ADT 2014 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2014 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

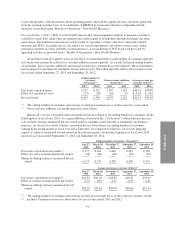

For fiscal year 2013, FCF increased $54 million compared with fiscal year 2012. This increase was

primarily due to an increase of $173 million in net cash provided by operating activities, which primarily resulted

from higher EBITDA and improvements in working capital, and a decrease of $93 million in cash paid for dealer

generated customer accounts and bulk account purchases. These factors were partially offset by an increase of

$202 million in internally generated subscriber systems and an increase of $10 million in capital expenditures.

Approximately $80 million of the increase in internally generated subscriber systems resulted from the mix shift

toward more ADT-owned systems and is substantially offset by higher cash flows from operating activities

related to increases in deferred subscriber acquisition revenue.

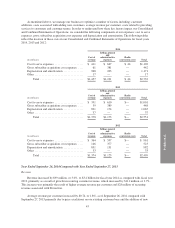

Liquidity and Capital Resources

Liquidity and Cash Flow Analysis

Significant factors driving our liquidity position include cash flows generated from operating activities and

investments in internally generated subscriber systems and dealer generated customer accounts. Our cash flows

from operations include cash received from monthly recurring revenue and upfront fees received from customers,

less cash costs to provide services to our customers, including general and administrative costs and certain costs

associated with acquiring new customers. Historically, we have generated and expect to continue to generate

positive cash flow from operations. Prior to the Separation, our cash was regularly “swept” by Tyco at its

discretion in conjunction with its centralized approach to cash management and financing of operations. For

fiscal year 2012 transfers of cash both to and from Tyco’s cash management system are reflected as changes in

parent company investment in the Consolidated and Combined Statements of Cash Flows.

Liquidity

At September 26, 2014, we had $66 million in cash and cash equivalents and another $375 million available

under our $750 million revolving credit facility. Our primary future cash needs are centered on operating

activities, working capital, capital expenditures, strategic investments and dividends. In addition, we may use

cash to repurchase shares of our common stock under our $3 billion share repurchase program. We believe our

cash position, amounts available under our revolving credit facility and cash provided by operating activities will

be adequate to meet our operational and business needs in the next twelve months.

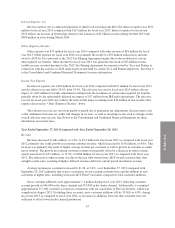

Revolving Credit Facility—At September 26, 2014, we had $375 million outstanding under our revolving

credit facility at an interest rate of 1.606%. During fiscal year 2014, we borrowed $600 million under the

revolving credit facility and repaid $375 million funded primarily with a portion of the cash proceeds from the

debt issuances described below.

Long Term Debt—In addition to the indebtedness outstanding at September 27, 2013, we issued $1.5 billion

aggregate principal amount of senior unsecured notes during fiscal 2014.

On October 1, 2013, we issued $1.0 billion aggregate principal amount of 6.250% senior unsecured notes

due October 2021 to certain institutional investors pursuant to certain exemptions from registration under the

Securities Act of 1933, as amended (the “October 2013 Debt Offering”). Net cash proceeds from the issuance of

this term indebtedness totaled $987 million, of which $150 million was used to repay the outstanding borrowings

under our revolving credit facility as of September 27, 2013. The remaining net proceeds were used primarily for

repurchases of outstanding shares of our common stock. Interest is payable on April 15 and October 15 of each

year, and commenced on April 15, 2014. We may redeem the notes, in whole or in part, at any time prior to the

maturity date at a redemption price equal to the greater of the principal amount of the notes to be redeemed, or a

make-whole premium, plus in each case, accrued and unpaid interest to, but excluding, the redemption date.

In connection with our October 2013 Debt Offering, we entered into an exchange and registration rights

agreement with the initial purchasers of the notes. Under this agreement, we were obligated to file a registration

49