Ally Bank 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Ally Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2012 or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For the transition period from to

Commission file number: 1-3754

ALLY FINANCIAL INC.

(Exact name of registrant as specified in its charter)

Delaware 38-0572512

(State or other jurisdiction of (I.R.S. Employer

incorporation or organization) Identification No.)

200 Renaissance Center

P.O. Box 200 Detroit, Michigan

48265-2000

(Address of principal executive offices)

(Zip Code)

(866) 710-4623

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act (all listed on the New York Stock Exchange):

Title of each class

10.30% Deferred Interest Debentures due June 15, 2015 7.375% Notes due December 16, 2044

7.30% Public Income Notes (PINES) due March 9, 2031 Fixed Rate/Floating Rate Perpetual Preferred Stock, Series A

7.35% Notes due August 8, 2032 8.125% Fixed Rate/Floating Rate Trust Preferred Securities,

Series 2 of GMAC Capital Trust I

7.25% Notes due February 7, 2033

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days. Yes No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months

(or for such shorter period that the registrant was required to submit and post such files). Yes No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K (§ 229.405 of this chapter) is not contained

herein and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference

in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange

Act. (Check one):

Large accelerated filer Accelerated filer Non-accelerated filer Smaller reporting company

(Do not check if a smaller reporting)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes No

Aggregate market value of voting and nonvoting common equity held by nonaffiliates: Ally Financial Inc. common equity is not registered

with the Securities and Exchange Commission and there is no ascertainable market value for such common equity.

At February 28, 2013, the number of shares outstanding of the Registrant’s common stock was 1,330,970 shares.

Documents incorporated by reference. None.

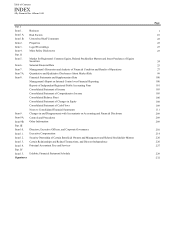

Table of Contents

Table of contents

-

Page 1

...% Fixed Rate/Floating Rate Trust Preferred Securities, Series 2 of GMAC Capital Trust I Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes No Aggregate market value of voting and nonvoting common equity held by nonaffiliates: Ally Financial... -

Page 2

... Statements Changes in and Disagreements with Accountants on Accounting and Financial Disclosure Controls and Procedures Other Information Directors, Executive Officers, and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related... -

Page 3

... of deposit, savings accounts, money market accounts, IRA (individual retirement account) deposit products, as well as an online checking product. We continue to expand the product offerings in our banking platform in order to meet customer needs. Ally Bank's assets and operating results are... -

Page 4

... form of installment sales financing. During 2012, we originated a total of 1.5 million automotive loans and leases totaling approximately $38.7 billion. Our consumer automotive financing operations generate revenue through finance charges or lease payments and fees paid by customers on the retail... -

Page 5

...mortgage loans totaling $32.5 billion in the United States. Conforming and government-insured residential mortgage loans comprised 93.2% of our 2012 originations, which, in the ordinary course of business, are sold to the Federal National Mortgage Association (Fannie Mae), Federal Home Loan Mortgage... -

Page 6

... operations. Our Commercial Finance Group provides senior secured commercial-lending products to primarily U.S.-based middle market companies. Ally Bank Ally Bank raises deposits directly from customers through direct banking via the internet, telephone, mobile, and mail channels. Ally Bank... -

Page 7

... Ally must operate and affect how it plans capital and liquidity levels; subject Ally to new and/or higher fees paid to various regulatory entities, including but not limited to deposit insurance fees paid by Ally Bank to the FDIC; impact a number of Ally's business and risk management strategies... -

Page 8

... financial protection provisions of the Dodd-Frank Act and related requirements. Many of these proposed rules, when finalized, will impose new requirements on Ally and its business operations. In addition, as an insured depository institution with total assets of more than $10 billion, Ally Bank... -

Page 9

... grow Ally Bank's business will be affected by the Affiliate Transaction Restrictions and the conditions set forth in the existing exemption letters. • Source of Strength - Pursuant to the Federal Deposit Insurance Act, FRB policy and regulations and the Parent Company Agreement and the Capital... -

Page 10

... insured by the FDIC, and Ally Bank is required to file periodic reports with the FDIC concerning its financial condition. Total assets of Ally Bank were $94.8 billion and $85.3 billion at December 31, 2012 and 2011, respectively. As a commercial nonmember bank chartered by the State of Utah, Ally... -

Page 11

... to applicable state laws generally governing insurance companies, as well as laws and regulations for products that are not regulated as insurance, such as vehicle service contracts and guarantees asset protection waivers. Investments in Ally Because Ally Bank is an FDIC-insured bank and Ally and... -

Page 12

... reports are available at www.ally.com. Choose Investor Relations, Financial Information, and then SEC Filings (under About Ally). These reports can also be found on the SEC website at www.sec.gov. Item 1A. Risk Factors Our businesses face many risks and uncertainties, any of which could result... -

Page 13

... of Ally Bank, such as asset securitization or financings in the capital markets, could be more expensive than funding through Ally Bank and could adversely affect our business prospects, results of operations and financial condition. We are subject to new capital planning and systemic risk regimes... -

Page 14

... Ally as suffering from financial or management weaknesses. The systemic risk provisions, when implemented, could adversely affect our business prospects, results of operations, and financial condition. Our ability to rely on deposits as a part of our funding strategy may be limited. Ally Bank... -

Page 15

... with which Ally must operate and how it plans capital and liquidity levels; subject Ally to new and/or higher fees paid to various regulatory entities, including but not limited to deposit insurance fees to the FDIC; impact a number of Ally's business and risk management strategies; restrict the... -

Page 16

..., injunctions, or other actions. Our business, financial position, and results of operations could be adversely affected by the impact of affiliate transaction restrictions imposed in connection with certain financing transactions. Certain transactions between Ally Bank and any of its nonbank... -

Page 17

...of GM and Chrysler. GM and Chrysler dealers and their retail customers compose a significant portion of our customer base, and our Dealer Financial Services operations are highly dependent on GM and Chrysler production and sales volume. In 2012, 63% of our U.S. new vehicle dealer inventory financing... -

Page 18

... Financial, which could enhance Chrysler Financial's ability to expand its product offerings and may result in increased competition. Ally Bank faces significant competition from commercial banks, savings institutions, mortgage companies, and other financial institutions. Our insurance business... -

Page 19

... servicing agreement with Ally Bank; (c) all state and federal law claims or causes of action the Debtors proposed to release as part of the Plan; and (d) the release of all existing or potential ResCap-related causes of action against AFI held by third parties. In the Examiner's original work plan... -

Page 20

... earnings are sensitive to general business and economic conditions in the United States. A downturn in economic conditions resulting in increased short and long term interest rates, inflation, fluctuations in the debt capital markets, unemployment rates, consumer and commercial bankruptcy filings... -

Page 21

... may default on their sovereign debt, and recent rating agency actions with respect to European countries and the United States and the resulting impact on the financial markets, could have a material adverse impact on our business, results of operations and financial position. The current crisis in... -

Page 22

... on our business, financial condition, and results of operations. Our borrowing costs and access to the unsecured debt capital markets depend significantly on our credit ratings. The cost and availability of unsecured financing are materially affected by our short- and long-term credit ratings. Each... -

Page 23

...-lease vehicles; and will generally reduce the value of automotive financing loans and contracts and retained interests and fixed income securities held in our investment portfolio. Throughout 2009 and 2010 the credit risk embedded in the balance sheet was reduced as a result of asset sales, asset... -

Page 24

... economies and applicable laws in these and other states could have an adverse effect on our business, results of operations and financial position. Item 1B. Unresolved Staff Comments None. Item 2. Properties Our principal corporate offices are located in Detroit, Michigan; New York, New York; and... -

Page 25

Table of Contents Ally Financial Inc. • Form 10-K office for our Insurance operations is located in Southfield, Michigan, where we lease approximately 71,000 square feet of office space under leases expiring in April 2016. The primary offices for our Mortgage operations are located in Fort ... -

Page 26

... Stock For a discussion of preferred stock currently outstanding, refer to Note 18 to the Consolidated Financial Statements. Unregistered Sales of Equity Securities Ally did not have any unregistered sales of its equity securities in fiscal year 2012, except as previously disclosed on Form 8-K. 24 -

