and fees related to the New Facility fluctuate based on our long-term senior unsecured credit ratings and our leverage ratio. The New Facility and letter of credit agreements contain financial and... -

Page 64

... are recorded in the Consolidated Balance Sheets at the time of merchandise title transfer, although the letters of credit are generally issued prior to this. As of February 3, 2007, we had $190 million in trade letters of credit issued under our letter of credit agreements totaling $500 million and... -

Page 65

.... The difference between the effective income tax rate and the U.S. federal income tax rate is summarized as follows: 53 Weeks Ended February 3, 2007 52 Weeks Ended January 28, 2006 52 Weeks Ended January 29, 2005 Federal tax rate ...State income taxes, less federal benefit ...Tax impact... -

Page 66

... adoption, management estimates that the adjustment to retained earnings will not be material. This estimate is subject to revision as we complete our analysis. NOTE 4. LEASES We lease most of our store premises and some of our headquarter facilities and distribution centers. These operating leases... -

Page 67

...) are reflected in operating expenses in our Consolidated Statements of Income. In June 2006, an Agreement of Purchase and Sale was executed with a buyer for our distribution center located in Brampton, Ontario, Canada. Upon completion of the sale in the third fiscal quarter of 2006, we recorded... -

Page 68

NOTE 6. DERIVATIVE FINANCIAL INSTRUMENTS We operate in foreign countries, which exposes us to market risk associated with foreign currency exchange rate fluctuations. Our risk management policy is to hedge substantially all forecasted merchandise purchases for foreign operations and intercompany ... -

Page 69

... on the Consolidated Balance Sheets. We have designated such swaps as cash flow hedges to hedge the total variability in functional currency. NOTE 7. COMMON STOCK Common and Preferred Stock The Board of Directors is authorized to issue 60 million shares of Class B common stock, which is convertible... -

Page 70

... purchase period. After December 1, 2006, eligible U.S. employees are able to purchase our common stock at 85 percent of the closing price on the New York Stock Exchange on the last day of the three-month purchase period. Employees pay for their stock purchases through payroll deductions at a rate... -

Page 71

... fiscal quarter of 2006, we added "Share-Based Compensation" as a critical accounting policy and estimate. The assumptions used to value stock options are as follows: 53 Weeks Ended February 3, 2007 52 Weeks Ended January 28, 2006 52 Weeks Ended January 29, 2005 Expected term (in years) ...Expected... -

Page 72

.... The assumptions used to value employee stock purchase rights are as follows: 53 Weeks Ended February 3, 2007 52 Weeks Ended January 28, 2006 52 Weeks Ended January 29, 2005 Expected term (in years) ...Expected volatility ...Dividend yield ...Risk-free interest rate ... 0.5 25.1% 1.4% 4.8% 0.5 21... -

Page 73

... to the fair market value of the stock at the date of grant or as determined by the Compensation and Management Development Committee of the Board of Directors. The following table summarizes stock option activity for our stock option plans: Shares Weighted-Average Exercise Price Balance at January... -

Page 74

...3, 2007 had a weighted-average remaining contractual life of 5.42 years. The following table summarizes unvested Service Award and Performance Equity Award activity: Weighted-Average Grant-Date Fair Value Price Shares Balance at January 28, 2006 ...2,106,686 Granted ...4,219,239 Vested ...(517,633... -

Page 75

... non-exclusive services agreement with International Business Machines Corporation ("IBM"). Under the services agreement, IBM operates certain aspects of our information technology infrastructure that had been previously operated by us. The services agreement has an initial term of ten years, and we... -

Page 76

... Audit and Finance Committee of the Board reviewed and approved the terms of agreements to lease to Doris F. Fisher, Director, and Donald G. Fisher a total of approximately 26,000 square feet of space in our One Harrison and Two Folsom San Francisco headquarter locations to display portions of their... -

Page 77

..., Old Navy North America, International, Forth & Towne, Outlet and Direct. Our stores sell merchandise under the Gap, Old Navy, Banana Republic, and Forth & Towne brand names. We consider our operating segments to be similar in terms of economic characteristics, production processes, and operations... -

