Aarons 2010 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2010 Aarons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our 55th year of operations was exciting,

challenging and rewarding. We are proud of the

Company’s operating results which we believe refl ect

the strength of our business model and the talent

of our associates.

We celebrated several milestones during 2010 in

addition to our 55th anniversary. Highlights include

the following.

Aaron’s had more than 1.4 million customers of

Company-operated and franchised stores at the

end of 2010, a gain of 10% for the year. Customer

count on a same store basis for Company-operated

stores and franchised stores was up 7.2% and 7.3%,

respectively, from last year.

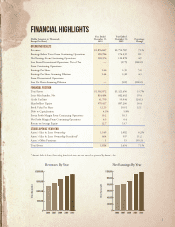

Revenues for the year were a record $1.877 billion,

an increase of 7% from 2009. In addition, our

franchisees reported an 11% increase in revenues

to $841.3 million, although those revenues are not

revenues of Aaron’s, Inc.

Net earnings for the year were also a record —

$118.4 million, a 5% increase over the $112.6

million earned in 2009. Fully diluted earnings per

share were $1.44 compared to $1.37 in the prior

year.

We are particularly proud of the consistent same

store revenue growth in our system, driven by

our increasing number of stores and customers.

For the year, same store revenues increased 4% in

Company-operated stores and 3% in franchised

stores. Many of our stores in states and market areas

with unemployment rates exceeding 10% reported

strong same store revenue gains in 2010, and

our stores over fi ve years old collectively achieved

positive same store revenue growth. We believe

this organic growth is impressive evidence of the

fl exibility, appeal, and economic resiliency of our

sales and lease ownership model.

Our Woodhaven Furniture Industries division

manufactured approximately $79 million, at cost, of

furniture and bedding in 2010 to meet the growing

demand by Aaron’s stores for furniture products.

Woodhaven’s 12 plants were also able to improve

production and operating effi ciencies during

the year, furthering Aaron’s distinct quality and

cost advantage.

In June, we made the decision to cease all the

operations of the Aaron’s Offi ce Furniture division.

The offi ce furniture business is highly cyclical and

the division has not been profi table for a number

of years. At the end of the year, there was one

store open to liquidate remaining merchandise.

The closure of this division resulted in charges to

operating expenses during the year of approximately

$.07 per diluted share.

During 2010, Aaron’s opened 91 new Company-

operated stores and 72 new franchised stores.

The Aaron’s Sales & Lease Ownership total net

store count increased 8% for the year. We expect

a comparable percentage increase in new stores

in 2011. We also awarded area development

agreements to open 120 new franchised stores. At

the end of 2010 there were 282 franchised stores

awarded that are expected to be opened over the

next several years.

For most of our corporate history, the Company

has required external capital to meet growth targets.

Over the past few years, Aaron’s has been generating

cash fl ow and we expect to internally fund our

growth in 2011 and into the foreseeable future. At

year end, the Company had $72 million of cash

on hand and no bank debt. During the year, we

declared a three-for-two stock split, increased our

dividend for the seventh year in a row and used

some of our cash fl ow for stock repurchases. The

Company reacquired 1,478,805 shares of Common

Stock in 2010 and is currently authorized to

purchase an additional 4,401,815 shares.

At December 31, 2010, the Aaron’s Sales & Lease

Ownership division consisted of 1,138 Company-

operated stores, 658 franchised stores, 11 Company-

operated RIMCO stores and six franchised RIMCO

stores. The Company also had one Aaron’s Offi ce

Furniture store. The total number of stores open at

the end of 2010 was 1,814.

A major event in 2010 was the conversion of the

Company’s non-voting Common Stock into voting

Class A Common Stock on a one-for-one basis.

All shares of the Company’s Common Stock were

converted into shares of Class A Common Stock,

and the Class A Common Stock was renamed as the

To OUr Shareholders

2