Page 27

... on the extinguishment of debt, primarily related to private exchange and cash tender offers settled during the fourth quarter. Effective June 30, 2009, we converted from a limited liability company into a corporation and, as a result, became subject to corporate U.S. federal, state, and local taxes... -

Page 28

...sheet data: Total assets Long-term debt Preferred stock/interests (a) Total equity Financial ratios Efficiency ratio (b) Core efficiency ratio (b) Return on assets (c) Net income (loss) from continuing operations Net income (loss) Core pretax (loss) income Return on equity (c) Net income (loss) from... -

Page 29

... relationship with General Motors Company (GM) and have developed strong relationships directly with GMfranchised dealers. We are a preferred financing provider to GM and Chrysler Group LLC (Chrysler) (including Fiat) for incentivized retail loans. Our agreements with GM and Chrysler expire on... -

Page 30

... in the United States. As a result of the bankruptcy filing, ResCap was deconsolidated from our financial statements; and beginning in the second quarter of 2012, we began presenting our mortgage business activities under one reportable operating segment, Mortgage operations. Previously our Mortgage... -

Page 31

...to develop long-term customer relationships and capitalize on the shift in consumer preference for direct banking. Ally Bank offers a full spectrum of deposit product offerings, such as checking, savings, and certificates of deposit (CDs), as well as 48month raise your rate CDs, IRA deposit products... -

Page 32

... Deposit Insurance Corporation (FDIC) and the Utah Department of Financial Institutions (UDFI). Ally Financial Inc. is subject to the supervision and examination of the Board of Governors of the Federal Reserve System (FRB). We are required to comply with regulatory risk-based and leverage capital... -

Page 33

... $5.9 billion in New MCP. As a result of its current common stock investment, Treasury is entitled to appoint six of the eleven total members of the Ally Board of Directors. The following table summarizes the investments in Ally made by Treasury in 2008 and 2009. ($ in millions) TARP GM Loan... -

Page 34

... operations Mortgage operations Corporate and Other Total Income (loss) from continuing operations before income tax (benefit) expense Dealer Financial Services Automotive Finance operations Insurance operations Mortgage operations Corporate and Other Total n/m = not meaningful 2012 2011 2010... -

Page 35

... the retail loan and operating lease portfolios. Additional favorability for the year ended December 31, 2012 was primarily the result of a more favorable servicing asset valuation, net of hedge, compared to the same period in 2011, higher fee income and net origination revenue related to increased... -

Page 36

...ResCap. Insurance premiums and service revenue earned decreased 9% for the year ended December 31, 2012, compared to 2011, primarily due to declining U.S. vehicle service contracts written between 2007 and 2009 as a result of lower domestic vehicle sales volume. Gain on mortgage and automotive loans... -

Page 37

... insurance operations during the fourth quarter of 2010 and lower earnings from our U.S. vehicle service contracts written between 2007 and 2009 due to lower domestic vehicle sales volume. Gain on mortgage and automotive loans decreased 62% for the year ended December 31, 2011, compared to 2010... -

Page 38

... Contents Management's Discussion and Analysis Ally Financial Inc. • Form 10-K Dealer Financial Services Results for Dealer Financial Services are presented by reportable segment, which includes our Automotive Finance and Insurance operations. Automotive Finance Operations Results of Operations... -

Page 39

...of earning assets, primarily as a result of growth in the retail loan and lease portfolios. Depreciation expense on operating lease assets increased 49% for the year ended December 31, 2012, compared to 2011, primarily due to higher lease asset balances as a result of strong lease origination volume... -

Page 40

...Buyer's Choice product on new GM and Chrysler vehicles to select states in the United States. The Ally Buyer's Choice financing product allows customers to own their vehicle with a fixed rate and payment with the option to sell it to us at a pre-determined point during the contract term and at a pre... -

Page 41

... % Share of consumer sales 2011 38 32 2010 38 45 The decline in consumer automotive financing volume in 2012, compared to 2011, was primarily driven by lower retail penetration at both GM and Chrysler in the United States. Additionally, both used and non-GM/Chrysler originations were higher due to... -

Page 42

...Contents Management's Discussion and Analysis Ally Financial Inc. • Form 10-K The following table presents the total U.S. consumer origination dollars and percentage mix by product type. Consumer automotive financing originations Year ended December 31, ($ in billions) GM new vehicles New retail... -

Page 43

..., we financed an average of $2.2 billion of new non-GM/Chrysler vehicles and $3.0 billion of used vehicles. Wholesale credit is arranged through lines of credit extended to individual dealers. In general, each wholesale credit line is secured by all vehicles and typically by other assets owned by... -

Page 44

...statement. Generally, dealers remit payments to us through wire transfer transactions initiated by the dealer through a secure web application. Dealers are assigned a risk rating based on various factors, including capital sufficiency, operating performance, financial outlook, and credit and payment... -

Page 45

...personal lines business during the second quarter of 2012. Insurance losses and loss adjustment expenses totaled $454 million for the year ended December 31, 2012, compared to $452 million for the year ended December 31, 2011. The slight increase was driven primarily by higher weather-related losses... -

Page 46

...contracts New retail Used retail Reinsurance Total vehicle service contracts Wholesale Other finance and insurance (a) North American operations International and Corporate (b) Total (a) (b) 2012 $ 406 509 (119) 796 132 129 1,057 4 $ 1,061 $ $ 2011 376 514 (103) 787 115 133 1,035 4 1,039 $ $ 2010... -

Page 47

...our Insurance operations cash and investment portfolio at fair value. December 31, ($ in millions) Cash Noninterest-bearing cash Interest-bearing cash Total cash Available-for-sale securities Debt securities U.S. Treasury and federal agencies Foreign government Mortgage-backed Asset-backed Corporate... -

Page 48

... 14, 2012) and the mortgage operations of Ally Bank. Refer to Note 1 to the Consolidated Financial Statements for further details on ResCap. The amounts presented are before the elimination of balances and transactions with our other reportable segments. Favorable/ (unfavorable) 2012-2011 % change... -

Page 49

... in our broker, retail, and servicing operations. Loan Production U.S. Mortgage Loan Production Channels Ally Bank continues to perform certain mortgage activities as a result of the ResCap bankruptcy process. Subsequent to the bankruptcy filing, ResCap announced the sale of certain assets to third... -

Page 50

...) Ally Bank ResCap Total U.S. production Mortgage Loan Production by Type We intend to continue to originate a modest level of jumbo and conventional conforming residential mortgages for our held-forinvestment portfolio through a select group of correspondent lenders. During 2012, 2011, and 2010... -

Page 51

... had total warehouse line of credit commitments of $2.8 billion, against which we had $1.9 billion of advances outstanding. Loans Outstanding Consumer mortgage loans held-for-sale and consumer mortgage loans held-for-investment as of December 31, 2012, represent loans held by Ally Bank. ResCap was... -

Page 52

...insurance premiums, counsel or otherwise work with delinquent borrowers, supervise foreclosures and property dispositions, and generally administer the loans. The majority of our serviced mortgage assets are subserviced by GMAC Mortgage, LLC, a subsidiary of ResCap, pursuant to a servicing agreement... -

Page 53

..., and reclassifications and eliminations between the reportable operating segments. Our Commercial Finance Group provides senior secured commercial-lending products to primarily U.S.-based middle market companies. Favorable/ (unfavorable) 2012-2011 % change (20) 62 1 31 32 (131) (18) (88) (134... -

Page 54

... in the United States. Refer to Note 1 to the Consolidated Financial Statements for additional information related to ResCap. Additionally, higher losses for the year ended December 31, 2012 were impacted by the early prepayment of certain Federal Home Loan Bank debt to further reduce funding costs... -

Page 55

...and federal agencies U.S. states and political subdivisions Foreign government Mortgage-backed Asset-backed Other debt (a) Total debt securities Equity securities Total available-for-sale securities Total cash and securities (a) Includes intersegment eliminations. 2012 $ 944 5,942 6,886 - - $ 2011... -

