Alcoa 2014 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2014 Alcoa annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

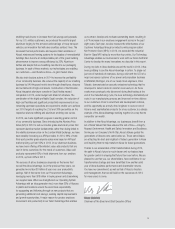

2014 FINANCIAL PERFORMANCE*

37

42 43 44

37 40 40 40 36 34 35 36

30 32 29 31 28 30 33 32 28

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14

4Q14

EVEN 1 DAY LOWER 6 DAYS LOWER 2 DAYS LOWER EVEN

9 day reduction since 4Q09

SUSTAINED WORKING CAPITAL EXCELLENCE

2013 2014

LME Currency Volume Price/Mix Productivity Energy Cost Increases/

Other

Raw

Materials

+$107 MARKET +$1,113 PERFORMANCE -$461 COST HEADWINDS

$ in millions

357 16 123 64 292

757 31 48 540

1,116

STRONG PERFORMANCE DRIVES EARNINGS GROWTH

2009 2010 2011 2012 2013

EPS

(

28%

)

GRP

(

23%

)

GPP

(

43%

)

OTHER

(

6%

)

2,410

742

1,099 1,291 1,117

2014

1,194

338

279

512

65

$ in millions

PRODUCTIVITY 2009–2014

All figures are pretax and pre-minority interest. 2009–2010 represents net productivity. 2011–2013 represents gross productivity. EPS: Engineered

Products and Solutions; GRP: Global Rolled Products; GPP: Global Primary Products represents the Alumina and Primary Metals segments combined.

5

Alcoa’s 2014 operating performance was the strongest since 2008, demonstrating how the Company’s

transformation is driving profitability. Excluding the impact of special items, performance growth drove

2014 net income of $1.1 billion, or $0.92 per share, up slightly more than threefold from 2013.

Through the power of Alcoa’s Degrees of Implementation program, which is the Company’s disciplined

execution methodology for moving from ideas to cash, our businesses generated $1.2 billion in productivity

savings. This result exceeded an $850 million annual target and improved total productivity savings since

2008 to $7.9 billion.

Alcoa also managed growth capital expenditures of $484 million against a $500 million annual target; controlled

sustaining capital expenditures of $735 million against a $750 million annual target; and invested $91 million in

our Saudi Arabia joint venture project against a $125 million annual target.

Additionally, we continued to manage working capital diligently in 2014, resulting in average days working

capital at 28 days in the fourth quarter, even with the fourth quarter of 2013, while supporting growth

initiatives related to the automotive and aerospace end markets we serve. We have reduced average days

working capital by nine days since the fourth quarter of 2009.

As a result of our disciplined execution, we met our overarching goal to be free cash flow positive for the fifth

consecutive year, ending 2014 with free cash flow totaling $455 million on cash from operations of $1.7 billion.

* See Calculation of Financial Measures at the end of this report for reconciliations of certain non-GAAP financial measures

(adjusted income, free cash flow, days working capital and adjusted EBITDA).