Avis 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Avis annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AVIS BUDGET GROUP, INC.

FORM 10-K

(Annual Report)

Filed 02/26/09 for the Period Ending 12/31/08

Telephone 973-496-2579

CIK 0000723612

Symbol CAR

SIC Code 7510 - Automotive Rental And Leasing, Without Drivers

Industry Rental & Leasing

Sector Services

Fiscal Year 12/31

http://www.edgar-online.com

© Copyright 2011, EDGAR Online, Inc. All Rights Reserved.

Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use.

Table of contents

-

Page 1

AVIS BUDGET GROUP, INC. FORM 10-K (Annual Report) Filed 02/26/09 for the Period Ending 12/31/08 Telephone CIK Symbol SIC Code Industry Sector Fiscal Year 973-496-2579 0000723612 CAR 7510 - Automotive Rental And Leasing, Without Drivers Rental & Leasing Services 12/31 http://www.edgar-online.com... -

Page 2

... FILE NO. 1-10308 AVIS BUDGET GROUP, INC. (Exact name of Registrant as specified in its charter) DELAWARE (State or other jurisdiction of incorporation or organization) 06-0918165 (I.R.S. Employer Identification Number) 6 SYLVAN WAY PARSIPPANY, NJ (Address of principal executive offices... -

Page 3

... of Operations Quantitative and Qualitative Disclosures about Market Risk Financial Statements and Supplementary Data Changes in and Disagreements with Accountants on Accounting and Financial Disclosure Controls and Procedures Other Information PART III Directors, Executive Officers and Corporate... -

Page 4

... rental volume; an increase in our fleet costs as a result of an increase in the cost of new vehicles and/or a decrease in the price at which we dispose of used vehicles either in the used vehicle market or under repurchase or guaranteed depreciation programs; the results of operations or financial... -

Page 5

...our goodwill or other intangible assets; our ability to meet and continue to meet the New York Stock Exchange's continuing listing standards, including the minimum share price requirement; our exposure to fluctuations in foreign exchange rates; and other business, economic, competitive, governmental... -

Page 6

... 2,500 dealer-operated, 300 company-operated and 75 franchisee-operated locations throughout the continental United States. We also license the use of the Avis and Budget trademarks to multiple licensees in areas in which we do not operate. The Avis and/or Budget vehicle rental systems in Europe... -

Page 7

...by third parties. Opportunities for ancillary revenue growth include adding sales of additional insurance coverages and insurance-related and other ancillary products and services, such as electronic toll collection services and our upgraded w here2 GPS navigation product, to the rental transactions... -

Page 8

... booking portal, increasing its exposure to additional customers. Avis was named "North America's Leading Car Hire" in the prestigious World Travel Awards, and Budget grew its award-winning small business program. We opened 90 new off-airport locations in 2008, and off-airport revenues represented... -

Page 9

... above phone number or address, attention: Investor Relations. In accordance with New York Stock Exchange (NYSE) Rules, on June 18, 2008, we filed the annual certification by our Chief Executive Officer certifying that he was unaware of any violation by us of the NYSE's corporate governance listing... -

Page 10

... Avis brand provides high-quality car rental services at price points generally above non-branded and value-branded national car rental companies. We offer Avis customers a variety of premium services, including Avis Preferred, a counter bypass program, which is available at major airport locations... -

Page 11

... Avis Europe and is comprised of approximately 900 additional company-operated and sub-licensee locations. We own and operate approximately 825 Budget car rental locations in the United States, Canada, Puerto Rico, Australia and New Zealand. In 2008, our Budget car rental operations generated total... -

Page 12

... a location directly. Travel agents can access our reservation systems through all major global distribution systems (GDSs) and can obtain information with respect to rental locations, vehicle availability and applicable rate structures through these systems. Marketing Avis and Budget support their... -

Page 13

... loss damage waivers, additional/supplemental liability insurance, personal accident/effects insurance, fuel service options, fuel service charges, electronic toll collection and other ancillary products and services as described above, such as rentals of w here2 GPS navigation units which in 2008 8 -

Page 14

... information about our locations, rental rates and vehicle availability, as well as the ability to place or modify reservations. Additionally, the Wizard System is linked to all major travel distribution networks worldwide and provides real-time processing for travel agents, travel industry partners... -

Page 15

...policies; Direct Connect, a service offered to business to business partners that allows them to easily connect their electronic systems to the Wizard System, and to obtain Avis or Budget rate, location and fleet information as well as book reservations for their customers; and operations management... -

Page 16

...used during the rental. We also generally offer our customers the convenience of leaving a rented vehicle at a location in a city other than the one in which it was rented, although, consistent with industry practices, a drop-off charge or special intercity rate may be imposed. We facilitate one-way... -

Page 17

...analyzed generally and by location to help further enhance our service levels to our customers. In addition, we utilize a toll-free "800" number and a dedicated customer service e-mail address to allow customers of both Avis and Budget to report problems directly to our customer relations department... -

Page 18

... offset credits, to enable both renters and corporate customers to be able to offset the emissions from their rental car use. Renters can offset emissions on a daily, weekly or monthly basis on Avis.com or Budget.com. Airport concession fees In general, concession fees for on-airport locations are... -

Page 19

... busiest quarter. Generally, December is also a strong month due to increased retail sales activity and package deliveries. Ancillary products and insurance coverages We supplement our daily truck rental revenue by offering customers a range of ancillary optional products. We rent automobile towing... -

Page 20

... harder" are material to our vehicle rental business. Our subsidiaries, licensees and franchisees actively use these marks. All of the material marks used by the Avis and Budget Systems are registered (or have applications pending for registration) with the United States Patent and Trademark Office... -

Page 21

...-corporate transfers of assets within the holding company structure. Such insurance statutes may also require that we obtain limited licenses to sell optional insurance coverage to our customers at the time of rental. Franchise regulation The sale of franchises is regulated by various state laws... -

Page 22

... car rental industry because it is more difficult to reduce fleet size in the truck rental industry in response to reduced demand. The Internet has increased pricing transparency among vehicle rental companies by enabling cost-conscious customers to more easily obtain and compare the rates available... -

Page 23

... programs. Our failure to purchase pre-determined volumes of cars for our rental fleet, or the elimination or reduction in incentive payments, could cause our per unit fleet costs to increase substantially and adversely impact our financial condition and results of operations. We face risks related... -

Page 24

...such as credit card companies and membership organizations, and other entities that help us attract customers and (ii) global distribution systems ("GDS") that connect travel agents, travel service providers and corporations to our reservations systems. In 2008, 19% and 2% of our domestic car rental... -

Page 25

..., including our operations in Australia, Canada and New Zealand. In addition, the financial position and results of operations of some of our foreign subsidiaries are reported in the relevant local currency and then translated to U.S. dollars at the applicable currency exchange rate for inclusion in... -

Page 26

... accept reservations, process rental and sales transactions, manage our fleet of vehicles, account for our activities and otherwise conduct our business. We have centralized our information systems, and we rely on communications service providers to link our systems with the business locations these... -

Page 27

...which our vehicle is rented. Our long-standing business practice has been to separately state the existence of these additional costs in our rental agreements and invoices, and disclose to consumers additional surcharges used to recover such costs together with an estimated total price, inclusive of... -

Page 28

... of our franchisees, dealers or agency operators to comply with laws and regulations may expose us to liability, damages and publicity that may adversely affect our business. Significant or sustained increases or significant volatility in fuel costs or limitations in fuel supplies could harm our... -

Page 29

... our operations at current levels, or at all, when our asset-backed rental car financings mature, and any new financing or refinancing of our existing financing could increase our borrowing costs, including due to an increase in required collateral levels. See "We face risks related to the financial... -

Page 30

... our senior credit facilities contain, and our future debt instruments may contain, various provisions that limit our ability to, among other things incur additional debt; provide guarantees in respect of obligations of other persons; issue redeemable stock and preferred stock; pay dividends or... -

Page 31

... additional collateral to the lenders party to such facilities, which represented most of our assets that were not already encumbered by existing financings. Risks related to the Cendant Separation We have limited operating history as a stand-alone vehicle rental company. The financial information... -

Page 32

... industry, business or related industries; the operating and stock price performance of other comparable companies; overall market fluctuations; general economic conditions and conditions in the credit markets; and our ability to meet the continued listing requirements of the New York Stock Exchange... -

