Aarons 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 Aarons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1

2006

Annual Report

Table of contents

-

Page 1

2006 Annual Report 1 -

Page 2

... office furniture, household appliances, computers and accessories in over 1,350 Company-operated and franchised stores in the United States and Canada. The Company's major operations are the Aaron's Sales & Lease Ownership division, the Aaron's Corporate Furnishings division and MacTavish Furniture... -

Page 3

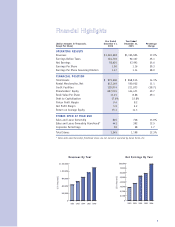

...Assets Rental Merchandise, Net Credit Facilities Shareholders' Equity Book Value Per Share Debt to Capitalization Pretax Profit Margin Net Profit Margin Return on Average Equity STORES OPEN AT YEAR END Sales and Lease Ownership Sales and Lease Ownership Franchised* Corporate Furnishings Total Stores... -

Page 4

... reporting quarterly same store revenue growth, our same store revenue in the Aaron's Sales & Lease Ownership division has increased at least 5% a quarter, a remarkable achievement of consistent growth. In 2006, 78 new Company-operated stores and 75 new franchised stores were opened in the Aaron... -

Page 5

... our cash dividend to shareholders. At December 31, 2006, we had open 828 Company-operated sales and lease ownership stores, 441 franchised stores, 17 RIMCO stores and 59 corporate furnishings stores, for a total of 1,345 stores. We believe Aaron Rents has considerable further growth potential... -

Page 6

... over the last five years, and we plan to add an additional 250 combined Company-operated and franchised sales and lease ownership stores in 2007. Our growth and success are the result of the outstanding commitment and efforts of our associates, franchisees and management team. Building for Growth -

Page 7

Ken Butler President, Aaron's Sales & Lease Ownership Division Years with Company: 33 O ur growth goal of reaching approximately 1,600 stores by the end of 2007 sounds really aggressive, but we have been working on systems, controls and procedures that make this growth possible. Plus, we have ... -

Page 8

... Over time, we expect close to half of our store growth to come from the franchise system. Todd Evans Vice President, Franchising, Aaron's Sales & Lease Ownership Division Years with Company: 16 e have put some extra focus on our franchise sales effort in order to meet the corporate growth goal. We... -