Page 56

... leadership team. The Board sets the risk appetite across our company while the risk committees and executive leadership team identify and monitor potential risks and manage the risk to be within our risk appetite. Ally's primary risks include credit, lease residual, market, operational, insurance... -

Page 57

...loans Dealer Financial Services Mortgage operations Corporate and Other Total held-for-sale loans Total on-balance sheet loans Off-balance sheet securitized loans Dealer Financial Services Mortgage operations Corporate and Other Total off-balance sheet securitized loans Operating lease assets Dealer... -

Page 58

... and monitor that credit risk exposures are managed in a safe-and-sound manner and are within our risk appetite. In addition, our Global Loan Review Group provides an independent assessment of the quality of our credit portfolios and credit risk management practices, and directly reports its... -

Page 59

... executed on our strategy of discontinuing and selling or liquidating nonstrategic operations. Refer to Note 2 to the Consolidated Financial Statements for additional information. The following table presents our total on-balance sheet consumer and commercial finance receivables and loans reported... -

Page 60

... the applicant's financial condition after approval could negatively affect the quality of our receivables portfolio, resulting in loan losses. Our servicing activities are another key factor in managing consumer credit risk. Servicing activities consist largely of collecting and processing customer... -

Page 61

... billion at December 31, 2012 compared with December 31, 2011. This decrease was related to the reclassification of foreign Automotive Finance operations to discontinued operations. This was partially offset by an increase in our core domestic business driven by automobile consumer loan originations... -

Page 62

Table of Contents Management's Discussion and Analysis Ally Financial Inc. • Form 10-K The following table includes consumer net charge-offs from finance receivables and loans at historical cost and related ratios reported at carrying value before allowance for loan losses. Net charge-offs Year ... -

Page 63

...0.8 1.9 2.0 44.2 - 100.0% 2011 1st Mortgage and home equity 5.5% 25.7 4.0 4.8 1.6 5.0 2.3 1.0 1.8 2.1 45.9 0.3 100.0% December 31, Texas California Florida Michigan Pennsylvania Illinois New York Ohio Georgia North Carolina Other United States Foreign (b) Total consumer loans (a) (b) Automobile 12... -

Page 64

... were no high original LTV mortgage loans or payment-option adjustable-rate mortgage loans classified as nonperforming or 90 days past due and still accruing at December 31, 2012 and December 31, 2011. The allowance for loan losses was $104 million, or 4.6%, of total higher-risk held-for-investment... -

Page 65

... States Total higher-risk mortgage loans 2011 California Virginia Maryland Illinois Michigan Other United States Total higher-risk mortgage loans Commercial Credit Portfolio Our commercial portfolio consists primarily of automotive loans (wholesale floorplan, dealer term loans including real estate... -

Page 66

...Ally Financial Inc. • Form 10-K The following table includes total commercial finance receivables and loans reported at carrying value before allowance for loan losses. Outstanding December 31, ($ in millions) Domestic Commercial and industrial Automobile Mortgage Other (c) Commercial real estate... -

Page 67

... of Contents Management's Discussion and Analysis Ally Financial Inc. • Form 10-K The following table includes total commercial net charge-offs from finance receivables and loans at historical cost and related ratios reported at carrying value before allowance for loan losses. Net charge-offs... -

Page 68

...for loan losses. December 31, Geographic region Texas Michigan Florida California New York Virginia North Carolina Pennsylvania Georgia Tennessee Other United States Foreign Total commercial real estate finance receivables and loans Property type Automotive dealers Other Total commercial real estate... -

Page 69

... the stated terms of the commercial loan agreements. This portfolio is reported at carrying value before allowance for loan losses. December 31, 2012 ($ in millions) Commercial and industrial Commercial real estate Total domestic Foreign Total commercial finance receivables and loans Loans at fixed... -

Page 70

... and Analysis Ally Financial Inc. • Form 10-K The allowance for commercial loan losses declined $78 million at December 31, 2012, compared to December 31, 2011, primarily related to the ongoing strength in dealer performance, the reclassification of foreign Automotive Finance operations to... -

Page 71

... Home equity Total foreign Total consumer loans Commercial Domestic Commercial and industrial Automobile Mortgage Other Commercial real estate Automobile Mortgage Total domestic Foreign Commercial and industrial Automobile Mortgage Other Commercial real estate Automobile Mortgage Total foreign Total... -

Page 72

... and Analysis Ally Financial Inc. • Form 10-K Provision for Loan Losses The following table summarizes the provision for loan losses by product type. Year ended December 31, ($ in millions) Consumer Domestic Consumer automobile Consumer mortgage 1st Mortgage Home equity Total domestic Foreign... -

Page 73

... rates, equity prices, market perceptions of credit risk, and other market fluctuations that affect the value of securities, assets held-for-sale, and operating leases. We are exposed to interest rate risk arising from changes in interest rates related to financing, investing, and cash management... -

Page 74

...and stresses to certain term points on the yield curve in isolation to capture and monitor a number of risk types. Included in our forward-looking forecast is the planned sale of our international and Canadian operations. These instruments were moved to discontinued operations at year end 2012 based... -

Page 75

..., risk and control assessment and testing, risk monitoring, and transparency through risk reporting mechanisms. The goal is to maintain operational risk at appropriate levels in view of our financial strength, the characteristics of the businesses and the markets in which we operate, and the related... -

Page 76

... Kingdom 2011 (b) Canada Germany United Kingdom (a) (b) Banks $ 396 10 265 $ 343 47 311 Sovereign $ 305 30 - $ 250 32 6 $ $ Other 190 3 16 451 5 13 Derivatives $ 6 450 237 20 576 1,356 As we continue to execute on our strategy of selling or liquidating our nonstrategic operations, our total... -

Page 77

... funding plans, evaluate the adequacy of liquidity buffers, review stress testing results, and assist senior management in the execution of its structured funding strategy and risk management accountabilities. We maintain available liquidity in the form of cash, unencumbered highly liquid securities... -

Page 78

... to remain active in the securitization markets to finance our Ally Bank automotive loan portfolios. During 2012, Ally Bank completed eleven term securitization transactions backed by retail and dealer floorplan automotive loans and lease notes raising $11.8 billion. Securitization has proven to be... -

Page 79

... the availability of eligible assets to collateralize the incremental funding and, in some instances, the funding also relies on the execution of interest rate hedges. Funding sources at the parent company generally consist of longer-term unsecured debt, unsecured retail term notes, committed credit... -

Page 80

... 2012 Secured financings Institutional term debt Retail debt programs (a) Bank loans and other Total debt (b) Deposits (c) Total on-balance sheet funding 2011 Secured financings Institutional term debt Retail debt programs (a) Temporary Liquidity Guarantee Program (d) Bank loans and other Total debt... -

Page 81

...of our Commercial Finance Group. Funding is generally available for assets originated by Ally Bank or the parent company, Ally Financial Inc. Uncommitted Funding Facilities Outstanding December 31, ($ in billions) Bank funding Secured - U.S. Federal Reserve funding programs FHLB advances Total bank... -

Page 82

... 31, 2012. In 2011, cash from issuances of long-term debt exceed repayments by $4.3 billion. Capital Planning and Stress Tests As a bank holding company with $50 billion or more of consolidated assets, Ally is required to conduct periodic stress tests and submit a proposed capital action plan to... -

Page 83

... or adjust to fair value for fair value-elected loans. At December 31, 2012 and 2011, $68.0 billion and $78.5 billion of our total assets, respectively, were related to secured financings. Refer to Note 16 to the Consolidated Financial Statements for further discussion. As part of our securitization... -

Page 84

... and Obligations Related to Loan Sales ResCap Bankruptcy Filing As described in Note 1 and Note 29 to the Consolidated Financial Statements, on May 14, 2012, Residential Capital, LLC (ResCap) and certain of its wholly owned direct and indirect subsidiaries (collectively, the Debtors) filed voluntary... -

Page 85

... payment where claims are not valid. The risk of repurchase or indemnification and the associated credit exposure is managed through underwriting and quality assurance practices and by servicing mortgage loans to meet investor standards. Ally Bank believes that, in general, the longer a loan... -

