Audiovox 2001 Annual Report Download

Download and view the complete annual report

Please find the complete 2001 Audiovox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AUDIOVOX

AUDIOVOX

A Clear Vision of Our Market Potential 2001 Annual Report

Table of contents

-

Page 1

AUDIOVOX A Clear Vision of Our Market Potential 2001 Annual Report -

Page 2

... distributors and retailers. Electronics: Our Electronics company, Audiovox Electronics Corp., is a wholly owned subsidiary that markets consumer and mobile electronics products. AEC markets its products through mass merchandisers, retailers, specialty retailers, distributors to new car dealers... -

Page 3

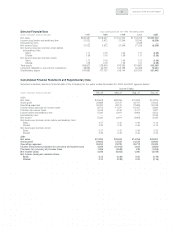

01 Audiovox 2001 Annual Report Selected Financial Data (Dollars in thousands, except per share data) Years ended November 30, 1997, 1998, 1999, 2000 and 2001: Net sales Income (loss) before extraordinary item Extraordinary item Net income (loss) Net income (loss) per common share before ... -

Page 4

... by Audiovox Electronics Corp. (AEC) as it exceeded sales and profit targets and finished with the best sales year in its history which helped the overall picture at Audiovox. During the year, AEC also made serious inroads in brand acceptance at major retailers such as Circuit City and Best Buy. In... -

Page 5

... the strong sales in the mobile video and consumer categories as well as entering two new markets-satellite radio and flat screen TV for the home. In addition, we plan to expand this business through acquisition and to that end, have purchased the assets of Code-Alarm, a security company with strong... -

Page 6

... wireless carriers and consumers. From entry-level handsets to sophisticated and powerful data and voice-capable Pocket PCs, Audiovox invites you to join us as we strive to keep everyone connected in this wireless world. Philip Christopher President & Chief Executive Officer Audiovox Communications... -

Page 7

COMMUNICATIONS "ACC will also build upon the successful launch of its Maestro Pocket PC by introducing Th¯ era, the next generation in our growing line of CDMAbased personal digital assistants." -

Page 8

... markets its products worldwide, maintaining operations centers and/or sales offices in the United States, Canada, Japan, Korea, Taiwan, Peru, Venezuela, and the Netherlands. ACC sells its wireless products to wireless carriers and their respective agents, distributors and retailers. Audiovox's key... -

Page 9

07 Audiovox 2001 Annual Report So, whether it is 1X, GPS-based location technology, Web browsers or the latest in sleek, hip-styling for a unique fashion accent, ACC is leading the way with cutting-edge products to meet every need, every level of sophistication and every budget. A Full Line of 3G ... -

Page 10

... in this market with the introduction of our new overhead DVD entertainment systems and an expanded line of do-it-yourself mobile video products. This year marks our company's entrance into the exciting new field of satellite radio. This new technology will take car audio receivers from analog... -

Page 11

ELECTRONICS " For the third year in a row, Mobile Electronics sales recorded a strong increase and this category continues to be our leader." -

Page 12

... " Our Consumer Electronics sales group had another record year as we benefited from increases in FRS and GMRS two-way radio sales. In addition, we were able to establish Audiovox as the number three supplier of portable DVD players, outselling some of the most famous brands in the industry... -

Page 13

... GMRS/GPS radios and base stations. In 2002 we will introduce a first to market 7 mile range GMRS. Home & Portable Stereo In addition to boom boxes, personal stereos and MP-3 players, the 2002 line includes home theater systems and our latest products, flat-screen TV's for the home. DVD Audiovox has... -

Page 14

...During fiscal 2001, we have continued to upgrade our IT systems to support our operations and incorporate new systems support as needed. New and improved systems have been developed for customer service, warranty support, increased B2B programs and refinements to our website. During fiscal 2001, our... -

Page 15

... Communications (Malaysia) Sdn. Bhd., Audiovox Holdings (M) Sdn. Bhd. and Audiovox Venezuela, C.A. The Electronics Group markets automotive sound and security systems, electronic car accessories, home and portable sound products, FRS radios, in-vehicle video systems, flat-screen televisions, DVD... -

Page 16

... and evaluating the reported consolidated financial results include the following: Revenue Recognition The Company recognizes revenue from product sales at the time of shipment and passage of title to the customer. The Company also records an estimate of returns. Management continuously monitors -

Page 17

... require the Company to repair or replace defective product returned to the Company during such warranty period at no cost to the customer. The Company records an estimate for warranty related costs based upon its actual historical return rates and repair costs at the time of sale, which are... -

Page 18

... Wireless products Activation commissions Residual fees Other Total Wireless Electronics Mobile electronics Sound Consumer electronics Other Total Electronics Total net sales Cost of sales 2000 2001 Percentage of Net Sales Years Ended November 30, 1999 Cost of sales Gross profit Selling General... -

