Adaptec 2001 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2001 Adaptec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

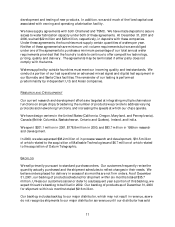

Quarterly Compari sons

The following tables set forth the consolidated statements of operations for each of the

Company's last eight quarters. This quarterly information is unaudited and has been prepared

on the same basis as the annual consolidated financial statements. In management's opinion,

this quarterly information reflects all adjustments necessary for fair presentation of the

information for the periods presented. The operating results for any quarter are not necessarily

indicative of results for any future period.

(1) Results include a $6.5 million write-down of excess inventory recorded in cost of revenues and a charge of $17.5 million for impairment of other

investments recorded in gain (loss) on investments.

(2) Results include a $12.1 million write-dow n of excess inventory recorded in cost of revenues.

(3) Results include a $2.1 million write-down of excess inventory recorded in cost of revenues.

(4) Reflects 2-for-1 stock splits in the form of 100% stock dividends effective February 2000 and May 1999.

Quarterly Data (Unaudited)

(in thousands except for per share data)

Year Ended December 31, 2001 Year Ended December 31, 2000

Fourth (1) Third Second (2) First (3) Fourth Third Second First

STATEMENT OF OPERATIONS DATA:

Net revenues 47,157$ 61,556$ 94,130$ 119,895$ 231,652$ 198,152$ 150,514$ 114,366$

Cost of revenues 26,142 24,359 48,834 37,927 57,718 46,582 35,689 26,172

Gross profit 21,015 37,197 45,296 81,968 173,934 151,570 114,825 88,194

Research and development 41,145 48,705 53,769 57,468 58,009 49,682 38,857 32,258

Marketing, general and administrative 18,445 22,697 24,067 25,093 30,085 28,703 23,676 18,125

Amortization of deferred stock compensation:

Research and development 1,130 1,386 2,090 27,900 10,082 15,201 3,296 3,679

Marketing, general and administrative 7,480 254 425 519 1,419 1,605 611 371

Amortization of goodwill 2,392 5,996 17,811 17,811 17,680 17,770 488 459

Restructuring costs and other special charges 175,286 - - 19,900 - - - -

Impairment of goodwill and purchased intangible assets 80,785 - 189,042 - - - - -

Costs of merger - - - - 1,116 23,180 5,776 7,902

Acquisition of in process research and development - - - - - 38,200 - -

Income (loss) from operations (305,648) (41,841) (241,908) (66,723) 55,543 (22,771) 42,121 25,400

Gain (loss) on investments (14,992) - - 401 17,208 14,173 22,993 4,117

Net income (loss) (308,028)$ (34,455)$ (233,045)$ (63,526)$ 43,854$ (34,645)$ 48,574$ 17,515$

Net income (loss) per share - basic (4) (1.82)$ (0.20)$ (1.39)$ (0.38)$ 0.26$ (0.21)$ 0.30$ 0.11$

Net income (loss) per share - diluted (4) (1.82)$ (0.20)$ (1.39)$ (0.38)$ 0.24$ (0.21)$ 0.27$ 0.10$

Shares used in per share calculation - basic 168,874 168,389 167,817 166,786 165,609 164,488 161,611 157,798

Shares used in per share calculation - diluted 168,874 168,389 167,817 166,786 184,245 164,488 180,694 177,658