Page 86

... interest payments for fixed-rate long-term debt Estimated interest payments for variable-rate long-term debt (b) Estimated net payments under interest rate swap agreements (b) Originate/purchase mortgages or securities Commitments to provide capital to investees Home equity lines of credit Lending... -

Page 87

...assets declined 72% or $3.4 billion primarily due to the deconsolidation of ResCap during the year ended December 31, 2012, which resulted in a significant decline in mortgage servicing rights, mortgage loans held-for-sale, net, and consumer mortgage finance receivables and loans, net. Refer to Note... -

Page 88

..., Commercial Finance Group, and Mortgage operations. As of December 31, 2012, we no longer have any commercial loans within our mortgage operations. These loans are primarily evaluated individually and are risk-rated based on borrower, collateral, and industry-specific information that management... -

Page 89

... the asset. There were no such impairment charges in 2012, 2011, or 2010. Our depreciation methodology on operating lease assets considers management's expectation of the value of the vehicles upon lease termination, which is based on numerous assumptions and factors influencing used vehicle values... -

Page 90

... against actual results at both the portfolio and product level. Discount rate - The cash flows of our mortgage servicing rights are discounted at prevailing market rates, which include an appropriate risk-adjusted spread, which management believes approximates yields required by investors for these... -

Page 91

Table of Contents Management's Discussion and Analysis Ally Financial Inc. • Form 10-K Goodwill The accounting for goodwill is discussed in Note 1 to the Consolidated Financial Statements. Goodwill is reviewed for potential impairment at the reporting unit level on an annual basis, as of August ... -

Page 92

... against the net U.S. deferred tax asset balance as of December 31, 2012, and December 31, 2011, respectively. For the year ended December 31, 2012, our results from operations benefited $1.3 billion from the release of U.S. federal and state valuation allowances and related effects on the basis of... -

Page 93

... and cash equivalents 273 13 Trading assets 12,336 262 Investment securities (b) 4,406 155 Loans held-for-sale, net 95,715 4,603 Finance receivables and loans, net (c) (d) 11,185 980 Investment in operating leases, net (e) 134,646 6,039 Total interest-earning assets Noninterest-bearing cash and cash... -

Page 94

... Trading assets Investment securities Loans held-for-sale, net Finance receivables and loans, net Investment in operating leases, net Total interest-earning assets Liabilities Interest-bearing deposit liabilities Short-term borrowings Long-term debt Total interest-bearing liabilities Net financing... -

Page 95

... Other Commercial real estate Automobile Mortgage Total domestic Foreign Commercial and industrial Automobile (b) Mortgage Other Commercial real estate Automobile Mortgage Total foreign Total commercial loans Total finance receivables and loans (c) Loans held-for-sale (a) (b) (c) 2012 2011 2010... -

Page 96

... industrial Automobile Mortgage Other Commercial real estate Automobile Mortgage Total foreign Total commercial (b) Total nonperforming finance receivables and loans Foreclosed properties Repossessed assets (c) Total nonperforming assets Loans held-for-sale (a) (b) (c) 2012 2011 2010 2009 2008... -

Page 97

... real estate Automobile Mortgage Total foreign Total commercial Total accruing finance receivables and loans past due 90 days or more Loans held-for-sale 1 4 73 6 25 $ $ - - 3 3 10 33 92 7 3 1 - - 3 4 - - 5 6 1 - 6 7 - - 40 92 - 3 5 5 40 1 - 1 1 - 1 1 - 1 1 - 1 33 - 52 19 2012 2011 2010... -

Page 98

... of change in accounting principles (a) Charge-offs Domestic Foreign Write-downs related to transfers to held-for-sale Total charge-offs Recoveries Domestic Foreign Total recoveries Net charge-offs Provision for loan losses Foreign provision for loan losses Deconsolidation of ResCap Other Balance at... -

Page 99

... Ally Financial Inc. • Form 10-K Allowance for Loan Losses by Type The following table summarizes the allocation of the allowance for loan losses by product type. 2012 December 31, ($ in millions) Consumer Domestic Consumer automobile Consumer mortgage 1st Mortgage Home equity Total domestic... -

Page 100

...) Domestic deposits Noninterest-bearing deposits Interest-bearing deposits Savings and money market checking accounts Certificates of deposit Dealer deposits Total domestic deposit liabilities (a) 2011 Average balance (a) 2,237 9,696 26,109 1,685 39,727 Average deposit rate 2010 Average balance... -

Page 101

Table of Contents Quantitative and Qualitative Disclosures about Market Risk Ally Financial Inc. • Form 10-k Item 7A. Quantitative and Qualitative Disclosures about Market Risk Refer to the Market Risk and the Operational Risk sections of Item 7, Management's Discussion and Analysis. 99 -

Page 102

... Company's Chief Executive Officer and Senior Executive Vice President of Finance and Corporate Planning to provide reasonable assurance regarding the reliability of financial reporting and the preparation of published financial statements in accordance with generally accepted accounting principles... -

Page 103

... 2012, in conformity with accounting principles generally accepted in the United States of America. We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the Company's internal control over financial reporting as of December 31, 2012... -

Page 104

... We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated financial statements as of and for the year ended December 31, 2012, of the Company and our report dated March 1, 2013, expressed an unqualified opinion on those... -

Page 105

... on loans held-for-sale Interest on trading assets Interest and dividends on available-for-sale investment securities Interest-bearing cash Operating leases Total financing revenue and other interest income Interest expense Interest on deposits Interest on short-term borrowings Interest on long-term... -

Page 106

... Financial Statements for further detail. Due to the antidilutive effect of converting the Fixed Rate Cumulative Mandatorily Convertible Preferred Stock into common shares and the net loss from continuing operations attributable to common shareholders for 2012, 2011, and 2010, respectively, loss... -

Page 107

Table of Contents Consolidated Statement of Comprehensive Income Ally Financial Inc. • Form 10-K Year ended December 31, ($ in millions) Net income (loss) Other comprehensive income (loss), net of tax Unrealized gains (losses) on investment securities Net unrealized gains arising during the ... -

Page 108

...-elected) Allowance for loan losses Total finance receivables and loans, net Investment in operating leases, net Mortgage servicing rights Premiums receivable and other insurance assets Other assets Assets of operations held-for-sale Total assets Liabilities Deposit liabilities Noninterest-bearing... -

Page 109

... net ($- and $835 fair value-elected) Allowance for loan losses Total finance receivables and loans, net Investment in operating leases, net Other assets Assets of operations held-for-sale Total assets Liabilities Short-term borrowings Long-term debt ($- and $830 fair value-elected) Interest payable... -

Page 110

... Statement of Changes in Equity Ally Financial Inc. • Form 10-K ($ in millions) Balance at January 1, 2010 (a) Capital contributions Net income Preferred stock dividends - U.S. Department of Treasury Preferred stock dividends Dividends to shareholders Conversion of preferred stock and related... -

Page 111

... Loss on extinguishment of debt Originations and purchases of loans held-for-sale Proceeds from sales and repayments of loans held-for-sale Impairment and accruals related to Residential Capital, LLC deconsolidation Net change in Trading securities Deferred income taxes Interest payable Other assets... -

Page 112

... in long-term debt due to a change in accounting principle (c) Transfer of mortgage servicing rights into trading securities through certification Conversion of preferred stock to common equity Other disclosures Proceeds from sales and repayments of mortgage loans held-for-investment originally... -

Page 113

... servicing agreement with Ally Bank; (c) all state and federal law claims or causes of action the Debtors proposed to release as part of the Plan; and (d) the release of all existing or potential ResCap-related causes of action against AFI held by third parties. In the Examiner's original work plan... -

Page 114

... of such investment. ResCap's results of operations have been removed from our Consolidated Financial Statements since May 14, 2012. As of December 31, 2012, due to Ally Bank performing certain mortgage activities during the bankruptcy process and the related uncertainty associated with the... -

Page 115

... of Contents Notes to Consolidated Financial Statements Ally Financial Inc. • Form 10-K the United States of America (GAAP). Additionally, where applicable, the policies conform to the accounting and reporting guidelines prescribed by bank regulatory authorities. We operate our international... -

