Avis 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Avis annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

April 17, 2012

Dear fellow shareholders:

2011 was an outstanding year for Avis Budget Group. We made significant progress on a

number of strategic initiatives, which contributed to our growth and profitability. We re-

united global ownership of each of the Avis and Budget brands through our acquisition of Avis

Europe plc, our long-time licensee, in a financially compelling transaction. We reported

record results. And in the process, we positioned Avis Budget Group for even greater long-

term success. In this letter, I’ d like to cover each of these topics in a bit more detail.

Strategic Progress. We entered 2011 with a focus on executing a new strategic plan designed

to generate profitable organic growth for our brands, improve our customer experience and

gain efficiency throughout our operations. We executed effectively against these initiatives.

We invested in new and enhanced brand marketing for Avis and Budget which resonated with

customers and strengthened our brands. We grew our rental volumes significantly among

international and small-business travelers, two particularly profitable segments that we have

targeted. We increased the profitability of our off-airport, or local-market, operations by

dual-branding another 400 locations. And we achieved more than $100 million of revenue

growth through our portfolio of new and existing travel and affinity partnerships, which we

expect will add to our growth again in 2012.

Our Performance Excellence process-improvement efforts made another strong contribution

to our financial results in 2011, generating more than $70 million in incremental savings from

projects that improved our efficiency and lowered our costs. And through our Company-wide

Customer Led, Service Driven initiative, we enhanced the customer experience we provide,

driving year-over-year improvements in Avis’ and Budget’ s customer satisfaction scores.

Acquisition of Avis Europe. We have long believed that competing with two truly global

brands offers a number of competitive advantages, so we were gratified to be able to

complete the acquisition of Avis Europe in October 2011. We can now provide customers with

global dual-branded solutions that no other company can match and are a leader in fast-

growing travel regions such as India and China.

We see significant opportunities to realize benefits from the combination with Avis Europe.

We expect to be generating more than $35 million in annual synergies by the first anniversary

of the transaction. And, including those synergies, the acquisition of Avis Europe would have

added more than $100 million to our 2011 pretax earnings on a pro forma basis1, which

highlights just how financially attractive this transaction was for us. Just as importantly, we

expect that substantial opportunities to reduce costs and accelerate growth, particularly of

the Budget brand in Europe, will remain available even after the first wave of synergies.

Record Results. Our financial performance was also a highlight. In 2011, we grew revenue

by 14% overall, reported strong organic revenue growth in each of our operating segments

(North America, International and Truck Rental), and reported double-digit growth in

Adjusted EBITDA in each of those operating segments. Most importantly, because we

Table of contents

-

Page 1

...brand marketing for Avis and Budget which resonated with customers and strengthened our brands. We grew our rental volumes significantly among international and small-business travelers, two particularly profitable segments that we have targeted. We increased the profitability of our off-airport, or... -

Page 2

... economy over time, our stock price will move to levels commensurate with our results. We are excited to be investing for growth and accelerating our strategic initiatives to capitalize on profitable opportunities. On behalf of the more than 28,000 Avis Budget Group employees around the world, we... -

Page 3

... FILE NO. 001-10308 _____ AVIS BUDGET GROUP, INC. (Exact name of Registrant as specified in its charter) DELAWARE (State or other jurisdiction of incorporation or organization) 6 SYLVAN WAY PARSIPPANY, NJ (Address of principal executive offices) 06-0918165 (I.R.S. Employer Identification Number... -

Page 4

... Data Changes in and Disagreements with Accountants on Accounting and Financial Disclosure Controls and Procedures Other Information PART III Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related... -

Page 5

... implement our business strategies; our ability to obtain financing for our operations, including the funding of our vehicle fleet via the asset-backed securities and lending market consistent with current costs, and the financial condition of financial-guaranty firms that have insured a portion of... -

Page 6

... accounting standards; risks related to future acquisitions or investments that we may pursue, including any incurrence of incremental indebtedness to help fund such transactions and our ability to promptly and effectively integrate any acquired businesses; and other business, economic, competitive... -

Page 7

... rental revenue in North America, Europe, Australia and New Zealand, and we operate one of the leading truck rental businesses in the United States. Our car rental business enjoys significant benefits from operating two distinct brands that target different industry segments but share the same fleet... -

Page 8

... per rental day that we generate from car class upgrades, where2 GPS navigation unit rentals, loss damage waivers and insurance products, and other ancillary services. In 2011, we maintained a diverse car rental fleet, in which no vehicle manufacturer represented more than 25% of our 2011 fleet... -

Page 9

... to be the first company to rent cars from airport locations. Avis expanded its geographic reach throughout the United States through licensed and corporate-owned growth in the 1950s and 1960s. In 1963, Avis introduced its award winning "We try harder®" advertising campaign, which is considered one... -

Page 10

... Avis brand provides high-quality car rental services at price points generally above non-branded and value-branded national car rental companies. We offer Avis customers a variety of premium services, including Avis Preferred, a counter bypass program, which is available at major airport locations... -