Page 33

...our common stock; reducing the number of investors willing to hold or acquire our common stock, which could negatively impact our ability to raise equity financing and access the public capital markets; or impairing our ability to provide equity incentives to our employees, officers or directors. 28 -

Page 34

...is currently vacant and is subject to a lease expiring in 2011. In addition, there are approximately 15 other leased office locations in the United States for administrative activities, regional sales and operations activities. We lease or have vehicle rental concessions for both the Avis and Budget... -

Page 35

... was filed in May 2008 against the Company and six other rental car companies, as well as the CTTC, and contained claims that the defendants had violated federal antitrust law and California's Unfair Competition Law and False Advertising Law by allegedly agreeing to pass on airport concession fees... -

Page 36

...judgment or payment related to the Credentials Litigation will have a net impact on our financial statements or cash balances. Realogy, Wyndham Worldwide and Travelport have also assumed under the Separation Agreement certain contingent and other corporate liabilities (and related costs and expenses... -

Page 37

... stock is listed on the New York Stock Exchange ("NYSE") under the symbol "CAR". At January 30, 2009, the number of stockholders of record was approximately 3,954. The following table sets forth the quarterly high and low sales prices per share of CAR common stock as reported by the NYSE for 2008... -

Page 38

...units, approximately 5 million shares are related to stock option grants that were made by Cendant Corporation to employees of Cendant Corporation prior to the spin-offs of Realogy and Wyndham, all of which have strike prices in excess of our closing stock price of $0.70 on December 31, 2008. Number... -

Page 39

... or Board may determine. The terms and conditions of options granted under this plan are to be determined by the Compensation Committee, provided that the exercise price of an option may not be less than the fair market value of the shares covered thereby on the date of grant. Each option granted... -

Page 40

... our stock price at the end and the beginning of the periods presented by (ii) the share price at the beginning of the periods presented with (B) the Standard & Poor's MidCap 400 Index and the Dow Jones U.S. Transportation Average Index. COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN Among Avis Budget... -

Page 41

... effect of accounting changes: Basic Diluted Net income (loss): Basic Diluted Cash dividends declared (a) Financial Position Total assets Assets of discontinued operations Assets under vehicle programs Long-term debt, including current portion Debt under vehicle programs (b) Stockholders' equity... -

Page 42

...in Carey Holdings, Inc. These charges reflect the decline in their fair value below their carrying value, primarily as a result of reduced market valuations for vehicle services and other companies, as well as reduced profit forecasts due to soft economic conditions and increased financing costs. In... -

Page 43

...the United States. International Car Rental -provides vehicle rentals and ancillary products and services primarily in Argentina, Australia, Canada, New Zealand, Puerto Rico and the U.S. Virgin Islands. Truck Rental -provides truck rentals and related services to consumers and light commercial users... -

Page 44

...using the following key operating statistics: (i) rental days, which represents the total number of days (or portion thereof) a vehicle was rented, and (ii) T&M revenue per rental day, which represents the average daily revenue we earned from rental and mileage fees charged to our customers. Our car... -

Page 45

... million (8%) increase in ancillary revenues, such as counter sales of insurance products, GPS navigation unit rentals, gasoline sales and fees charged to customers. In addition, the total revenue decrease includes a $7 million favorable effect related to foreign currency exchange rate fluctuations... -

Page 46

...-reduction initiatives, and (iii) a $9 million increase in selling, general and administration expense primarily related to higher travel agency commissions, travel incentive programs and other marketing costs. International Car Rental Revenues and EBITDA increased $31 million (4%) and $10 million... -

Page 47

... in truck rental days and an 8% reduction in truck T&M revenue per day. Ancillary revenue growth was primarily driven by increases in airport concession and vehicle licensing revenues, rentals of GPS navigation units, and sales of loss damage waivers and insurance products. In addition, the total... -

Page 48

...our common stock, (ii) a $146 million (5%) increase in operating expense largely due to the 4% increase in car rental days, (iii) an increase in vehicle depreciation and lease charges of $155 million (11%) resulting from higher per unit vehicle costs and 4% growth in our average car rental fleet and... -

Page 49

... of additional expenses associated with increased car rental volume and fleet size, primarily related to credit card fees and agency operator commissions and (ii) $29 million of incremental expenses, primarily representing inflationary increases in salaries and wages and off-airport rental expense... -

Page 50

... business units and (iv) a $21 million decrease in intercompany interest expense prior to the Cendant Separation. FINANCIAL CONDITION, LIQUIDITY AND CAPITAL RESOURCES We present separately the financial data of our vehicle programs. These programs are distinct from our other activities as the assets... -

Page 51

... increase in long-term income taxes payable. Assets under vehicle programs decreased $155 million primarily due to (i) a $310 million decrease in our net vehicles primarily due to the effect of foreign currency translations and (ii) a $113 million decrease in our Investment in Avis Budget Rental Car... -

Page 52

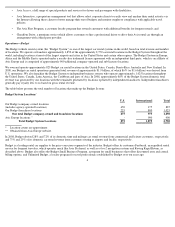

... at December 31, 2007. The following table summarizes such increase: Year Ended December 31, 2008 2007 Change Cash provided by (used in): Operating activities Investing activities Financing activities Effects of exchange rate changes Net change in cash and cash equivalents $ 1,704 (2,096) 463 (27... -

Page 53

... and certain other real and personal property. (b) The following table summarizes the components of our debt under vehicle programs (including related party debt due to Avis Budget Rental Car Funding (AESOP) LLC ("Avis Budget Rental Car Funding")): As of December 31, 2008 5,142 316 126 450 6,034... -

Page 54

... of availability at the corporate level and approximately $1.1 billion available for use in our vehicle programs). As of December 31, 2008, the committed credit facilities available to us and/or our subsidiaries at the corporate or Avis Budget Car Rental level included: Outstanding Total Capacity... -

Page 55

... of Avis Budget Car Rental including $1.0 billion of fixed and floating rate senior notes and $789 million outstanding under a secured floating rate term loan. Represents debt under vehicle programs (including related party debt due to Avis Budget Rental Car Funding), which was issued to support the... -

Page 56

... for vehicle services and other companies, as well as reduced profit forecasts due to soft economic conditions and increased financing costs. Domestic Car Rental operations recorded $882 million and International Car Rental recorded $275 million, for goodwill and tradename impairment, Truck Rental... -

Page 57

... derivative instruments. Most of these financial instruments are not publicly traded on an organized exchange. In the absence of quoted market prices, we must develop an estimate of fair value using dealer quotes, present value cash flow models, option pricing models or other conventional valuation... -

Page 58

... Accounting Pronouncements that Address Leasing Transactions" FASB Staff Position FAS 157-2, "Effective Date of SFAS 157" FASB Staff Position FAS 157-3 "Determining the Fair Value of a Financial Asset When the Market for That Asset Is Not Active" SFAS No. 159, "The Fair Value Option for Financial... -

Page 59

...foreign currency exchange rates and commodity prices on our earnings, fair values and cash flows would not be material. While these results may be used as benchmarks, they should not be viewed as forecasts. ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA See Consolidated Financial Statements and... -

Page 60

... assessment, our management believes that, as of December 31, 2008, our internal control over financial reporting is effective. Our independent registered public accounting firm has issued an attestation report on the effectiveness of the Company's internal control over financial reporting, which is... -

Page 61

... OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of Avis Budget Group, Inc. We have audited the internal control over financial reporting of Avis Budget Group, Inc. and subsidiaries (the "Company") as of December 31, 2008, based on criteria established... -

Page 62

... Company's Annual Proxy Statement under the section titled "Certain Relationships and Related Transactions" and "Board of Directors" is incorporated herein by reference in response to this item. ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES The information contained in the Company's Annual Proxy... -

Page 63

...duly authorized. AVIS BUDGET GROUP, INC. By: /s/ BRETT D. WEINBLATT Brett D. Weinblatt Senior Vice President and Chief Accounting Officer Date: February 26, 2009 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf... -

Page 64

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS Page Report of Independent Registered Public Accounting Firm Consolidated Statements of Operations for the years ended December 31, 2008, 2007 and 2006 Consolidated Balance Sheets as of December 31, 2008 and 2007 Consolidated Statements of Cash Flows for ... -

Page 65

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of Avis Budget Group, Inc. We have audited the accompanying consolidated balance sheets of Avis Budget Group, Inc. and subsidiaries (the "Company") as of December 31, 2008 and 2007, and the related ... -

