Avid 1996 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 1996 Avid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

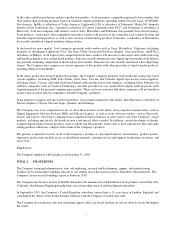

ITEM 6. SELECTED FINANCIAL DATA

The following table sets forth selected condensed consolidated financial data for Avid Technology, Inc. In January 1995,

Avid Technology, Inc. (Avid) completed a merger with Digidesign, Inc. (Digidesign) that was accounted for as a pooling of

interests. All financial data presented herein have been restated to include the combined financial results of Avid and

Digidesign as though the merger had occurred retroactively. Prior to the merger, Digidesign had a March 31 fiscal year end.

Effective with the merger, Digidesign's fiscal year end was changed from March 31 to December 31 to conform with Avid's

year end. The results of Digidesign's operations for the twelve-month periods ended December 31, 1994, March 31, 1994,

1993 and 1992 are included in the Company's 1994, 1993, 1992 and 1991 results, respectively. Accordingly, Digidesign's

operations for the three months January through March 1994 are included in the Company's results for both of the years

ended December 31, 1993 and December 31, 1994. Revenues, net income, and earnings per share for Digidesign for the

three months ended March 31, 1994 were $8,510,000, $1,078,000 and $0.14 respectively. Net income for this period has

been reported as an adjustment to consolidated 1994 retained earnings. In March 1995, the Company acquired Elastic

Reality, Inc., a developer of digital image manipulation software, Parallax Software Limited and 3 Space Software Limited,

together developers of paint and compositing software. The Company’s previous years’ financial statements have not been

restated to include operations of Parallax Software Limited, 3 Space Software Limited and Elastic Reality, Inc. as they were

not material to the Company’s consolidated operations and financial condition. Costs associated with these mergers,

approximately $5,456,000, were charged to operations in 1995. In addition, the Company acquired certain other businesses

which were accounted for as purchases; the results of such acquisitions have been included in the Company’s financial

statements since the respective dates of acquisition. The selected consolidated financial data below should be read in

conjunction with the "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the

consolidated financial statements and notes thereto included elsewhere in this filing.

Consolidated Statements of Income Data: For the year ended December 31,

In thousands (except per share data) 1996 1995 1994 1993 1992

Net revenues $429,009 $406,650 $233,633 $134,366 $69,020

Cost of revenues 238,808 198,841 108,057 60,939 29,333

Gross profit 190,201 207,809 125,576 73,427 39,687

Operating expenses:

Research and development 69,405 53,841 28,223 16,396 8,276

Marketing and selling. 127,006 107,780 61,366 38,960 21,279

General and administrative 24,203 18,085 12,575 7,801 3,335

Nonrecurring costs 28,950 5,456 3,750

Total operating expenses 249,564 185,162 102,164 66,907 32,890

Operating income (loss).. (59,363) 22,647 23,412 6,520 6,797

Other income and expense, net 3,416 1,380 1,675 1,791 152

Income (loss) before income taxes (55,947) 24,027 25,087 8,311 6,949

Provision for (benefit from) income taxes (17,903) 8,588 7,294 2,209 2,504

Net income (loss) $(38,044) $15,439 $17,793 $6,102 $4,445

Net income (loss) per common share $(1.80) $0.77 $0.99 $0.40 $0.38

Weighted average common and common equivalent

shares outstanding 21,163 20,165 17,921 15,216 11,805

Consolidated Balance Sheet Data: As of December 31,

In thousands (except per share data) 1996 1995 1994 1993 1992

Working capital $145,320 $162,260 $86,513 $91,473 $21,780

Total assets 300,979 331,604 182,174 132,355 43,104

Long-term debt, less current portion 1,186 2,945 2,369 545

Redeemable convertible preferred stock 30,897

Total stockholders' equity (deficit) 213,415 247,966 127,887 106,732 (901)