Adaptec 2004 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2004 Adaptec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

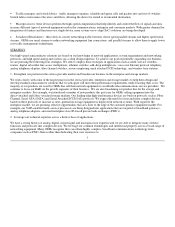

ITEM 6. Selected Financial Data

Year Ended December 31, (1)

2004(2) 2003(3) 2002(4) 2001(5) 2000(6)

(in thousands, except for per share data)

STATEMENT OF OPERATIONS DATA:

Net revenues $ 297,383 $ 249,483 $ 218,093 $ 322,738 $ 694,684

Cost of revenues 87,542 87,875 89,542 137,262 166,161

Gross profit 209,841 161,608 128,551 185,476 528,523

Research and development 120,492 119,473 137,734 201,087 178,806

Marketing, general and administrative 46,135 45,974 63,419 90,302 100,589

Amortization of deferred stock compensation

Research and development — 317 2,645 32,506 32,258

Marketing, general and administrative 697 691 168 8,678 4,006

Impairment of property and equipment — — 1,824 — —

Restructuring costs and other special charges 3,520 15,314 — 195,186 —

Impairment of goodwill and purchased

intangible assets — — — 269,827 —

Amortization of goodwill — — — 44,010 36,397

Costs of merger — — — — 37,974

Acquisition costs 1,212 — — — —

Acquisition of in process research and

development — — — — 38,200

Income (loss) from operations 37,785 (20,161) (77,239) (656,120) 100,293

Interest income, net 4,859 1,709 6,518 14,339 18,887

Foreign exchange gain (loss) (1,295) (954) (1) 207 38

Gain (loss) on extinguishment of debt and

amortization of debt issue costs (2,233) 287 (1,564) (652) —

Gain (loss) on investments 9,242 2,416 (11,579) (14,591) 58,491

Provision for (recovery of) income taxes (3,323) (8,712) (18,858) (17,763) 102,412

Net income (loss) $ 51,681 $ (7,991) $ (65,007) $ (639,054) $ 75,298

Net income (loss) per share − basic: (7) $ 0.29 $ (0.05) $ (0.38) $ (3.80) $ 0.46

Net income (loss) per share − diluted: (7) $ 0.27 $ (0.05) $ (0.38) $ (3.80) $ 0.41

Shares used in per share calculation − basic 180,353 173,568 170,107 167,967 162,377

Shares used in per share calculation − diluted 188,903 173,568 170,107 167,967 181,891

As of December 31, (1)

(in thousands)

BALANCE SHEET DATA:

Working capital $ 152,306 $ 317,444 $ 229,021 $ 214,471 $ 340,986

Cash, cash equivalents, and short−term

investments 274,686 411,928 416,659 410,729 375,116

Long−term investment in bonds and notes 139,111 41,569 148,894 171,025 —

Total assets 507,024 552,956 728,716 855,341 1,126,090

Long−term debt (including current portion) 68,071 175,000 275,000 275,470 2,333

Stockholders’ equity 299,337 226,297 198,639 272,227 851,318

(1) The Company’s fiscal year ends on the last Sunday of the calendar year. December 31 has been used as the fiscal year end for

ease of presentation.

(2) Results for the year ended December 31, 2004 include $0.7 million amortization of deferred stock compensation, $0.7 million

reversal of a provision for excess inventory resulting from the sale of inventory that was previously provided for, $1.2 million

acquisition costs related to a purchase of assets, $3.5 million net charge for additional excess facilities costs related to our 2001

restructurings, $1.3 million elimination of a provision for employee−related taxes, $1.8 million loss on extinguishment of debt, $9.2

million gain on sale of investments, $5.1 million recovery of prior year taxes, $9.4 million tax recovery based on agreements and

assessments with Canada Revenue Agency and $1.5 million foreign exchange loss on Canadian taxes.

(3) Results for the year ended December 31, 2003 include a $15.3 million net charge for restructuring costs, the $1.8 million

elimination of a provision for potential litigation costs, a $2.5 million gain on sale of property and investments, $1.7 million gain on