Page 19

...hand-held market. However, even as Wireless and the wireless communications market continues to shift away from analog to digital technology, Wireless will continue, upon request by its customers, to sell analog telephones on a limited basis to specific customers to support specific carrier programs... -

Page 20

... The change to 1XXT and GPS phones requires extensive testing and software development which could delay entry into the market and affect our digital sales in the future. In addition, given the anticipated emergence of new technologies in the wireless industry, the Company will need to sell existing... -

Page 21

19 Audiovox Corporation and Subsidiaries Electronics Group sales were $278,264 in fiscal 2000, a 14.6% increase from sales of $242,855 in fiscal 1999. This increase was largely due to increased sales in the mobile video and consumer electronics product lines. Sales by the Company's international ... -

Page 22

...of $3,410 from fiscal 1999. The Company believes that the Electronics Group has an expanding market with a certain level of volatility related to both domestic and international new car sales and general economic conditions. Also, certain of its products are subject to price fluctuations which could... -

Page 23

... A common shares at a price to the public of $45.00 per share. Of the 3,565,000 shares sold, the Company offered 2,300,000 shares and 1,265,000 shares were offered by selling shareholders. Audiovox received approximately $96,573 after deducting expenses. The Company used these net proceeds to repay... -

Page 24

... in the future to support its working capital requirements or for other purposes, and may seek to raise such additional funds through the sale of public or private equity and/or debt financings as well as from other sources. No assurance can be given that additional financing will be available in... -

Page 25

... with the Company's policy on the recognition of such transactions. In February 2000 and 2001, the Board of Directors of Audiovox Communications Corp. (ACC), declared a dividend payable to its shareholders, Audiovox Corporation, a 95% shareholder, and Toshiba Corporation (Toshiba), a 5% shareholder... -

Page 26

... Toshiba Corporation (Toshiba). Toshiba owns 5% of the Company's Wireless subsidiary. Inventory on hand at November 30, 2001 purchased from Toshiba approximated $99,816. During the quarter ended November 30, 2001, the Company recorded a receivable in the amount of $4,550 from Toshiba for upgrades... -

Page 27

... Marketable securities at November 30, 2001, which are recorded at fair value of $5,777 and include net unrealized losses of $(1,647), have exposure to price risk. This risk is estimated as the potential loss in fair value resulting from a hypothetical 10% adverse change in prices quoted by stock... -

Page 28

... 2001 26 Audiovox Corporation and Subsidiaries (In thousands, except share data) 2000 2001 Assets Current assets: Cash Accounts receivable, net Inventory, net Receivable from vendor Prepaid expenses and other current assets Deferred income taxes, net Total current assets Investment securities... -

Page 29

...2001 27 Audiovox Corporation and Subsidiaries (In thousands, except per share data) Net sales Cost of sales Gross profit Operating expenses: Selling General...905 134,628 36,606 44,748 15,037 96,391 38,237 (4,712) 4,257 3,501 - 3,800 (2,360) 4,486 42,723 15,477 27,246 27,246 1.43 1.39 1.43 1.39 $ $... -

Page 30

... 1999, 2000 and 2001 28 Audiovox Corporation and Subsidiaries (In thousands, except share data) Preferred Common Stock Stock Paid-In Capital Accumulated Other Gain on CompreHedge of hensive AvailableRetained Income for-Sale Earnings (Loss) Securities Treasury Stock Total Stockholders' Equity... -

Page 31

... 2000 and 2001 29 Audiovox Corporation and Subsidiaries (...market value of investment security Deferred income tax benefit, net Extraordinary item (Gain) loss on disposal of property, plant and equipment, net Income tax benefit on exercise of stock options Changes in: Accounts receivable Receivable... -

Page 32

...2001 (Dollars in thousands, except share and per share data) 30 Audiovox Corporation and Subsidiaries (1) Summary of Significant Accounting Policies (a) Description of Business Audiovox Corporation and its subsidiaries (the Company) design and market a diverse line of products and provide related... -

Page 33

... emergence of new technologies in the wireless industry, the Company will need to sell existing inventory quantities of current technologies to avoid further write-downs to market. In particular, at November 30, 2001, the Company had on hand 575,000 units of a certain phone model, which approximated... -

Page 34

... after June 30, 2001. Statement 141 will require, upon adoption of Statement 142, that the Company evaluate its existing intangible assets and goodwill that were acquired in a prior purchase business combination, and make any necessary reclassifications in order to conform with the new criteria in... -