Page 11

... respect to rental locations, vehicle availability and applicable rate structures through these systems. In 2011, we generated approximately 31% of our reservations through our Avis and Budget branded websites, 8% through our contact centers, 30% through GDSs, 6% through online travel agencies, 14... -

Page 12

... throughout 2011 represented approximately 32% of total revenue generated by the Avis and Budget Systems in 2011. We facilitate one-way car rentals between corporate-owned and licensed locations, which enables us to offer an integrated network of locations to our customers. We generally enjoy good... -

Page 13

... and online travel sites), corporate travel departments and individual consumers through our websites or calls to our contact centers. The Wizard system also provides personal profile information to our reservation and rental agents to help us better serve our customers. We also use data supplied... -

Page 14

... for our International fleet, including vehicles acquired as part of the Avis Europe Acquisition. We generally hold a vehicle in our fleet for a term of four to sixteen months. In 2011, on average approximately 47% of our rental car fleet was comprised of vehicles subject to agreements requiring... -

Page 15

...help further enhance our service levels to our customers. In addition, we utilize a toll-free telephone number and a dedicated customer service e-mail address to allow customers of both Avis and Budget to report problems directly to our customer relations department. Location associates and managers... -

Page 16

... one-way truck rental businesses in the United States. The Budget truck rental business has a combined fleet of approximately 26,000 trucks, which are rented through a network of approximately 1,850 dealers and 300 Company-operated locations throughout the continental United States. A certain number... -

Page 17

... price and service competition as well as competition based on location (proximity to customer). We compete with a large number of truck rental companies throughout the country, including UHaul International, Inc., Penske Truck Leasing Corporation, Ryder System, Inc., Enterprise Rent-A-Car Company... -

Page 18

... We are subject to various federal, state and local laws and regulations in the United States and internationally, including those relating to taxing and licensing of vehicles, trademark licensing, consumer credit, consumer protection, environmental protection, insurance, privacy and labor matters... -

Page 19

... structure. Such insurance statutes may also require that we obtain limited licenses to sell optional insurance coverage to our customers at the time of rental. In addition, our car rental operations in Europe must comply with certain European Union regulations regarding the sale of travel insurance... -

Page 20

... car rental industry because it can be more difficult to reduce the size of our truck rental fleet in response to reduced demand. The Internet has increased pricing transparency among vehicle rental companies by enabling cost-conscious customers to more easily obtain and compare the rates available... -

Page 21

... to perform. We currently sell non-program vehicles through auctions, third-party resellers and other channels in the used vehicle marketplace. Such channels may not produce stable used vehicle prices. A reduction in residual values for non-program cars and trucks in our vehicle rental fleet could... -

Page 22

... United States, Europe and/or worldwide were to weaken, our financial condition and results of operations could be adversely impacted in 2012 and beyond. In 2011, we generated approximately 74% of our car rental T&M revenue from our on-airport locations; therefore, a decline in airline travel will... -

Page 23

... of our car rental reservations through third-party distribution channels, which include: ï,· ï,· traditional and online travel agencies, airlines and hotel companies, marketing partners such as credit card companies and membership organizations and other entities that help us attract customers; and... -

Page 24

.... Optional insurance products that we offer to renters in the United States, including, but not limited to, supplemental liability insurance, personal accident insurance and personal effects protection, are regulated under state laws governing such products. Our car rental operations in Europe must... -

Page 25

... systems, including our reservation system, to accept reservations, process rental and sales transactions, manage our fleet of vehicles, account for our activities and otherwise conduct our business. We have centralized our information systems, and we rely on communications service providers to link... -

Page 26

... of our cash flow from operations to pay principal and interest on our debt, which would reduce the funds available to us for other purposes; and making us more vulnerable to adverse changes in general economic, industry and competitive conditions, as well as changes in government regulation and... -

Page 27

...backed facilities in Canada and Australia, and a vehicle-backed credit facility in Europe. If the asset-backed financing market is disrupted for any reason, we may be unable to obtain refinancing for our operations at current levels, or at all, when our asset-backed rental car financings mature, and... -

Page 28

... our results of operations, financial condition or cash flows. Realogy was acquired by an affiliate of Apollo Management VI, L.P. following the Separation. In accordance with the terms of the Separation Agreement, Realogy posted a letter of credit for the benefit of the Company in an amount designed... -

Page 29

..., strategies, marketing affiliations, projections, fleet costs, pricing actions or other competitive actions; changes in earnings estimates by securities analysts or our ability to meet those estimates; changes in investors' and analysts' perceptions of our industry, business or related industries... -

Page 30

...North America and internationally, we are contractually obligated to pay certain airports a percentage of our vehicle rental revenue, with a guaranteed minimum. Because there is a limit to the number of vehicle rental locations in an airport, vehicle rental companies frequently bid for the available... -