Page 9

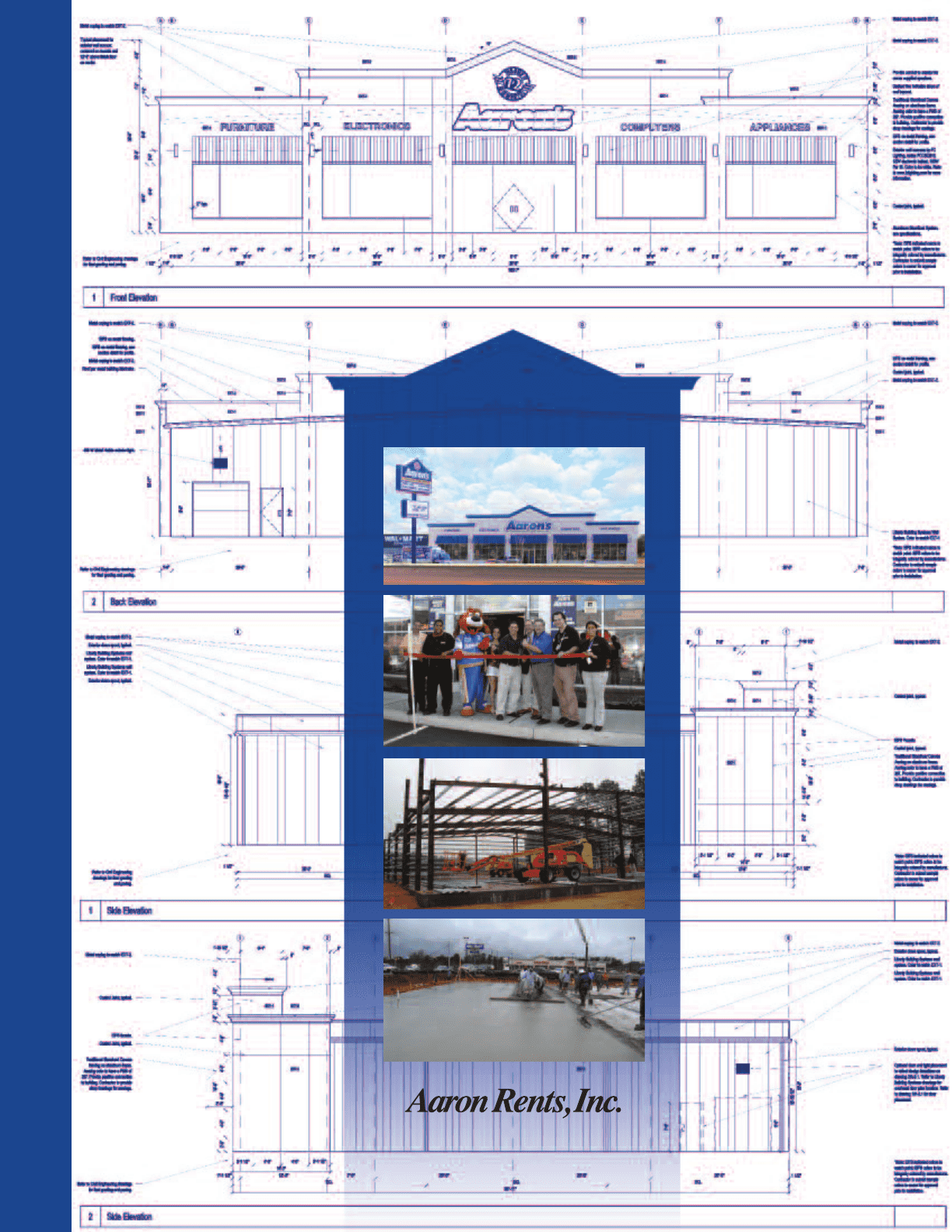

...but Aaron's is one of the largest retail developers in America. We will manage 500 projects this year, including new stores, remodels and relocations. Our team is already working on locations for 2008 stores. The corporate growth goal is ambitious, but we have a solid group of professionals to meet... -

Page 10

... that work extremely closely with our stores. All of our fulfillment centers operate with a software system that Mitch Paull Senior Vice President, Merchandising and Logistics, Aaron's Sales & Lease Ownership Division Years with Company: 15 t Aaron's, our marketing is centered around "making dreams... -

Page 11

... continued growth in the Aaron's store base. Mark Rudnick Vice President, Marketing, Aaron's Sales & Lease Ownership Division Years with Company: 6 A ll of our corporate marketing efforts are designed to build the image and brand awareness of Aaron's on both the national and local levels while... -

Page 12

... greatly increased our use of television on both the national and local levels. Both corporate and franchise stores benefit from our national advertising, which features a highly targeted campaign to attract more of our core customers. Over the last year, the national advertising program has greatly... -

Page 13

... help desk, data security and a field support team that maintains the equipment in all of our stores. A network connects all Aaron's stores to our data center, which enables real-time processing and reporting. In the past, only the store that created a customer agreement could accept payments... -

Page 14

... furnish all of the offices and trailers used in the NFL Super Bowl and certain NASCAR races. Growth Gil Danielson Executive Vice President, Chief Financial Officer, Aaron Rents, Inc. Years with Company: 17 ue to the nature of our business, Aaron Rents requires capital to grow. A typical new store... -

Page 15

... and to the opportunities within Aaron's. We call our NASCAR driving team "the dream team" but that could just as easily refer to our management team. Robin Loudermilk President, Chief Operating Officer, Aaron Rents, Inc. Years with Company: 25 ur strong corporate culture is a key factor in the... -

Page 16

... ...26 Consolidated Statements of Shareholders' Equity ...26 Consolidated Statements of Cash Flows ...27 Notes to Consolidated Financial Statements ...28-39 Management Report on Internal Control Over Financial Reporting ...40 Reports of Independent Registered Public Accounting Firm ...40-41 14 -

Page 17

...,635 $ 1.50 1.47 $ .057 .057 FINANCIAL POSITION Rental Merchandise, Net Property, Plant and Equipment, Net Total Assets Interest-Bearing Debt Shareholders' Equity AT YEAR END Stores Open: Company-Operated Franchised Rental Agreements in Effect Number of Employees $ 612,149 170,294 979,606 129,974... -