Page 35

... ranging from 90 days to the lifetime of the product. Warranty expenses are accrued at the time of sale based on the Company's estimated cost to repair expected returns for products. At November 30, 2000 and 2001, the liability for future warranty expense amounted to $8,263 and $9,165, respectively... -

Page 36

... with the Company's policy on the recognition of such transactions. In February 2000 and 2001, the Board of Directors of Audiovox Communications Corp. (ACC), declared a dividend payable to its shareholders, Audiovox Corporation, a 95% shareholder, and Toshiba Corporation (Toshiba), a 5% shareholder... -

Page 37

35 Audiovox Corporation and Subsidiaries During 2001, 314,800 warrants were exercised and converted into 314,800 shares of common stock (Note 16(d)). extended its option to repurchase the Property and AX Japan delayed its repayment of the loans for an additional six months. In March 2001, upon ... -

Page 38

...incurred by the Company for upgrades that were performed by the Company in 2001 on certain models which Toshiba manufactured. (7) Investment Securities As of November 30, 2000, the Company's investment securities consists of $3,273 of available-for-sale marketable securities which consist primarily... -

Page 39

...; ASA which acts as a distributor to specialized markets for RV's and van conversions, of televisions and other automotive sound, security and accessory products; and G.L.M. Wireless Communications, Inc. (G.L.M.) which is in the cellular telephone, pager and communications business in the New York... -

Page 40

... finance additional working capital needs. As of November 30, 2001, the available line of credit for direct borrowing, letters of credit, bankers' acceptances and other forms of credit approximated $5,242. The credit facilities are partially secured by three standby letters of credit of $1,300, $800... -

Page 41

...' equity: Unrealized holding gain (loss) on investment securities recognized for financial reporting purposes Unrealized holding gain (loss) on equity collar recognized for financial reporting purposes Income tax benefit of employee stock option exercises Total income tax expense (benefit) $15... -

Page 42

...Statements (Continued) 40 Audiovox Corporation and Subsidiaries The significant components of deferred income tax recovery for the years ended November 30, 2000 and 2001 are as follows: November 30, 2000 Deferred tax recovery (exclusive of the effect of other components listed below) Decrease in... -

Page 43

... common stock on the date of grant. The options must be exercisable no later than ten years after the date of grant. The vesting requirements are determined by the Board of Directors at the time of grant. Compensation expense is recorded with respect to the options based upon the quoted market value... -

Page 44

... Pro-forma Net income (loss) per common share (diluted): As reported Pro-forma $27,246 25,494 2000 $27,229 22,795 2001 $ (8,209) (10,496) date of grant. Compensation expense for the performance-restricted shares is recorded based upon the quoted market value of the shares on the balance sheet date... -

Page 45

... for contributions of $800, $1,000 and $300 were recorded by the Company for the United States plan in fiscal 1999, 2000 and 2001, respectively. Contributions required by law to be made for eligible employees in Canada were not material. (f) Deferred Compensation Plan Effective December 1, 1999, the... -

Page 46

... statements. During 1998, the Company entered into a sale/lease back transaction with its principal stockholder and chief executive officer for $2,100 of equipment. No gain or loss on the transaction was recorded as the book value of the equipment equaled the fair market value. The lease is for... -

Page 47

...reportable segments which are organized by products: Wireless and Electronics. The Wireless segment markets wireless handsets and accessories through domestic and international wireless carriers and their agents, independent distributors and retailers. The Electronics segment sells autosound, mobile... -

Page 48

... accounted for approximately 35% of the Company's 2001 sales. No customers in the Electronics segment exceeded 10% of consolidated sales in fiscal 1999, 2000 or 2001. Effective December 1, 1999, a non-Quintex retail operation, previously reported in the Wireless segment, has been included in the... -

Page 49

... ended November 30, 2001, the Company recorded a receivable in the amount of $4,550 from Toshiba for upgrades that were performed by the Company in 2001 on certain models which Toshiba manufactured. Subsequent to November 30, 2001, the amount was received in full. The Company engages in transactions... -

Page 50

...New York March 15, 2002 Market for the Registrant's Common Equity and Related Stockholder Matters Summary of Stock Prices and Dividend Data The Class A Common Stock of Audiovox are traded on the Nasdaq Stock Marketா under the symbol VOXX. No dividends have been paid on the Company's common stock... -

Page 51

... Lavelle Sr. Vice President, Audiovox Corporation President and Chief Executive Officer, Audiovox Electronics Corp. Ann M. Boutcher Vice President, Marketing Richard Maddia Vice President, MIS Dennis McManus Vice President, New Product Marketing, LSSi Corp. Paul C. Kreuch, Jr. Managing Director... -

Page 52

150 Marcus Boulevard Hauppauge, New York 11788 (631) 231-7750