Page 31

...which was filed in 2003 by our licensee, Alaska Rent-A-Car, involved breach of contract and other claims related to the acquisition of our Budget vehicle rental business in 2002. In addition to the judgment for damages, in June 2010 the district court also entered an order against the Company in the... -

Page 32

...limited by the Company's senior credit facilities, the indentures governing our senior notes and our vehicle financing programs, insofar as we may seek to pay dividends out of funds made available to Avis Budget by Avis Budget Car Rental and/or its subsidiaries. The declaration and payment of future... -

Page 33

... under any of these plans provides for a term in excess of 10 years or an exercise price below fair market value as of the date of grant (other than options assumed or replaced in connection with acquisitions). All options granted under these plans have been approved by the Board of Directors or the... -

Page 34

...yearly change in our cumulative total stockholder return on our common stock (as measured by dividing (i) the sum of (a) the cumulative amount of dividends, assuming dividend reinvestment, during the five years commencing on the last trading day before January 1, 2006 and ending on December 31, 2011... -

Page 35

... (loss): Basic Diluted Cash dividends declared Financial Position Total assets Assets under vehicle programs Corporate debt Debt under vehicle programs (a) Stockholders' equity _____ (a) At or For the Year Ended December 31, 2010 2009 2008 2007 (In millions, except per share data) $ 5,900 $ 5,185... -

Page 36

... of an investment. These charges reflect the decline in their fair value below their carrying value, primarily as a result of reduced market valuations for vehicle services and other companies, as well as reduced profit forecasts due to soft economic conditions and increased financing costs. In 2007... -

Page 37

... by us and by our competitors; Changes in per-unit car fleet costs and in conditions in the used vehicle marketplace; Changes in borrowing costs and in market willingness to purchase corporate and vehicle-related debt; Our 2011 acquisition of Avis Europe and our ability to successfully integrate its... -

Page 38

... our International segment. We measure performance using the following key operating statistics: (i) rental days, which represents the total number of days (or portion thereof) a vehicle was rented, and (ii) T&M revenue per rental day, which represents the average daily revenue we earned from rental... -

Page 39

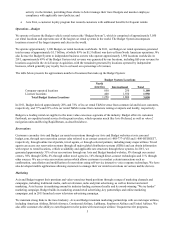

...the transaction-related costs related to the Avis Europe Acquisition. For 2010, our effective tax rate was 25%. Following is a more detailed discussion of the results of each of our reportable segments: Revenues North America International Truck Rental Corporate and Other (a) Total Company 2011 2010... -

Page 40

... due to the Avis Europe Acquisition, which added to our operating locations, headcount, fleet and other operating expenses, as well as increased advertising, marketing and sales commissions, inflationary increases in rent and modestly higher per-unit fleet costs. Truck Rental Revenues and Adjusted... -

Page 41

... us related to the 2002 acquisition of our Budget vehicle rental business. In 2009, we recorded impairment charges of $33 million primarily related to an investment. In 2010, we recorded transaction-related costs of $14 million associated with our previous efforts to acquire Dollar Thrifty. 35 -

Page 42

... $52 million decrease in expenses related to car rental volume including maintenance and damage, agency operator commissions, credit card fees, and other costs, and (ii) a $23 million decrease in employee costs, rents and other expenses related primarily to reduced staffing levels and the closure of... -

Page 43

... assets. FINANCIAL CONDITION As of December 31, 2011 2010 Change 3,848 $ 3,462 $ 386 5,598 3,962 1,636 9,090 6,865 2,225 6,928 5,955 973 412 410 2 Total assets exclusive of assets under vehicle programs Total liabilities exclusive of liabilities under vehicle programs Assets under vehicle programs... -

Page 44

... change primarily reflects an approximately $1.8 billion net increase in cash provided from our vehicle programs' financing activities due to our use of cash in financing activities in 2009 for significant debt repayment associated with reducing our fleet size in response to weak economic conditions... -

Page 45

... Proceeds were used to partially fund the Avis Europe Acquisition. The following table summarizes the components of our debt under vehicle programs (including related party debt due to Avis Budget Rental Car Funding (AESOP) LLC ("Avis Budget Rental Car Funding")): As of December 31, 2011 2010 4,574... -

Page 46

... debt arrangements related to our vehicle programs at December 31, 2011: Total Outstanding Available Capacity (a) Borrowings Capacity $ 7,199 $ 4,574 $ 2,625 188 188 542 348 194 1,479 454 1,025 $ 9,408 $ 5,564 $ 3,844 Debt due to Avis Budget Rental Car Funding (b) Budget Truck financing (c) Capital... -

Page 47

... of floating rate term loans and $345 million of convertible senior notes. Represents debt, including related party debt due to Avis Budget Rental Car Funding (see Note 16 to our Consolidated Financial Statements), and capital leases, which were issued to support the purchase of vehicles. Operating... -

Page 48

...-lived intangible assets are allocated among our reporting units. During 2011, 2010 and 2009, there was no impairment of goodwill or other intangible assets. Business Combinations. The Company uses the acquisition method of accounting for business combinations, which requires that the purchase price... -