Page 78

(3) Other includes Forth & Towne beginning August 2005, our franchise business beginning September 2006, Piperlime.com beginning October 2006, and Business Direct ended July 2006. Long-lived assets of our international operations, including Canada, were $557 million and $601 million, and represented... -

Page 79

... quarter of fiscal 2006, we recognized approximately $31 million relating to the change in our estimate of the elapsed time for recording income associated with unredeemed gift cards. During fiscal 2006, we recorded a charge of approximately $32 million in impairment of long-lived assets. (b) During... -

Page 80

... also Item 1 above in the section entitled "Executive Officers of the Registrant." The Company has adopted a code of ethics, our Code of Business Conduct, that applies to all employees including our principal executive officer, principal financial officer, controller and persons performing similar... -

Page 81

Item 14. Principal Accountant Fees and Services The information required by this item is incorporated herein by reference to the section entitled "Principal Accounting Firm Fees" in the 2007 Proxy Statement. PART IV Item 15. Exhibits and Financial Statement Schedules 1. 2. 3. Financial Statements: ... -

Page 82

... Financial Officer (Principal Financial and Accounting Officer) Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated. Date: March 30, 2007 Date... -

Page 83

... Bank of New York, filed as Exhibit 4.2 to Registrant's Annual Report on Form 10-K for the year ended February 2, 2002, Commission File No. 1-7562. Credit Agreement, dated as of August 30, 2004, among The Gap, Inc., the LC Subsidiaries, the Subsidiary Borrowers, the Lenders and the Issuing Banks (as... -

Page 84

... Services Agreement between Registrant and IBM, dated as of January 13, 2006, filed as Exhibit 10.18 to Registrant's Form 10-K for the year ended January 28, 2006, Commission File No. 1-7562.(1) 10.10 EXECUTIVE COMPENSATION PLANS AND ARRANGEMENTS 10.11 10.12 10.13 Executive Management Incentive... -

Page 85

...'s 1996 Stock Option and Award Plan, dated September 25, 2002, filed as Exhibit 10.43 to Registrant's Form 10-K for the year ended January 28, 2006, Commission File No. 1-7562. Form of Nonqualified Stock Option Agreement for Paul Pressler under the company's 1996 Stock Option and Award Plan filed as... -

Page 86

... Stock Award Agreement for Paul Pressler under the Company's 1996 Stock Option Award Plan, filed as Exhibit 10.1 to Registrant's Form 10-Q for the quarter ended October 29, 2005, Commission File No. 1-7562. UK Employee Stock Purchase Plan, filed as Exhibit 4.1 to Registrant's Registration Statement... -

Page 87

...1-7562. Form of Stock Unit Agreement and Stock Unit Deferral Election Form for Nonemployee Directors under the 2006 Long-Term Incentive Plan, filed as Exhibit 10.2 to Registrant's Form 10-Q for the quarter ended July 29, 2006, Commission File No. 1-7562. Employment Agreement dated as of September 25... -

Page 88

... File No. 1-7562. Summary of Changed Named Executive Officer Compensation, filed as Exhibit 10.1 to Registrant's Form 8-K on April 28, 2006, Commission File No. 1-7562. Cash Payments in Connection with December 2005 Option Exchange, filed as Exhibit 10.81 to Registrant's Form 10-K for the year ended... -

Page 89

Board of Directors Howard P. Behar, 62 †‡ Director since 2003. Former Starbucks Corporation executive. Director of Shurgard Storage Centers, Inc. and Starbucks Corporation. Adrian D. P. Bellamy, 65 †‡ Director since 1995. Chairman of The Body Shop International plc, a personal care retailer... -

Page 90

... retailer offering clothing, accessories and personal care products for men, women, children and babies under the Gap, Banana Republic, Old Navy and Piperlime brand names. Please visit www.gapinc.com for more information, including online versions of our Annual Report, Securities and Exchange... -

Page 91

Design: Cahan & Associates, San Francisco Printing: Cenveo Anderson Lithograph Executive Photo: Chris Gaede Photography -

Page 92

Two Folsom Street San Francisco, CA 94105 gapinc.com