AMD 2001 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2001 AMD annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. In order to remain competitive, we must continue to make substantial

investments in the improvement of our process technologies. In particular, we

have made and continue to make significant research and development investments

in the technologies and equipment used to fabricate our microprocessor products

and our Flash memory devices. Portions of these investments might not be fully

recovered if we fail to continue to gain market acceptance or if the market for

our microprocessor or Flash memory products should significantly deteriorate.

In addition, if we are unable to remain competitive with respect to process

technology, we will be materially and adversely affected.

Competition

The IC industry is intensely competitive. Products compete on performance,

quality, reliability, price, adherence to industry standards, software and

hardware compatibility, marketing and distribution capability, brand

recognition and availability. After a product is introduced, costs and average

selling prices normally decrease over time as production efficiency improves,

competitors enter the market and successive generations of products are

developed and introduced for sale. Technological advances in the industry

result in frequent product introductions, regular price reductions, short

product life cycles and increased product capabilities that may result in

significant performance improvements.

In each area of the digital IC market in which we participate, we face

competition from different companies. With respect to microprocessors, Intel

holds a dominant market position. With respect to Flash memory products, our

principal competitors are Intel, STMicroelectronics N.V., Sharp Electronics

Corporation, Atmel Corporation and Fujitsu, our joint venture partner in FASL.

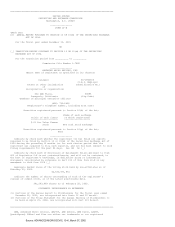

Manufacturing Facilities

Our current IC manufacturing facilities are described in the chart set forth

below:

Wafer Approximate

Size Production Clean Room

(Diameter Technology (Square

Facility Location in Inches) (in Microns) Footage)

----------------- ---------- ------------ -----------

Austin, Texas

Fab 25.................................. 8 0.18 120,000

Fabs 14 and 15.......................... 6 0.5 42,000

Aizu-Wakamatsu, Japan

FASL JV1/(1)/........................... 8 0.35 70,000

FASL JV2/(1)/........................... 8 0.25 & 0.35 91,000

FASL JV3/(1)/........................... 8 0.17 118,000

Dresden, Germany

Fab 30.................................. 8 0.18 115,100

--------

/(1)/ We own 49.992 percent of FASL. Fujitsu owns 50.008 percent of FASL.

In connection with a restructuring plan announced in September 2001, AMD

will close Fabs 14 and 15 at the end of the second quarter of 2002.

The FASL JV3 building and clean room were completed and released to

production with volume revenue shipments beginning in the fourth quarter of

2001.

We also have foundry arrangements for the production of our products by

third parties.

Research and development are conducted at our Submicron Development Center,

a 42,000 square foot facility located in Sunnyvale, California, Fab 25 and

Dresden Fab 30.

9

Source: ADVANCED MICRO DEVIC, 10-K, March 07, 2002