Page 49

... derivative instruments. Most of these financial instruments are not publicly traded on an organized exchange. In the absence of quoted market prices, we must develop an estimate of fair value using dealer quotes, present value cash flow models, option pricing models or other valuation methods, as... -

Page 50

... related to our debt; foreign currency forwards to manage and reduce foreign currency exchange rate risk; and derivative commodity instruments to manage and reduce the risk of changing unleaded gasoline prices. We are exclusively an end user of these instruments. We do not engage in trading, market... -

Page 51

...Avis Europe plc) from our assessment of internal control over financial reporting as of December 31, 2011, as permitted, because we acquired Avis Europe plc on October 3, 2011. Avis Budget EMEA Limited is a wholly owned subsidiary of Avis Budget Group and constituted 20% of consolidated total assets... -

Page 52

... total assets, and 6% of consolidated revenues as of and for the year ended December 31, 2011. Accordingly, our audit did not include the internal control over financial reporting at Avis Budget EMEA Limited and subsidiaries (formerly Avis Europe plc). The Company's management is responsible... -

Page 53

..., EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE The information contained in the Company's Annual Proxy Statement under the sections entitled "Board of Directors," "Executive Officers" and "Section 16(a) Beneficial Ownership Reporting Compliance" is incorporated herein by reference in response to this... -

Page 54

... by the undersigned, thereunto duly authorized. AVIS BUDGET GROUP, INC. /s/ IZILDA P. MARTINS Izilda P. Martins Vice President and Acting Chief Accounting Officer Date: February 29, 2012 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the... -

Page 55

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS Page Report of Independent Registered Public Accounting Firm Consolidated Statements of Operations for the years ended December 31, 2011, 2010 and 2009 Consolidated Balance Sheets as of December 31, 2011 and 2010 Consolidated Statements of Cash Flows for ... -

Page 56

... respects, the financial position of the Company as of December 31, 2011 and 2010, and the results of its operations and its cash flows for each of the three years in the period ended December 31, 2011, in conformity with accounting principles generally accepted in the United States of America. Also... -

Page 57

Avis Budget Group, Inc. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except per share data) Year Ended December 31, 2011 2010 2009 Revenues Vehicle rental Other Net revenues Expenses Operating Vehicle depreciation and lease charges, net Selling, general and administrative Vehicle interest, ... -

Page 58

... under vehicle programs: Program cash Vehicles, net Receivables from vehicle manufacturers and other Investment in Avis Budget Rental Car Funding (AESOP) LLC-related party Total assets Liabilities and stockholders' equity Current liabilities: Accounts payable and other current liabilities Short-term... -

Page 59

... Net assets acquired (net of cash acquired) Other, net Net cash used in investing activities exclusive of vehicle programs Vehicle programs: Decrease (increase) in program cash Investment in vehicles Proceeds received on disposition of vehicles Investment in debt securities of Avis Budget Rental Car... -

Page 60

... Ended December 31, 2011 2010 2009 Financing activities Proceeds from long-term borrowings Principal payments on long-term borrowings Net change in short-term borrowings Proceeds from warrant issuance Purchase of call options Debt financing fees Other, net Net cash provided by (used in) financing... -

Page 61

... liability adjustment, net of tax of $(7) Total comprehensive income Issuance of warrants Purchase of call options, net of tax of $36 Net activity related to restricted stock units Activity related to employee stock purchase plan Post-separation dividend adjustment Other Balance at December 31, 2009... -

Page 62

... gains on available-for-sale securities, net of tax of $0 Pension liability adjustment, net of tax benefit of $(16) Total comprehensive income Net activity related to restricted stock units Exercise of stock options Realization of tax benefits for stock-based awards Balance at December 31, 2011 137... -

Page 63

... business segments: ï,· ï,· North America-provides car rentals in the United States and vehicle rentals in Canada, as well as related products and services. International-provides, and licenses the Company's brands to third parties for, vehicle rentals and ancillary products and services in Europe... -

Page 64

... The Company derives revenue through the operation and licensing of the Avis and Budget rental systems and, providing vehicle rentals and other services to business and leisure travelers and others. Other revenue includes rentals of GPS navigation units, sales of loss damage waivers and insurance... -

Page 65

... to repurchase vehicles at a specified price and date, or guarantee the depreciation rate for a specified period of time, subject to certain eligibility criteria (such as car condition and mileage requirements). The Company depreciates vehicles such that the net book value on the date of return to... -

Page 66

...manage exposure to market risks associated with fluctuations in foreign currency exchange rates, interest rates and gasoline costs. As a matter of policy, derivatives are not used for trading or speculative purposes. All derivatives are recorded at fair value either as assets or liabilities. Changes... -

Page 67

... relate primarily to public liability and third-party property damage claims, as well as claims arising from the sale of ancillary insurance products including but not limited to supplemental liability, personal effects protection and personal accident insurance. These obligations represent... -