Page 66

Avis Budget Group, Inc. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except per share data) Year Ended December 31, 2008 2007 2006 Revenues Vehicle rental Other Net revenues Expenses Operating Vehicle depreciation and lease charges, net Selling, general and administrative Vehicle interest, ... -

Page 67

...: Program cash Vehicles, net Receivables from vehicle manufacturers and other Investment in Avis Budget Rental Car Funding (AESOP) LLC-related party Total assets Liabilities and stockholders' equity Current liabilities: Accounts payable and other current liabilities Current portion of long-term debt... -

Page 68

...taxes Accounts payable and other current liabilities Other, net Net cash provided by (used in) operating activities exclusive of vehicle programs Vehicle programs: Vehicle depreciation Net cash provided by operating activities Investing activities Property and equipment additions Net assets acquired... -

Page 69

...of vehicle programs Vehicle programs: Proceeds from borrowings Principal payments on borrowings Net change in short-term borrowings Other, net Net cash provided by (used in) financing activities Effect of changes in exchange rates on cash and cash equivalents Cash provided by discontinued operations... -

Page 70

... liability adjustment, net of tax of $5 Total comprehensive loss Net activity related to restricted stock units Exercise of stock options Tax benefit from exercise of stock options Repurchases of common stock Payment of dividends Dividend of Realogy Corporation and Wyndham Worldwide Corporation... -

Page 71

... liability adjustment, net of tax of $20 Total comprehensive loss Net activity related to restricted stock units Exercise of stock options Repurchases of common stock Activity related to employee stock purchase plan Post-separation dividend adjustment Other Balance at December 31, 2008 Shares... -

Page 72

...the United States. International Car Rental -provides vehicle rentals and ancillary products and services primarily in Argentina, Australia, Canada, New Zealand, Puerto Rico and the U.S. Virgin Islands. Truck Rental -provides truck rentals and related services to consumers and light commercial users... -

Page 73

...Wyndham and Travelport with various services, including services relating to payroll, accounts payable, telecommunications and information technology in exchange for fees based on the estimated cost of the services provided. As of December 31, 2008, the majority of these services are no longer being... -

Page 74

... stock share data in the accompanying Consolidated Financial Statements and notes have been revised to reflect the reverse stock split, unless otherwise noted. Changes in Accounting Estimate . During fourth quarter 2008, the Company increased the assumed service lives of its Truck Rental segment... -

Page 75

... will increase compared to 2008. In addition, approximately $300 million and $1.1 billion of term asset-backed financings for the Company's domestic and international car rental operations will mature in 2009 and 2010, respectively. The existing availability under the asset-backed vehicle financing... -

Page 76

... through the operation and franchising of the Avis and Budget rental systems, providing vehicle rentals and other services to business and leisure travelers and others. Other revenue includes rentals of GPS navigational units, sales of loss damage waivers and insurance products, fuel and fuel F-13 -

Page 77

... computed utilizing the straight-line method over the estimated benefit period of the related assets, which may not exceed 20 years, or the lease term, if shorter. Useful lives are as follows: Buildings Furniture, fixtures & equipment Capitalized software Buses and support vehicles 30 years 3 to 10... -

Page 78

... $1.3 billion within discontinued operations to reflect the difference between Travelport's carrying value and its estimated fair value, less costs to dispose. PROGRAM CASH Program cash primarily represents amounts specifically designated to purchase assets under vehicle programs and/or to repay... -

Page 79

... the net sales proceeds and the remaining book value. Vehicle-related interest amounts are net of vehicle-related interest income of $7 million, $5 million and $6 million for 2008, 2007 and 2006, respectively. During the fourth quarter of 2008, the Company increased the assumed service lives of its... -

Page 80

... and a customer in its Consolidated Statements of Operations. DERIVATIVE INSTRUMENTS Derivative instruments are used as part of the Company's overall strategy to manage exposure to market risks associated with fluctuations in foreign currency exchange rates, interest rates and gasoline costs. As... -

Page 81

...December 31, 2008 and 2007, respectively. Such liabilities relate to additional liability insurance, personal effects protection insurance, public liability, property damage and personal accident insurance claims for which the Company is self-insured. These obligations represent an estimate for both... -

Page 82

... in earnings. The election to use the fair value option is available when an entity first recognizes a financial asset or a financial liability or upon entering into a firm commitment. Additionally, SFAS No. 159 allows for a onetime election for existing positions upon adoption, with the transition... -

Page 83

... after November 15, 2008. The Company adopted SFAS No. 161 on January 1, 2009, as required, and it had no impact on its financial statements at the time of adoption. In December 2008, the FASB issued FSP No. FAS 132(R)-1, "Employers' Disclosure about Postretirement Benefit Plan Assets" ("FSP FAS 132... -

Page 84

...", to provide users of financial statements with useful, transparent, and timely information about the asset portfolios of postretirement benefit plans. FSP FAS 132(R)-1 applies prospectively for fiscal years ending after December 15, 2009. The Company adopted FSP FAS 132(R)-1 on January 1, 2009... -

Page 85

... receivable agreement excluding amounts remitted to Realogy and Wyndham. Represents payments in connection with a guarantee obligation made to the Company's former Marketing Services division, which was disposed of in October 2005, and a tax charge primarily related to state taxes prior to the date... -

Page 86

... accounting changes Net loss (a ) $ As the Company incurred a loss from continuing operations in 2008, 2007 and 2006, all outstanding stock options and restricted stock units have an anti-dilutive effect and therefore are excluded from the computation of diluted weighted average shares outstanding... -

Page 87

... recorded in the Company's Corporate and Other, Truck Rental and Domestic Car Rental segments amounted to $19 million, $5 million and $2 million, respectively. In 2006, the Company recorded a $2 million charge representing a revision to its original estimate of costs to exit a lease in connection... -

Page 88

... independent commissioned dealer locations for the Budget truck rental business and Avis and Budget locations operated by or through Avis Europe Holdings, Limited, an independent third party) is as follows: 2008 Company-owned Avis brand Budget brand Franchised Avis brand Budget brand 1,334 1,128... -

Page 89

... included in the Company's Consolidated Statements of Operations since their respective dates of acquisition. The excess of the purchase price over the estimated fair values of the underlying assets acquired, including trademark assets related to franchisees, and liabilities assumed was allocated... -

Page 90

... 2008, as a result of reduced equity market valuations for vehicle services and other companies, as well as reduced profit forecasts due to soft economic conditions and increased financing costs, it was determined that an impairment had occurred (see Note 2-Summary of Significant Accounting Policies... -

Page 91

...Car Rental, LLC ("Avis Budget Car Rental") subsidiary. Such interest is recorded within interest expense related to corporate debt, net on the accompanying Consolidated Statements of Operations. 10. Income Taxes The income tax provision (benefit) consists of the following: 2008 Current Federal State... -

Page 92

... $7 million, respectively. The valuation allowance will be reduced when and if the Company determines that the related deferred income tax assets are more likely than not to be realized. Deferred income tax assets and liabilities related to the vehicle programs are comprised of the following: As of... -

Page 93

...a tabular reconciliation of the total amounts of unrecognized tax benefits for the year: December 31, 2008 2007 $ 612 $ 614 - - 27 21 (36) (23) (2) - $ 601 $ 612 Balance at January 1, Additions based on tax positions related to the current year Additions for tax positions for prior years Reductions... -

Page 94

...related to corporate debt, net on the accompanying Consolidated Statements of Operations. Penalties incurred during the twelve months ended December 31, 2008 and 2007, were not significant and were recognized as a component of income taxes. The Company is subject to income taxes in the United States... -

Page 95

... in Carey and its option to acquire an additional ownership stake in Carey, which was not exercised. At December 31, 2008, the Company's investment totaled $43 million, including $2 million of deferred acquisition costs. The Company's share of Carey's operating results were insignificant in... -

Page 96

...damage insurance liabilities - current Disposition related liabilities Other 15. Other Non-Current Liabilities Other non-current liabilities consisted of: As of December 31, 2008 2007 $ 480 $ 440 219 252 111 52 69 22 59 65 38 29 145 138 $ 1,121 $ 998 Long-term income taxes payable Public liability... -

