BMW 2010 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2010 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

124

74 GROUP FINANCIAL STATEMENTS

74 Income Statements

74 Statement of

Comprehensive Income

76 Balance Sheets

78 Cash Flow Statements

80 Group Statement of Changes

in Equity

81 Notes

81 Accounting Principles

and Policies

89 Notes to the Income

Statement

95 Notes to the Statement

of Comprehensive Income

96 Notes to the Balance Sheet

117 Other Disclosures

133 Segment Information

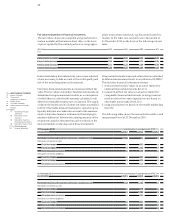

46months) to hedge currency risks attached to future

transactions. It is expected that euro 110 million of net

losses, recognised in equity at the end of the reporting

period, will be recognised in the income statement in 2011.

At 31 December 2010 the BMW Group held derivative

instruments with terms of up to 72 months (2009:

84months) to hedge interest rate risks. It is expected that

euro 42 million of net losses, recognised in equity at

theend of the reporting period, will be recognised in the

income statement in 2011.

At 31 December 2010 the BMW Group held derivative

instruments with terms of up to 35 months (2009:

The difference between the gains / losses on hedging

instruments and the result recognised on hedged items

represents the ineffective portion of fair value hedges.

Fair value hedges are mainly used to hedge the market

prices of bonds, other financial liabilities and receivables

from sales financing.

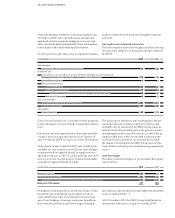

Credit risk

Notwithstanding the existence of collateral accepted, the

carrying amounts of financial assets generally take account

of the maximum credit risk arising from the possibility

that the counterparties will not be able to fulfil their con-

tractual obligations. The maximum credit risk for irrevo-

cable credit commitments relating to credit card business

amounts to euro 1,020 million (2009: euro 1,513 mil-

lion).

The equivalent figure for dealer financing is euro

14,388 million (2009: euro 12,634 million).

In the case of performance relationships underlying

non-derivative financial instruments, collateral will be re-

quired, information on the credit-standing of the coun-

terparty obtained or historical data based on the existing

business relationship (i.e. payment patterns to date) re-

viewed in order to minimise the credit risk, all depending

on the nature and amount of the exposure that the BMW

Group is proposing to enter into.

Within the financial services business, the financed items

(e.g. vehicles, equipment and property) in the retail cus-

tomer and dealer lines of business serve as first-ranking

collateral with a recoverable value. Security is also put up

by customers in the form of collateral asset pledges, asset

assignment and first-ranking mortgages, supplemented

35months) to hedge raw material price risks attached to

future transactions. It is expected that euro 88 million of

net gains, recognised in equity at the end of the reporting

period, will be recognised in the income statement in

2011.

Cash flow hedges are generally used to hedge cash flows

arising in conjunction with the supply of vehicles to sub-

sidiaries and to hedge raw material price fluctuations.

Fair value hedges

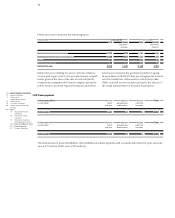

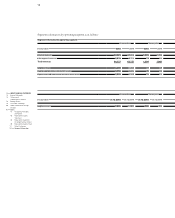

The following table shows gains and losses on hedging

instruments and hedged items which are deemed to be

part of a fair value hedge relationship:

where appropriate by warranties and guarantees. If an

item previously accepted as collateral is acquired, it under-

goes

a multi-stage process of repossession and disposal

in accordance with the legal situation prevailing in the

relevant market. The assets involved are generally vehi-

cles which can be converted into cash at any time via the

dealer organisation.

Impairment losses are recorded as soon as credit risks

are

identified on individual financial assets, using a

methodology specifically designed by the BMW Group.

More detailed information regarding this methodology

is provided in the section on accounting policies.

The use of comprehensive rating and scoring techniques

and credit monitoring procedures ensures the

recovera-

bility of the value of receivables from sales financing

which

are neither overdue nor impaired.

The credit risk relating to derivative financial instruments

is minimised by the fact that the Group only enters into

such contracts with parties of first-class credit standing.

The general credit risk on derivative financial instru-

ments utilised by the BMW Group is therefore not con-

sidered to be significant.

A concentration of credit risk with particular borrowers or

groups of borrowers has not been identified in conjunc-

tion with financial instruments.

Further disclosures relating to credit risk, in particular

impairment losses recognised, are provided in the notes

to the relevant category of receivables on page 102 and

pages 104 et seq.

in euro million 31. 12. 2010 31. 12. 2009

Gains / losses on hedging instruments designated as part of a fair value hedge relationship – 808 – 398

Gains / loss from hedged items 763 446

– 45 48