Page 68

..., except for the cost to issue debt related to the acquisition. The operating results of the acquired business are reflected in the Company's consolidated financial statements after the date of the acquisition. Adoption of New Accounting Standards During 2011 In January 2010, the FASB issued ASU No... -

Page 69

... Company's North America, International and Truck Rental segments, as part of a cost-reduction and efficiency improvement plan to reduce costs, enhance organizational efficiency and consolidate and rationalize existing processes and facilities. During the years ended December 31, 2011, 2010 and 2009... -

Page 70

... of December 31, 2010 Restructuring charge Acquired restructuring obligation Cash payment/utilization Balance as of December 31, 2011 5. Licensing Activities North America $ 12 16 (25) 3 11 (8) 6 2 (7) $ 1 International $ 2 2 (3) 1 (1) 3 1 (3) $ 1 Truck Rental $ 2 2 (3) 1 (1) - $ $ Total 16 20... -

Page 71

...other Total identifiable assets acquired Accounts payable and other current liabilities Debt Other non-current liabilities Liabilities under vehicles program - debt Total liabilities assumed Net assets acquired Goodwill Non-cash charge related to the reacquired unfavorable license rights Total $ 136... -

Page 72

... the Avis Europe Acquisition. The decrease relates to fluctuations in foreign currency. Amortization expense relating to all intangible assets was as follows: Year Ended December 31, 2011 2010 2009 $ 4 $ 2 $ 2 3 1 1 $ 7 $ 3 $ 3 License agreements Customer relationships Total Based on the Company... -

Page 73

..., respectively, of interest expense related to the Company's convertible senior notes and the fixed and floating rate borrowings of the Company's Avis Budget Car Rental, LLC ("Avis Budget Car Rental") subsidiary. Such interest is recorded within interest expense related to corporate debt, net on the... -

Page 74

... allowance will be reduced when and if the Company determines it is more likely than not that the related deferred income tax assets will be realized. Deferred income tax assets and liabilities related to vehicle programs are comprised of the following: As of December 31, 2011 2010 Deferred income... -

Page 75

... tax liability for unremitted earnings is not practicable. In 2011, the Company recorded tax adjustments related to prior periods that reduced the Company's non-current deferred income tax assets by approximately $230 million, deferred income tax liabilities under vehicle programs by approximately... -

Page 76

... in accounts payable and other current liabilities, and other current assets, respectively, as of December 31, 2010. 10. Other Current Assets Other current assets consisted of: As of December 31, 2010 2011 $ 179 $ 140 92 28 109 114 $ 380 $ 282 Prepaid expenses Sales and use tax Other 11. Property... -

Page 77

... payroll and related Accrued sales and use taxes Public liability and property damage insurance liabilities - current Income taxes payable - current Advertising and marketing Other 14. Other Non-Current Liabilities Other non-current liabilities consisted of: As of December 31, 2011 2010 $ 281 $ 212... -

Page 78

... to reduce the net number of shares required to be issued upon conversion of the Convertible Notes. The significant terms of the convertible note hedge and warrant transactions can be found in Note 18-Stockholders' Equity. AVIS BUDGET CAR RENTAL CORPORATE DEBT Floating Rate Term Loans The Company... -

Page 79

... 31, 2011. Upon issuance of the loan, the Company paid to the lenders 2% of each lender's commitments under the loan, which payment was structured as an original issue discount. The Company used the proceeds from the loan to partially fund the Avis Europe Acquisition. Floating Rate Senior Notes The... -

Page 80

... FUNDING ARRANGEMENTS At December 31, 2011, the committed credit facilities available to the Company and/or its subsidiaries at the corporate or Avis Budget Car Rental level were as follows: Total Outstanding Letters of Available Capacity Borrowings Credit Issued Capacity $ 1,400 $ - $ 643 $ 757 11... -

Page 81

... our international fleet, primarily as a result of the Avis Europe Acquisition. Avis Budget Rental Car Funding (AESOP) LLC. Avis Budget Rental Car Funding, an unconsolidated bankruptcy remote qualifying special purpose limited liability company, issues privately placed notes to investors as well as... -

Page 82

...31, 2011. This facility provides for the availability of fleet financing for certain of the Company's operations in Europe. DEBT MATURITIES The following table provides the contractual maturities of the Company's debt under vehicle programs (including related party debt due to Avis Budget Rental Car... -

Page 83

... various term lengths and prevailing market rate rents. Future minimum lease payments required under noncancelable operating leases, including minimum concession fees charged by airport authorities which, in many locations, are recoverable from vehicle rental customers, as of December 31, 2011, are... -

Page 84

... trial for damages related to breach of contract in the United States District Court for the District of Alaska. The lawsuit, which was filed in 2003, involved breach of contract and other claims by one of the Company's licensees related to the acquisition of its Budget vehicle rental business in... -

Page 85

... of vehicle-backed debt in addition to cash received upon the sale of vehicles in the used car market and under repurchase and guaranteed depreciation programs. Other Purchase Commitments In the normal course of business, the Company makes various commitments to purchase goods or services from... -

