Audiovox 2008 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2008 Audiovox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

•home electronic accessories such as cabling,

•other connectivity products,

•power cords,

•performance enhancing electronics,

•TV universal remotes,

•flat panel TV mounting systems,

•iPod specialized products,

•wireless headphones,

•rechargeable battery backups (UPS) for camcorders, cordless phones and portable video (DVD) batteries and accessories,

and

•power supply systems.

We believe our product groups have expanding market opportunities with certain levels of volatility related to both domestic and

international markets, new car sales, increased competition by manufacturers, private labels, technological advancements,

discretionary consumer spending and general economic conditions. Also, all of our products are subject to price fluctuations which

could affect the carrying value of inventories and gross margins in the future.

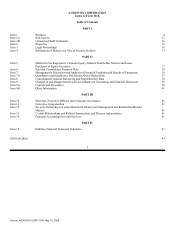

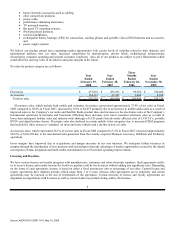

Net sales by product category are as follows:

Three

Year Year Months Year

Ended Ended Ended Ended

February 29, February 28, February 28, November 30,

2008 2007 2006 2005

Electronics $ 437,018 $ 432,943 $ 99,566 $ 530,408

Accessories 154,337 23,747 3,484 9,308

Total net sales $ 591,355 $ 456,690 $ 103,050 $ 539,716

Electronics sales, which include both mobile and consumer electronics, represented approximately 73.9% of net sales in Fiscal

2008 compared to 94.8% in Fiscal 2007, increased by 0.9% or $4,075 primarily due to an increase in mobile audio sales as a result of

improved sales in the Company’s car audio and Satellite Radio product lines and increases in the electronics sales of the Company’s

International operations in Germany and Venezuela. Offsetting these increases were lower consumer electronic sales as a result of

lower than anticipated holiday sales and industry-wide shortages of LCD panels that adversely affected sales of LCD TV’s, portable

DVD’s and digital picture frames. Electronic sales also declined in certain mobile video categories due to increased OEM programs

that include the video system as “standard” on more and more vehicles and a decline in new car sales.

Accessories sales, which represented 26.1% of our net sales in Fiscal 2008 compared to 5.2% in Fiscal 2007, increased approximately

549.9% or $130,590 due to the incremental sales generated from the recently acquired Thomson Accessory, Oehlbach and Technuity

operations.

Gross margins have improved due to acquisitions and margin increases in our core business. We anticipate further increases in

margins through the introduction of new products with technologies that take advantage of market opportunities created by the digital

convergence of data, navigation and multi-media entertainment as well as future operating improvements.

Licensing and Royalties

We have various license and royalty programs with manufacturers, customers and other electronic suppliers. Such agreements entitle

us to receive license and royalty income for Audiovox products sold by the licensees without adding any significant costs. Depending

on the terms of each agreement, income is based on either a fixed amount per unit or percentage of net sales. Current license and

royalty agreements have duration periods, which range from 1 to 8 years, whereas other agreements are in perpetuity and certain

agreements may be renewed at the end of termination of the agreement. Certain renewals of license and royalty agreements are

dependent on negotiations with licensees as well as current Audiovox products being sold by the licensee.

8

Source: AUDIOVOX CORP, 10-K, May 14, 2008