Page 97

AVIS BUDGET CAR RENTAL CORPORATE DEBT Floating Rate Term Loan The Company's floating rate term loan was entered into in April 2006. This floating rate term loan was amended in December 2008 to change the financial covenants, interest rate spreads and restrictions on certain activities contained ... -

Page 98

... 31, 2008, the committed credit facilities available to the Company and/or its subsidiaries at the corporate or Avis Budget Car Rental level were as follows: Outstanding Total Capacity $ 1,150 228 Borrowings $ Letters of Credit Issued $ 816 224 Available Capacity $ 334 4 Revolving credit facility... -

Page 99

... program, Avis Budget has been paying a lower rate of interest than if the Company had issued debt directly to third parties. AESOP Leasing is required to use these proceeds to acquire or finance the acquisition of vehicles used in the Company's rental car operations. Avis Budget Rental Car Funding... -

Page 100

... 300 $ 5,908 Leases $ 94 32 $ 126 Total $2,263 1,389 974 1,108 300 $6,034 COMMITTED CREDIT FACILITIES AND AVAILABLE FUNDING ARRANGEMENTS As of December 31, 2008, available funding under the Company's vehicle programs (including related party debt due to Avis Budget Rental Car Funding) consisted of... -

Page 101

...The future minimum lease payments in the above table have been reduced by minimum future sublease rental inflows of $18 million and include minimum concession fees charged by airport authorities which, in many locations, are recoverable from vehicle rental customers. The Company maintains concession... -

Page 102

...'s vehicle rental operations, arising or accrued on or prior to the separation of Travelport from the Company ("Assumed Assets"). Additionally, if Realogy or Wyndham were to default on its payment of costs or expenses to the Company related to any Assumed Liabilities the Company would be responsible... -

Page 103

... of vehicle-backed debt in addition to cash received upon the sale of vehicles in the used car market and under repurchase and guaranteed depreciation programs. Other Purchase Commitments In the normal course of business, the Company makes various commitments to purchase goods or services from... -

Page 104

...retaining pre-existing guarantee obligations for certain real estate operating lease obligations on behalf of certain MSD subsidiaries. The Company established a liability for the estimated fair value of these guarantees in the amount of approximately $100 million on the sale date, which reduced the... -

Page 105

... in Avis Budget Rental Car Funding on the Consolidated Balance Sheet. 20. Stock-Based Compensation The Company expects to grant stock options, and may grant stock appreciation rights ("SARs"), restricted shares and restricted stock units ("RSUs") to its employees, including directors and officers of... -

Page 106

... in January 2009 that vest based on performance, market and/or time vesting criteria. The annual activity of the Company's common stock option plans consisted of (in thousands of shares): 2008 Weighted Number of Options 5,963 (5) (955) 5,003 Average Exercise Price (c) $ 26.16 10.68 32.89 24.90... -

Page 107

...-Scholes option-pricing model with the following weighted average assumptions: dividend yield-0%; expected volatility-32.9%; risk-free interest rate-4.9%; and expected holding period-4.9 years. Employee Stock Purchase Plan The Company is authorized to sell shares of its Avis Budget common stock to... -

Page 108

... expenses on the accompanying Consolidated Statements of Operations except amounts incurred in connection with the 2006 accelerated vesting of RSUs and stock options related to the Cendant Separation (which are recorded within the Separation costs, net line item). The Company also recorded pretax... -

Page 109

...assumptions related to the cost consisted of the following: 2008 Service cost Interest cost Expected return on plan assets Amortization of unrecognized amounts Net periodic benefit cost $ For the Year Ended December 31, 2007 2 $ 2 $ 12 11 (14) (12) 3 3 3 $ 4 $ 2006 2 13 (14) 5 6 $ The Company uses... -

Page 110

... 2008 Discount rate: Net periodic benefit cost Benefit obligation Long-term rate of return on plan assets 6.25% 6.25% 8.25% 2006 5.50% 5.75% 8.25% To select a discount rate for its defined benefit pension plans, the Company uses a modeling process that involves matching the expected cash outflows... -

Page 111

...hedging strategies related to its corporate debt included swaps and financial instruments with purchased option features designated as either fair value hedges or freestanding derivatives. The fair value hedges were effective resulting in no impact on the Company's consolidated results of operations... -

Page 112

...of cash and cash equivalents, available-for-sale securities, accounts receivable, program cash and accounts payable and accrued liabilities approximate fair value due to the short-term maturities of these assets and liabilities. The carrying amounts and estimated fair values of financial instruments... -

Page 113

... Total Liabilities: Interest rate swaps and other derivatives Interest rate swaps and other derivatives under vehicle programs Total 23. Segment Information The reportable segments presented below represent the Company's operating segments for which separate financial information is available... -

Page 114

... of assets under vehicle programs Assets under vehicle programs Capital expenditures (excluding vehicles) Domestic Car Rental $ 4,679 1,270 259 265 74 2,528 6,421 79 Car Rental $ 873 205 28 131 7 717 1,043 12 Truck Rental $ 416 96 28 17 2 192 517 3 and Other (a) $ 18 1 1 1,056 - Total $5,986... -

Page 115

... full and unconditional and joint and several. This financial information is being presented in relation to the Company's Guarantee of the Notes issued by Avis Budget Car Rental. See Note 16-Long-term Debt and Borrowing Arrangements for additional description of these Notes. The Notes have separate... -

Page 116

Consolidating Condensed Statements of Operations For the Year Ended December 31, 2008 Subsidiary Parent Revenues Vehicle rental Other Net revenues Expenses Operating Vehicle depreciation and lease charges, net Selling, general and administrative Vehicle interest, net Non-vehicle related depreciation... -

Page 117

...Operating Vehicle depreciation and lease charges, net Selling, general and administrative Vehicle interest, net Non-vehicle related depreciation and amortization Interest expense related to corporate debt, net: Interest expense Intercompany interest expense (income) Separation costs Impairment Total... -

Page 118

... 31, 2006 Subsidiary Parent Revenues Vehicle rental Other Net revenues Expenses Operating Vehicle depreciation and lease charges, net Selling, general and administrative Vehicle interest, net Non-vehicle related depreciation and amortization Interest expense related to corporate debt, net: Interest... -

Page 119

...: Program cash Vehicles, net Receivables from vehicle manufacturers and other Investment in Avis Budget Rental Car Funding (AESOP) LLC-related party Total assets Liabilities and stockholders' equity Current liabilities: Accounts payable and other current liabilities Current portion of long-term debt... -

Page 120

...: Program cash Vehicles, net Receivables from vehicle manufacturers and other Investment in Avis Budget Rental Car Funding (AESOP) LLC-related party Total assets Liabilities and stockholders' equity Current liabilities: Accounts payable and other current liabilities Current portion of long-term debt... -

Page 121

... Statements of Cash Flows For the Year Ended December 31, 2008 Subsidiary Parent Net cash provided by (used in) operating activities Investing activities Property and equipment additions Net assets acquired, net of cash acquired, and acquisition-related payments Proceeds received on asset sales... -

Page 122

...of vehicle programs Vehicle programs: Proceeds from borrowings Principal payments on borrowings Net change in short-term borrowings Other, net Net cash provided by (used in) financing activities Effect of changes in exchange rates on cash and cash equivalents Net increase (decrease) in cash and cash... -

Page 123

F-59 -

Page 124

...and equipment additions Net assets acquired, net of cash acquired, and acquisition-related payments Proceeds received on asset sales Other, net Net cash provided by (used in) investing activities exclusive of vehicle programs Vehicle programs: Increase in program cash Investment in vehicles Proceeds... -

Page 125

... stock equivalents outstanding during each quarter, which may fluctuate, based on quarterly income levels, market prices and share repurchases. Therefore, the sum of the quarters' per share information may not equal the total year amounts presented on the Consolidated Statements of Operations. 2008... -

Page 126

Schedule II - Valuation and Qualifying Accounts (in millions) Balance at Beginning Description Allowance for Doubtful Accounts: Year Ended December 31, 2008 2007 2006 of Period Expensed Other - Translation Adjustment Deductions Balance at End of Period $ 19 20 20 $ 10 7 16 G-1 $ (2) 1 1 $ (... -

Page 127

... to the Company's Current Report on Form 8-K dated October 30, 2006). Indenture, dated as of April 19, 2006, among Avis Budget Car Rental, LLC, Avis Budget Finance, Inc., the guarantors from time to time parties thereto and the Bank of Nova Scotia Trust Company of New York, as trustee, relating to... -