Page 86

..., the lenders to Anji Car Rental and Leasing Company Limited ("Anji"), our joint venture in China. These guarantees relate primarily to various bank borrowings used to purchase vehicles and for working capital needs. The maximum potential amount of future payments that the Company may be required to... -

Page 87

... rate debt (see Note 21-Financial Instruments). Such amount in 2011 includes $53 million ($32 million, net of tax) of unrealized gains on cash flow hedges related to the Company's vehicle-backed debt and is offset by a corresponding increase in the Company's Investment in Avis Budget Rental Car... -

Page 88

... into stock options of Avis Budget, Realogy and Wyndham. The Company used the Black-Scholes option pricing model to calculate the fair value of the time-vesting stock options granted first quarter 2010 and the time-vesting and performance-vesting stock option awards granted in 2009. The Company... -

Page 89

... and Stock Unit Awards RSUs granted by the Company entitle the employee to receive one share of Avis Budget common stock upon vesting, which occurs ratably over a three- or four-year period for the majority of RSUs outstanding as of December 31, 2011. The Company also employs performance- and time... -

Page 90

...employee Directors Deferred Compensation Plan The Company grants RSUs annually to members of its Board of Directors representing annual retainer, committee chair and membership stipends, which are payable in the form of Avis Budget common stock upon termination of service. During 2011, 2010 and 2009... -

Page 91

...) during 2011 and $15 million ($9 million, net of tax) in each of 2010 and 2009, related to employee stock awards that were granted by the Company. 20. Employee Benefit Plans Defined Contribution Savings Plans The Company sponsors several defined contribution savings plans in the United States and... -

Page 92

...used to determine pension obligations and pension costs for the principal plans in which the Company's employees participated: For the Year Ended December 31, 2011 2010 2009 U.S. Pension Benefit Plans Discount rate: Net periodic benefit cost Benefit obligation Long-term rate of return on plan assets... -

Page 93

... plans. As such, the Company allocates assets among traditional equity, fixed income (U.S. and non-U.S. government issued securities, corporate bonds and short-term cash investments) and alternative investment strategies. The equity component's purpose is to provide a total return that will help... -

Page 94

... term investments U.S. stock Non-U.S. stock Real estate investment trusts Non-U.S. government securities U.S. government securities Corporate bonds Other assets Total assets 2011 $ 8 5 84 124 6 64 18 90 13 412 $ 2010 1 5 74 30 6 3 13 40 1 173 $ $ The Company estimates that future benefit payments... -

Page 95

... 31, 2011 or 2010 other than (i) risks related to the Company's repurchase and guaranteed depreciation agreements with car manufacturers, including General Motors Company, Volkswagen Group, Fiat Automobiles, Hyundai Motor America, PSA Peugeot Citroën, Chrysler Group LLC, Ford Motor Company and Kia... -

Page 96

... other current liabilities. Included in assets under vehicle programs and liabilities under vehicle programs. Included in other current liabilities. The effect of derivatives recognized in the Company's Consolidated Financial Statements are as follows: For the Year Ended December 31, 2011 2010 2009... -

Page 97

... by short-term floating rate debt, the Company has determined that its carrying value approximates the fair value of this debt. The carrying amounts of cash and cash equivalents, available-for-sale securities, accounts receivable, program cash and accounts payable and accrued liabilities approximate... -

Page 98

... for a litigation judgment against the Company related to the 2002 acquisition of the Company's Budget vehicle rental business. In 2009, a $33 million charge was recorded for the impairment of investments (see Note 2-Summary of Significant Accounting Policies). Provided below is a reconciliation... -

Page 99

... segment information provided below is classified based on the geographic location of the Company's subsidiaries. United States 2011 Net revenues Assets exclusive of assets under vehicle programs Assets under vehicle programs Property and equipment, net 2010 Net revenues Assets exclusive of assets... -

Page 100

... Vehicle interest, net Non-vehicle related depreciation and amortization Interest expense related to corporate debt, net: Interest expense Intercompany interest expense (income) Restructuring charges Transaction-related costs Total expenses Income (loss) before income taxes and equity in earnings... -

Page 101

...-vehicle related depreciation and amortization Interest expense related to corporate debt, net: Interest expense Intercompany interest expense (income) Early extinguishment of debt Restructuring charges Transaction-related costs Total expenses Income (loss) before income taxes and equity in earnings... -

Page 102

... Non-vehicle related depreciation and amortization Interest expense related to corporate debt, net: Interest expense Intercompany interest expense (income) Restructuring charges Impairment Total expenses Income (loss) before income taxes and equity in earnings of subsidiaries Provision for (benefit... -

Page 103

... under vehicle programs: Program cash Vehicles, net Receivables from vehicle manufacturers and other Investment in Avis Budget Rental Car Funding (AESOP) LLC-related party Total assets Liabilities and stockholders' equity Current liabilities: Accounts payable and other current liabilities Short-term... -

