AutoNation 2003 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2003 AutoNation annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

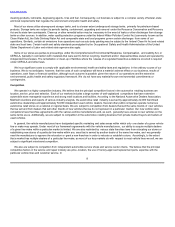

Item 6. SELECTED FINANCIAL DATA

You should read the following Selected Financial Data in conjunction with “Management’s Discussion and Analysis of Financial

Condition and Results of Operations,” our Consolidated Financial Statements and Notes thereto and other financial information included

elsewhere in this Form 10-K.

As of and for the Years Ended December 31,

2003 2002 2001 2000 1999

(In millions, except per share data)

Revenue $19,381.1 $19,478.5 $19,989.3 $20,599.0 $20,099.0

Income (loss) from continuing

operations $506.1 $381.6 $245.0 $328.1 $(31.5)

Net income $479.2 $381.6 $232.3 $329.9 $282.9

Basic earnings (loss) per share:

Continuing operations $1.81 $1.20 $.74 $.91 $(.07)

Discontinued operations $(.04) — $(.04) — $.73

Cumulative effect of accounting

change $(.05) — — — —

Net income $1.71 $1.20 $.70 $.91 $.66

Diluted earnings (loss) per share:

Continuing operations $1.76 $1.19 $.73 $.91 $(.07)

Discontinued operations $(.04) $ — $(.04) $ — $.73

Cumulative effect of accounting

change $(.05) — — — —

Net income $1.67 $1.19 $.69 $.91 $.66

Diluted weighted average common

shares outstanding 287.0 321.5 335.2 361.4 429.8

Total assets $8,823.1 $8,502.7(1) $8,065.4 $8,867.3 $9,583.1

Long-term debt, net of current

maturities $808.5 $642.7 $647.3 $850.4 $836.1

Shareholders’ equity $3,949.7 $3,910.2 $3,827.9 $3,842.5 $4,601.2

(1) See Note 24 to Notes to Consolidated Financial Statements.

See Notes 10, 12, 13, 14, 15, 16, 18 of Notes to Consolidated Financial Statements for discussion of shareholders’ equity, finance

underwriting and asset securitizations, restructuring activities and impairment charges, income taxes, earnings (loss) per share,

discontinued operations, and acquisitions and divestitures, respectively, and their effect on comparability of year-to-year data. See “Item 5.

Market for the Registrant’s Common Equity and Related Stockholder Matters” for a discussion of our dividend policy.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

You should read the following discussion in conjunction with Part I, including matters set forth in the “Risk Factors” section of this

Form 10-K, and our Consolidated Financial Statements and notes thereto included elsewhere in this Form 10-K.

As further discussed in Note 24, Prior Year Reclassifications and Disaggregations, of Notes to Consolidated Financial Statements, in an

effort to improve reporting consistency within our automotive retailing peer group, certain amounts have been reclassified from the previously

reported financial statements to conform with the income statement presentation of the current period. Finance and Insurance Revenue has

been adjusted to include corporate volume incentives that were previously included in Other Revenue. Additionally, Used Vehicle Revenue

and Cost of Sales have been adjusted to include the results of wholesale operations that were previously included in Other Revenue and

Cost of Sales. There was no impact to total revenue or total gross profit as a result of these changes.

17