Page 128

... Employment Agreement between Avis Budget Group, Inc. and Larry D. De Shon (Incorporated by reference to Exhibit 10.5 to the Company's Current Report on Form 8-K dated December 31, 2008). †Employment Agreement between Avis Budget Group, Inc. and Patric T. Siniscalchi. †1987 Stock Option Plan... -

Page 129

...the Company's Current Report on Form 8-K dated August 4, 2006).†Form of Award Agreement- Stock Options. †Form of Award Agreement- Stock Options. †Avis Budget Group, Inc. Non-Employee Directors Deferred Compensation Plan, Amended and Restated as of January 1, 2007. †Avis Budget Group, Inc... -

Page 130

... 10.2 to the Company's Current Report on Form 8-K dated January 20, 2006). Second Amendment, dated as of May 9, 2007, among AESOP Leasing L.P., as Borrower, PV Holding Corp., as Permitted Nominee, Quartx Fleet Management, Inc., as Permitted Nominee, and Avis Budget Rental Car Funding (AESOP) LLC... -

Page 131

... Lease Guarantor, Avis Rent A Car System, Inc.****, as Lessee, and Budget Rent A Car System, Inc., as Lessee, to the Amended and Restated Master Motor Vehicle Finance Lease Agreement, dated as of June 3, 2004 (Incorporated by reference to Exhibit 10.30(b) to the Company's Annual Report on Form... -

Page 132

...Bank of New York), as Trustee and as Series 2002-2 Agent (Incorporated by reference to Exhibit 10.1 to the Company's Current Report on Form 8-K dated October 28, 2008). Twelfth Amendment to the Amended and Restated Series 2002-2 Supplement, dated as of December 23, 2008, among Avis Budget Rental Car... -

Page 133

... Series 2004-1 Supplement, dated as of May 9, 2007, among Avis Budget Rental Car Funding (AESOP) LLC, as Issuer, Avis Budget Car Rental, LLC, as Administrator, Mizuho Corporate Bank, Ltd., as Administrative Agent, certain financial institutions, as Purchasers, and The Bank of New York Trust Company... -

Page 134

...Current Report on Form 8-K dated May 22, 2008). First Amendment, dated as of November 11, 2008, between Avis Budget Rental Car Funding (AESOP) LLC, as Issuer, and The Bank of New York Mellon Trust Company, N.A. (as successor in interest to The Bank of New York), as Trustee and as Series 2005-2 Agent... -

Page 135

... of New York Trust Company, N.A., as trustee and as Series 2008-1 Agent (Incorporated by reference to Exhibit 10.1 to the Company's Current Report on Form 8-K dated February 22, 2008). First Amendment to the Series 2008-1 Supplement, dated as of October 27, 2008, among Avis Budget Rental Car Funding... -

Page 136

... Purchasers, certain Funding Agents, certain APA Banks and The Bank of New York Trust Company, N.A., as Trustee (Incorporated by reference to Exhibit 10.42(c) to the Company's Annual Report on Form 10-K for the year ended December 31, 2007, dated February 29, 2008). Amendment No. 3 to the Series... -

Page 137

... Company's Current Report on Form 8-K dated February 4, 2005).†††Cendant Corporation* Officer Personal Financial Services Policy (Incorporated by reference to Exhibit 10.1 of the Company's Current Report on Form 8-K dated January 26, 2005). Form of TRAC Participation Agreement (Incorporated... -

Page 138

... of Canada, in its capacity as trustee of Bay Street Funding Trust, as limited partners (Incorporated by reference to Exhibit 10.4 to the Company's Current Report on Form 8-K dated December 20, 2006). Credit Agreement, dated as of April 19, 2006, among Avis Budget Holdings, LLC and Avis Budget Car... -

Page 139

... 10.2 to the Company's Current Report on Form 8-K dated April 21, 2006). First Amendment, dated December 23, 2008 to the Credit Agreement dated as of April 19, 2006 among Avis Budget Holdings, LLC, Avis Budget Car Rental, LLC, the subsidiary borrowers from time to time parties thereto, the several... -

Page 140

... to the Company's Annual Report on Form 10-K for the year ended December 31, 2007, dated February 29, 2008). Statement Re: Computation of Ratio of Earnings to Fixed Charges. Subsidiaries of Registrant. Consent of Independent Registered Public Accounting Firm. Certification of Chief Executive Officer... -

Page 141

Exhibit 4.1(c) AVIS BUDGET CAR RENTAL, LLC and AVIS BUDGET FINANCE, INC., as Issuers, The GUARANTORS from time to time parties hereto and THE BANK OF NOVA SCOTIA TRUST COMPANY OF NEW YORK as Trustee SECOND SUPPLEMENTAL INDENTURE DATED as of JANUARY 28, 2009 TO THE INDENTURE DATED as of APRIL 19, ... -

Page 142

..."), by and among Avis Budget Car Rental, LLC, a Delaware limited liability company (the "Company"), Avis Budget Finance, Inc., a Delaware corporation (together with the Company and their respective successors, the "Issuers"), Wizard Services, Inc., a Delaware corporation ("Wizard"), PR Holdco, Inc... -

Page 143

... THE LAWS OF THE STATE OF NEW YORK. THE TRUSTEE, THE COMPANY, ANY OTHER OBLIGOR IN RESPECT OF THE NOTES AND (BY THEIR ACCEPTANCE OF THE NOTES) THE HOLDERS AGREE TO SUBMIT TO THE JURISDICTION OF ANY UNITED STATES FEDERAL OR STATE COURT LOCATED IN THE BOROUGH OF MANHATTAN, IN THE CITY OF NEW YORK, IN... -

Page 144

...Successors. All covenants and agreements in this Second Supplemental Indenture by the Issuers, the Existing Guarantors, each New Subsidiary Guarantor and the...remaining provisions shall not in any way be affected or impaired thereby. 10. Counterparts. The parties hereto may sign one or more copies of ... -

Page 145

..., LIMITED AVIS CAR RENTAL GROUP, LLC AVIS CARIBBEAN, LIMITED AVIS ENTERPRISES, INC. AVIS GROUP HOLDINGS, LLC AVIS INTERNATIONAL, LTD. AVIS LEASING CORPORATION AVIS RENT A CAR SYSTEM, LLC PF CLAIMS MANAGEMENT, LTD. WIZARD CO., INC. AB CAR RENTAL SERVICES, INC. ARACS LLC AVIS OPERATIONS, LLC WIZARD... -

Page 146

THE BANK OF NOVA SCOTIA TRUST COMPANY OF NEW YORK, as Trustee By /s/ Warren Goshine Authorized Officer -

Page 147

... Executive Vice President, International Avis Budget Group 6 Sylvan Way Parsippany, NJ 07054 Dear Pat: We are pleased to confirm your continued employment with Avis Budget Car Rental, LLC, ("ABCR" or the "Company"), a subsidiary of Avis Budget Group, as Executive Vice President, International... -

Page 148

... Date (or, in the event of your death, within 30 days of your death) equal to the fair market value as of your termination of employment of all of your stock-based awards. "Termination for Cause" shall mean: (i) your willful failure to substantially perform your duties as an employee of the Company... -

Page 149

...any other plan or agreement of the Company providing you with payments or benefits upon your separation from service) during the six-month period immediately following your separation from service shall instead be paid or provided on the first business day after the date that is six months following... -

Page 150

...(c) FORM OF TIME-BASED AWARD AVIS BUDGET GROUP, INC. 2007 EQUITY AND INCENTIVE PLAN STOCK OPTION AGREEMENT [ ] (the "Optionee") is granted, effective as of the day of (the "Date of Grant"), options (the "Options") to purchase shares of common stock, par value $.01 ("Stock") of Avis Budget Group, Inc... -

Page 151

... Payment of the Exercise Price for the Option Shares to be purchased on the exercise of the Option shall be made by (i) cash (ii) certified or bank cashier's check payable to the order of the Company, (iii) unless otherwise determined by the Committee at the time of exercise, in the form of Shares... -

Page 152

...the Optionee and the Company, in the event of a Change in Control, the Option Shares granted pursuant to this Agreement shall be treated in the manner set forth in Section 7 of the Plan. Governing Law: This Agreement shall be governed by and construed under the internal laws of the State of Delaware... -

