ADT 2013 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2013 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K

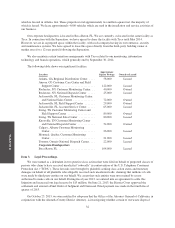

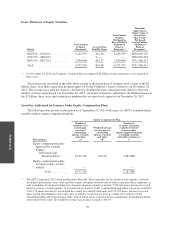

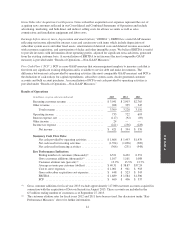

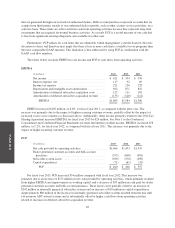

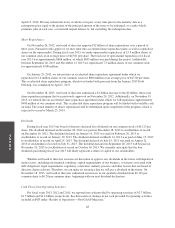

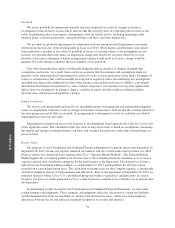

As mentioned above, we manage our business to optimize a number of factors including: customer

additions, costs associated with adding new customers, average revenue per customer, costs related to providing

services to customers and customer tenure. In order to understand how these key factors impact our Consolidated

and Combined Statements of Operations, we consider the following components of our expenses: cost to serve

expenses, gross subscriber acquisition cost expenses, and depreciation and amortization. The following tables

reflect the location of these costs in our Consolidated and Combined Statements of Operations for fiscal years

2013, 2012 and 2011:

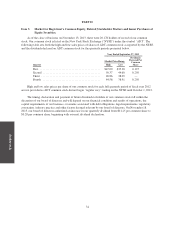

2013

(in millions) Cost of revenue

Selling, general

and

administrative

expenses Total

Cost to serve expenses ..................... $ 391 $ 610 $1,001

Gross subscriber acquisition cost expenses . . . . . 59 389 448

Depreciation and amortization ............... 891 174 1,065

Other ................................... 37 — 37

Total ............................... $1,378 $1,173 $2,551

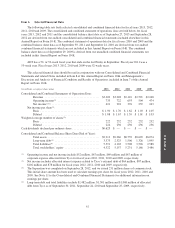

2012

(in millions) Cost of revenue

Selling, general

and

administrative

expenses Total

Cost to serve expenses ..................... $ 364 $ 597 $ 961

Gross subscriber acquisition cost expenses . . . . . 146 377 523

Depreciation and amortization ............... 831 151 982

Other ................................... 33 — 33

Total ............................... $1,374 $1,125 $2,499

2011

(in millions) Cost of revenue

Selling, general

and

administrative

expenses Total

Cost to serve expenses ..................... $ 350 $ 568 $ 918

Gross subscriber acquisition cost expenses . . . . . 175 368 543

Depreciation and amortization ............... 787 140 927

Other ................................... 29 — 29

Total ............................... $1,341 $1,076 $2,417

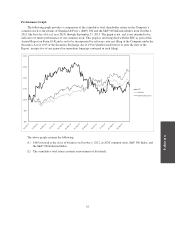

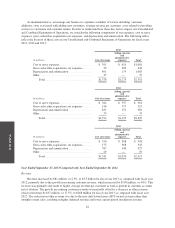

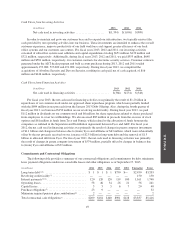

Year Ended September 27, 2013 Compared with Year Ended September 28, 2012

Revenue

Revenue increased by $81 million, or 2.5%, to $3.3 billion for fiscal year 2013 as compared with fiscal year

2012, primarily due to the growth in recurring customer revenue, which increased by $138 million, or 4.8%. This

increase was primarily the result of higher average revenue per customer as well as growth in customer accounts,

net of attrition. The growth in recurring customer revenue was partially offset by a decrease in other revenue,

which went down by $57 million, or 17.5%, to $268 million for fiscal year 2013 as compared with fiscal year

2012. The reduction in other revenue was due to the mix shift toward more ADT-owned systems rather than

outright system sales, resulting in higher deferred revenue and lower current period installation revenue.

42