Page 18

... of rental merchandise reflects the expense associated with depreciating merchandise held for rent and rented to customers by our company-operated sales and lease ownership and corporate furnishings stores. CRITICAL ACCOUNTING POLICIES REVENUE RECOGNITION Rental revenues are recognized in the month... -

Page 19

RENTAL MERCHANDISE Our sales and lease ownership division depreciates merchandise over the agreement period, generally 12 to 24 months when rented, and 36 months when not rented, to 0% salvage value. Our corporate furnishings division depreciates merchandise over its estimated useful life, which ... -

Page 20

... and our distribution network. The total number of franchised sales and lease ownership stores at December 31, 2006 was 441, reflecting a net addition of 84 stores since the beginning of 2005. The 12.9% increase in franchise royalties and fees, to $33.6 million in 2006 from $29.8 million in 2005... -

Page 21

... to a 7.2% increase in same store revenues, and a 12.9% increase in franchise royalties and fees. Additionally, included in other revenues in 2006 was a $7.2 million gain from the sale of the assets of our 12 stores located in Puerto Rico and three additional stores in the continental United States... -

Page 22

... and lease ownership division related to the growth in same store revenues and the increase in the number of stores described above. Rental revenues in our corporate furnishings division increased $7.7 million, or 10.1%, to $83.7 million in 2005 from $76.0 million in 2004 as a result of generally... -

Page 23

... consist of buying rental merchandise for both sales and lease ownership and corporate furnishings stores. As Aaron Rents continues to grow, the need for additional rental merchandise will continue to be our major capital requirement. Other capital requirements include purchases of property, plant... -

Page 24

... by the LLC for a total purchase price of approximately $5.0 million. This LLC is leasing back these properties to Aaron Rents for a 15-year term at an aggregate annual rental of $572,000. During 2006, a property sold by Aaron Rents to a second LLC controlled by the Company's major shareholder for... -

Page 25

... in the stores nor do we provide any guarantees, other than a corporate level guarantee of lease payments, in connection with the sale-leasebacks. The operating leases that resulted from these transactions are included in the table below. FRANCHISE LOAN GUARANTY. We have guaranteed the borrowings... -

Page 26

... time horizons. We do not have significant agreements for the purchase of rental merchandise or other goods specifying minimum quantities or set prices that exceed our expected requirements for three months. RECENT ACCOUNTING PRONOUNCEMENTS In July 2006, the Financial Accounting Standards Board... -

Page 27

...,085 22,954 $858,515 LIABILITIES AND SHAREHOLDERS' EQUITY Accounts Payable and Accrued Expenses Dividends Payable Deferred Income Taxes Payable Customer Deposits and Advance Payments Credit Facilities Total Liabilities Commitments and Contingencies Shareholders' Equity: Common Stock, Par Value $.50... -

Page 28

... 31, 2006 Year Ended December 31, 2005 Year Ended December 31, 2004 REVENUES Rentals and Fees Retail Sales Non-Retail Sales Franchise Royalties and Fees Other COSTS AND EXPENSES Retail Cost of Sales Non-Retail Cost of Sales Operating Expenses Depreciation of Rental Merchandise Interest Earnings... -

Page 29

...to Rental Merchandise Book Value of Rental Merchandise Sold or Disposed Change in Deferred Income Taxes Gain on Marketable Securities Loss on Sale of Property, Plant and Equipment Gain on Asset Dispositions Change in Income Tax Receivable, Prepaid Expenses and Other Assets Change in Accounts Payable... -

Page 30

...primarily of residential and office furniture, consumer electronics, appliances, computers, and other merchandise and is recorded at cost. The sales and lease ownership division depreciates merchandise over the rental agreement period, generally 12 to 24 months when on rent and 36 months when not on... -

Page 31

... prior to the month due are recorded as deferred rental revenue. Until all payments are received under sales and lease ownership agreements, the Company maintains ownership of the rental merchandise. Revenues from the sale of merchandise to franchisees are recognized at the time of receipt of... -

Page 32

... 2006, the Company adopted the fair value recognition provisions of the Financial Accounting Standards Board's ("FASB") Statement of Financial Accounting Standards ("SFAS") No. 123(R), Share-Based Payments ("SFAS 123R"), using the modified prospective application method. Under this transition method... -