Page 104

...from vehicle manufacturers and other Investment in Avis Budget Rental Car Funding (AESOP) LLC-related party Total assets Liabilities and stockholders' equity Current liabilities: Accounts payable and other current liabilities Current portion of long-term debt Total current liabilities Long-term debt... -

Page 105

... $ Investing activities Property and equipment additions Proceeds received on asset sales Net assets acquired (net of cash acquired) and acquisition-related payments Other, net Net cash (used in) investing activities exclusive of vehicle programs Vehicle programs: Decrease in program cash Investment... -

Page 106

... $ Investing activities Property and equipment additions Proceeds received on asset sales Net assets acquired (net of cash acquired) and acquisition-related payments Other, net Net cash (used in) investing activities exclusive of vehicle programs Vehicle programs: Decrease in program cash Investment... -

Page 107

... programs Vehicle programs: Proceeds from borrowings Principal payments on borrowings Net change in short-term borrowings Debt financing fees Net cash provided by (used in) financing activities Effect of changes in exchange rates on cash and cash equivalents Net increase (decrease) in cash and cash... -

Page 108

... expense, both related to the Avis Europe Acquisition and the Company's previous efforts to acquire Dollar Thrifty, and $23 million ($14 million, net of taxes) of losses on foreign-currency hedges related to the Avis Europe Acquisition purchase price. Net income for third quarter 2011 includes $47... -

Page 109

...2010 2009 (a) Balance at Beginning of Period Expensed Other Adjustments Deductions Balance at End of Period $ 16 14 17 $ 9 6 6 $ 1 (1) $ (4) (5) (8) $ 21 16 14 $ 192 166 157 $ 16 26 9 $ 65 - $ - $ 273 192 166 For 2011, other adjustments relate to the Avis Europe Acquisition... -

Page 110

... Company's Annual Report on Form 10-K for the year ended December 31, 2009 dated February 23, 2010). Supplemental Indenture, dated as of June 30, 2011, to the Indenture, dated as of April 19, 2006, among Avis Budget Car Rental, LLC, Avis Budget Finance, Inc., the guarantors from time to time parties... -

Page 111

... Report on Form 8-K dated October 5, 2011). Amended and Restated Employment Agreement between Avis Budget Group, Inc. and Ronald L. Nelson (Incorporated by reference to Exhibit 10.1 to the Company's Current Report on Form 8-K dated January 29, 2010).†Employment Agreement between Avis Budget Group... -

Page 112

... year ended December 31, 2009 dated February 23, 2010).†Form of Avis Budget Group, Inc. Severance Agreement (Incorporated by reference to Exhibit 10.8 to the Company's Annual Report on Form 10-K for the year ended December 31, 2009 dated February 23, 2010).†1987 Stock Option Plan, as amended... -

Page 113

... 31, 2008).†Form of Other Stock or Cash-Based Award Agreement (Incorporated by reference to Exhibit 10.4 to the Company's Quarterly Report on Form 10-Q for the quarter ended June 30, 2009).†Avis Budget Group, Inc. Non-Employee Directors Deferred Compensation Plan, Amended and Restated as of... -

Page 114

...(b) to the Company's Annual Report on Form 10-K for the year ended December 31, 2009 dated February 23, 2010).†Second Amendment to the Avis Budget Group, Inc. Non-Employee Directors Deferred Compensation Plan dated December 20, 2011. Avis Budget Group, Inc. Deferred Compensation Plan, amended and... -

Page 115

...2009).††Avis Budget Car Rental 2010 Model Year Program Letter dated August 28, 2009 between Avis Budget Car Rental, LLC and Ford Motor Company (Incorporated by reference to Exhibit 10.1 to the Company's Current Report on Form 8-K dated September 2, 2009).††Avis Budget Car Rental 2011 Model... -

Page 116

... Master Motor Vehicle Operating Lease Agreement, dated as of December 23, 2005 (Incorporated by reference to Exhibit 10.3 to the Company's Current Report on Form 8-K dated January 20, 2006). Third Amendment, dated as of May 9, 2007, among AESOP Leasing L.P., as Lessor and Avis Budget Car Rental, LLC... -

Page 117

... Company's Annual Report on Form 10-K for the year ended December 31, 2005, dated March 1, 2006). Amended and Restated Series 2005-2 Supplement, dated May 20, 2008, between Avis Budget Rental Car Funding (AESOP) LLC (formerly known as Cendant Rental Car Funding (AESOP) LLC), as issuer and The Bank... -

Page 118

... 10.4 to the Company's Current Report on Form 8-K, dated October 28, 2010). Amended and Restated Series 2010-6 Supplement, dated as of October 14, 2011, by and among Avis Budget Rental Car Funding (AESOP) LLC, as Issuer, Avis Budget Car Rental, LLC, as Administrator, JPMorgan Chase Bank, N.A., as... -