Page 116

...of senior secured commercial lending. • • • Commercial Real Estate • • Automobile - Consists of term loans to finance dealership land and buildings. Mortgage - Related primarily to activities within our business capital group, which provides financing to residential land developers and... -

Page 117

... to service the debt in accordance with the contractual terms, possible regulatory actions and other potential business disruptions (e.g. the loss of a significant customer or other revenue stream). Consideration of a concession is also similar for commercial loans. In addition to the factors noted... -

Page 118

... of our home equity class that are secured by real estate in a first-lien position are written down to the estimated fair value of the collateral, less costs to sell, once a mortgage loan becomes 180 days past due. Second-lien consumer mortgage loans within our home equity class are charged off at... -

Page 119

... of Contents Notes to Consolidated Financial Statements Ally Financial Inc. • Form 10-K The forecasted losses consider historical factors such as frequency (the number of contracts that we expect to default) and loss severity (the expected loss on a per vehicle basis). The loss severity within... -

Page 120

... Federal Home Loan Mortgage Corporation (Freddie Mac), and the Government National Mortgage Association (Ginnie Mae) (collectively the Government-sponsored Enterprises or GSEs) and private investors. We also serve as the collateral manager in the securitizations of commercial investment securities... -

Page 121

... underlying the leases and is reported at cost, less accumulated depreciation and net of impairment charges and origination fees or costs. Depreciation of vehicles is generally provided on a straight-line basis to an estimated residual value over the lease term. Manufacturer support payments that we... -

Page 122

... assets less cost to sell. During 2012, 2011, and 2010, impairment losses were recognized on asset groups that were classified as held-forsale or disposed of by sale. Refer to Note 2 for a discussion of discontinued and held-for-sale operations. Property and Equipment Property and equipment stated... -

Page 123

... we do not consider them valid. In cases where we repurchase loans, we bear the credit loss on the loans. Repurchased loans are classified as held-for-sale and initially recorded at fair value and subsequently at the lower of cost or market. We seek to manage the risk of repurchase and associated... -

Page 124

... held for risk management purposes that are not designated for hedge accounting under GAAP and changes in the fair value of derivative financial instruments held for trading purposes are reported in current period earnings. Loan Commitments We enter into commitments to purchase and make loans... -

Page 125

... the sale of our U.S. consumer property and casualty insurance business. Select Automotive Finance Operations During the fourth quarter of 2012, we committed to sell our Canadian automotive finance operations, Ally Credit Canada Limited, and ResMor Trust (Ally Canada) to Royal Bank of Canada. On... -

Page 126

...Financial Inc. • Form 10-K During the first quarter of 2012, we completed the sale of our Venezuela operations. During the first quarter of 2011, we completed the sale of our Ecuador operations. During 2010, we completed the sale of our Argentina and Poland operations and our full-service leasing... -

Page 127

...for loan losses Total finance receivables and loans, net Investment in operating leases, net Premiums receivable and other insurance assets Other assets Impairment on assets of held-for-sale operations Total assets Liabilities Interest-bearing deposit liabilities Short-term borrowings Long-term debt... -

Page 128

... of Contents Notes to Consolidated Financial Statements Ally Financial Inc. • Form 10-K December 31, 2011 ($ in millions) Assets Cash and cash equivalents Noninterest-bearing Interest-bearing Total cash and cash equivalents Investment securities Loans held-for-sale, net Finance receivables and... -

Page 129

...: Derivative liabilities Interest rate contracts Foreign currency contracts Total liabilities December 31, 2011 Assets Investment securities Available-for-sale securities Debt securities Foreign government Other assets Interest retained in financial asset sales Total assets $ - 171 $ - 15 $ 66... -

Page 130

... and repossession State and local non-income taxes Other Total other operating expenses (a) This charge consists of the $442 million total impairment of our investment in ResCap and a $750 million accrual of a cash settlement offer to the Debtors' estate. Refer to Note 1 for more information... -

Page 131

...for-sale securities Debt securities U.S. Treasury and federal agencies U.S. states and political subdivisions Foreign government Mortgage-backed residential (a) Asset-backed Corporate debt Other Total debt securities Equity securities Total available-for-sale securities (b) (a) (b) 2011 losses Fair... -

Page 132

... agencies Foreign government Mortgage-backed residential Asset-backed Corporate debt Total available-for-sale debt securities Amortized cost of available-for-sale debt securities December 31, 2011 Fair value of available-for-sale debt securities (b) U.S. Treasury and federal agencies U.S. states and... -

Page 133

... related to investment securities and our methodology for evaluating potential other-than-temporary impairments. 2012 Less than 12 months December 31, ($ in millions) Available-for-sale securities Debt securities U.S. Treasury and federal agencies Foreign government Mortgage-backed residential Asset... -

Page 134

...Financial Statements Ally Financial Inc. • Form 10-K The following table summarizes held-for-sale mortgage loans reported at carrying value by higher-risk loan type. December 31, ($ in millions) High original loan-to-value (greater than 100%) mortgage loans Payment-option adjustable-rate mortgage... -

Page 135

... to Consolidated Financial Statements Ally Financial Inc. • Form 10-K The following tables present an analysis of the activity in the allowance for loan losses on finance receivables and loans. ($ in millions) Allowance at January 1, 2012 Charge-offs Domestic Foreign Total charge-offs Recoveries... -

Page 136

... and loans $ 53,715 7,173 2,648 9,821 December 31, ($ in millions) 2012 Consumer automobile Consumer mortgage 1st Mortgage Home equity Total consumer mortgage Commercial Commercial and industrial Automobile Mortgage Other Commercial real estate Automobile Mortgage Total commercial Total consumer... -

Page 137

... Commercial and industrial Automobile Mortgage Other Commercial real estate Automobile Mortgage Total commercial Total consumer and commercial finance receivables and loans $ 37 - 216 858 $ 67 12 339 906 146 - 33 223 - 37 342 40 382 281 58 339 $ 2012 260 $ 2011 228 Management performs a quarterly... -

Page 138

... millions) 2012 Consumer automobile Consumer mortgage 1st Mortgage Home equity Total consumer mortgage Commercial Commercial and industrial Automobile Mortgage Other Commercial real estate Automobile Mortgage Total commercial Total consumer and commercial finance receivables and loans 2011 Consumer... -

Page 139

...Financial Statements Ally Financial Inc. • Form 10-K The following tables present average balance and interest income for our impaired finance receivables and loans. 2012 Year ended December 31, ($ in millions) Consumer automobile Consumer mortgage 1st Mortgage Home equity Total consumer mortgage... -

Page 140

... Contents Notes to Consolidated Financial Statements Ally Financial Inc. • Form 10-K The following table presents information related to finance receivables and loans recorded at historical cost modified in connection with a troubled debt restructuring during the period. 2012 (a) Premodification... -

Page 141

...0.8 1.9 2.0 44.2 - 100.0% 2011 1st Mortgage and home equity 5.5% 25.7 4.0 4.8 1.6 5.0 2.3 1.0 1.8 2.1 45.9 0.3 100.0% December 31, Texas California Florida Michigan Pennsylvania Illinois New York Ohio Georgia North Carolina Other United States Foreign (b) Total consumer loans (a) (b) Automobile 12... -

Page 142

...loan losses by geographic region and property type. December 31, Geographic region Texas Michigan Florida California New York Virginia North Carolina Pennsylvania Georgia Tennessee Other United States Foreign Total commercial real estate finance receivables and loans Property type Automotive dealers... -

Page 143

... reported at carrying value before allowance for loan losses by industry concentrations. December 31, Industry Automotive Manufacturing Services Other Total commercial criticized finance receivables and loans 85.7% 5.5 4.9 3.9 100.0% 82.9% 1.8 1.9 13.4 100.0% 2012 2011 9. Investment in Operating... -

Page 144

...Government-Sponsored Enterprises or GSEs. During 2012 and 2011, our consumer mortgage loans were primarily securitized through the GSEs. In executing a securitization transaction, we typically sell pools of financial assets to a wholly owned, bankruptcy-remote SPE, which then transfers the financial... -

