Atmos Energy 2007 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2007 Atmos Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

9

BRIDGING THE FUTURE

expect continued strong results from our regulated intrastate

pipeline, Atmos Pipeline–Texas, due to the drilling boom in the

Barnett Shale and other gas basins in Texas.

In our nonregulated gas marketing business, we expect

earnings in 2008 to be lower than in 2007. Volatile gas prices after

Hurricanes Katrina and Rita helped our gas marketing operations

maximize margins and increase sales volumes in fiscal 2006 and

into 2007. With natural gas production in the Gulf of Mexico

now back to normal, spreads between what we pay for gas and

what we sell it for are less. Therefore, the margins in our gas

marketing business are likely to return to more historical levels.

Our nonregulated operations are continuing to add major new

customers. Our dedication to serving our customers over the

years is helping us retain a high proportion of them year after

year in a business based on competitive commodity pricing.

In addition, we are offering customers numerous services

for asset optimization using our nonregulated pipeline and

storage operations. In these ways, we provide added value in

our relationships with our nonregulated customers.

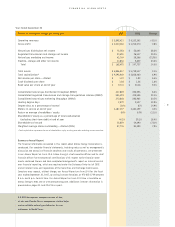

For fiscal 2008, we estimate earnings per diluted share will

range from $1.95 to $2.05*. We expect our dividend to continue

increasing annually, with a dividend payout ratio at about 65

percent, which is consistent with our peers in the natural gas

utility industry.

Our capital investments in fiscal 2007 totaled $392 million.

For fiscal 2008, we expect to invest between $445 million and

$465 million. About 70 percent of our invested capital will go for

maintenance projects and the other 30 percent for growth

projects, such as new pipeline expansion, gas gathering systems,

marketing operations or storage facilities.

BRIDGING TO OUR FUTURE

Fiscal 2007 was a pivotal year for Atmos Energy. Not only did

we maintain our pace of earnings growth in the face of some

strong headwinds, but we also adjusted our course toward new

opportunities. We’re now pursuing a number of ventures that

could deliver significant long-term benefits.

Many of these ventures are extensions into closely related

operating areas, such as gas gathering systems, which have

common characteristics with our pipeline operations. These

ventures can take advantage of our existing management and

technical skills and financial strength. In addition, they can

add new services to expand our customer base.

We have strengthened our balance sheet by reducing our

debt-to-capitalization ratio to below 55 percent. This has been

our consistent practice after making acquisitions. Today we are

in an excellent position to acquire properties or invest in

internal projects, regulated and nonregulated.

In only a decade’s time, we have grown to become a $6 billion

company in both revenues and assets. Our board of directors

has carefully guided our growth through the years and has

prepared us for future opportunities. I thank them for their con-

stant support and wise counsel that have brought us to this point.

In November 2007, Richard W. Douglas joined our board

of directors. Mr. Douglas is executive vice president and a

member of the executive committee of The Staubach Company, a

global real estate advisory firm. He brings a wealth of expertise

in commercial real estate, business investments, economic

development and municipal government.

Our future looks bright; however, it rests not on our current

assets or future projects. Our future is in the people who keep

Atmos Energy financially strong and efficient. From our founding

a century ago, we have benefited from the loyalty of our

shareholders and investors. Equally, our employees have exhibited

a deep sense of responsibility to serve the needs of both our

customers and investors. Together, this immutable bond

between capital and labor has created our success and it

provides the bridge to our future.

Robert W. Best

Chairman, President and Chief Executive Officer

November 27, 2007

* Our estimated earnings per share for fiscal 2008 are based on assumptions that

include: less volatility in natural gas prices affecting our natural gas marketing seg-

ment, successful rate cases and collection efforts, normal weather, bad-debt expense

not exceeding $20 million, average annual short-term interest at 6.5%, average cost of

natural gas ranging from $7.95 to $10.00 per thousand cubic feet (Mcf), and no mate-

rial acquisitions.