Page 153

... of the day of (the "Date of Grant"), options (the "Options") to purchase shares of common stock, par value $.01 ("Stock") of Avis Budget Group, Inc. (the "Option Shares") pursuant to the 2007 Equity and Incentive Plan (the "Plan") of Avis Budget Group, Inc. (the "Company"). The Options are subject... -

Page 154

... Payment of the Exercise Price for the Option Shares to be purchased on the exercise of the Option shall be made by (i) cash, (ii) certified or bank cashier's check payable to the order of the Company, (iii) unless otherwise determined by the Committee at the time of exercise, in the form of Shares... -

Page 155

...the Company, in the event of a Change in Control, the Option Shares granted pursuant to this Agreement shall be treated in the manner set forth in Section 7 of the Plan. Recapture Policy. If the Committee learns of any intentional misconduct by the Optionee that resulted in an increase to the number... -

Page 156

... a number of Avis Share Units. The number of Avis Share Units allocated to a Director's account will be equal to the amount of Fees deferred into the Plans as of any given date (an "Allocation Date"), divided by the fair market value of Avis common stock, par value $0.01 per share ("Avis Stock") as... -

Page 157

...(A) the product of (i) the number of Avis Share Units credited to such account on the dividend or distribution record date and (ii) the dividend (or distribution value as determined by the Committee in its sole discretion) per share of Avis Stock, by (B) the closing price of a share of Avis Stock as... -

Page 158

... except in accordance with the provisions of Internal Revenue Code Section 409A. The Board of Directors of Avis may, without the consent of any Director or beneficiary, amend the Plan at any time and from time to time; provided , however , that no such amendment shall adversely affect the rights of... -

Page 159

Exhibit 10.17 AVIS BUDGET GROUP, INC. DEFERRED COMPENSATION PLAN Amended and Restated as of November 1, 2008 -

Page 160

AVIS BUDGET GROUP, INC. DEFERRED COMPENSATION PLAN Table of Contents ARTICLE I - SPONSORSHIP AND PURPOSE OF PLAN ARTICLE II - DEFINITIONS ARTICLE III - PARTICIPATION ARTICLE IV- ELECTIVE AND MATCHING DEFERRALS ARTICLE V - ACCOUNTS ARTICLE VI - PAYMENTS ARTICLE VII - BENEFICIARY DESIGNATION ARTICLE ... -

Page 161

...the "Company") a corporation organized under the laws of the State of Delaware, sponsors the Avis Budget Group, Inc. Deferred Compensation Plan (the "Plan"), a non-qualified deferred compensation plan for the benefit of Participants and Beneficiaries (as defined herein). This Plan shall generally be... -

Page 162

...the Board of Directors of the Company. Change of Control means the date on which: (a) any one person, or more than one person acting as a group, acquires ownership of stock of the Company that, together with stock held by such person or group, constitutes more than 50% of the total fair market value... -

Page 163

... in accordance with Article III. Plan means this Avis Budget Group, Inc. Deferred Compensation Plan, as amended from time to time. Effective November 1, 2008, this term shall be interpreted to include the Old ARAC Plan. Plan Year means the twelve consecutive month period ending each December 31 st... -

Page 164

... of Participation Any Eligible Employee who elects to defer part of his or her Compensation in accordance with Section 4.1 shall become a Participant in the Plan as of the date such deferrals commence in accordance with Section 4.1. Participants under the Old ARAC Plan are automatically deemed... -

Page 165

...or more payments of Compensation, on such terms as the Committee may permit, which are earned by and payable to the Participant after the date on which the individual files the Election Form. Such election will be effective only for the Plan Year in which it is filed. Any other Eligible Employee may... -

Page 166

...administration of the Plan, including a sub-account for amounts deferred (and any subsequent earnings related thereto) under the Old ARAC Plan. The Committee shall periodically, but no less frequently than annually, provide the Participant with a statement of his or her Account reflecting the income... -

Page 167

...Code and the regulations thereunder, prior to December 31, 2008, each Participant shall have the opportunity to revoke their current election on file and make a new distribution election which will apply to their Account balance determined by excluding amounts attributable to the Old ARAC Plan. Each... -

Page 168

...Old ARAC Plan (and any subsequent earnings related thereto) upon an Unforeseen Emergency. Such distribution is limited to amounts reasonably necessary to meet the emergency and pay... federal, state or local taxes that the Committee determines are required to be withheld from any payments made pursuant... -

Page 169

..., without liability for any interest thereon, until the rights thereto are determined, or the Committee may pay such amount into any court of appropriate jurisdiction and such payment shall be a complete discharge of the obligations of the Employer under the Plan. 7.3 Payment to Representatives If... -

Page 170

... individual benefits under, the Plan. Any action of the Committee may be taken by a vote or written consent of the majority of the Committee members entitled to act. Any Committee member shall be entitled to represent the Committee, including the signing of any certificate or other written direction... -

Page 171

... between the Employer and any Eligible Employee (or any other employee) or a consideration for, or an inducement or condition of employment for, the performance of the services by any Eligible Employee (or other employee). The Company reserves the right to terminate the Plan at any time, subject to... -

Page 172

... of this Plan, including all costs and expenses reasonably incurred in its defense, in case the Employer fails to provide such defense. 10.6 Liability No member of the Board, the Committee, or management of the Employer shall be liable to any person for any action taken under the Plan. Page 13 -

Page 173

... to persons or objects of any gender. Singular and Plural . Unless clearly inappropriate, singular terms refer also to the plural number and vice versa. Severability . If any provision of this Plan is held illegal or invalid for any reason, the remaining provisions are to remain in full force and... -

Page 174

...the Employer to pay benefits to the extent, and subject to the limitations, provided for herein. Although, this Plan constitutes an "employee benefit plan" within the meaning of Section 3(3) of the Employee Retirement Income Security Act of 1974 ("ERISA"), it is intended to cover only a select group... -

Page 175

... of this Plan by the Company, it has caused the same to be signed by its officers thereunto duly authorized, and its corporate seal to be affixed thereto, this 21 st day of November, 2008. ATTEST AVIS BUDGET GROUP, INC. By: Name: Karen C. Sclafani Title: Executive Vice President, General Counsel and... -

Page 176

Exhibit 10.18 AVIS BUDGET GROUP, INC. SAVINGS RESTORATION PLAN Amended and Restated as of November 1, 2008 -

Page 177

AVIS BUDGET GROUP, INC. SAVINGS RESTORATION PLAN Table of Contents ARTICLE I - SPONSORSHIP AND PURPOSE OF PLAN ARTICLE II - DEFINITIONS ARTICLE III - ENROLLMENT AND PARTICIPATION ARTICLE IV- DEFERRAL CONTRIBUTIONS ARTICLE V - EARNINGS ARTICLE VI - DISTRIBUTIONS AND FORM OF BENEFITS ARTICLE VII - ... -

Page 178

... (the "Company") a corporation organized under the laws of the State of Delaware, sponsors the Avis Budget Group, Inc. Savings Restoration Plan (the "Plan"), a non-qualified deferred compensation plan for the benefit of Participants and Beneficiaries (as defined herein). This Plan shall generally be... -

Page 179

... use of a Voice Response System), which will document the Participant's elections as to the form of distribution. Board means the Board of Directors of the Company. Change of Control means the date on which: (a) any one person, or more than one person acting as a group, acquires ownership of stock... -

Page 180

... in accordance with Article V hereof by which the value of a Participant's Account is adjusted. Eligible Employee means, with respect to any Plan Year, any officer or other employee of the Employer who is (i) a Highly Compensated Employee, as such term is defined under Code Section 414(q), and is... -

Page 181

...Qualified Plan means the Avis Budget Group, Inc. Employee Savings Plan or other applicable 401(k) plan maintained by the Company in which the Participant is eligible to participate, as amended and restated from time to time. Termination of Employment means a Participant's separation from the service... -

Page 182

ARTICLE III - ENROLLMENT AND PARTICIPATION 3.1 Enrollment An Eligible Employee shall enroll in the Plan and become a Participant by completing an Election Form and filing it either online or directly with the Committee in accordance with Article IV. 3.2 Continuation of Participation A Participant ... -

Page 183

... not be made available to such Participant, except as provided in Article VI hereof, but instead shall be allocated to the Participant's Account as soon as administratively feasible following the date such Compensation would otherwise have been paid to the Participant. 4.2 Application of Deferral... -

