Ally Bank 2012 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2012 Ally Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.10

• Truth in Lending Act — The Truth in Lending Act (TILA), as amended, and Regulation Z, which implements TILA, requires

lenders to provide borrowers with uniform, understandable information concerning terms and conditions in certain credit

transactions. These rules apply to Ally and its subsidiaries in transactions in which they extend credit to consumers and require, in

the case of certain mortgage and automotive financing transactions, conspicuous disclosure of the finance charge and annual

percentage rate, if any. In addition, if an advertisement for credit states specific credit terms, Regulation Z requires that such

advertisement state only those terms that actually are or will be arranged or offered by the creditor. The Consumer Financial

Protection Bureau has recently issued substantial amendments to the mortgage requirements under TILA, and additional changes

are likely in the future. Failure to comply with TILA can result in liability for damages as well as criminal and civil penalties.

• Sarbanes-Oxley Act — The Sarbanes-Oxley Act of 2002 implemented a broad range of corporate governance and accounting

measures designed to promote honesty and transparency in corporate America. The principal provisions of the act include, among

other things, (1) the creation of an independent accounting oversight board; (2) auditor independence provisions that restrict non-

audit services that accountants may provide to their audit clients; (3) additional corporate governance and responsibility measures

including the requirement that the principal executive and financial officers certify financial statements; (4) the potential forfeiture

of bonuses or other incentive-based compensation and profits from the sale of an issuer's securities by directors and senior officers

in the twelve-month period following initial publication of any financial statements that later require restatement; (5) an increase in

the oversight of and enhancement of certain requirements relating to audit committees and how they interact with the independent

auditors; (6) requirements that audit committee members must be independent and are barred from accepting consulting, advisory,

or other compensatory fees from the issuer; (7) requirements that companies disclose whether at least one member of the audit

committee is a “financial expert” (as defined by the SEC) and, if not, why the audit committee does not have a financial expert;

(8) a prohibition on personal loans to directors and officers, except certain loans made by insured financial institutions, on

nonpreferential terms and in compliance with other bank regulatory requirements; (9) disclosure of a code of ethics;

(10) requirements that management assess the effectiveness of internal control over financial reporting and that the Independent

Registered Public Accounting firm attest to the assessment; and (11) a range of enhanced penalties for fraud and other violations.

• USA PATRIOT Act/Anti-Money-Laundering Requirements — In 2001, the Uniting and Strengthening America by Providing

Appropriate Tools Required to Intercept and Obstruct Terrorism Act (USA PATRIOT Act) was signed into law. Title III of the

USA PATRIOT Act amends the Bank Secrecy Act and contains provisions designed to detect and prevent the use of the

U.S. financial system for money laundering and terrorist financing activities. The Bank Secrecy Act, as amended by the USA

PATRIOT Act, requires bank holding companies, banks, and certain other financial companies to undertake activities including

maintaining an anti-money-laundering program, verifying the identity of clients, monitoring for and reporting on suspicious

transactions, reporting on cash transactions exceeding specified thresholds, and responding to requests for information by regulatory

authorities and law enforcement agencies. We have implemented internal practices, procedures, and controls designed to comply

with these anti-money-laundering requirements.

• Community Reinvestment Act — Under the Community Reinvestment Act (CRA), a bank has a continuing and affirmative

obligation, consistent with the safe-and-sound operation of the institution, to help meet the credit needs of its entire community,

including low- and moderate-income persons and neighborhoods. The CRA does not establish specific lending requirements or

programs for financial institutions. However, institutions are rated on their performance in meeting the needs of their communities.

Failure by Ally Bank to maintain a satisfactory or better rating under the CRA may adversely affect Ally's ability to make

acquisitions, engage in new activities, and become a financial holding company.

• Other — Our U.S. mortgage business has subsidiaries that are required to maintain regulatory capital requirements under

agreements with the GSEs and the Department of Housing and Urban Development.

Employees

We had approximately 10,600 and 14,800 employees at December 31, 2012 and 2011, respectively. Employees of operations held-for-

sale are included within our employee count at December 31, 2012, and 2011. Employees of operations that were deconsolidated during 2012

are included only within our employee count at December 31, 2011.

Additional Information

The results of operations for each of our reportable operating segments and the products and services offered are contained in the

individual business operations sections of Management's Discussion and Analysis of Financial Condition and Results of Operations. Financial

information related to reportable operating segments and geographic areas is provided in Note 26 to the Consolidated Financial Statements.

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K (and amendments to these

reports) are available on our internet website, free of charge, as soon as reasonably practicable after the reports are electronically filed with or

furnished to the SEC. These reports are available at www.ally.com. Choose Investor Relations, Financial Information, and then SEC Filings

(under About Ally). These reports can also be found on the SEC website at www.sec.gov.

Item 1A. Risk Factors

Our businesses face many risks and uncertainties, any of which could result in a material adverse effect on our results of operations or

financial condition. We believe that the most significant of the risks and uncertainties that we face are described below. This Form 10-K is

qualified in its entirety by these risk factors.

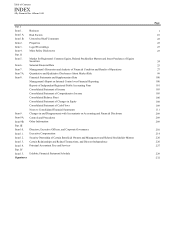

Table of Contents

Ally Financial Inc. • Form 10-K