Page 145

... Notes to Consolidated Financial Statements Ally Financial Inc. • Form 10-K Other Variable Interest Entities Servicer Advance Funding Entity We previously assisted in the financing of our servicer advance receivables; we formed a VIE that issued variable funding notes to thirdparty investors... -

Page 146

... as trading securities or other assets, and $0 million and $386 million classified as mortgage servicing rights at December 31, 2012, and December 31, 2011, respectively. CMHC is the Canada Mortgage and Housing Corporation. Due to combination of the credit loss insurance on the mortgages and... -

Page 147

... held by the securitization entity. Additionally, to qualify for off-balance sheet treatment, transfers of financial assets must meet the sale accounting conditions in ASC 860, Transfers and Servicing. Previously, our residential mortgage loan securitizations consisted of Ginnie Mae and private... -

Page 148

... Consumer mortgage - private-label Total pretax gain $ $ 2012 6 942 - 948 $ $ 2011 - 818 - 818 $ $ 2010 - 1,065 17 1,082 The following table summarizes cash flows received from and paid related to securitization entities, asset-backed financings, or other similar transfers of financial assets where... -

Page 149

... and net credit losses. Refer to Note 11 for further detail on total serviced assets. Total Amount December 31, ($ in millions) On-balance sheet loans Consumer automobile Consumer mortgage (a) Commercial automobile Commercial mortgage Commercial other Total on-balance sheet loans Off-balance... -

Page 150

... fees Total mortgage servicing fees $ $ 2012 504 29 59 592 $ $ 2011 977 65 156 1,198 $ $ 2010 998 77 187 1,262 Mortgage Servicing Advances In connection with our primary Mortgage servicing activities (i.e., servicing of mortgage loans), we make certain payments for property taxes and insurance... -

Page 151

... of Ally Bank's serviced mortgage assets are subserviced by GMAC Mortgage, LLC, a subsidiary of ResCap, pursuant to a servicing agreement. At December 31, 2012, Ally Bank was in compliance with the requirements of the servicing agreements. Automobile Finance Servicing Activities We service consumer... -

Page 152

... Ally Financial Inc. • Form 10-K Automobile Finance Serviced Assets The total serviced automobile finance loans outstanding were as follows. December 31, ($ in millions) On-balance sheet automobile finance loans and leases Consumer automobile Commercial automobile Operating leases Operations held... -

Page 153

... Real estate and other investments Servicer advances Prepaid expenses and deposits Goodwill Other assets Total other assets (a) (b) (c) Represents cash collection from customer payments on securitized receivables. These funds are distributed to investors as payments on the related secured debt... -

Page 154

... Secured (a) $ Refer to Note 16 for further details on assets restricted as collateral for payment of the related debt. Other primarily includes nonbank secured borrowings at our Commercial Finance Group at December 31, 2012 and Automotive Finance operations at December 31, 2011. Based on the debt... -

Page 155

... rate at December 31 of each year. Includes $0.0 billion at December 31, 2012 and $7.4 billion at December 31, 2011, guaranteed by the Federal Deposit Insurance Corporation (FDIC) under the Temporary Liquidity Guarantee Program. Includes secured long-term debt of $0.0 billion at December 31, 2012... -

Page 156

... agreements. 2012 December 31, ($ in millions) Trading assets Investment securities Loans held-for-sale Mortgage assets held-for-investment and lending receivables Consumer automobile finance receivables Commercial automobile finance receivables Investment in operating leases, net Mortgage servicing... -

Page 157

..., loss ratios, commercial payment rates. During 2012, there were no trigger events that resulted in the repayment of debt at an accelerated rate or impacted the usage of our credit facilities. When we issue debt securities in private offerings, we may be subject to registration rights agreements... -

Page 158

...of our Commercial Finance Group. Funding is generally available for assets originated by Ally Bank or the parent company, Ally Financial Inc. Uncommitted Funding Facilities Outstanding December 31, ($ in billions) Bank funding Secured - U.S. Federal Reserve funding programs FHLB advances Total bank... -

Page 159

... Agreement) with Treasury, pursuant to which a series of transactions occurred resulting in Treasury acquiring 228,750,000 shares of Ally's newly issued Fixed Rate Cumulative Mandatorily Convertible Preferred Stock, Series F-2 (the New MCP), with a total liquidation preference of $11.4 billion... -

Page 160

... on the New MCP are fully paid. Series A Preferred Stock On March 1, 2011, pursuant to a registration rights agreement between Ally and GM, GM notified Ally of its intent to sell shares of Ally's existing Fixed Rate Perpetual Preferred Stock, Series A (Existing Series A Preferred Stock), held by... -

Page 161

Table of Contents Notes to Consolidated Financial Statements Ally Financial Inc. • Form 10-K The changes to the terms of the Existing Series A Preferred Stock pursuant to the terms of the Amendment were deemed substantive, and as a result, the transaction was accounted for as a redemption of the... -

Page 162

Table of Contents Notes to Consolidated Financial Statements Ally Financial Inc. • Form 10-K The following table summarizes information about our Series F-2, Series A, and Series G preferred stock. December 31, Mandatorily convertible preferred stock held by U.S. Department of Treasury Series ... -

Page 163

... Notes to Consolidated Financial Statements Ally Financial Inc. • Form 10-K 19. Accumulated Other Comprehensive Income (Loss) The following table presents changes, net of tax, in each component of accumulated other comprehensive income (loss). Unrealized gains (losses) on investment securities... -

Page 164

... Notes to Consolidated Financial Statements Ally Financial Inc. • Form 10-K The following table presents the before- and after-tax changes in each component of accumulated other comprehensive income (loss). December 31, ($ in millions) 2012 Unrealized gains (losses) on investment securities... -

Page 165

... risk. Under the guidelines, total capital is divided into two tiers: Tier 1 capital and Tier 2 capital. Tier 1 capital generally consists of common equity, minority interests, qualifying noncumulative preferred stock, and the fixed rate cumulative preferred stock sold to Treasury under the Troubled... -

Page 166

... by banking regulators, investors and analysts to assess and compare the quality and composition of Ally's capital with the capital of other financial services companies. Also, bank holding companies with assets of $50 billion or more, such as Ally, must develop and maintain a capital plan annually... -

Page 167

... the FDIC and the Utah Department of Financial Institutions. Ally Bank's deposits are insured by the FDIC, and Ally Bank is required to file periodic reports with the FDIC concerning its financial condition. Total assets of Ally Bank were $94.8 billion and $85.3 billion at December 31, 2012 and 2011... -

Page 168

... a portion of our fixed-rate debt and a portion of our outstanding floating-rate borrowing associated with Ally Bank's secured floating-rate credit facility, we do not apply hedge accounting to our derivative portfolio held to mitigate interest rate risk associated with our debt portfolio. Typically... -

Page 169

...-related event. If a credit risk-related event had been triggered the amount of additional collateral required to be posted by us would have been insignificant. We placed cash and securities collateral totaling $1.3 billion and $1.4 billion at December 31, 2012 and 2011, respectively, in accounts... -

Page 170

...for hedge accounting Economic hedges and trading derivatives Interest rate risk MSRs Mortgage loan commitments and mortgage loans held-for-sale Debt Other Total interest rate risk Foreign exchange risk Total economic hedges and trading derivatives Total derivatives (a) (b) 2011 Derivative contracts... -

Page 171

... accounting Economic and trading derivatives (Loss) gain recognized in earnings on derivatives Interest rate contracts Interest on long-term debt Servicing asset valuation and hedge activities, net Loss on mortgage and automotive loans, net Other income, net of losses Other operating expenses Total... -

Page 172

... accounting relationships. Year ended December 31, ($ in millions) Cash flow hedges Interest rate contracts Gain reclassified from accumulated other comprehensive income to interest on long-term debt (Loss) gain recorded directly to interest on long-term debt Total interest on long-term debt (Loss... -

Page 173

...- 54 (20) 4 51 104 $ 2012 (264) $ 2011 (333) $ 2010 137 As discussed in Note 1, on May 14, 2012, we deconsolidated ResCap for financial reporting purposes. For U.S. federal tax purposes, however, ResCap will continue to be included in our consolidated return filing until ultimate disposition of our... -

