Asus 2012 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2012 Asus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221

|

|

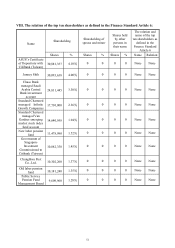

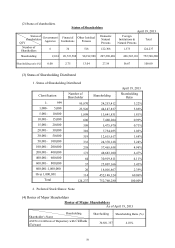

60

Shareholding

Shareholder’s Name

Shareholding Shareholding Ratio (%)

Jonney Shih 30,093,638 4.00%

Standard Chartered managed Van Gardner

emerging market stock index fund account 24,831,445 3.30%

Standard Chartered managed Infinite Growth

Companies 17,730,000 2.36%

Chase Bank managed Saudi Arabia Central Bank

investment account 14,640,958 1.94%

New labor pension fund 11,478,980 1.52%

Governemnt of Singapore Investment

Commissioned to Citibank (Taiwan) 10,882,358 1.45%

Chunghwa Post Co., Ltd. 10,302,200 1.37%

Old labor pension fund 10,181,240 1.35%

Public Service Pension Fund Management Board 9,609,960 1.28%

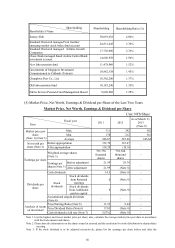

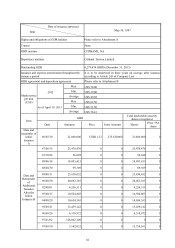

(5) Market Price, Net Worth, Earnings & Dividend per Share of the Last Two Years

Market Price, Net Worth, Earnings & Dividend per Share

Unit: NT$/Share

Fiscal year

Item 2011 2012

As of March 31,

2013

(Note 9)

Market price per

share

(Note 1) (Note 3)

Max. 311 342 382

Min. 178 212 316

Average 246.87 287.28 345.64

Net worth per

share (Note 2)

Before appropriation 152.70 167.47 -

After appropriation 138.20 (ຏ8)

Earnings per share

Weighted average shares

(Note 3)

753,776

thousand

shares

752,760

thousand

shares

-

Earnings per

shares (Note 3)

Before adjustment 21.99 29.79 -

After adjustment 21.99 (Note 8)

Dividends per

share

Cash dividends 14.5 (Note 8) -

Stock

dividends

Stock dividends

from Retained

earnings

0 (Note 8) -

Stock dividends

from Additional

paid-in capital

0 (Note 8) -

Accumulated unpaid dividends

(Note 4) - - -

Analysis of return

on investment

Price/Earning Ratio (Note 5) 11.23 9.64 -

Price/Dividend Ratio (Note 6) 17.03 (Note 8) -

Cash dividends yield rate (Note 7) 5.87ʘ(Note 8) -

Note 1: List the highest and lowest market price per share; also, calculate the average market price per share in accordance

with the trade amount and shares.

Note 2: Please base the information on the shares issued at yearned and the resolution for stock distribution in shareholders

meeting.

Note 3: If the stock dividend is to be adjusted retroactively, please list the earnings per share before and after the