Page 33

...35%) was outstanding under the revolving credit agreement. The Company pays a .20% commitment fee on unused balances. The weighted average interest rate on borrowings under the revolving credit agreement (before giving effect to interest rate swaps in 2004) was 5.97% in 2006, 4.42% in 2005, and 2.72... -

Page 34

... gain or loss was recognized in this transaction. During 2006, a property sold by Aaron Rents to a second LLC controlled by the Company's major shareholder for $6.3 million in April 2002 and leased back to Aaron Rents for a 15-year term at an annual rental of $681,000 was sold to an unrelated third... -

Page 35

...normal purchase options. The Company also leases transportation and computer equipment under operating leases expiring during the next five years. Management expects that most leases will be renewed or replaced by other leases in the normal course of business. Future minimum rental payments required... -

Page 36

... Principles Board Opinion No. 25, Accounting for Stock Issued to Employees, and related interpretations. Effective January 1, 2006, the Company adopted the fair value recognition provisions of SFAS 123R, using the modified prospective application method. Under this transition method, compensation... -

Page 37

...was $4.9 million, $1.2 million, and $675,000 in 2006, 2005, and 2004, respectively. The Company did not grant any stock options in 2006. The Company amended the Key Executive grants in 2006 and raised the exercise price of each of the stock options to the fair market value of the common stock on the... -

Page 38

.... Deferred franchise and area development agreement fees, included in customer deposits and advance payments in the accompanying consolidated balance sheets, was $4.3 million and $5.2 million as of December 31, 2006 and 2005, respectively. Franchised Aaron's Sales and Lease Ownership store activity... -

Page 39

... a monthly payment basis with no credit requirements. The corporate furnishings division rents and sells residential and office furniture to businesses and consumers who meet certain minimum credit requirements. The Company's franchise operation sells and supports franchisees of its sales and lease... -

Page 40

... Furnishings Franchise Other Manufacturing Elimination of Intersegment Revenues Cash to Accrual Adjustments Total Revenues from External Customers EARNINGS BEFORE INCOME TAXES: Sales and Lease Ownership Corporate Furnishings Franchise Other Manufacturing Earnings Before Income Taxes for Reportable... -

Page 41

... marketing program, the Company has sponsored professional driver Michael Waltrip's Aaron's Dream Machine in the NASCAR Busch Series. The sons of the president of the Company's sales and lease ownership division were paid by Mr. Waltrip's company as drivers and raced in 2006 Aaron's sponsored cars... -

Page 42

... its method of accounting for share-based compensation as required by Statement of Financial Accounting Standard No. 123(R), Share Based Payments. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the effectiveness of Aaron Rents... -

Page 43

... control over financial reporting, evaluating management's assessment, testing and evaluating the...Company Accounting Oversight Board (United States), the consolidated balance sheets of Aaron Rents, Inc. as of December 31, 2005 and 2006, and the related consolidated statement of earnings, shareholders... -

Page 44

..., the yearly percentage change in the cumulative total shareholder return (assuming reinvestment of dividends) on the Company's Common Stock with that of the S&P SmallCap 600 Index and a Peer Group. For 2006, the Peer Group consisted of Rent-A-Center, Inc. The stock price performance shown is not... -

Page 45

Locations in the United States and Canada Company Stores Franchise Stores 845 441 Corporate Furnishings Stores 59 Fulfillment Centers MacTavish Manufacturing 16 12 43 -

Page 46

... of the Board, Chief Executive Officer, Aaron Rents, Inc. Ronald W. Allen (1) Retired Chairman of the Board, President and Chief Executive Officer, Delta Air Lines, Inc. Leo Benatar (2) Principal, Benatar & Associates William K. Butler, Jr. President, Aaron's Sales & Lease Ownership Division Gilbert... -

Page 47

... The annual meeting of the shareholders of Aaron Rents, Inc. will be held on Tuesday, May 8, 2007, at 10:00 a.m. EDT on the 4th Floor, SunTrust Plaza, 303 Peachtree Street, Atlanta, Georgia 30303 Transfer Agent and Registrar SunTrust Bank, Atlanta Atlanta, Georgia General Counsel Kilpatrick Stockton... -

Page 48

309 E. Paces Ferry Rd., N.E. Atlanta, Georgia 30305-2377 (404) 231-0011 www.aaronrents.com