Page 174

... tax assets Tax credit carryforwards Tax loss carryforwards Mark-to-market on consumer finance receivables and loans Equity investment in ResCap Provision for loan losses Hedging transactions State and local taxes ResCap settlement accrual Sales of finance receivables and loans Unearned insurance... -

Page 175

... for pension payments upon retirement based on factors such as length of service and salary. In recent years, we have transferred, frozen, or terminated a significant number of our other defined benefit plans. All income and expense noted for pension accounting was recorded as compensation and... -

Page 176

... Financial Statements Ally Financial Inc. • Form 10-K pay and administer all future annuity payments to the current retiree population of the GMACM Pension Plan (retired as of September 1, 2012) beginning on January 1, 2013. Additionally, during the fourth quarter the GMACM Pension Plan... -

Page 177

..., as available. To estimate cash flows, we are required to utilize various significant assumptions including market observable inputs (e.g., forward interest rates) and internally developed inputs (including prepayment speeds, delinquency levels, and credit losses). Mortgage loans held-for-sale, net... -

Page 178

...by investors in this asset. Cash flows primarily include servicing fees, float income, and late fees in each case less operating costs to service the loans. The estimated cash flows are discounted using an option-adjusted spreadderived discount rate. Interests retained in financial asset sales - The... -

Page 179

... federal agencies Foreign government Mortgage-backed residential Asset-backed Corporate debt securities Total debt securities Equity securities (a) Total available-for-sale securities Mortgage loans held-for-sale, net (b) Mortgage servicing rights Other assets Interests retained in financial asset... -

Page 180

... and federal agencies States and political subdivisions Foreign government Mortgage-backed residential Asset-backed Corporate debt securities Other debt securities Total debt securities Equity securities (a) Total available-for-sale securities Mortgage loans held-for-sale, net (b) Consumer mortgage... -

Page 181

...154 December 31, 2012 ($ in millions) Assets Mortgage servicing rights Other assets Interests retained in financial asset sales Valuation technique (a) Discounted cash flow Unobservable input (a) Discount rate Commercial paper rate Range (a) 5.4-6.1% 0-0.1% (a) Refer to Note 11 for information... -

Page 182

... operations (a) Net unrealized gains (losses) included in earnings still held at Dec. 31, 2012 ($ in millions) Assets Trading assets (excluding derivatives) Mortgage-backed residential securities Investment securities Available-for-sale debt securities Asset-backed Mortgage loans heldfor-sale... -

Page 183

... in earnings still held at Dec. 31, 2011 ($ in millions) Assets Trading assets (excluding derivatives) Mortgage-backed residential securities Asset-backed securities Total trading assets Investment securities Available-for-sale debt securities Mortgagebacked residential Asset-backed Total debt... -

Page 184

... Financial Statements Ally Financial Inc. • Form 10-K Nonrecurring Fair Value We may be required to measure certain assets and liabilities at fair value from time to time. These periodic fair value measures typically result from the application of lower-of-cost or fair value accounting... -

Page 185

... Statements Ally Financial Inc. • Form 10-K Nonrecurring fair value measurements December 31, 2011 ($ in millions) Assets Mortgage loans held-for-sale (a) Commercial finance receivables and loans, net (c) Automotive Mortgage Other Total commercial finance receivables and loans, net Other assets... -

Page 186

... option for both nongovernment-eligible mortgage loans held-for-sale subject to conditional repurchase options and the related liability. These conditional repurchase options within our private label securitizations allowed us to repurchase a transferred financial asset if certain events outside our... -

Page 187

... Statement of Income Interest and fees on finance receivables and loans (a) Interest on loans held-forsale (a) Interest on long-term debt (b) Total included in earnings Change in fair value due to credit risk (c) Year ended December 31, ($ in millions) 2012 Assets Mortgage loans held-for-sale... -

Page 188

... available at December 31, 2012 and 2011. 2012 Estimated fair value December 31, ($ in millions) Financial assets Loans held-for-sale, net (a) Finance receivables and loans, net (a) Nonmarketable equity investments Financial liabilities Deposit liabilities Short-term borrowings Long-term debt... -

Page 189

...coverage, and GAP products. We also underwrite selected commercial insurance coverages, which primarily insure dealers' wholesale vehicle inventory in the United States. Mortgage operations - Our ongoing Mortgage operations are conducted through Ally Bank. We intend to continue to originate a modest... -

Page 190

... in the United States. As a result of the bankruptcy filing, ResCap was deconsolidated from our financial statements; and beginning in the second quarter of 2012, we began presenting our mortgage business activities under one reportable operating segment, Mortgage operations. Previously our Mortgage... -

Page 191

... of Ally Bank. Total assets for the Commercial Finance Group were $1.5 billion, $1.2 billion, and $1.6 billion at December 31, 2012, 2011 and 2010, respectively. Net financing revenue after the provision for loan losses totaled $1.5 billion, $0.9 billion, and $0.9 billion in 2012, 2011 and 2010... -

Page 192

... are Ally US LLC, IB Finance Holding Company, LLC (IB Finance), and GMAC Continental Corporation (GMAC Continental). The Guarantors fully and unconditionally guarantee the senior notes on a joint and several basis. In connection with the purchase and sale agreement with General Motors Financial (GMF... -

Page 193

...loans held-for-sale Interest on trading assets Interest and dividends on available-for-sale investment securities Interest-bearing cash Interest-bearing cash - intercompany Operating leases Total financing revenue and other interest income Interest expense Interest on deposits Interest on short-term... -

Page 194

... Notes to Consolidated Financial Statements Ally Financial Inc. • Form 10-K Year ended December 31, 2012 ($ in millions) Parent Guarantors Nonguarantors Consolidating adjustments Ally consolidated Net income Other comprehensive (loss) income, net of tax Unrealized gains on investment securities... -

Page 195

... on loans held-for-sale Interest on trading assets Interest and dividends on available-for-sale investment securities Interest-bearing cash Operating leases Total financing revenue and other interest income Interest expense Interest on deposits Interest on short-term borrowings Interest on long-term... -

Page 196

... Financial Statements Ally Financial Inc. • Form 10-K Year ended December 31, 2011 ($ in millions) Parent Guarantors Nonguarantors Consolidating adjustments Ally consolidated Net (loss) income Other comprehensive (loss) income, net of tax Unrealized (losses) gains on investment securities... -

Page 197

... fees on finance receivables and loans - intercompany Interest on loans held-for-sale Interest on trading assets Interest and dividends on available-for-sale investment securities Interest and dividends on available-for-sale investment securities - intercompany Interest-bearing cash Operating leases... -

Page 198

... Statements Ally Financial Inc. • Form 10-K Year ended December 31, 2010 ($ in millions) Parent Guarantors Nonguarantors Consolidating adjustments Ally consolidated Net income Other comprehensive (loss) income, net of tax Unrealized (losses) gains on investment securities Net unrealized (losses... -

Page 199

...Mortgage servicing rights Premiums receivable and other insurance assets Other assets Assets of operations held-for-sale Total assets Liabilities Deposit liabilities Noninterest-bearing Noninterest-bearing - intercompany Interest-bearing Total deposit liabilities Short-term borrowings Long-term debt... -

Page 200

... Financial Statements Ally Financial Inc. • Form 10-K December 31, 2011 ($ in millions) Assets Cash and cash equivalents Noninterest-bearing Interest-bearing Interest-bearing - intercompany Total cash and cash equivalents Trading assets Investment securities Loans held-for-sale, net Finance... -

Page 201

... capital Net cash effect from deconsolidation of ResCap Proceeds from sale of business units, net Other, net Net cash provided by (used in) investing activities Financing activities Net change in short-term borrowings - third party Net increase in bank deposits Proceeds from issuance of long-term... -

Page 202

...in operating lease assets Capital contributions to subsidiaries Returns of contributed capital Proceeds from sale of business units, net Other, net Net cash provided by (used in) investing activities Financing activities Net change in short-term borrowings - third party Net increase in bank deposits... -