Page 184

... As of each Valuation Date, earnings or losses will be credited to each Participant's Account for the period beginning with the previous Valuation Date and ending with the current Valuation Date. Earnings and losses shall be based on rate of return (including a negative return) determined by the... -

Page 185

... will be made in such Participant's Benefit Payment Direction Form on the date of such Participant's initial participation in the Plan. The Participant may elect distribution to occur on a specified date or the date that is six months after Termination of Employment. The Participant shall also make... -

Page 186

..., and the Participant's Accounts shall be reduced by the amount distributed including any related forfeitures. 6.7 Automatic Cash-Out If there is no valid election in effect at the time of a Participant's Termination of Employment, or (ii) the Account of a Participant on the date of such Participant... -

Page 187

..., without liability for any interest thereon, until the rights thereto are determined, or the Committee may pay such amount into any court of appropriate jurisdiction and such payment shall be a complete discharge of the obligations of the Employer under the Plan. 7.3 Payment to Representatives If... -

Page 188

... individual benefits under, the Plan. Any action of the Committee may be taken by a vote or written consent of the majority of the Committee members entitled to act. Any Committee member shall be entitled to represent the Committee, including the signing of any certificate or other written direction... -

Page 189

... between the Employer and any Eligible Employee (or any other employee) or a consideration for, or an inducement or condition of employment for, the performance of the services by any Eligible Employee (or other employee). The Company reserves the right to terminate the Plan at any time, subject to... -

Page 190

... of this Plan, including all costs and expenses reasonably incurred in its defense, in case the Employer fails to provide such defense. 10.6 Liability No member of the Board, the Committee, or management of the Employer shall be liable to any person for any action taken under the Plan. 14 -

Page 191

... to persons or objects of any gender. Singular and Plural . Unless clearly inappropriate, singular terms refer also to the plural number and vice versa. Severability . If any provision of this Plan is held illegal or invalid for any reason, the remaining provisions are to remain in full force and... -

Page 192

...the Employer to pay benefits to the extent, and subject to the limitations, provided for herein. Although, this Plan constitutes an "employee benefit plan" within the meaning of Section 3(3) of the Employee Retirement Income Security Act of 1974 ("ERISA"), it is intended to cover only a select group... -

Page 193

... of this Plan by the Company, it has caused the same to be signed by its officers thereunto duly authorized, and its corporate seal to be affixed thereto, this 21 st day of November, 2008. ATTEST AVIS BUDGET GROUP, INC. By: Name: Karen C. Sclafani Title: Executive Vice President, General Counsel and... -

Page 194

Exhibit 10.20 AVIS RENT A CAR SYSTEM, LLC PENSION PLAN EFFECTIVE JUNE 1, 2006 -

Page 195

... Part I of the Cendant Corporation Pension Plan, as a successor employer. Accordingly, the Plan is being amended pursuant to this restatement to reflect that the terms and provisions of the Cendant Corporation Pension Plan, Part I are no longer applicable, as the remaining assets and liabilities... -

Page 196

... 1.8 "Beneficiary" 1.9 "Board of Directors" 1.10 "Code" 1.11 "Committee" 1.12 "Company" 1.13 "Compensation" 1.14 "Credited Service" 1.15 "Date of Original Employment" 1.16 "Effective Date of the Salaried Plan" 1.17 "Employee" 1.18 "Employment Commencement Date" 1.19 "Equivalent Actuarial Value" 1.20... -

Page 197

... Benefits for Members of Salaries or Hourly Plans ARTICLE 5 NORMAL FORMS OF RETIREMENT PENSION 5.1 Normal Form of Retirement Pension - Unmarried Member 5.2 Normal Form of Retirement Pension - Married Member 5.3 Small Payments 5.4 Facility of Payments ARTICLE 6 TERMINATION OF SERVICE 6.1 Termination... -

Page 198

... in Service Option II 8.4 Consent of Spouse 8.5 Other Death Benefits CONTRIBUTIONS 9.1 Contributions of the Company 9.2 Irrevocability of Contributions 9.3 Use of Forfeitures ARTICLE 8 ARTICLE 9 ARTICLE 10 MANAGEMENT OF FUNDS 10.1 Medium of Funding 10.2 Fund to be for Exclusive Benefit of Members... -

Page 199

... OF BENEFITS ARTICLE 16 SERVICE AND TRANSFER RULES 16.1 Application of Provisions 16.2 Service Other Than as an Employee 16.3 Service Following Service as an Employee 16.4 "Affiliated Company" ARTICLE 17 NON-ALIENATION OF BENEFITS ARTICLE 18 MISCELLANEOUS 18.1 Rights of Employees 18.2 Return of... -

Page 200

... service with any governmental agency or any department of the United States; (iii) the period of any such absence during which sickness or accident benefits are being paid by the Company. 1.3. "Acquisition Date" shall mean, with respect to any Predecessor Corporation, the date on which the business... -

Page 201

... to administer the Plan pursuant to Article 11. 1.12. "Company" shall mean Cendant Car Rental, Inc. (formerly HFS Car Rental, Inc.), Avis Rent A Car System, Inc. or any successor by merger, purchase or otherwise, with respect to its Employees, and any other Participating Corporation or Participating... -

Page 202

...after July 1, 1994, the annual Compensation of each Member taken into account under the Plan shall not exceed the OBRA '93 annual compensation limit. The OBRA '93 annual compensation limit is $150,000, as adjusted by the Commissioner for increases in the cost-of-living in accordance with section 401... -

Page 203

... worked the regular schedule in effect for his job classification in accordance with Company policy in effect at such time. 1.14.2 If, after incurring a Break in Service after a Severance Date (as described in Sections 1.34.1 and 1.34.2) occurring on or after January 1, 1976, a Member is re-employed... -

Page 204

... Service under the Plan, using the rule of either (a) or (b) below, whichever produces the greater total Credited Service: (a) The Member's prior Credited Service shall be restored if the period of time between the date of his Termination of Employment and the date of his reemployment by the Company... -

Page 205

... Plan" shall mean January 1, 1972. 1.17. "Employee" shall mean any person employed by the Company and with respect to persons employed by Cendant Car Rental, Inc. only, those persons who were previously employed by the Prior Company, and who receives Compensation, whether on an annual or hourly... -

Page 206

... Mortality Table and the interest rate promulgated by the Pension Benefit Guaranty Corporation as applicable for valuing immediate annuities as of the first day of the Plan Year in which the Annuity Starting Date occurs. In the case of a Member who continues employment with the Company after age 65... -

Page 207

... all or part of the business and assets of any such corporation shall have been acquired by the Company either before or after the Effective Date of the Salaried Plan. (b) "Prior Company" shall mean ARAC with respect to those Cendant Car Rental, Inc. employees who were previously employed by ARAC... -

Page 208

... with a Predecessor Corporation which includes the Acquisition Date and (b) the period of employment during which an Employee previously performed work for the Company or Prior Company and did not accrue benefits under either the Salaried Plan or the Hourly Plan but instead accrued benefits for such... -

Page 209

...Employee's Severance Date and ending on his next Reemployment Commencement Date. 1.35. "Social Security Benefit" shall mean, except as otherwise specified below, the estimated amount which is payable to a Member at age 65 under Title II of the Social Security Act as in effect on the date his Service... -

Page 210

... Actuarial Value of the Vested Benefit which would be payable to the Member under Section 6.4 if he were not married. 1.38. "Termination of Employment" shall mean a Member's ceasing to be employed by the Company other than by reason of death. A Member's ceasing to be an Employee (as defined... -

Page 211

... shall be payable to or on the account of a Member or former Member entitled to a Vested Benefit under the Plan, such Member or former Member shall file with the Committee such information as it shall require to establish his rights under the Plan. ARTICLE 3. Retirement Dates 3.1. Normal Retirement... -

Page 212

...Year beginning on or after January 1, 1994, as applied to the Employee's total years of Credited Service taken into account under the Plan for the purposes of benefit accruals, or (b) the sum of: (i) the Employee's accrued benefit as of June 30, 1994, frozen in accordance with Section 1.401(a)(4)-13... -

Page 213

..., as applied to the Employee's years of Credited Service credited to the Employee for Plan Years beginning on or after January 1, 1994, for purposes of benefit accruals. A Section 401(a)(17) Employee means an Employee whose current accrued benefit as of a date on or after the first day of the first... -

