Adobe 1998 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 1998 Adobe annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

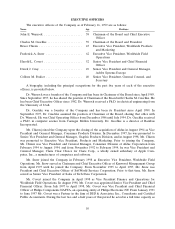

Restructuring and other charges:

1998 Change 1997 Change 1996

Restructuring and other charges ...................... $38.2 NA $(0.6) (112)% $5.0

Percentage of total revenue ......................... 4.3% (0.1)% 0.6%

In the third quarter of fiscal 1998, the Company implemented a restructuring program aimed at

streamlining its underlying cost structure to better position the Company for growth and profitability. As

part of the restructuring program, the Company implemented a reduction in force of 364 positions,

primarily in its North American operations. The reductions came predominantly from overhead areas,

divested business units and redundant marketing activities, and as of August 31, 1998, the majority of these

terminations were completed. In addition to severance and related charges associated with the reduction in

force, the restructuring program included charges for divesting two business units, vacating leased facilities,

and canceling certain contracts. These actions and other non-restructuring related items resulted in

charges of $38.2 million, of which approximately $9.1 million were non-cash charges. For detailed

information regarding the Company’s restructuring program, see Note 7 of the Notes to the Consolidated

Financial Statements.

The Company estimates that, as a result of the restructuring program, annualized pre-tax savings of

$60.0 million will be realized. Approximately 50% of the savings are the result of the reduction in force and

the remaining 50% savings are the result of reductions in marketing and facilities expense, as well as other

discretionary savings, such as travel and outside services.

Restructuring and other charges in fiscal 1997 include a gain of $2.4 million related to the divestiture

of a product line partially offset by a $1.8 million charge related to the acquisition of intellectual property.

Restructuring and other charges in fiscal 1996 include charges of $5.7 million related to the

disposition of two business units previously owned by an acquired company less the reversal of $0.7 million

of excess reserves related to restructuring costs recorded in prior years.

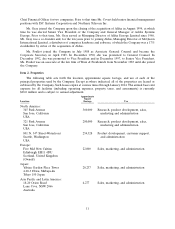

Nonoperating income:

1998 Change 1997 Change 1996

Investment gain ................................. $15.0 (56)% $34.3 (50)% $68.9

Percentage of total revenue ........................ 1.7% 3.8% 8.8%

Investment gain consists principally of realized gains or losses from direct investments as well as

mark-to-market valuation adjustments for investments held by Adobe Incentive Partners, L.P. (‘‘AIP’’).

In fiscal 1998, the Company recorded a realized gain of $6.7 million related to the Company’s

investment in McQueen International Limited (‘‘McQueen’’) due to the acquisition of McQueen by Sykes

Enterprises, Incorporated (‘‘Sykes’’), a publicly traded company. In addition, the Company liquidated its

investment in Siebel Systems, Incorporated (‘‘Siebel’’) through the distribution to its stockholders of

approximately 165,000 shares of Siebel common stock as a dividend-in-kind and the sale of its remaining

Siebel shares. A gain was recognized on the transaction of approximately $5.7 million. The remaining net

realized gain recorded by the Company in fiscal 1998 represents valuation adjustments recorded by the

Company related to its venture investments held by AIP.

In fiscal 1997, the investment gain related primarily to the Company’s liquidation of its investment in

Netscape Communications Corporation (‘‘Netscape’’) through the distribution to its stockholders of

554,660 shares of Netscape common stock as a dividend-in-kind and the sale of its remaining Netscape

shares.

20