Page 203

... in operating lease assets Capital contributions to subsidiaries Returns of contributed capital Proceeds from sale of business unit, net Other, net Net cash (used in) provided by investing activities Financing activities Net change in short-term borrowings - third party Net increase in bank deposits... -

Page 204

... to Sell mortgages or securities (a) Originate/purchase mortgages or securities (a) Provide capital to investees (b) Provide retail automotive receivables to third-parties (c) Warehouse and construction-lending commitments (d) Home equity lines of credit (e) Unused revolving credit line commitments... -

Page 205

... rate financing or lease products. Our preferred provider agreements with GM and Chrysler terminate on December 31, 2013, and April 30, 2013, respectively. Mortgage-Related Matters ResCap Bankruptcy Filing On May 14, 2012, Residential Capital, LLC (ResCap) and certain of its wholly owned direct... -

Page 206

...) are named as defendants in various cases relating to ResCap mortgage-backed securities (MBS) and certain other mortgage-related matters, which are described in more detail below (collectively, the Mortgage Cases). In the private-label securities litigation, the plaintiffs generally allege that... -

Page 207

... cases, recovery of money damages, together with statutory interest from the date of payment, costs, and attorneys' fees. Plaintiff dismissed the Debtor entities in March 2012 and the case remains pending against Ally Securities only. FDIC Litigation The Federal Deposit Insurance Corporation filed... -

Page 208

... insured offerings and seeks damages relating to all claims. The Defendants filed a motion to dismiss on February 15, 2013. FGIC Litigation FGIC filed twelve complaints in New York state court against Ally Financial Inc. (ten of the twelve), Ally Bank (four of the twelve) and a number of ResCap... -

Page 209

... ResCap. Representation and warranty reserve was $105 million at December 31, 2012 with respect to Ally Bank's sold and serviced loans. The current liability for representation and warranty obligations reflects management's best estimate of probable losses with respect to Ally Bank's mortgage loans... -

Page 210

... Automotive Finance Operation Sale On February 1, 2013, we completed the sale of our Canadian automotive finance operation, Ally Credit Canada Limited, and ResMor Trust (Ally Canada) to Royal Bank of Canada. Ally received $4.1 billion USD for the business in the form of a $3.7 billion payment at... -

Page 211

... disclosed in the reports we file and submit under the Exchange Act is accumulated and communicated to management, including our Chief Executive Officer (Principal Executive Officer) and Senior Executive Vice President of Finance and Corporate Planning (Principal Financial Officer), to allow timely... -

Page 212

...Member of Audit Committee) Director and Chief Executive Officer Senior Executive Vice President of Finance and Corporate Planning Chief Financial Officer Chief Executive Officer and President of Ally Bank President Vice President, Chief Accounting Officer, and Corporate Controller Chief Risk Officer... -

Page 213

..., a specialized private equity firm that invests in financial services. Previously, she served as chairman and chief executive officer of the Global Consumer Group at Citigroup. In this position, she was responsible for the company's operations serving consumers through retail banking, credit cards... -

Page 214

... and the New York City Investment Fund and has been a board member of the New York Stock Exchange, General Signal, Loews Cineplex, and various other private and public companies. Jeffrey J. Brown - Appointed Senior Executive Vice President of Finance and Corporate Planning in June 2011. In this... -

Page 215

... executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions will be posted at this same internet website location as required by applicable law. Certain Corporate Governance Matters Election of Directors - Our current directors... -

Page 216

... Ally Financial Inc. • Form 10-K Item 11. Executive Compensation Corporate Governance and Related Disclosures The Compensation, Nominating and Governance Committee The Ally Compensation, Nominating and Governance Committee (the Committee) is a committee of the Ally Board of Directors (Board... -

Page 217

... any features that may unnecessarily expose Ally to risks or encourage manipulation of reported earnings. The Compensation, Nominating and Governance Committee certifies that: • • • It has reviewed with senior risk officers the SEO compensation plans and has identified and limited features... -

Page 218

... its financial statements for 2012. Assessing Ally Compensation Competitiveness We compare our total direct compensation against a peer group of other comparably sized financial services companies with whom we compete for business and senior executive talent. We use publicly available reported pay... -

Page 219

... financial officer. For executives below the Top 25 whose pay is not determined by the Special Master, our compensation philosophy is to set base salaries and employee benefits at median competitive levels and to set annual incentive compensation to deliver total annual cash and equity compensation... -

Page 220

... structures in place for Ally did not adequately address issues raised by these developments. As a result, the Committee sought and obtained the Special Master's approval of certain modifications to the compensation structures for the NEOs and other senior executives of the company. The purpose of... -

Page 221

... In connection with the risk assessment Ally conducted in 2012, the Company has reviewed all of its incentive compensation programs to ensure they include language allowing the Company to recoup incentive payments made to recipients in the event those payments were based on financial statements that... -

Page 222

... Senior Executive Vice President of Finance and Corporate Planning Barbara Yastine Chief Executive Officer and President, Ally Bank William Muir President James G. Mackey Chief Financial Officer Thomas Marano Chief Executive Officer, ResCap (a) Year 2012 2011 2010 2012 2011 2010 2012 2011 2012 2011... -

Page 223

Table of Contents Ally Financial Inc. • Form 10-K All Other Compensation in 2012 Michael A. Carpenter Financial counseling (a) Liability insurance (b) Wellness credit (c) Total perquisites Life insurance (d) 401(k) matching contribution (e) Total all other compensation (a) Jeffrey J. Brown $ 3,... -

Page 224

... granted to named executives that have not vested. Each award represents one phantom share of Ally. The fair market value for the phantom shares is determined by the Board at least annually, as required by the Ally Financial Long-Term Equity Compensation Incentive Plan. The fair market value for... -

Page 225

... $110,000 of the $180,000 annual retainer in 2011, and were also awarded for a portion of the annual retainer paid for the first quarter of 2012, as part of planning for a potential initial public offering. An additional retainer is paid to non-employee directors who serve as a chair of a standing... -

Page 226

Table of Contents Ally Financial Inc. • Form 10-K Beginning January 1, 2012, Ally pays additional director compensation to John J. Stack for his service as a director of Ally Bank in an annual amount equal to $165,000, representing the equivalent of a Board retainer of $115,000 and an additional ... -

Page 227

.../31/2011 3/31/2012 Mayree C. Clark John D. Durrett Kim S. Fennebresque Franklin W. Hobbs Marjorie Magner John J. Stack (d) The following table sets forth the aggregate number of DSUs held by each non-employee director at December 31, 2012. Each DSU represents one phantom share of Ally. Name... -

Page 228

... of class 73.78% Name and address of beneficial owner U.S. Department of Treasury 1500 Pennsylvania Avenue Washington, D.C. 20220 GMAC Common Equity Trust I c/o Hillel Bennett Stroock & Stroock & Lavan 180 Maiden Lane New York, New York 10038-4982 Persons affiliated with Cerberus Capital Management... -

Page 229

... Certain Corporate Governance Matters in Item 10. Item 14. Principal Accountant Fees and Services We retained Deloitte & Touche LLP, the member firms of Deloitte Touche Tohmatsu Limited, and their respective affiliates (collectively, Deloitte & Touche) to audit our consolidated financial statements... -

Page 230

...-related fees (b) Tax fees (c) Total principal accountant fees (a) 2012 $ 20 $ 5 - $ 25 $ 2011 20 6 1 27 (b) (c) Audit fees include fees for the integrated audit of our annual Consolidated Financial Statements, reviews of interim financial statements included in our Quarterly Reports on Form... -

Page 231

.... Filed as Exhibit 4(a) to the Company's Registration Statement No. 2-75115, incorporated herein by reference. 3.2 4.1 Form of Indenture dated as of July 1, 1982, between the Company and Bank of New York (Successor Trustee to Morgan Guaranty Trust Company of New York), relating to Debt Securities... -

Page 232

... and Chrysler Group LLC* Intellectual Property License Agreement, dated November 30, 2006, by and between General Motors Corporation and GMAC LLC Capital and Liquidity Maintenance Agreement, entered into on October 29, 2010, between Ally Financial Inc., IB Finance Holding Company, LLC, Ally Bank and... -

Page 233