Aarons 2002 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2002 Aarons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

merchandise to stores. Under the new

method, depreciation begins once the

merchandise goes out on initial lease.

This change in accounting method

increased 2002 net earnings by approxi-

mately $.14 per diluted share. Also dur-

ing 2002, the Company adopted SFAS

No. 142 which eliminated the amortiza-

tion of goodwill, having the effect of

increasing net earnings for the year by

$.03 per diluted share. In addition, the

new Sight & Sound stores reduced net

earnings by approximately $.06 per

diluted share during the year.

Some investors question the Company’s

exposure to a weak economy. Aaron

Rents, over its 48 years, has proven to

be recession-resistant and our Aaron’s

Sales & Lease Ownership business con-

tinues to reflect that characteristic. Not

only are Aaron’s customers normally in

the market for necessities rather than

for discretionary furnishings, but the

sales and lease ownership program also

captures revenue from individuals who

would in many cases not qualify for

traditional credit financing. It should be

noted, however, that our rent-to-rent

business has become increasingly depen-

dent upon corporate spending patterns.

We are optimistic that when the general

corporate environment improves, we

will see stronger revenue and earnings

contributions from this business.

MacTavish Furniture Industries, the

Company’s manufacturing division with

10 facilities in four states, posted a

record year of production in 2002,

manufacturing more than $55 million

(at cost) in furniture for our stores. In

addition, we now operate 11 distribu-

tion centers in the Aaron’s Sales & Lease

Ownership division, having added four

new locations in 2002 (in Arizona,

Tennessee, Oklahoma, and Puerto

Rico). We continue to believe that ver-

tical integration is a strategic advantage,

enabling our stores to offer rapid

delivery of a full product line to our

customers and allowing our stores to

operate with lower inventory levels.

Our nimble manufacturing operation

enables us to respond quickly to

changes in demand and styling with the

result of better service to our customers.

The Company’s financial strength was

substantially improved in 2002. A June

secondary offering of 1,725,000 shares

of Common Stock generated net pro-

ceeds of $34.1 million and a private

placement of $50 million in senior

unsecured notes was completed in

August. At year-end, there was minimal

bank debt outstanding under our $110

million revolving credit facility. With

our debt to capital ratio very low, the

Company has the financial strength to

achieve our expansion goals for the

foreseeable future.

During the year Ray M. Robinson was

elected to our Board of Directors, filling

a vacancy created by the resignation of

J. Rex Fuqua. Mr. Robinson is the

President of AT&T, Southern Region,

and brings a strong operating perspec-

tive to our Board. Mr. Fuqua served on

the Board for nearly eight years, and we

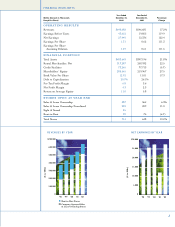

For the year, consolidated revenues

increased 17% to $640.7 million com-

pared to $546.7 million in 2001.

Systemwide revenues, which includes

the revenues of franchised stores,

advanced to $874.7 million, a 19%

increase over 2001. Net earnings for the

year were $27.4 million versus $12.3 mil-

lion last year. Diluted earnings per share

were $1.29 for 2002 compared to $.61 per

diluted share a year ago. Same store rev-

enues for Aaron’s Sales & Lease Owner-

ship stores opened for the entire year in

both 2002 and 2001 increased 13%.

Over the last few years we have dramat-

ically increased the number of Aaron’s

Sales & Lease Ownership stores, taking

advantage of opportunities in the mar-

ketplace. This aggressive new store

growth began to show positive results

during 2002 as these stores grew in rev-

enues and earnings. Start-up expenses

for these stores reduced pre-tax earn-

ings by approximately $7 million or $.20

per diluted share in 2002, a dramatic

reduction from the $14 million or $.42

per diluted share impact in 2001. As a

group, the stores opened during 2001

turned profitable in early 2003 and we

project substantial earnings contribu-

tions in future years as maturation of

these and other stores continues. At the

end of 2002, over 30% of our sales and

lease ownership stores were less than

two years old.

Effective January 1, 2002, the Company

changed its method of depreciating

merchandise in the Aaron’s Sales &

Lease Ownership division. Formerly

depreciation was tied to the delivery of