Page 214

...the total benefit payable to him upon his subsequent Termination of Employment, including any earlier benefit he may have retained under the Plan, shall be limited to the amount it would have been if the Re-employed Member's total periods of Service had been one continuous period of Service. Payment... -

Page 215

...from Benefits . Unless the Board of Directors otherwise provides under rules uniformly applicable to all Employees similarly situated, the Committee shall deduct from the amount of any Retirement Pension or Vested Benefit under the Plan any amount paid or payable to or on account of any Member under... -

Page 216

... (v) the relative value of the various optional forms of benefit under the Plan. The explanation shall also state that the Committee will provide the information described in Section 5.2.4, if he requests such information in writing within sixty (60) days after the foregoing statement is mailed or... -

Page 217

...excess of the applicable rate that would be used by the Pension Benefit Guaranty Corporation ("PBGC") (determined as of the first month of the Plan Year during which falls the Member's Annuity Starting Date) for purposes of determining the present value of a lump sum distribution for single employer... -

Page 218

... falls the Member's Annuity Starting Date shall be used, if such rate produces a greater benefit) and (2) "Applicable Mortality Table" means the mortality table based on the prevailing Commissioner's standard table (described in section 807(d)(5)(A) of the Code) used to determine reserves for group... -

Page 219

... for cause) and he has completed at least twenty-five years of Credited Service, 1/4 of 1 percent for each full month by which the commencement of benefits precedes the Member reaching age 62, or (iii) if the Member was an employee of We Try Harder, Inc. on September 30, 1986, and the sum of (a) his... -

Page 220

... of a previous election to waive the Terminated Member's Spouse Joint and Survivor Annuity and (v) the relative values of the various optional forms of benefit under the Plan. The explanation shall also state that the Committee will provide the information described in Section 6.5.4, if he requests... -

Page 221

... furnish to him (by mail or personal delivery) a written explanation in nontechnical language of the terms and conditions of the Terminated Member's Spouse Joint and Survivor Annuity provisions of the Plan and the financial effects upon the Member's Vested Benefit of his making the election under... -

Page 222

...receive the Retirement Pension or Vested Benefit to which he is entitled under the Plan in the form of an annuity payable for the Member's life and terminating with the last monthly payment preceding such Member's death. 7.3. Joint and Survivor Annuity Option . A Member may elect, in accordance with... -

Page 223

... Security benefits under this Social Security Level Income Option, the estimated amount payable to a Member at age 62 under Title II of the Social Security Act as in effect on the Member's Annuity Starting Date shall be used. 7.6. Exercise of Option . The Member's election of an option described... -

Page 224

... to take into account the period after age 70 1 / 2 during which such Member did not receive a Retirement Pension. Such actuarial increase shall be the actuarial equivalent of the Member's Retirement Pension using an interest rate of 8% and the 1984 UP Mortality Table and shall be determined... -

Page 225

... in accordance with section 242(b)(2) of the Tax Equity and Fiscal Responsibility Act (TEFRA) and the provisions of the plan that relate to section 242(b)(2) of TEFRA. (ii) Time and Manner of Distribution . (a) Required Beginning Date. The Member's entire interest will be distributed, or begin to be... -

Page 226

... in the form of an annuity purchased from an insurance company, distributions thereunder will be made in accordance with the requirements of section 401(a)(9) of the Code and the Treasury regulations. Any part of the Member's interest which is in the form of an individual account described in... -

Page 227

... a qualified domestic relations order within the meaning of section 414(p); (C) to provide cash refunds of employee contributions upon the Member's death; or (D) to pay increased benefits that result from a plan amendment. (b) Amount Required to be Distributed by Required Beginning Date. The amount... -

Page 228

.... If the annuity starting date precedes the year in which the Member reaches age 70, the applicable distribution period for the Member is the distribution period for age 70 under the Uniform Lifetime Table set forth in section 1.401(a)(9)-9 of the Treasury regulations plus the excess of 70 over the... -

Page 229

.... Life expectancy as computed by use of the Single Life Table in section 1.401(a)(9)-9 of the Treasury regulations. (d) Required beginning date. The date specified in Section 7.7 of the Plan. 7.8. Rollover Distribution . Notwithstanding any provision of the Plan to the contrary that would otherwise... -

Page 230

... Annuity in effect. Payment of the Qualified Pre-retirement Survivor Annuity in such case shall commence on such earliest Annuity Starting Date. 8.2. Death in Service Option I . An active Member who is still employed by the Company on or after his Early Retirement Date or, if applicable, on or after... -

Page 231

...the payment of his Retirement Pension had commenced in the month in which his death occurred, computed as if the Member had Elected a Joint and Survivor Annuity Option under Section 7.3 with 100% continued to his Joint Annuitant with the designated person nominated as his Joint Annuitant, reduced by... -

Page 232

...returns to employment with the Company, the applicable period for such Member shall be redetermined. 8.5. Other Death Benefits . If a Member dies at any time on or after his Annuity Starting Date, his benefit (if any is payable) shall be paid in accordance with the Plan provisions governing the form... -

Page 233

... hereunder and shall not be used to increase the benefits any Member or other person would otherwise receive under the Plan. ARTICLE 10. Management of Funds 10.1. Medium of Funding . The Fund shall be held by a Trustee or Trustees appointed from time to time by the Board of Directors, in one or more... -

Page 234

... Committee of the Board. The members of the Committee and their successors shall be appointed from time to time by the Compensation Committee of the Board. If no Committee is appointed, the term Committee shall refer to the Board of Directors of the Company. 11.2 Officers and Subcommittees . The... -

Page 235

... the Board of Directors or the Trustee. The Committee shall have all powers to administer the Plan, within its discretion, other than the power to invest or reinvest the assets of the Plan to the extent such powers have been delegated to the Trustee, an insurance company and/or an asset manager. The... -

Page 236

...Act of 1940, as Banks (as defined in that Act), or which are insurance companies qualified to manage, acquire or dispose of the Fund's assets under the laws of more than one state, and provided that each of such persons or firms has acknowledged to the Committee and the Trustee in writing that he is... -

Page 237

...of any additional material or information necessary to perfect the claim and an explanation of why such material or information is necessary; and (4) an explanation of the Plan's claims review procedure for the denied or partially denied claim and any applicable time limits, and a statement that the... -

Page 238

...shall afford the Claimant or the Claimant's representative upon request and free of charge, reasonable access to, and copies of, all documents, records, and other information relevant to the Claimant's claim for benefits. The review shall take into account all comments, documents, records, and other... -

Page 239

...the Company . This Plan may be terminated by vote of the Board of Directors at any time in accordance with its established rules of procedure; provided, however, that such termination shall not cause any of the assets held under the Plan to be used for any purpose other than the exclusive benefit of... -

Page 240

... day immediately prior to the EGTRRA Effective Date. 14.1.2 Combined Limitations . In the case where (i) this Plan and another defined benefit plan or defined contribution plan of the Company cover the same Member and (ii) reductions in either the amount of the annual benefit payable under this Plan... -

Page 241

... shall be reduced by 6 2 / 3 % per year for the first three years, and 5% per year for any additional years, by which the Member's annual pension benefit commences after age 62, but prior to the Member's Social Security Retirement Age. The interest rate assumption used to adjust the limitation under... -

Page 242

... realized from the sale, exchange or other disposition of stock acquired under a qualified stock option; (iv) other amounts which received special tax benefits, or contributions made by the Company or any Related Company (whether or not under a salary reduction agreement) towards the purchase of an... -

Page 243

...the current liabilities under the Plan. 15.3. Notwithstanding the preceding provisions of this Article 15, in the event the Plan is terminated, the restrictions contained in Section 15.1 shall not be applicable if the benefits payable under the Plan to any Member who is a highly compensated Employee... -

Page 244

... ARTICLE 16. Service and Transfer Rules 16.1. Application of Provisions . Notwithstanding any provision to the contrary contained in the Plan, the provisions of this Article 16 shall apply to (a) any Member who ceases to be an Employee and who either (i) remains in the employ of the Company as other... -

Page 245

..., nor shall it interfere with the Employee's right to terminate his employment at any time. 18.2. Return of Contributions . 18.2.1 The obligation of the Company to make any contribution to the Plan hereby is conditioned upon the continued qualification of the Plan under section 401(a) of the Code... -

Page 246