Page 119

... the Company's Current Report on Form 8-K dated September 12, 2011). Incremental Tranche B Term Facility Agreement, dated as of September 22, 2011, among Avis Budget Holdings, LLC, Avis Budget Car Rental, LLC, JPMorgan Chase Bank, N.A., as administrative agent, the lenders from time to time parties... -

Page 120

... Chase Bank, N.A., as administrative agent (Incorporated by reference to Exhibit 10.2 to the Company's Current Report on Form 8-K dated May 6, 2011). Purchase Agreement dated as of October 7, 2009, by and among Avis Budget Group, Inc. and J.P. Morgan Securities Inc., Citigroup Global Markets Inc... -

Page 121

...Company's Current Report on Form 8-K dated October 13, 2009). Purchase Agreement, dated as of March 5, 2010, by and among Avis Budget Car Rental, LLC, Avis Budget Finance, Inc., Avis Budget Group, Inc., Avis Budget Holdings, LLC, AB Car Rental Service, Inc., ARACS LLC, Avis Asia and Pacific, Limited... -

Page 122

...10.2 to the Company's Current Report on Form 8-K dated November 18, 2010). Purchase Agreement, dated as of November 15, 2010, by and among Avis Budget Car Rental, LLC, Avis Budget Finance, Inc., Avis Budget Group, Inc., Avis Budget Holdings, LLC, AB Car Rental Service, Inc., ARACS LLC, Avis Asia and... -

Page 123

... Motor Vehicle Operating Lease Agreement (Group I), dated March 9, 2010, among, Centre Point Funding, LLC, as Lessor, Budget Truck Rental LLC, as Administrator and as Lessee, and Avis Budget Car Rental, LLC, as Guarantor (Incorporated by reference to Exhibit 10.86(a) to the Company's Annual Report... -

Page 124

... Bank of America, N.A. (Australia Branch) (Incorporated by reference to Exhibit 10.4 to the Company's Current Report on Form 8-K dated September 27, 2011). Avis Europe Interim Fleet Financing Facility Agreement dated as of October 20, 2011 among Avis Budget Car Rental, LLC, Avis Budget EMEA Limited... -

Page 125

... as Avis Rent A Car System, LLC. ***** Avis Group Holdings, Inc. is now known as Avis Group Holdings, LLC. †Denotes management contract or compensatory plan. ††Confidential treatment has been requested for certain portions of this Exhibit pursuant to Rule 24b-2 of the Securities Exchange Act... -

Page 126

Exhibit 12 Avis Budget Group, Inc. COMPUTATION OF RATIO OF EARNINGS TO FIXED CHARGES (Dollars in millions) Year Ended December 31, 2010 2009 2008 72 $ 510 582 $ (77) $ (1,343) $ 408 464 331 $ (879) $ 2011 Earnings available to cover fixed charges: Income (loss) from continuing operations before ... -

Page 127

... Budget Car Rental LLC Avis Budget Car Rental Canada ULC Avis Budget Contact Centers Inc. Avis Budget de Puerto Rico, Inc. Avis Budget EMEA Limited Avis Budget Finance Inc. Avis Budget Group Business Support Centre Kft Avis Budget Group Pty Limited Avis Budget Holdings LLC Avis Budget International... -

Page 128

... LLC Avis Service Inc. Avis (US) Holdings BV Aviscar Inc. Avis Truck Leasing Limited B2B Leasing BV Baker Car and Truck Rental Inc. Barcelsure Limited Bell'Aria S.p.A BGI Leasing Inc. Budget Funding Corporation Budget International, Inc. Budget Locacao de Veiculos Ltda. Budget Rent A Car Australia... -

Page 129

Budget Truck Rental LLC Budgetcar Inc. Business Rent A Car GmbH Camfox Pty. Ltd. Caraway Travel sarl CCRG Servicos De Automoveis Ltda CD Intellectual Property Holdings, LLC C.D. Bramall (Bingley) Limited Cellrent Limited Cendant Finance Holding Company LLC Centre Point Funding, LLC Centrus Limited ... -

Page 130

Zodiac Autovermietung AG Zodiac Europe Finance Company Limited Zodiac Europe Investments Limited Zodiac Europe Limited Zodiac Italia S.p.A. Zodiac Rent a Car Limited Austria England and Wales England and Wales England and Wales Italy England and Wales -

Page 131

... reports dated February 29, 2012 relating to the consolidated financial statements and financial statement schedule of Avis Budget Group, Inc. (formerly Cendant Corporation) and the effectiveness of Avis Budget Group, Inc.'s internal control over financial reporting appearing in this Annual Report... -

Page 132

..., summarize and report financial information; and b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: February 29, 2012 /s/ Ronald L. Nelson Chief Executive Officer -

Page 133

... financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; The registrant's other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules... -

Page 134

... Annual Report of Avis Budget Group, Inc. (the "Company") on Form 10-K for the period ended December 31, 2011, as filed with the Securities and Exchange Commission on the date hereof (the "Report"), Ronald L. Nelson, as Chief Executive Officer of the Company, and David B. Wyshner, as Chief Financial...